Updated 12/19/2023

Determining a financial asset’s value is part of calculating the present value of future cash flows. To value a company, we need to have a sense of magnitude and sense of those cash flows, plus any risk associated with receiving that cash.

Part of determining the future value of those cash flows is estimating a discount rate or hurdle rate for that investment. That involves determining the cost of capital financing or potential investments. Those involve the cost of equity and the cost of debt.

Each capital investment carries a financial cost, and the two main sources of company investment are equity and debt.

Estimating the cost of debt is relatively straightforward, but there are a few items you need to keep in mind when using the cost of debt formula. The cost of debt and equity are part of the discount rate we use in a DCF (discounted cash flow) model to find the future value of those cash flows.

In today’s post, we will learn:

- What is the Cost of Debt?

- How the Cost of Debt Works

- How Do You Calculate the Cost of Debt Formula?

- Examples of the Cost of Debt Formula

Okay, let’s dive in and learn more about the cost of debt formula.

What is the Cost of Debt?

Simply put, the cost of debt is the after-tax rate a company would pay today for its long-term debt.

It boils down to a company’s effective interest rate on its debts, such as loans or bonds. The cost of debt refers to either the before cost of debt, Apple’s cost of debt before accounting for taxes, or the after-cost tax of that same debt.

The main ingredient differentiating between pre- and after-tax debt is the interest expense, which is tax-deductible.

Calculating Apple’s cost of debt involves finding the average interest paid on all of Apple’s debt, including bonds and leases.

The cost of debt also reflects a company’s default risk; for example, a company with a AAA rating, such as Microsoft, carries little risk of default, whereas a company with a credit rating of BBB carries a higher risk of default.

Along with those different default rates come higher interest rates; with its AAA rating, Microsoft earns lower interest rates on any bond offerings than its counterpart with a lower credit rating.

The different credit ratings also reflect the prevailing interest rates in the market.

Let’s go back to the basics for a moment.

Bonds are the most common debt on a company’s balance sheet. Companies use bond offerings to raise cash for capital projects and other items.

To entice investors, bond offerings include interest payments, coupons, or, if it makes more sense, dividends. These payments encourage investors to take the risk of the investment.

The better the company’s credit rating, the safer the investment, and therefore, the lower interest payments they need to offer for their bonds. That is why Microsoft offers lower interest rates than Hertz, who was on the verge of bankruptcy earlier.

That risk of default drives higher interest rates on their bond offerings to encourage investment.

However, those higher interest rates translate to higher interest payments for that company, which leads to a higher debt cost on the balance sheet. It also leads to lower accounting earnings on the income statement.

Higher debt offers some pluses and minuses, the good being:

- In the case of higher credit ratings, access to cheap cash to buy additional assets and grow faster

- Lower costs of capital because of lower financing costs

- Higher earnings as a result of lower interest expenses

- Greater cash flows as a result of higher earnings

Some of the minuses are:

- More expensive financing in the form of higher interest expenses

- Lower earnings because of those higher interest expenses

- Smaller cash flows because of the lower earnings

- There is a greater risk of default because of the higher interest expenses

How The Cost of Debt Works

A company’s capital structure is one part debt and another part equity. A company’s capital structure manages how a company finances its overall operations and growth through different sources.

Those sources include:

- Debt (bonds or loans)

- Equity (selling shares)

- Free cash (operations)

The cost of debt helps management and investors understand the rates or costs to the company for any debt financing. We can also use the cost of debt to measure any riskiness in investment compared to other companies.

The higher credit ratings or cost of debt tend to follow companies with higher risk levels.

There are a couple of scenarios to consider when looking at the capital structure and how different companies finance their growth.

Some companies choose to use short-term debt as their means of financing, and using the interest rates for the short term can lead to issues. For example, short-term rates don’t consider inflation and its impacts.

Long-term rates better approximate interest rate costs over time because they match the long-term focus of calculating free cash flows and their present-day values.

If a company uses exclusively short-term financing, it is good to use its credit rating to approximate the cost of long-term debt.

If all else fails, you can always use the 10-year Treasury rates as a proxy for the interest rate for a company’s debt, especially a company relying on short-term debt as its source of financing.

Remember that most companies choose to use debt as a means of financing because it is markedly cheaper than equity.

One reason for the cheaper financing is the fixed interest payments, and the other reason is the tax benefits companies receive on the interest expense on the income statement.

A company’s income tax will be lower because of the deduction of the interest component from taxable income.

How Do You Calculate the Cost of Debt Formula?

There are two parts to calculating the cost of debt; both are part of calculating the after-tax cost of debt, which accounts for that interest rate expense and the tax benefits.

The cost of debt formula equals:

After-tax cost of debt = pretax cost of debt * (1 – marginal tax rate)

To calculate the after-tax cost of debt, we need first to determine the pretax cost of debt.

To calculate the pretax cost of debt, we need two pieces of information:

- Interest expense found on the income statement

- We can find total debt on the balance sheet, including bonds, lines of credit, loans, and capital leases.

To determine the pretax cost of debt, we divide the interest expense by the total debt on the balance sheet, like:

Pretax cost of debt = Interest expense / Total debt

For example, a company has a total debt on its balance sheet of $100 million and pays $5 million in interest expense each year.

Remember that the interest expense on the income statement represents the total interest paid for both debt and leases.

**Note that capital leases are a line item on the balance sheet and include any interest expense associated with those leases on the income statement.**

Operating leases are separate and off-balance sheet items and, thus, are not included in the interest expense line item.

Then, the pretax cost of debt would be:

Pretax cost of debt = $5 million / $100 million = 5%

To calculate the after-tax cost of debt, we would take that 5% and multiply that by one minus the marginal tax rate, which is currently 21% for the US.

After-tax cost of debt = 5% * (1 – 21%) = 3.95%

Simple, huh?

How Taxes Impact Debt

Let’s explore the tax impact on debt for a moment.

Because the tax codes treat any interest paid on debt favorably, the tax deductions from outstanding debt can lower the effective cost of debt the borrower pays.

For example, the after-tax cost of debt is the interest they pay on debt minus any possible income tax savings because of the deductions available from interest expenses.

To calculate the after-tax cost of debt, we multiply the cost of debt by the difference of 1 minus the effective tax rate. We combine the company’s state and federal rates to determine the effective tax rate, not the marginal tax rate, which includes many tax offsets like foreign tax rate deductions.

Currently, the US effective tax rate for corporations is 21%, but Congress might raise those rates per the sitting president’s wishes. If those rates do rise, that will impact the cost of debt for every publicly traded company and is something to keep in mind.

Example

Let’s look at a simple example to understand better the impact of tax savings on the cost of debt and earnings.

Imagine that our wine distribution company has issued $100,000 in bonds at a 5% interest rate. The annual interest payments are $5,000, which it claims as an expense, lowering the company’s income by $5,000.

Our company pays a tax rate of 30%, and it saves $1,500 in taxes by expensing the interest. We calculate that by taking $5,000 in interest expense by a 30% tax rate, giving us a $1,500 write-off.

Because of the write-off on taxes, our wine distributor only pays $3,500 ($5,000 interest expense – $1,500 tax write-off) on its debt, equating to a cost of 3.5%.

Or as after-tax cost of debt = 5% * (1-30%) = 3.5%

**Pro-tip: A company’s debt cost should never exceed its equity cost.**

Examples of the Cost of Debt Formula

To put this into action, let’s use Microsoft (MSFT) as our guinea pig, and I will pull together some of the information required to calculate the after-tax cost of debt formula using the latest 10-k, dated July 29, 2021.

Unless otherwise stated, all numbers will be in millions for clarity.

Using our friend CTRL-F to locate interest expense because most companies don’t list it as a separate line item; they usually combine it with other interests.

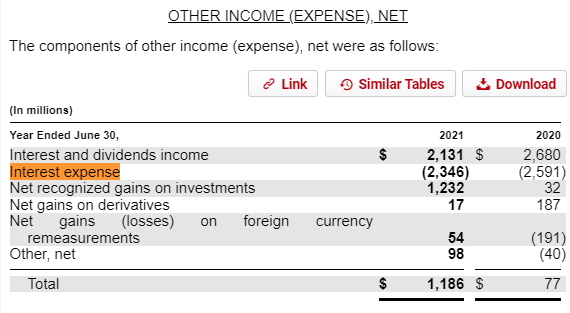

Here is a screenshot highlighting the interest expense Microsoft paid in 2021.

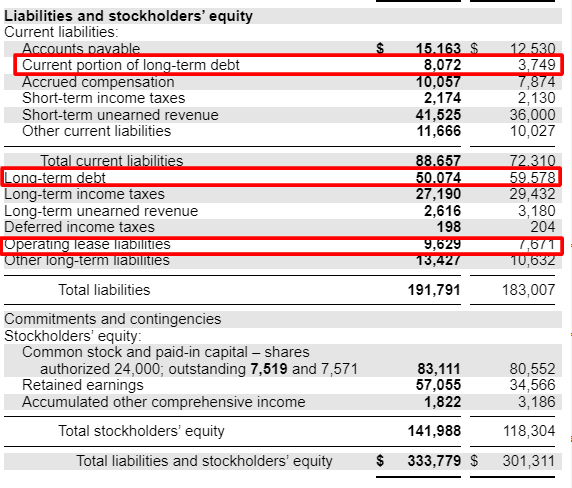

Next, we will locate Microsoft’s total debt from the balance sheet below the screenshot.

Okay, now that we have some numbers, we can calculate our after-tax cost of debt for Microsoft.

Here are the inputs for our formula:

- Interest expense = $2,346

- Total debt = $67,775

- Current portion of long-term debt = $8,072Long-term debt = $50,074

- Lease liabilities = $9,629

Now we take the above inputs and calculate our cost of debt for Microsoft, which equals:

Cost of debt = ($2,346 / $67,775) * ( 1 – 21%)

Cost of debt = 3.46% * .79 = 2.73%

Okay, now I will put together a chart pulling together the cost of debt for the FAANG stocks using the TTM (trailing twelve months) numbers for the “most” current after-tax cost of debt we can calculate.

| Company | Interest Expense | Total Debt | Taxes | After-tax cost of debt |

| 0 | 0 | 21% | 0.00% | |

| Apple | $2,645 | $124,719 | 21% | 1.68% |

| Amazon | $1,741 | $113,903 | 21% | 1.21% |

| Netflix | $721 | $15,493 | 21% | 3.68% |

| $282 | $27,860 | 21% | 0.80% |

Aside from Netflix, there are some seriously low costs of debt, which shows how strong these companies’ financials are and the low cost of debt they can access to pursue additional growth projects.

Companies such as Tesla and Gamestop carry higher costs of debt, too; for example, Tesla currently carries a cost of debt of 4.21%, which reflects the poor credit rating the company currently carries. Likewise, Gamestop carries a debt cost of 4.13%, indicating a poor credit rating and higher lending costs.

Investor Takeaway

Debt and equity provide companies with the capital to buy assets and maintain their operations.

Equity financing tends to be more expensive because of the higher returns from the stock market. They also don’t come with the tax benefits of debt.

Debt financing tends to be less expensive and comes with tax benefits that help increase earnings and cash flows.

However, nothing is free and without some tradeoffs. Taking on too much debt, especially in a rising rate environment, can lead to excessive interest payments, putting pressure on operations and putting the company at more risk of default.

Because of these risks and rewards for equity and debt, companies tend to balance their financing use to achieve the optimal balance.

Calculating the cost of debt using the after-tax cost of debt formula is a simple process once you know where to find the inputs and the reasoning behind the line items.

Along with helping investors and management determine the costs of reinvestments in various projects, it is also a great idea to compare the cost of debt to competitors to understand how cheap or expensive it will be for that company to grow.

And with that, we will wrap up our discussion on the cost of debt formula.

As always, thank you for taking the time to read today’s post, and I hope you find some value in the article. If I can further assist, please don’t hesitate to reach out.

Until next time, take care and be safe out there,

Dave

Dave Ahern

Dave, a self-taught investor, empowers investors to start investing by demystifying the stock market.

Related posts:

- Weighted Average Cost of Capital Guide (+WACC Calculator Excel Download) The weighted average cost of capital (WACC) is a cornerstone of any discounted cash flow valuation and a fundamental learning for every investor’s toolbox. This...

- The 3 Inputs for the Cost of Equity Formula Updated 12/19/2023 The value of any financial asset is the present value of its future cash flows discounted to the present. That is the basis...

- Earnings Power Value — A Straightforward Intrinsic Value Estimator Among the many valuation methods and models, an undervalued model, no pun intended, is the earnings power value formula, which helps us find undervalued companies...

- Income Statement Forecasting: The First Step of a 3-Part Financial Model Forecasting the income statement is the first step of a 3-statement financial model and it is the most critical part of any forward-looking financial analysis....