The Cost of Debt that a company has is essentially how efficient a company is at paying off their debt. Having a cost of debt calculator such as the one presented in this post can be a valuable tool towards learning which stocks have better debt situations than others, and can have stronger long term financial performance (or not).

For instance, a company that has a lower cost of debt would be one that is a more efficient lender of money as compared to a company that might not have as low of a Cost of Debt being a less efficient lender.

Cost of debt might not inherently seem like a big deal, but it is extremely important to think about, and the calculation is very simple to understand. Not only does the actual cost of debt number matter when you’re looking at the balance sheet for your stock evaluation, but it’s also very beneficial to compare that cost of debt to direct competitors to potentially show you how “savvy” the company might be from a financial side.

Calculating the Cost of Debt is actually a very simple formula. To do so, you simply need to know the Effective Interest Rate of all outstanding debt and the effective tax rate. Your formula looks like this:

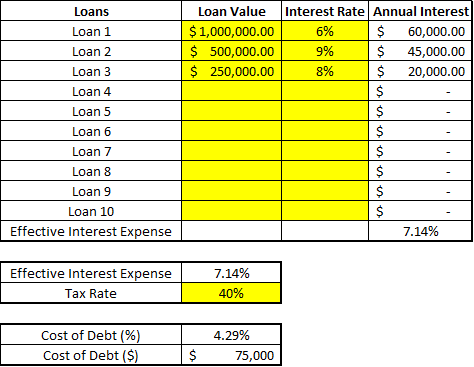

For instance, let’s imagine a company has the following outstanding debts:

- $1,000,000 at a 6% interest rate

- $500,000 at a 9% interest rate

- $250,000 at an 8% interest rate

For this example, we’re also going to imagine that the company’s tax rate is 40% (I just picked a simple, round number). So, the first step is to calculate the total interest expense for the company.

To do this, you will simply take the total outstanding amount and multiply it by the interest rate – see below:

- $1,000,000 at a 6% interest rate – $60,000

- $500,000 at a 9% interest rate $45,000

- $250,000 at an 8% interest rate $20,000

- Total Interest Expense: $60,000 + $45,000 + $20,000 = $125,000, or $125,000/$1,750,000 (total debt) = 7.14%.

- Cost of Debt: 7.14%*(1-40%) = 4.29%, or $125,000*(1-40%) = $75,000

This is essentially blending all of your debt and interest levels together to determine your actual interest rate based on total debt levels. If you wanted to view this in terms of a dollar amount, you could do so by taking the Total Interest Expense and plug it into the rest of the formula.

For this example, it would be $125,000 (1 – 40%) to get you a total of $75,000. So, the cost of these loans for the year will be $75,000, or in other words, this should be the “hurdle rate” that you should try to overcome.

So, if you think that these three loans will generate more than $75,000 worth of income in a year, then you are advantaged to take out these loans to help continue to grow your business. If you don’t believe that they will clear that hurdle, then you shouldn’t decide to take out the loans.

Click here to download Cost of Debt Calculator (Excel)

I have created a Cost of Debt calculator that is extremely simple to use but gives you the ability to just “plug and chug” the numbers rather than having to create the formula on your own. All you need to do is fill in your loans and annual interest rates and then your annual tax bracket/rate and the rest auto populates! Take a look:

In the picture above, I’ve inputted the details of the previous scenario that I outlined. As you can see at the bottom, there is the Cost of Debt in terms of a dollar amount and a percentage.

This Cost of Debt calculator can also be used in your own personal finances. There is no reason that you can’t use the same formula to help understand the cost/benefit of taking out a loan for your own personal use. It’s pretty straightforward if it’s just one loan, but it can definitely be applied in that fashion.

Imagine if you were debating taking out a loan on a car for $10,000 at a 5% interest rate, and you were debating if you could make that money better used in a different way. For the sake of this example, we’re going to assume that you’re in a 25% tax bracket for your personal income.

Your Cost of Debt would be the following:

Interest Expense = $10,000 at 6% interest = $600 Annually

Cost of Debt = $600 * (1-25%) = $450

So, if by keeping that $10,000, you think that you can use that money in a way to generate you more than $450 on an annual basis, you’re better off taking the loan and investing your money. Maybe you’re going to use that $10,000 to pay down some other debt with a higher interest rate or put it into the stock market.

As I’ve mentioned many times before, the Compound Annual Growth Rate since 1950 is 11%, so if you wanted to assume an 8% return, you would’ve made $800 in your first year and easily hurdled your cost of debt.

The thing to always think about is that a low cost of debt is good, but everything is relative.

Paying off debt is a guaranteed return while choosing to take on the debt and invest always has a level of risk that is never definitive.

Just because the average CAGR is 11% since 1950 doesn’t mean that you should expect 11% every single year, so think about your time horizon and the appetite for risk that you have before making any decisions.

Concluding Thoughts

At the end of the day, the Cost of Debt is simply another tool that you can use to help you determine the proper value for a company (as well as help your own personal finance decision making) but it is by no means the end all, be all.

The cost of debt calculator presented here will hopefully help you continue to learn and develop your tool chest to figure out your own stock picking strategy for success.

Cost of Debt helps give you a firm grasp on how efficient a company is using their credit line to grow their business, and personally, this is a huge factor when evaluating a stock. Because one of the biggest potential pitfalls in my eyes, is a company trying to grow too fast and doing so at an inefficient rate, which will inevitably result in a very bad ending…

Related posts:

- 5 Debt Solutions for the Average Person that Don’t Cost Money Somebody in debt is the last person who should be spending more money to try and get out of it. Having been there and done...

- The Continuous Compound Interest Formula Excel Function for (Us) Nerds Ever wanted to illustrate exactly how powerful compound interest can be? Wanted to have an Excel function to do it for you? This post reveals...

- This 401k Match Calculator Shows How Powerful Compound Interest Can Be There’s various compound interest calculators out there, but not many specific 401k match calculators that are easily manipulable to show how different contributions and employers...

- A Convenient ‘Rule of 72’ Calculator to Help Investors Plan for Retirement The Rule of 72 formula is a quick way to quantify how your investment return builds your wealth over time. You can use this to...