Cisco (CSCO) implemented their first dividend back in April of 2011, which really isn’t that long ago if you really think about it. Back then, the first annual CSCO dividend was $.24, a modest $.06/quarter.

Although it doesn’t sound like much, for a shareholder of a company that wasn’t receiving a dividend at all, it likely was a much-appreciated surprise.

For a company to become a Dividend Aristocrat, they need to meet the following criteria:

- Be in the S&P 500

- Have 25 consecutive years of increasing annual dividend payments

That’s it! Simple, right? Well, not really…

Currently, only 57 companies are dividend aristocrats, so it is a pretty prestigious group.

Investing in Dividend Aristocrats is great, but the real key is to try to identify a company that might be the next dividend aristocrat and then invest for the long-term. So, with that being said, is CSCO going to be a future dividend aristocrat?

Be in the S&P 500

The S&P 500 is made up of the 500 or so American companies that have the largest market cap. Currently, Cisco sits at 29th on this list so they’re pretty firmly planted. CSCO initially was put in the S&P 500 on 1993, so I really don’t see a realistic situation where they’re going to be taken off this list at anytime in the near future.

Without getting in too deep, I don’t see anything major on the horizon that is going to bump CSCO from the S&P 500, so for the sake of this article, let’s assume that the answer for this requirement is Yes, they will be in the S&P 500.

Have 25 consecutive years of increasing annual dividend payments

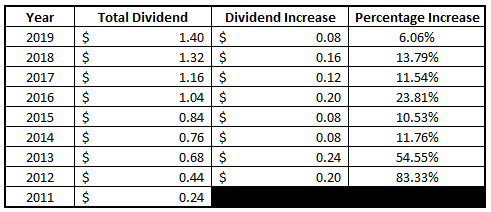

Since implementing a dividend in 2011, CSCO has consistently increased their dividend by an average of $.15/year. That might not seem like a major increase, but it is. Over the existence of the CSCO dividend, the average annual increase has been 26.92%. I mean, the first year got you a total of $.24 in dividend payments.

As of the most recent year, which will pay out its last quarterly dividend in January, the annual dividend payments will total $1.40, or nearly 6 times what the dividend was the first year. Take a look below at how the dividends have paid out since implementation:

This might seem a little bit strange if you focus on the percentage increase column because the percentage started out extremely high and then has consistently shrunk since 2011.

That is not abnormal by any means.

Many companies will pick a dividend that is a flat number and try to increase it annually by a certain amount rather than by trying to obtain a certain percentage gain. The dividends have consistently been increased by $.02 – $.06/quarter, or $.08 – $.24/year.

While the dividend is increasing steadily, so is the stock price. The stock price for CSCO in March of 2011 when the first dividend was implemented, the stock price was $17.95. The stock price now is $45.30, so the total amount that you would have would be $53.18 for every share of CSCO that you bought in 2011 when you take the dividends into account, and that’s if you simply just held onto the dividends and didn’t reinvest them like we recommend that you do.

In my eyes, I really don’t see any potential drastic changes that will cause CSCO to slow or implement their dividend, either. When a company chooses to not increase their annual dividend, that is a major sign to shareholders that bad things might be coming.

There is almost this unwritten rule on Wall Street about how when a company slashes their dividend, it really is a major red flag and it causes the stock to get hit, negatively, in a major, major way.

For that reason, a company will do everything that they can to keep from reducing their dividend. While I personally don’t think that this is a good thing, because I think that companies might prioritize increasing their dividends over focusing on keeping the heart of the business healthy when times get tough, it does add somewhat of a sense of security for CSCO to become a future dividend aristocrat.

Andrew and Dave frequently talk about it on the podcast and I write about it on the blog, but the importance of thinking ahead and zigging when others zag is so incredible.

Yes, everyone wants to invest in a dividend aristocrat, but the key is trying to identify the next dividend aristocrats before they get to that level, and I think that CSCO can certainly fall into that category.

Of course, there is so much more that I recommend you take a look at before you blindly invest in a company that has eight years of increasing dividend payments just because they might become a dividend aristocrat at some point. If you’re struggling to decipher whether stocks are investment worthy on your own, I highly recommend that you check out Andrew’s Value Trap Indicator (VTI) which does the legwork to tell you if a company is overvalued or not.

So, in summary, CSCO has had a lot of success, both simply as a company and also for those that are using the stock as a source of dividend income. I think that by 2037, CSCO is going to become a dividend aristocrat because I don’t see anything fundamentally that is going to change the outlook of the company that will require them to reduce their dividend or that their market cap is going to drop so low that they will no longer be included in the S&P 500.

For someone that is trying to buy and hold for years and years, this is the exact type of company that might be worthwhile to invest in – a company that has a really strong track record but still is in the early stages of fully finding it’s true potential.

As I mentioned, I will always do a much more thorough look at a company prior to investing but finding a company with this strong of an early dividend track record is a great first step!

Related posts:

- AOS: Dividend Aristocrat’s Phenomenal 25 Year Track Record In the most recent episode of the Investing for Beginners Podcast with Andrew and Dave, they talked about some of the companies that have recently...

- [S&P 500] Average Valuation Multiples by Industry: P/E, P/FCF, P/S, P/B, PEG There are many valuation multiples which investors use to compare stocks with their peers in an industry. This post displays the mostly commonly used valuation...

- A Look Through 3M (MMM) Dividend History If you’ve been following my posts at all, you probably see that I cover a lot of different topics, so it should be of absolutely...

- A History of the HRL Dividend and Where it Could Go from Here Have you ever heard of Hormel (HRL) before? Hormel is very well known in the grocery store space, but they’re equally, and maybe even more...