In the personal finance community, there are many varying opinions on all topics imaginable. And as you might anticipate, some of them can get pretty feisty – well, one of those debates is about credit vs. debit cards. Credit cards have a ton of perks as you might know, but there are also many debit card advantages and disadvantages.

Key Takeaways:

- Debit Cards vs. Credit Cards – Depends on the Person!

- Credit Card Rewards Can Be Significant but Easily Wiped Out with Interest

- Debit Cards Help Teach Spending Responsibility

- Debit Cards are Like Bowling with Guard Rails – You Don’t Look Cool but You Don’t Ever Get a Gutter Ball

In this post, I’m going to cover the following major topics:

- What is a Debit Card?

- Debit Card Advantages

- Debit Card Disadvantages

- Does it Cost to Have a debit card?

- Credit Card vs. Debit Card

What is a Debit Card?

A debit card is a card given to you by your bank that allows you to pull money directly out of your checking account. In essence, it’s like a virtual check. You swipe your card, enter your PIN, and the money will come straight out of your checking account.

This is different than a credit card as when you use a credit card, you’re borrowing on a line of credit, as the name of the card hints. Then, you have to pay back that amount that you borrowed if you want to avoid paying interest.

On a debit card, because you’re using it to pull money directly out of your account, you’re not borrowing money from anyone so you don’t have to pay anything back. Now, there are major pros and cons to having a debit card as you can likely imagine, so let’s dive right into it!

Debit Card Advantages

One of the major advantages of a debit card is that you’re only spending what is in your account. Truthfully, I think this is far and away the biggest advantage.

By not ever borrowing any funds, you’re eliminating the potential to spend more money than you have. That’s oftentimes how people will get themselves in a lot of trouble with credit cards because they’re overextending themselves and spending more than they can afford.

Then they find themselves stuck paying interest at a rate of 20%+ and not ever being able to get out of the hole, all because they started by spending too much.

With a debit card, you spend what you have, and if you don’t have it, you can’t spend it – plain and simple.

For someone that struggles with their financial discipline, this can be an amazing option to keep you from overspending.

Another advantage is that debit cards are easy to acquire. Because you’re not applying for credit, there is no impact on your credit score, and you can simply open one with your bank. Now, it will take some time for the bank to create a card and get it sent out to you, but it’s a much simpler process than having to fill out an application like you would with a credit card.

And finally, the last major advantage is that you can use it anywhere. Some credit cards, like American Express, aren’t accepted by some vendors because of the fees that they charge. With a debit card, this is not going to be the case for you.

If you’re going, “Andy, most large places will accept American Express”, then I would agree most of the time, but not always! I go shopping at Aldi for my protein and fresh produce because it’s much cheaper (and better quality) than some other grocery stores near me, and they don’t accept American Express. Pretty messed up, right?

Well, I get some pretty massive rewards back from that credit card, and that’s all funded by American Express charging their merchants, so that does somewhat make sense.

With a debit card, you don’t ever have this fear. Your card is always going to be accepted because it’s effectively straight cash coming out of your account.

Debit Card Disadvantages

The largest disadvantage to me is the rewards points that you miss out on vs. a credit card. And honestly, I think it’s a pretty major disadvantage.

There are so many different types of credit cards with great rewards that you can make quite a significant amount of money but simply finding the best credit card that fits your needs. For starters, I like to search for the best credit cards and usually end up on Nerdwallet.com and seeing what their current top cards are listed as.

When I do that, I was able to find multiple cards that offer you cash back of 2%+ on every dollar that you spend. That’s amazing!

Just think – if you were to currently be spending $2000/month on your debit card and switched that money to a credit card that’s earning you 2%, you’re looking at $40/month or $480/year!

That’s not an insignificant amount of money for essentially doing the exact same thing as you would with a debit card.

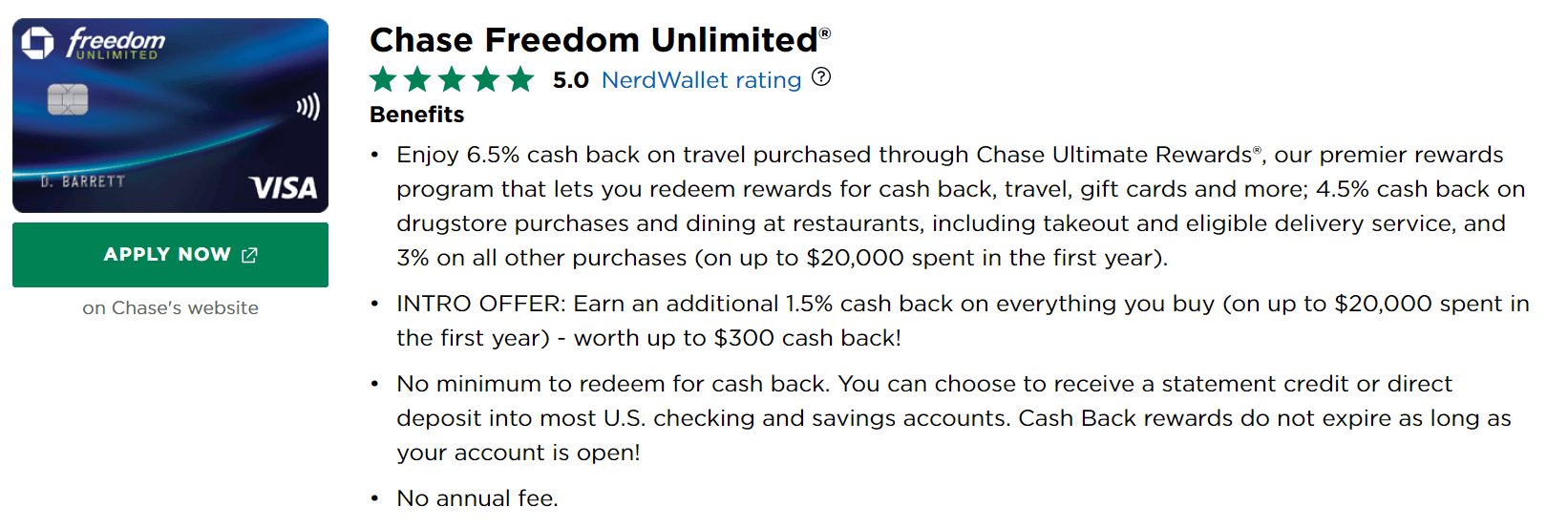

For a specific example, let’s just take the first credit card that is listed on the Nerdwallet article, the Chase Freedom Unlimited card:

With this card you get:

- 4.5% cash back on drugstore

- 3% on all purchases

- 1.5% on all purchases up to $20K in the first year

- No Annual Fee

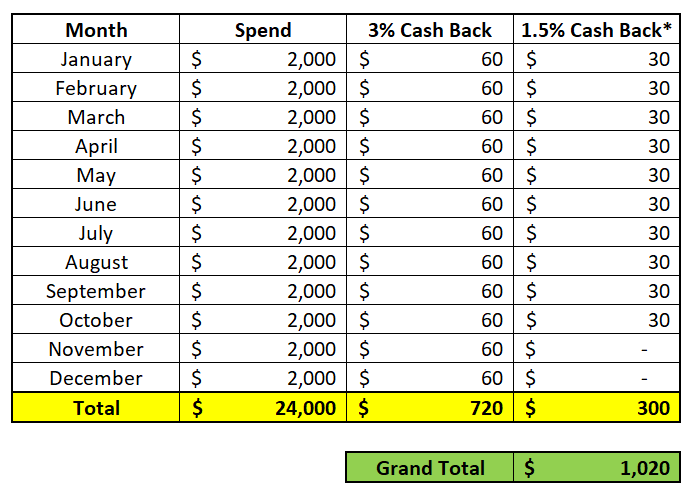

With a debit card you don’t get any of these benefits. but, how exactly does this impact you monetarily? In just one year, you would have saved over $1K if you spent $2K on your credit card:

Pretty incredible, isn’t it?

The credit card rewards are unbeatable when it comes to cash back, but if you’re not going to be able to pay off your card in full each month, then you’re quickly going to erode any benefits that you’d receive by using a credit card.

Another disadvantage, that could also be considered an advantage, is that you can only spend what is in your account. Now, there is an obvious benefit to the fact that this is going to help keep you from going into consumer debt, but this also can be a very big disadvantage if you’re savvy with your personal finances.

For example, let me explain how I use my credit card. After I’m paid, I will allocate my money to the various funnels that it needs to go to. This includes my savings/investing, setting aside money for any upcoming bills, and then paying off my credit card balance.

For the next two weeks until I am paid again, I will spend on my credit card. My checking account will hover right around $500 (as a buffer) + the amount of money that I need to cover my fixed monthly expenses (rent, insurance, utilities, etc.) until my next paycheck. I won’t keep any money in my checking account for whatever I spend on my credit card but rather just let the balance grow.

Then, when I’m paid again, I will pay off my credit card, put some money away for savings/investing, keep enough in my checking account for a $500 buffer + other fixed expenses, rinse and repeat.

The reason that I will do this is because I know from years and years of budgeting with Doctor Budget that I don’t need to worry about way overextending myself. Typically, I know how much I can spend and don’t ever come close to going over that balance unless I have an emergency, and in that case, I will simply use my emergency fund.

I am comfortable running my balance down to $0 because like I mentioned, I am very confident in knowing my financial situation like the back of my hand. This confidence wasn’t natural for me as I have made many, many financial mistakes, but they have motivated me to learn and get to where I am now.

If you’re someone that doesn’t have any spending discipline, this strategy is not for you. But the reason that I like this strategy is because I can spend without worrying about overspending what is in my account. And the reason that this is nice is because if you overspend your account, you’re going to have an overdraft fee.

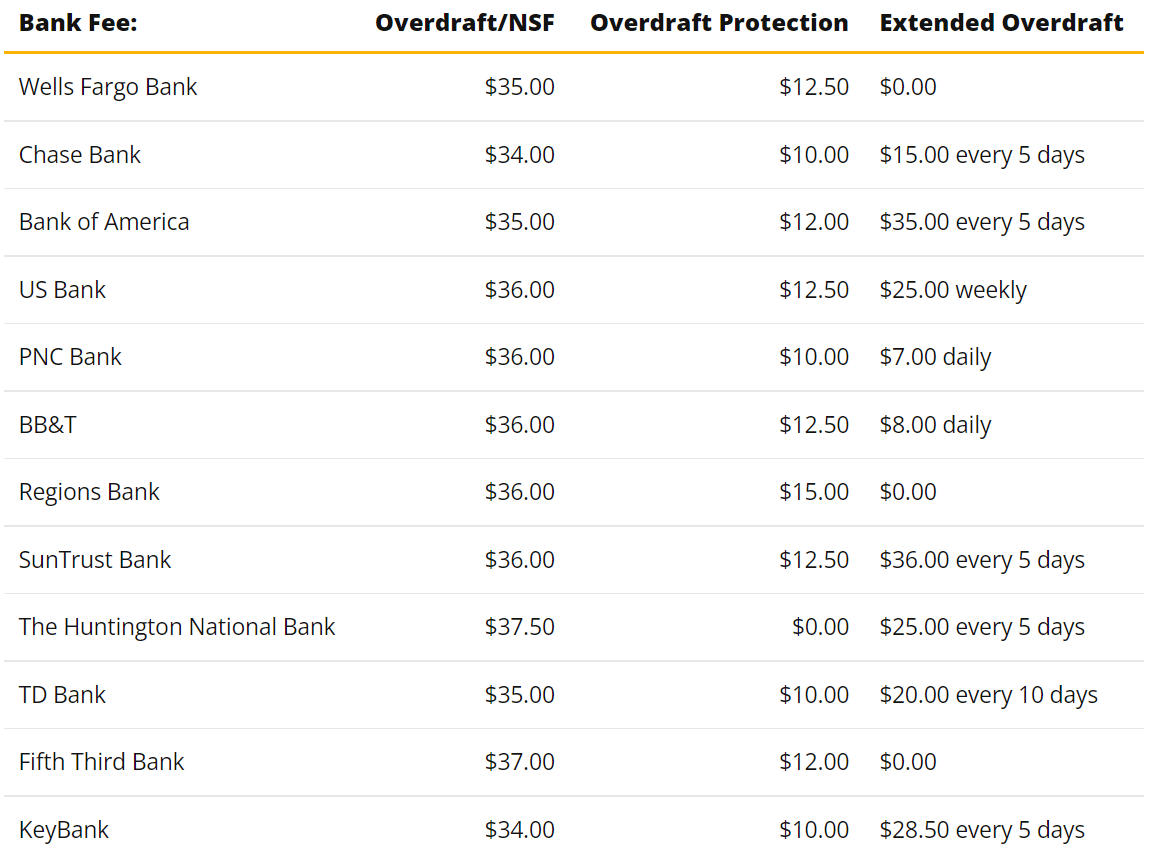

Many banks, especially the brick & mortar banks that are more “traditional”, are going to charge you an overdraft fee if you try to make a purchase that’s larger than the money in your account, and these overdraft fees can be quite hefty!

Can you imagine paying $35+ for trying to make a purchase that you don’t even get to make? Let me say this again…

If you have $100.00 in your account and something costs $100.01, not only will you not be able to make the purchase, but you will have to pay $35+ simply for trying to make that purchase.

Nothing like a poor tax, right? That’s brutal!

There are some newer banks that offer debit cards that don’t have an overdraft fee but they’re typically newer, online banks.

At the end of the day, if you’re not going to overspend what you have, then this is a moot point. But even for the most savvy personal finance expert, sometimes things will slip the back of their mind and you will get hit with one of these “nice” reminders…the $35 variety.

Does it Cost to Have Debit Card?

Nope! Debit cards are almost always free to the account holder. Now, there are some fees that you’ll likely encounter if you’re going to use the ATM somewhere different than your bank, but the actual cost of the debit card is $0.

Credit Card vs. Debit Card

“Ok Andy, I stumbled through this entire blog post but I really just want to know which one is better for me.”

Fair enough – let’s get down to brass tax.

In one sentence, I think that the credit card is for those that are financially disciplined and the debit card is for those that are needing some guard rails up for their spending.

There are inevitably great monetary advantages to using a credit card as I’ve shown above but if you’re going to end up spending more than you can afford to pay off, you’re going to be stuck paying a 20%+ interest rate. Not only that, but you literally will have spent more than you intended to, meaning that you’re losing more than you even spent!

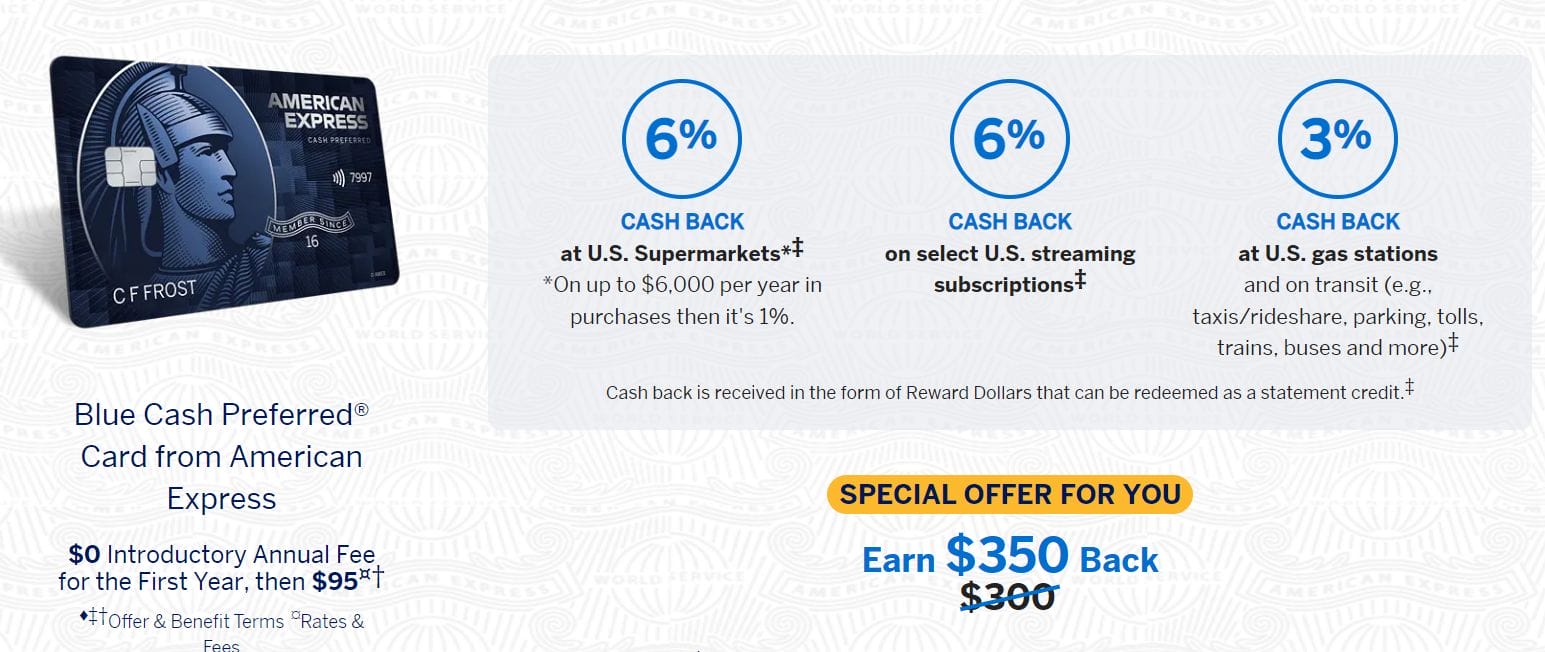

Personally, I use the American Express Blue Cash Preferred card for all of my purchases:

I love this card because my highest discretionary spending, by far, is at the grocery store and now in my car when gas prices are hitting nearly $5/gallon in the Midwest. I recently upgraded to this card from the Blue Cash Everyday card because the benefits are just too good to pass up.

Now I will have to pay the $95 fee each year, but simply by getting 6% at supermarkets instead of 3% on $6K in purchases, that’s going to make me $180 every year, so I’m already coming out ahead.

Normally I wouldn’t open a credit card just for $100/year, but since I already had an AmEx, it allowed me to upgrade without having to apply and show a hit to my credit report.

Again, I like this because I feel confident in my spending restraint. If you don’t, use a debit card.

I used a debit card for years and years before I was comfortable opening a credit card, and once I did open a credit card, I maxed that thing out, realized I made a mistake, and went back to my debit card.

Both cards have major pros and cons but the end goal is the same – maximize the amount of money that stays in your pocket. And why do we like to do that? So we can go invest in some great companies with the Sather Research eLetter, of course!

Related posts:

- A Deeper Look at all of the Credit Card Pros and Cons that Exist We now live in a world where most people solely use credit cards, cash is a blast from the past. Check out these credit card...

- Understanding all the Visa Perks on Different Credit Card Options With so many different credit card options available, it’s important to weigh all the possibilities. Check out the Visa perks on these different cards and...

- Evaluating the Allegiant Credit Card Perks and if it Makes Sense for You When it comes to choosing a credit card and rewards program, there are a ton of different options to choose from. Keep reading to see...

- 5 Disadvantages of Credit Cards to Be Aware Of Prior to Opening One! “Wait – Andy, are you telling me that there actually are disadvantages of credit cards?” Yes, I certainly am. I know that sounds facetious, and...