For people trying to take control of their money and get out of debt, the Dave Ramsey plan is a very popular way to finally get results with your personal finances.

There are debates on whether the Debt Snowball method, made popular by Dave Ramsey, is the best way to do it. This post will discuss the pros and cons of the method and how to apply it to your own life.

Click to jump to a section:

- Dave Ramsey’s Advice on Debt vs. Investing

- The Dave Ramsey Debt Snowball Plan

- Motivation vs. Optimized Progress

- Introducing the Debt Avalanche Method

- Snowball vs. Avalanche Methods

- Implement the Debt Avalanche Method

Personally, I am a big fan of Dave Ramsey and what he is doing. I think that he does a great job motivating and teaching people how to get out of debt and become financially independent.

One thing that Dave Ramsey does, though, is he takes very extreme opinions on things.

Dave Ramsey’s Advice on Debt vs. Investing

For instance, he often says that you should completely eliminate your debt before doing other things with your money. I disagree with that statement.

If your debt is on a 2.5% interest student loan, paying off that debt shouldn’t be your priority. Instead, put it in the stock market to realize the beauty of compound interest, as the S&P 500 has averaged 11% annualized returns since 1950.

I get why he says the things that he says.

If you’re teaching someone that’s not financially savvy or new to understanding their finances, it’s much easier to explain to someone to “pay off all your debt first” rather than “pay off your debt unless the interest level is very low.”

“You should invest in the market if you think your returns will outperform the guaranteed X% return you have on your loan. But you have to invest properly and pick the correct stocks. Or, if the market crashes, then you can lose money. But you should invest.”

Yes, did I make that quote a bit dramatic?

Sure. But you understand what I’m saying.

The Dave Ramsey Debt Snowball Plan

Another thing about Dave Ramsey’s plan is the Snowball method to pay off debt.

For this method, you will pay off the highest balance first, then move on to the second highest balance, and once you pay that off, move on to the third. You will still continue to make minimum payments on all other payments during this time.

It’s called the snowball method because you will start slowly with your debt being paid off. But once you pay off one loan, you can then take all of that money that was going towards the first loan and apply it to the second, in addition to the minimum payment you already had on the second, and so on and so forth.

The snowball of paying off the debt will grow more and more, and you can wipe your debt out very fast, or so it may appear.

This is a very easy method for people to understand and execute, and I think that it is a good method for some people, but definitely not all.

Motivation vs. Optimized Progress

When I first started really trying to lose weight a few years ago, I was told that “the best diet is the one that you will stick to.” That makes a ton of sense, but is it actually true?

The person was trying to say that if you only eat chicken, sweet potatoes, and broccoli for every meal for months on end, you will likely quit your diet and go back to being unhealthy.

So, they were saying that I needed to find a happy medium – maybe, chicken, sweet potatoes and broccoli five dinners a week and then a cheat meal for two dinners.

But, is the diet with the cheat meals actually the best diet?

No, it’s not.

The best is to have the most efficient and healthy meals possible 100% of the time.

If you’re going to “relapse” from the strict diet, then maybe it’s the best diet for you specifically, but it’s not the most efficient diet.

Dave Ramsey’s plan is the same way. His plan might be the best plan for you because it’s easiest to understand, but I can guarantee it’s not the fastest way to pay off your debt.

Plus, I can guarantee it will cost you more money doing it his way.

I’m not one to say what is right and what is wrong, because different people are motivated by different things, but I am motivated by numbers. Judging by the fact that you’re on the Investing for Beginners Website, I am guessing you are too. The numbers say that the Debt Avalanche method is the most efficient, fastest, and cheapest way to pay off debt.

Introducing the Debt Avalanche Method

So, what is the Debt Avalanche Method?

First, pay off the loan with the highest APR. Second, pay off the loan with the second-highest APR. So on and so forth.

Rinse and repeat. That’s it. Very simple.

Essentially, it is the Dave Ramsey method, but focusing on APR instead of balances. Who cares if you have $10,000 in debt but are charged 0.1% interest? Focusing on the APR of debt gives a better picture of how important it is to pay off quickly.

Snowball vs. Avalanche Methods

Let’s put some numbers to this so it can make more sense because right now, I feel like I’m explaining but not teaching. Let’s take a look at the following example:

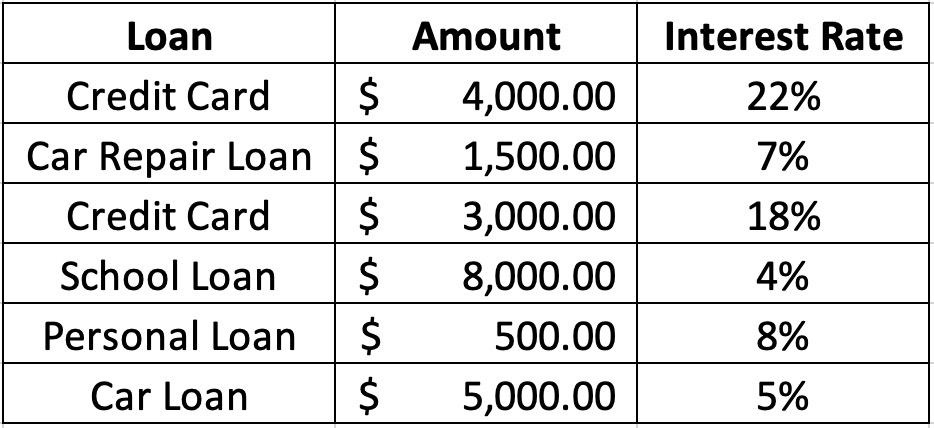

Let’s imagine that you have the following loans:

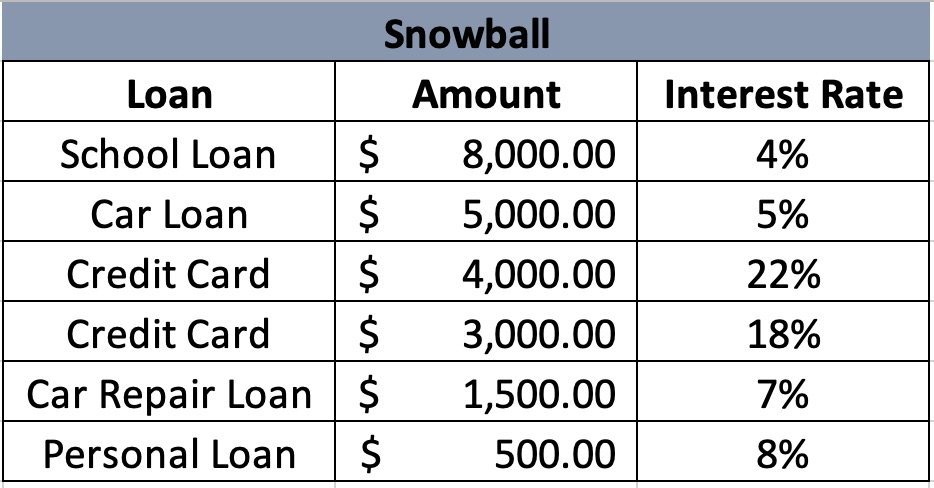

If you were going to pay these off using the Dave Ramsey plan of the Debt Snowball, the order of payments would look like this:

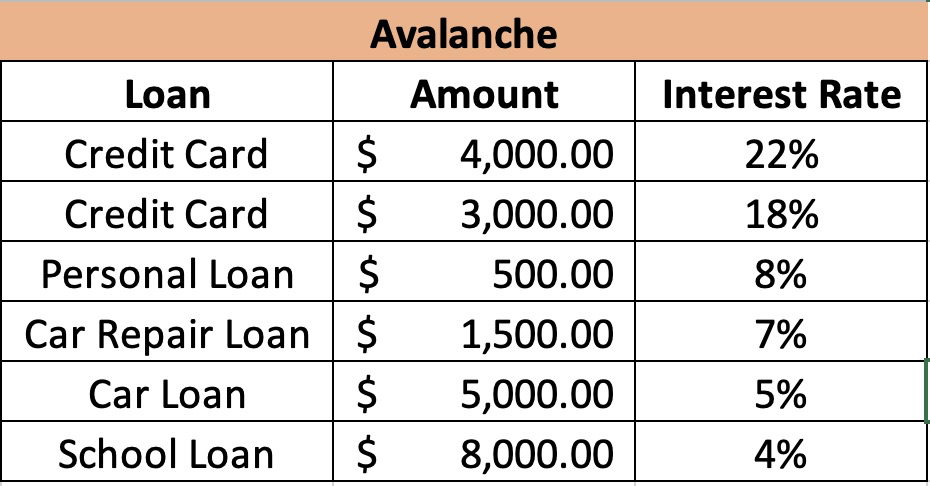

If you were going to pay these off using the Debt Avalanche Method, the order of payments would look like this:

As you recall, I mentioned that in either method, you need to make sure that you’re still paying your minimum payment method. Otherwise, you will get hit with a late fee and a ding on your credit score.

For the purposes of this example, let’s assume that the required minimum payment is 3% of the total amount due and that you can pay $1000/month total for all of these debts.

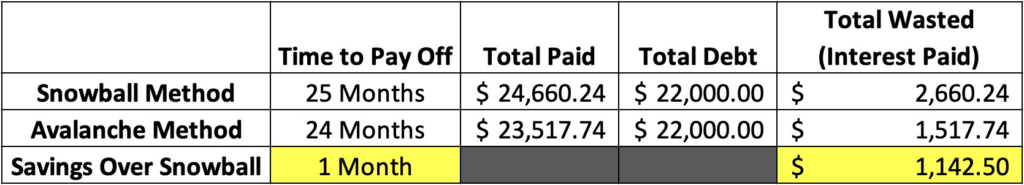

If you were to pay off your debts using the Snowball method, you would be able to pay off all debt in its entirety in 25 months. The $22,000 in debt would cost you a total of $2,660.24 in interest.

If you were to use the avalanche method, your debt would be paid off in 24 months, and you would’ve paid a total of $23,517.74, therefore wasting $1,517.74 (interest paid).

This might not seem like a crazy amount of money, but it’s literally 1 extra minute of work to implement. With either debt repayment method, you have to track your debt amounts – the avalanche method only takes that 1 extra minute to find out the APR, which is listed on your credit card statements, and then pay that down first.

That one extra minute can allow you to pay off your debt faster and allow you to save $1,142.50 over the snowball method.

If you’re like me and like to calculate things on an hourly rate or salary, then your hourly rate would be an hourly rate of $68,550 or an annual salary of nearly $143 million…lol.

Implement the Debt Avalanche Method

Implementing the Debt Avalanche Method is quite simple. To get started, follow these steps:

- Look back at your last 6 months of spending

- Find ALL monthly payments that you have to make for debt/loans

- Examples are credit cards that aren’t paid off in full, car loans, personal loans, student loans, second mortgages, anything.

- Once you find all of your loans, you need three pieces of information

- Total Loan Balance

- APR of the Loan

- Minimum Monthly Payment

- List them in the format of: Loan – Amount Owed – APR – Minimum Monthly Payment

- Sort them by the highest APR

- Determine how to apply those loan payments

- Determine how much in TOTAL you an afford to pay off the loans each month

- For example, $1,000

- Determine the minimum monthly payment of all loans combined except the highest APR loan

- For example, $600 total

- Pay the minimum monthly payments on all loans except the highest APR. The highest APR loan gets the remainder of your monthly budget for debt payoff.

- In this example, it would be $400 ($1,000 loan repayment budget – $600 total other minimum payments = $400 leftover for highest APR loan)

- Determine how much in TOTAL you an afford to pay off the loans each month

As you can see, the process is very simple, and you can save a ton of money and time by being proactive on your end. I really do encourage you to look at the numbers and try to understand the math as to why this method will help you get out of debt faster than the snowball method.

I know the snowball concept is to start slowly and build up a lot of momentum, but why not just come out of the gates hot with the avalanche method?

Related posts:

- Optimizing Home Savings with the Right Down Payment Options Have you started your home savings account and aren’t sure what to do with the funds? Do you feel like you’re not doing enough with...

- How Much Should I Budget for a Car? At times you need to treat yourself, but always make sure to calculate how much you can spend on a car before you go crazy!...

- Stop Bleeding Money with Activity Based Budgeting! Updated: 6/7/22 Many of you know me as Doctor Budget, which I absolutely love, but I personally think one of the most important things for...

- What to Do With a Money Windfall (with 2 Real-life Budgeting Examples) Imagine this situation – you’ve just had a lot of money come into your life unexpectedly – maybe it was an inheritance, or a big...