One of the most controversial debates that occur in the Financial Independence Retire Early (FIRE) community are ones that are based on your savings rate. People debate numbers and methods that are all over the board so I’m here to cut through the nonsense and answer the question once and for all – how much of your paycheck should you save?

One thing that absolutely drives me bonkers is when people give blanket advice that says “save 15% of your income”. There’s so many issues with this and it’s infuriating.

Is this 15% of your gross or net pay? Is it 15% regardless of if I retire tomorrow or in 40 years? What if my employer matches 10% – should I only put in 7.5% and waste the rest of the match?

It’s blanket advice that not only doesn’t apply to everyone, but really doesn’t apply to anyone. That’s why we ALWAYS need to dive in and do the calculations ourselves. So how much should you save?

Well, in short, the obvious answer is as much as you humanly can, right? Let me show you a little infographic that should tell you all that you need to know!

Of course, I am being extremely facetious with that chart because the goal is always to save as much as you can. But my chart is actually a bit misleading…

Having a 0% savings rate is actually not the worst case. If you’re spending more than you’re making, you’re actually going to have a negative savings rate. If you make $50K/year and you spend $55K, then your “savings” are -$5K. -$5K/$50K = -10% savings rate, or, you’re spending 10% more than you made and are now in a much worse position than you were at the beginning of the year.

That’s why I put such a high importance on something as simple as knowing where your money is going and tracking your expenses. There is no better way to truly understand your financial situation than if you were to just track your expenses as I do with Doctor Budget.

For you to properly identify what your savings rate is going to be, I think there are a few different things that you need to know.

First off, you need to know what you’re saving for. For most of us, this is likely retirement. But you need to have a pretty good grasp on exactly what your retirement life is going to look like.

Is it going to be a life of traveling the world or is it going to be one where you’re going to downsize and live on a completely paid off home? Do you think you’re going to spend $25K/year or $125K/year? Are you in good health with hopefully minimal health bills or do you have a family history that is concerning?

These are all things that should give you at least an estimate about the type of spending that you might need when you’re going to retire. A good rule of thumb could be to think about your current spending and adjust it for 2-3% annually for inflation, and then maybe tack on a little bit more for increased health insurance and just a good buffer for a conservative look.

For the purposes of this example, let’s say you want $100K/year.

The next step is to take the inverse of the 4% rule to find out the total dollar amount that you need to have saved. For those that do not know, the 4% rule is mathematically back tested and proven to allow people to take out 4% of their portfolio each year, adjust that amount for inflation, and they will theoretically never run out of money.

Now, I threw in the word “theoretically” because past performance is never a perfect indicator of future gains, so nobody can guarantee this will be 1000% effective but it’s a great rule of thumb for planning purposes.

So, if you can take out 4% each year, and you plan to need $100K, then simply take $100K/4% and you’ll end up with $2.5 million. Or, you can take $100K*25 since that’s the inverse of 4% and you’ll still end up with the same $2.5 million.

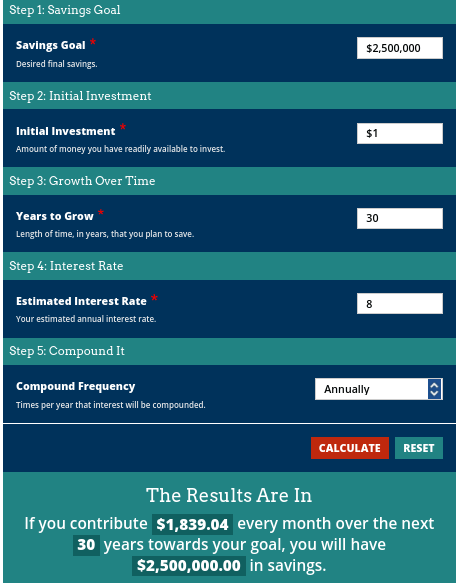

So, what do you do now? Now is when we head to Investor.gov to get an idea of exactly how much you need to save to hit your goal. To do this, you need to know a few pieces of information:

- Savings Goal – This would be the amount that you calculated above. In this case, it’s $2.5 million.

- Initial Investment – Do you have anything saved or are you starting from $0? Unfortunately, this calculator won’t let you put $0 in the field so just put $1 if you have nothing saved.

- Years to Grow – This one is a little bit simpler as you can just put in the amount of years between now and when you’ll need the money. If you’re 40 and want to retire at 62, then you would put 22 in this section.

- Estimated Interest Rate – This is the return that you anticipate getting each year. Typically I will put in 8% because the S&P 500 gets you 10%+ each year, and then you can take out a couple percent for inflation, putting you around 8%. If you want to be safe, put in an amount lower such as 6% just to be extra safe. It’s always better to oversave than it is to undersave.

- Compound Frequency – Keep this at annual.

When you do this, you will get an amount that you need to save each month to hit your goal:

As you can see, you’re going to need to save $1,839.04 for 30 years to hit your goal of $2.5 million. Now, there’s one major thing that you need to remember – your return is not going to be 8% every year. It will change for better or worse. This is nothing more than an estimate that was put in for planning purposes.

You have to be flexible when you’re doing this planning. Something that I personally do is I will recalculate my goals each year to make sure that I am saving enough. To round out this example we’re going to keep pushing through with these assumptions because it’s truly as good of an assumption as we can make.

$1,839.04/month is the same as $22,068.48 in a year, which is the amount that you need to save to hit that $2.5 million goal.

So, what does your savings rate need to be? Well, whatever the heck it takes to save at least $22,068 each year!

If you make $100K then it needs to be just over 22%. If you’re making $50K then it needs to be 44%.

“But Andy, I make $50K but after taxes it’s really only about $40K”.

Ok. Then you still need to save $22,068.48. So that’s 22% of your $50K gross salary and 55% of your net salary after tax.

I hope that you’re catching onto what I am really hinting at as I am writing this…the actual percent savings rate that you have is literally worthless. It’s pointless. It’s stupid. It’s a waste of time.

Look, I know that was extremely harsh, but this is a case where the percentage that you can save literally has no impact on your end goals. Let me give you an example.

If I was making $100K and was saving $25K, or 25% of my gross income. But let’s pretend that I was living in NYC and it cost me a ton of money to live there, so I decided to move to North Dakota and cut my expenses drastically. Unfortunately, my income also dropped a lot and now I’m only making $50K.

If I am making $50K and saving $20K then my savings rate went up to 40%! Isn’t that amazing?

But guess what – I am saving LESS money. The savings rate went up because my income dropped, but that’s absolutely silly to think that I am in a better spot now just because my savings rate is higher.

This is why I think it is so imperative for people to really do this reverse-engineering that I did to back into the amount of money that they should be saving, and investing, every single year. if you just apply a blanket percentage to it, you’re going to be using a flawed system.

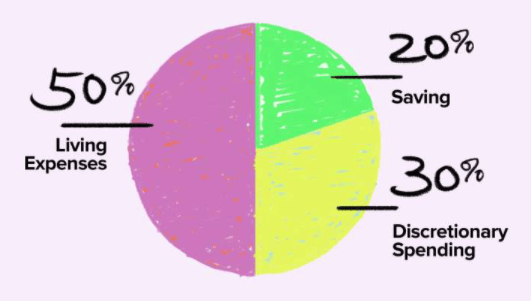

I just went and googled “how much should I save” and basically every single picture was a chart that showed the ever-popular 50-30-20 rule, as shown below from Money.com:

I’m sure that by now you can instantly tell what is wrong with this chart because it is missing all of this information that I talked about earlier.

Is this 20% of my gross income or net income?

Is this the same if I have 10 years till retirement vs. 30?

Is it the same if I put the money in a savings account earning literally .01% interest vs the 10% that the S&P 500 has historically returned?

No!

It all varies based on your own personal situation as does literally every single situation with your life when it comes to personal finance.

Ok – you know how much you need to save each year, so you’re all set, right?

WRONG!

There is one major piece of information that I have purposefully left out that needs to be considered… “The only constant in life is change”.

Have you ever heard that quote before? It’s one that I have heard many times and I have made it a point to have my financial life properly account for it as well. Let me explain.

Personally, my wife and I have one child currently. We know that we’re going to want at least one more child and potentially more after that – this means that our expenses are going to skyrocket in the future with daycare alone being up to $400/week in some cities.

Yes – I said $400/week. In fact, we recently were given a quote for daycare for our son in the new city that we’re moving to (Indianapolis) and it was $1750/month – OUCH!

Imagine 3 kids at that rate…it’s not feasible.

So what does this mean for how much of our paycheck we should save? It means that we should do literally every single thing that we can to save more money now because there’s a very good chance that we literally won’t be able to save as much when we have another kid, or more.

We need to take advantage of our current situation and do everything we can to save extra money now. So while we might only “need” to save that $22K/year, we actually should try to up that amount as high as we can to take advantage knowing that our expenses are lower than they will be in the near future.

If you’ve read some of my posts before then you know that one thing that I always talk about is the importance of being opportunistic when opportunities present themselves, and this is exactly what I mean.

Your life is not linear – your income will change. Your expenses will change. You may lose a job. You might get a raise. You might get an inheritance. You might have some major health expenses. The market might only return 2% each year for a decade. You might get 100%+ in a 5-year period (this just happened!).

Things have changed. You have to be ready to pounce when you are able to and that all comes down to knowing your numbers, knowing your goals, and making sure that you’re really thinking about the future.

Personally, our goal is to reach “Coast FI” by the age of 40 where we can literally stop saving money and just let the money that we’ve invested stay in the market for another 20 years and then use that money to retire.

Of course, even if this happened, we’d still continue to save, but we plan aggressively so that if we miss our goal by 2 years, then we’re still in Coast FI by 42 – a great spot to be in!

So, again – think about the future. crunch the numbers. Know what you need and be prepared to pounce when the opportunity is there. Find out how much you need to save, in dollars and not in percent, and then reverse engineer to get to what you need each month. And then maybe try to save a little bit above that just to be safe 🙂

Of course, a major part of this is making sure your money is invested properly as well. Once you start to create this budget surplus and save your money, it’s time to focus on investing.

My advice to you is to start with the Investing for Beginners Podcast for education and the Sather eLetter as a jumpstart to creating your portfolio – the perfect 1-2 punch to becoming the ultimate investor and beating the market!

Related posts:

- How to Save For Your Short-Term Financial Goals We spend a lot of time talking about saving and investing for retirement but one topic that we don’t touch on much is the importance...

- Struggling to Save? Start with These 4 Simple Auto-Investments Updated 4/1/2024 One of the most challenging steps to becoming financially independent is getting that little snowball moving downhill by creating a gap between your...

- Handy Andy’s Lessons: 3 Methods to Save Money from Your Salary I often hear that people can’t save money because they have none. For many people, this likely isn’t true. Instead, they likely don’t have the proper...

- How Much Should I Have Saved by 30? It’s Less Than You Think! Updated 3/27/2024 If you’re wondering, “How much should I have saved by 30?” then let me tell you this—you’re not alone. It’s scary how little...