Bitcoin. There, I bet I made you feel some type of way. Maybe excited, triggered, happy, sad, something! Bitcoin is a very common crypto and it made me wonder if crypto was the answer to U.S. debt – let’s take a look!

Essentially, the thought process is that with the U.S. Debt continuing to increase to record highs every year, what is going to happen when the bubble eventually bursts? I always hear people telling me that the debt is just becoming so insurmountable, and all that they do is look at the total number without any sort of context at all, and it absolutely drives me nuts. How can you tell me the bubble is going to burst if you literally know one thing about it? First off, I think that we need to answer is if it’s even a bubble at all.

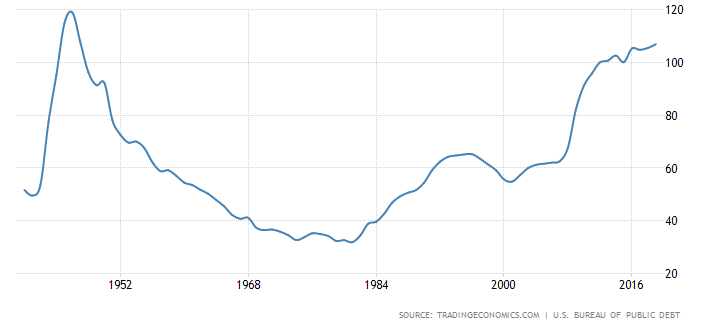

Personally, I like to look at the Debt/GDP to get a true picture of how things are trending and this chart from Trading Economics really helps to paint the picture:

Yes, things are getting worse, but they’re starting to stabilize a bit and we’re definitely not at the worst point in history. Andrew and Dave talked a ton about the Government Debt on a recent podcast episode and they can teach you way more about it than I can, so definitely take a listen the next time that you find yourself with some time to make sure you really understand this subject.

In essence, the thought process is that when a recession occurs, the Fed will prop up the economy and our citizens by printing money and handing it out via some sort of stimulus. Does this sound familiar at all? Like, maybe the exact situation that we’re going on in the coronavirus?

The thing is that we’re in such a weird situation right now that you can make the case for both inflation and deflation but the fact is that many people are unemployed and the government is flat out just printing money to help keep these people alive. Personally, I am happy that the government is doing it because the government is the one that told people that they can’t work.

And personally, I am also very happy that the government told people that they can’t work, either. I think we responded pretty well (after kinda just sitting around) with the coronavirus but now we’re opening back up and I think that we’re going to see another pretty bad spike in the fall…but we shall see, I suppose.

I didn’t mean to digress but I wanted to show that I think the opportunity for the fed to keep printing more money is still very real, both right now and in the future, and that’s just going to increase the U.S. Debt. So, how does Crypto fall into this?

Well, Bitcoin, for instance, is produced at a steady rate and really won’t increase or decrease as things occur in life. It’s something that’s pretty much setup to just continue on at this steady rate to account for population change, meaning that you’re not really going to have to deal with inflation or deflation and that it’s purely a supply and demand product.

In theory, this is great, because it can prevent the fed from devaluing the dollar, but I would personally hate for us to be in a situation where we need to shutdown the economy to protect the entire country during a pandemic and we choose not to because we know it’s going to bankrupt many families and potentially result in an increase in crime out of pure necessity for families.

It would be absolutely awful. Sure, I don’t want us to go in more debt, but I don’t want a family to suffer simply because we don’t have that lever to pull to provide some sort of assistance to companies.

Another major think that crypto would need to overcome is that it would need to become more universally accepted at places of business. Of course, this isn’t something that is impossible to occur because I feel like electronic payments are continuously evolving, but I can only imagine a small independent restaurant trying to accept bitcoin as a payment for their customer’s waffle breakfast.

I mean, many gas stations still don’t even have the full EMV capability. “EMV? What’s that, Andy?” You know the little chip on your credit card where now you enter the card sideways instead of swiping it? That’s EMV. And yes, many gas stations still don’t have the ability to accept that. And that seems like that was many moons ago! Because it was…

The thing is, we just don’t move fast…at anything. If there was a major cause for us to move to some sort of crypto then I definitely think that we would, but right now I just don’t think that the benefit is worth the potential negative.

Call me what you want, but I think that some government intervention is actually good for us all, even if it seems awful at the time.

I was reading a pretty good article from CCN where they talked about how Bitcoin could be impacted in the next recession and sure enough, here we are. One thing that they talked about is that the value of Bitcoin was going to skyrocket.

Well, BTC is up 33% YTD in 2019 through 6/15 and nearly 8% since March 1st, but I don’t know if I would call that a skyrocket. It’s still now at 2020 highs and about 30% behind a TTM (Trailing Twelve Month) look.

My point really of saying this is this – crypto, and bitcoin in particular, receive an absolute ton of hype at almost all times. Is it a really cool innovation that has a use in society? Sure, I guess. Is it something that is going to solve the U.S. Debt situation? I’m not sure and I don’t care, because I’ll bet the farm that it won’t happen during any of our lifetimes!

And if it does happen, then I’ll just trade all of my cows for a bitcoin ? Get it? Farm joke? Sorry. I do have the same number of cows as I have bitcoins, though.

Zero.

Related posts:

- Economy 101: The Fed, Money Supply, Debt, Inflation, and Deflation I am now a few years into my investing journey and while I feel like I have a pretty good grasp on what sort of...

- Navigate the Federal Reserve Balance Sheet with This Simple Guide Updated 4/4/2024 With the recent announcement that the Fed will increase its balance sheet by about $4 trillion, I thought it might be a good...

- Global Wealth, Money, Real Estate, Bond, and Stock Market Statistics With so many trillions and billions of dollars changing hands around the world today, how can the average investor make sense of it all? Follow...

- The Effects of Inflation and Its Role on the Economy and Your Money We’re living in super uncertain times right now and if you’re anything like me, you’re likely wondering about how all of this coronavirus and stimulus...