If you know anything about me, you know that I am a literal fanatic (psycho) about personal finance. I love finding continuous ways to optimize my finances in the most optimal solution, and that’s exactly how I came across the Dependent Care FSA.

I listen to personal finance podcasts and read all sorts of FI articles nonstop in my life, partially for the continuous encouragement and motivation, but also because I sometimes will stumble upon hidden gems that I previously was unaware of. Well, the Dependent Care FSA is one of those hidden gems, and I can’t wait to share it with you!

Key Takeaways

- A Dependent Care FSA is a way to avoid taxes on up to $5000/year of eligible expenses

- Eligible expenses include popular items like daycare, after school programs, day camps, preschool, nanny, and even some elder care

- 67% of employers offer a Dependent Care FSA

- The maximum potential savings that a couple could realize is $1,850 on federal taxes alone

As I mentioned, I am always listening to podcasts, reading books and articles, and just seeking any way that I can to try to find unique ways to put my money to work in the most efficient way possible. Honestly, to me, it’s simply a game.

I like to find ways to make my dollars stretch as far as humanly possible and it’s why I’m such a fan of things like the Roth IRA, the HSA, money-saving apps, and meal prepping, but this is a method that takes the savings to the absolute next level.

In this post, I’m going to answer the following questions:

- What is a Dependent Care FSA?

- What is Covered and Not Covered Under a Dependent Care FSA?

- Who is Eligible for a Dependent Care FSA?

- Is it Worth Doing a Dependent Care FSA?

- How Does a Dependent Care FSA Work?

What is a Dependent Care FSA?

Before understanding what a Dependent Care FSA is, we need to start with the basics of explaining what a Flexible Spending Account, or FSA, is.

You might be familiar with an FSA from your employer for health insurance. They are a type of account that you can contribute money to on a pretax basis for medical bills. One extremely important aspect of the FSA is that the money has to be spent in that calendar year, unlike an HSA. A lot of times you will see this option available to someone that uses a low-deductible plan because it provides them a way to save money by using pretax money.

Let me really emphasize this point…You either use it or lose it. This isn’t an issue at all if you have medical bills that you can plan for and put money into your account to get the tax savings, but otherwise, it’s a bit of a risk.

In 2022, the most that you can contribute to a Dependent Care FSA is $2500 if you’re single and $5000 if you’re married. That might sound like a bit of risk depending on your scenario but remember that these are simply the max contributions and you can contribute less than that if you’re worried about spending it all.

A Dependent Care FSA has the same mechanics as an FSA used for health, but this is instead used for, well, dependent care. But the question remains – what is dependent care?

What is Covered and Not Covered Under a Dependent Care FSA?

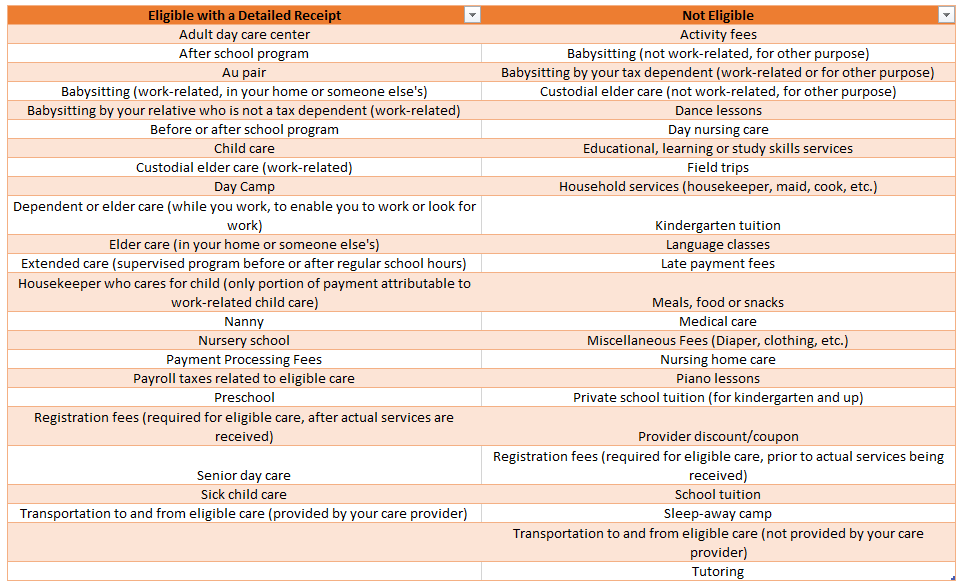

There are many things that you can use a Dependent Care FSA for but the piece that most of us are likely familiar with is child care. Below shows a comprehensive list that you can use the Dependent Care FSA for:

Many of these expenses are extremely niche, but this list was taken directly from FSAfeds.com and if there’s one thing that I’ve learned with requesting reimbursement for programs like this, it’s always better to be safe than sorry and know what you’re working with. I can’t imagine putting $5K away with the intent to use it for tutoring and then finding out at the end of the year that my savings cannot be reimbursed.

And not only can it not be reimbursed, but you just put $5K into an account that expires and goes away forever!

Let me say this extremely clearly – make sure that your intended reimbursement meets the requirements of a Dependent Care FSA before putting a single penny into the account. The risk isn’t worth the reward!

Who is Eligible for a Dependent Care FSA?

There are some specific rules to determine eligibility for a Dependent Care FSA, but in my opinion, it starts with your employer. A Dependent Care FSA is an employer-sponsored plan, meaning that they are not required to offer a Dependent Care FSA and if they don’t, your ability to open one is effectively nonexistent.

So, the first step is to reach out to your HR team and understand if the Dependent Care FSA is an option and if it’s not, understand why it’s not. Chances are there are a lot of people that could take advantage of this and currently aren’t, so it would be worthwhile to yourself and many others to at least ask the question!

The good news is that as of 2018, 67% of employers did offer a Dependent Care FSA according to business.com, which I actually think is pretty high given this is a more niche product and benefits outside of the normal health insurance and 401k match that you see from many employers.

If your employer does offer the Dependent Care FSA, there are some additional things that you need to qualify for. First of all, if you’re married, you either need to be working or looking for work. There are some stipulations around it such as being laid off vs. stay-at-home parent, full-time students, nanny, etc., so again, I recommend understanding those before opening a Dependent Care FSA.

At the end of the day, if both you and your spouse are employed, you’re good to go.

Is it Worth Doing a Dependent Care FSA?

If you are someone that is currently paying for daycare, then you’re not asking this question, plain and simple. The cost of daycare and some of the other expenses that are covered under a Dependent Care FSA are just so insanely outrageous that you already know that opening a Dependent Care FSA is worth it.

Just to hammer the point home a bit more, check out some of these statistics from Zippia.com on current child care availability, costs, and trends:

- 57% of working families spent more than $10,000 on child care in 2020. In 2021, 59% of families are budgeting to spend more than $10,000 in yearly child care costs.

- On average, Americans with children spend at least 10% of their household income on child care.

- 58% of working parents rely on child care centers — that’s about 6.38 million parents across the nation.

- On average, it costs $340 per week to send a child to child care or daycare center.

- About 20% of stay-at-home mothers would enter the workforce if they had child care assistance.

- The cost of child care has led to a 13% decline in the employment of mothers.

- About 42% of mothers are sole or primary breadwinners for their household.

- 62% of families are more concerned about the cost of child care now compared to before the pandemic.

- Roughly 27.1% of infants and toddlers in the U.S. attended some form of paid child care as their primary care arrangement in the U.S.

- 27% of families who have difficulty accessing child care can not find an open child care slot.

In summary, daycare is extremely expensive, people struggle to pay for it, and even if they can afford it, it’s hard to find a daycare to get their children into. Not being able to get your children in a certain daycare might lead to you enrolling them at a more expensive daycare just to get them enrolled faster.

Truthfully, it’s pretty dang depressing trying to comprehend some of these child care statistics. It has become just insane to first of all even try to find daycare availability in itself, and then when you do find a daycare with some availability, you’re having to pay a ludicrous amount to send them somewhere that you’re confident your child is going to develop and grow.

My family recently relocated from Ohio to Indiana and we found that the literal cheapest daycare we could find was still going to be $5/week more than where our son was currently going, which was the high-end of the town we were in. And when we heard them say that the cost was $200/week, my initial reaction was, “what is wrong with your daycare being this cheap?”

Now, of course, I didn’t say that, but how messed up is it that this was my initial reaction because every other place I was calling was $300+ per week. Some were even upwards of $2K/month!

WHAT IN THE WORLD!

And, is daycare the place where you want to do your bargain shopping? I mean, if the phrase “you get what you pay for” is true, do you want to cut out on your child’s education, safety, healthy meals, and honestly the majority of their living environment? I mean, they’re going to potentially be there 8-5 from M-F, maybe earlier and later like our son is. He is literally in daycare more than at home for hours that he’s awake. So, no – this is not where we’re bargain shopping, and in turn, we pay a pretty penny for his daycare.

And all of these reasons are the exact reason why I love the Dependent Care FSA. The savings that you can receive are regardless of the actual daycare that you choose. Let’s go ahead and get into the semantics of the way that the Dependent Care FSA works.

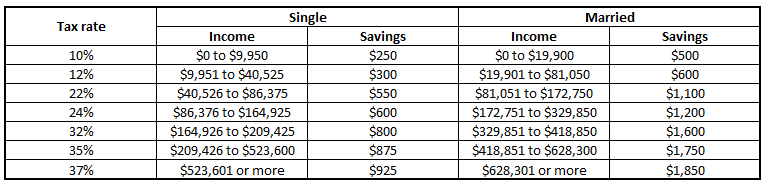

Based on the 2022 income tax brackets, your savings can be extremely substantial. The chart below shows the potential savings that you’re looking at for federal taxes only if you were to max out the contribution of $2500 for Single Filers and $5000 for Married Filers:

The average household income where I live is around $85K meaning that if my wife and I made the average income and we maxed out the $5K contribution, we would save $1,100 in taxes each year.

Not bad for doing about 10 extra minutes of work! Sure, $1,100 doesn’t now make daycare cheap all of a sudden, but it sure does lessen the blow just a little bit.

How Does a Dependent Care FSA Work?

The process is extremely simple. You will have automatic contributions taken directly out of your paycheck and put into a spending account. These contributions might be taken out ratably throughout the entire year or they can be loaded towards a certain timeframe.

As you incur expenses for daycare or a different eligible expense, you simply will save the receipts and submit them for reimbursement. The process is extremely simple but you must keep good records of your expenses and receipts just in case you were to ever be audited.

If you have an HSA, you should be doing the same thing for your receipts because you can take reimbursements for medical expenses that you’ve paid out of pocket at any point in the future – no questions asked. You just need to have the receipt.

I just use a Google Sheets file and put in pictures of the expense/receipt with some information such as the date, amount, etc., and call it a day.

Again, if you have questions, definitely reach out to HR first because each plan will likely slightly vary since it is indeed an employer-sponsored plan.

Summary

If you have some expenses that are eligible for the Dependent Care FSA, hopefully, you’re all-in and are already asking yourself, “now who is my HR person again?” because contacting them should be your first step. Once you’ve done that, you’re ready to start changing nothing in your life except for counting the “savings” that you’re going to get.

What’re you going to do with the savings? Well, I recommend taking a small portion of it and purchasing the Sather Research eLetter to expedite your Financial Independence journey, but that’s just me!

Related posts:

- Why you Should Consider a Dependent Care FSA With the cost of child care through the roof the last few years, a Dependent Care FSA is a great option to get a slight...

- Curious How Much Of Your Paycheck Should You Save? I Got You Covered! One of the most controversial debates that occur in the Financial Independence Retire Early (FIRE) community are ones that are based on your savings rate....

- Handy Andy’s Lessons: 3 Methods to Save Money from Your Salary I often hear that people can’t save money because they have none. For many people, this likely isn’t true. Instead, they likely don’t have the proper...

- Struggling to Save? Start with These 4 Simple Auto-Investments Updated 4/1/2024 One of the most challenging steps to becoming financially independent is getting that little snowball moving downhill by creating a gap between your...