A few months ago, Andrew and Dave hosted a guest on the Investing for Beginners Podcast and it was one of my favorite episodes. Their guest was someone that was so focused on finding deep value that I went back and listened to the podcast again and wanted to do an episode summary completely on my key takeaways. So, here we go…Deep Value – Tobias Carlisle edition!

I previously included Carlisle on my ‘Super 6’ List of Deep Value Investors and I think it’s for good reason. Carlisle has written many great books, including one that I might even think about as a candidate for my next chapter review series as I’ve previously hit on ‘The Essays of Warren Buffett,’ ‘Rich Dad, Poor Dad,’ ‘Common Stocks and Uncommon Profits,’ and ‘What Works on Wall Street.’

Carlisle has a list of eight rules for deep value investing and they all really hit home, but a couple stood out to me that I think really summarize his investing philosophy:

“Zig when the crowd zags” and “the bigger the discount, the better the return.”

I love these because they really get you into the contrarian mindset and Carlisle’s thought process in this entire investing strategy really is that things will revert back to the mean. If a stock is overvalued, it will eventually revert back to being properly valued and if it’s undervalued then you can expect the same to occur.

Therefore, if you can identify stocks that are undervalued, you should be able to capture significant returns as those stocks become more properly valued.

I love the idea of a mean reversion strategy and think that it can be a fantastic tool to use if you know how to use it properly and can stick to your guns on it.

But before I get going too far off down the wrong path, let’s reel it back in and talk about the podcast episode that I’ve mentioned!

There are a few key takeaways that I had when I went back and listened to the podcast, so let’s get a little bit more in depth with them:

1 – Look for companies that are cyclical in nature

This one makes a lot of sense to me. If you’re focusing on a company that is very cyclical in its nature then it will naturally go through time periods where the company, or industry, is booming and then sometimes where it’s really lagging behind.

I instantly think of oil companies because they’re so tied to a commodity where they really have minimal impact about how that commodity is priced.

Essentially, if you wait until the oil company that you’re evaluating is booming, then everyone is going to start to buy into that company as well. The key for you, as an investor, is to try to identify that company and get a position in them prior to the cyclicality period of badness (I need to trademark that) ending and then the good times starting to begin.

In fact, Carlisle even says that the worst time to invest in a stock is when things are booming and everyone is throwing money into that industry, because that means that you’re likely in the middle of the great times…i.e. buying high!

2 – Focus on buying a company with a great balance sheet

Stop me if you have heard this one before. Maybe from like every single successful value investor ever!

Andrew and Dave are always talking about the value of the balance sheet and in these uncertain times with coronavirus, I think it’s even more important than ever before. It’s important to not only understand the long-term liquidity but also the short term by using the quick ratio and the current ratio.

Carlisle really boils it down to two simple things to look at, cash and free cash flow, if you want to make sure that the company has a strong financial base.

“If you have the cash, you have a long runway to resolve all the other problems.”

Ain’t that the truth?

3 – Maintain a contrarian mindset

To be honest, this is probably my favorite one. When I first listened to this podcast episode I really started to try to think different from others. Benjamin Graham once said that “The intelligent investor is a realist who sells to optimists and buys from pessimists.” I think that this really sums up what we should be trying to do as investors.

If you’re always trying to think differently from the market and the consensus, then you’re never going to find yourself just going with the flow. Sure, sometimes the majority and consensus are in fact right, but that’s not always the case by any means.

To do this, Carlisle created his own ETF, ZIG, where they will look for companies that have strong balance sheets and are cheap on an operating income to enterprise value basis.

Another big thing that they look for are companies that are generating free cash flow and using that free cash flow to buy back stock or to pay down debt.

“So, we build in all of these advantages on the long side, and then we concentrate on the 30 best names, and we roll them every quarter.”

I’ve mentioned before that I am not a big fan of ETFs in general, but I have done some research on ZIG and I really like the premise and what they’re trying to accomplish.

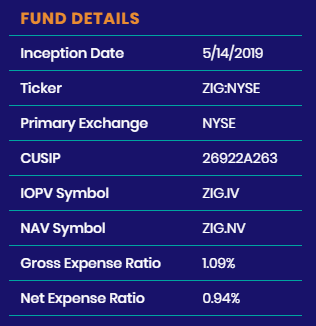

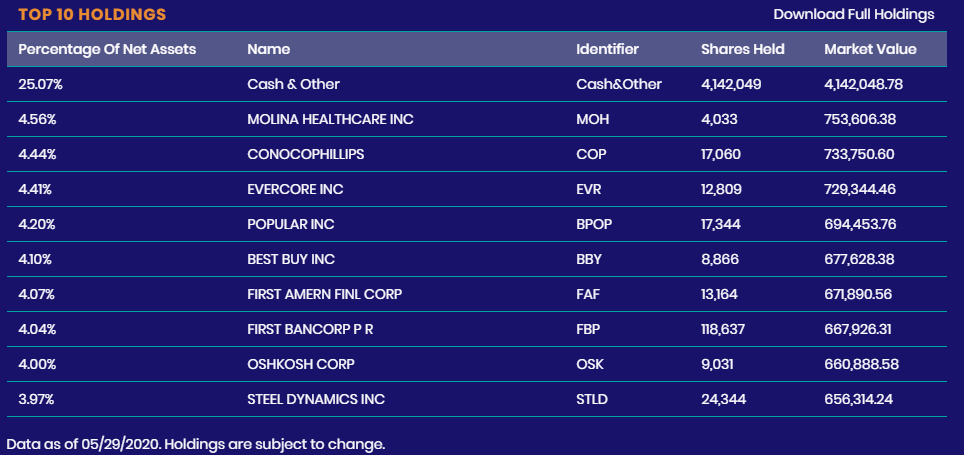

You can learn more about the ETF on the Acquirer’s Multiple website but I have also included some of the Fund Details and the Top 10 holdings listed below:

I love that I have the ability to download the entire portfolio into an excel spreadsheet and then I can even do some of my own research on these companies if I want to, or even put them into the Value Trap Indicator to get my VTI score.

Honestly, I could’ve probably summed up this article in one sentence by saying…

“Focus on buying company’s that people are overlooking, have a great balance sheet and go against the consensus opinion.”

But let’s be honest. This was way more fun to get into the weeds! I get so far in the weeds that they call me the gardener! (Nobody calls me that but the wheels have officially fallen off)

Oh yeah, one last thing to add – check out the podcast episode, ESPECIALLY if you haven’t listened before. You will absolutely learn something!

Related posts:

- ‘Super 6’ List of Deep Value Investing Thought Leaders (and their quotes) Deep value investing is a kind of value investing that compares the price of a stock to what it’s really worth. Rather than looking at...

- The Emotional Decision of When to Sell Stocks in Your Portfolio Every new investor wants to know when you know that you should buy a stock, but it seems like the question is never asked about...

- 9 Top Benjamin Graham Quotes on Value Investing Benjamin Graham is one of the most successful value investors of all time and he also has given us some freaking amazing quotes throughout his...

- Advice from Investment Management Associates CEO Vitaliy Katsenelson One of my favorite things about the Investing for Beginners Podcast is that a lot of the information is timeless lessons that you can go...