Updated 8/7/2023

Depreciation is an accounting term that has a big impact on a company’s future profitability. It is a controversial topic because, as Warren Buffett states in many shareholder letters, it is unquestionably a proxy for required capital expenditures.

Buffett includes depreciation in his owner’s earnings calculations and why most free cash flow calculations include it in their calculations.

Buffett thinks metrics like EBITDA are a bunch of junk because, as he says, “Does management think the tooth fairy pays for capital expenditures?”

Depreciation plays a large role in determining a company’s profitability because of the impact on the income statement, balance sheet, and cash flow statement.

As I dive deeper into companies’ financials and learn more about what makes them tick, items such as capital expenditures, depreciation, free cash flows, and metrics like return on invested capital start to take greater meaning. All of the above subjects help drive the growth of businesses, from Microsoft to Wells Fargo and everything in between.

In today’s post, we will learn:

- What is Depreciation?

- What is Depreciation Expense?

- Accumulated Depreciation and Depreciation Expense

- Depreciation On The Balance Sheet

- Impacts on Cash Flows

Let’s dive in and learn more about depreciation.

What is Depreciation?

Before diving in today, we will look at both the accounting definition of depreciation and the financial accounting of depreciation and its impacts on companies.

The accounting definition of depreciation according to Investopedia:

“Depreciation is an accounting method of allocating the cost of a tangible or physical asset over its useful life or life expectancy.”

Depreciation tells investors how much of the asset’s value has been used. For example, let’s buy a computer for our business. It has a useful life expectancy, and accounting rules allow us to depreciate that value over the life of the computer.

Businesses can enjoy two benefits from depreciating assets, from an accounting perspective and a tax perspective. For example, companies can take a tax deduction for the cost of the computer, which reduces taxable income. But, our friends at the IRS state you must spread out the cost of the assets over time to take the tax benefit.

Depreciation is an accounting term that allows companies to spread out the cost of an item over a period, typically over the asset’s useful life.

For example, assets such as machinery or equipment for Chevron are expensive. Chevron purchased the equipment instead of realizing the purchase cost in the year; depreciation allows Chevron to spread out that cost over the years, allowing Chevron to realize revenues from the asset.

Depreciation accounts for the decline in the values of the assets over the years. To depreciate the cost of an asset, companies have many accounting choices to account for the depreciation.

- Straight-line depreciation

- Accelerated depreciation

- Units-of-production

Straight-Line Depreciation

The straight-line depreciation is the most common and easiest to illustrate. For example, if Chevron purchased equipment for $500,000, it would have a five-year useful life. The annual depreciation for the equipment would be $100,000 a year, which we find by dividing the cost of the equipment ($500k) by useful years (5).

Accelerated Depreciation

Accelerated depreciation is used when the asset’s value depreciates faster in earlier years; a great example would be a vehicle a construction company purchases. The vehicle would depreciate faster in the first few years before leveling off in later years. To do this, accountants pick a number above one, say 1.5, and multiply the depreciating value by that multiple.

Units-Of-Production

The final method of depreciation is the units-of-production, which takes the historical value of the equipment minus any residual value after depreciation of the useful life of the equipment.

Straight-line depreciation is far and away the most common, with accelerated depreciation next on the list. Each industry has a standard method for depreciating its assets, and it will differ by industry. For example, units-of-production is more common in the mining industry, whereas accelerated depreciation is more common in the trucking industry.

Accountants set up depreciation schedules for each asset purchased and use those schedules to help organize how the asset’s life is depreciated. Over time most assets will become zero value, but some will have residual life beyond the depreciation.

For investors, it is not critical to understand depreciation schedules per se; instead, it is better to understand the definition of depreciation and how it works. Think of it this way, when you buy supplies or equipment for a business, there is typically an upfront cost, which impacts the income and cash flow of the business. We also must understand the equipment will eventually wear out or need replacement.

That is where depreciation comes into play. Depreciation helps companies smooth out the economic impact of purchasing the necessary equipment to operate the business.

What is Depreciation Expense?

We are moving beyond the accounting measure of depreciation to the financial accounting for depreciation. In finance, when a company buys a long-term asset, the asset should be capitalized instead of expensed in the period the company bought the asset.

Let’s assume Chevron’s asset has an economic benefit beyond the period they bought it. Expensing the asset in the current period understates the earnings in the period and the earnings in the coming useful periods of the assets.

Depreciation expense allows accounting to purchase that asset and account for the impact over a longer period.

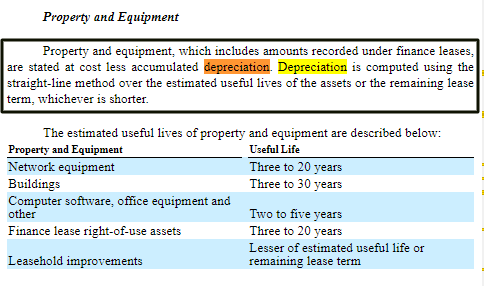

Many companies list the expense on their income statement as an operating cost for the business. Depreciation expense on the income statement is the product of determining depreciation based on the schedule set up by accountants. Companies will tell you in their financial statements what kind of depreciation schedule they use.

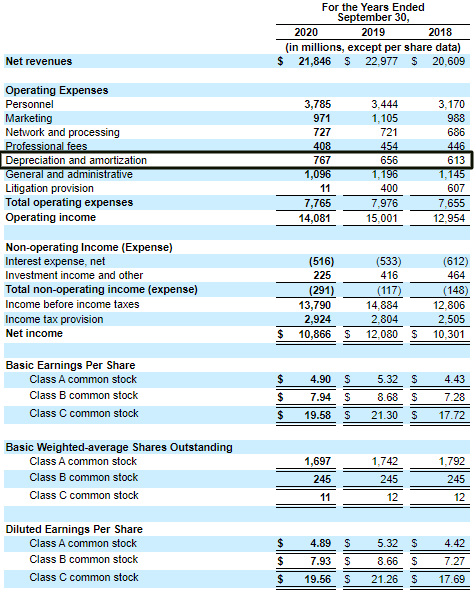

As we can see from Visa’s above income statement, the company list’s its depreciation expense out there for everyone to see. Unfortunately, Visa’s disclosure is uncommon; most companies include the expense in other operating costs, sometimes by each line item.

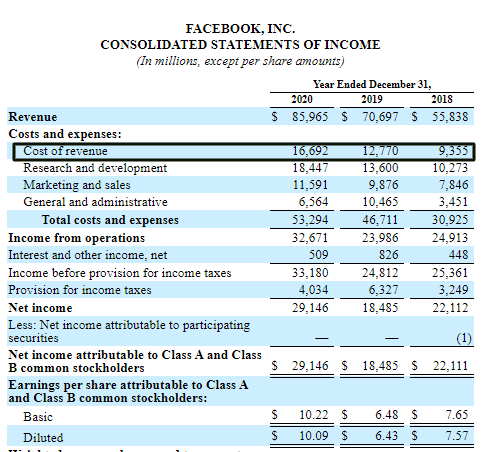

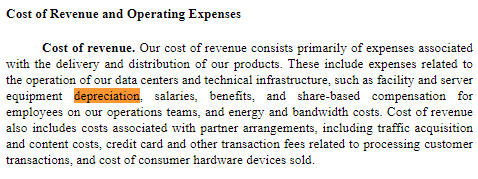

For example, Facebook lists its depreciation expense as part of its costs of revenues, as seen below:

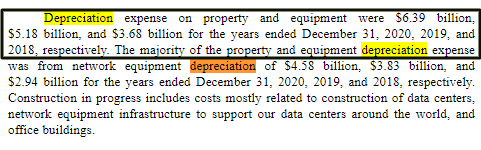

Which means we might need to go hunting to find the dollar amount of the depreciation expense:

The above example shows how much depreciation Facebook expensed for 2020, 2019, and 2018. And finally, the company will tell you what kind of depreciation, as well as any types of schedule for each item they depreciate, and they list in their financials:

Accumulated Depreciation and Depreciation Expense

Accumulated depreciation is like it sounds; it is the accumulation of depreciated assets, while depreciation expenses are the amount the company is reducing its assets, typically for a single period, such as one quarter or one fiscal year.

The easiest way to think of accumulated depreciation is the total amount of Chevron’s cost for buying equipment or assets, and depreciation assets are the amount reducing that accumulated cost.

All of this comes into play on the balance sheet. Accumulated depreciation is a line item that adds to the company’s assets. It reduces the total amount of fixed assets on the balance sheet, also known as Property, Plant, and Equipment, or PP&E.

Over time, the accumulated depreciation will grow as the depreciated expenses continue to credit against the assets. When the asset is sold or reaches its useful life, accumulated depreciation reverses, eliminating the asset from the balance sheet.

The easiest way to think of this is as depreciation expense reduces income; accumulated depreciation increases the company’s assets.

Depreciation is part of the non-cash expenses and stock-based compensation because it does not involve a cash transaction.

The above transaction plays out on the cash flow statement by being added back to the company’s net income because no cash outlay happens in the transaction.

For example, if Walmart buys a piece of equipment for $250,000 at the beginning of the year. The asset’s useful life has a residual value of $25,000, with the asset’s useful life expected at ten years. Based on using straight-line depreciation, Walmart will have a depreciation expense each year of $22,500.

On Walmart’s balance sheet, each year, it will add $22,500 to its accumulated depreciation. The accumulated depreciation would total $112,500 at the end of five years, equaling $22,500 per year x 5 years.

Accumulated depreciation also impacts the book value of the company. For example, accumulated depreciation impacts the net book value of the assets. So to use our above example, if Walmart purchases an asset for $250,000. Those assets list on the balance sheet for $250,000. Accumulated depreciation reduces the value of that asset by subtracting the accumulated depreciation, in this case, by $112,500 after five years.

That tells us the asset’s book value on Walmart’s balance sheet will list as a net book value of $112,500 instead of the $250,000 purchase price of the asset.

Remember, accumulated depreciation can never exceed the cost of the asset. If Walmart sells or removes the asset, the accumulated depreciation falls off the balance sheet. Net book value doesn’t tell us the market value of the asset. For example, if Walmart purchased a truck to transport inventory for $50,000 and decides to sell the truck, the accumulated depreciation may list the book value of the truck as $25,000. But Walmart could sell the truck for more than the book value because the market says it has more value.

Depreciation on the Balance Sheet

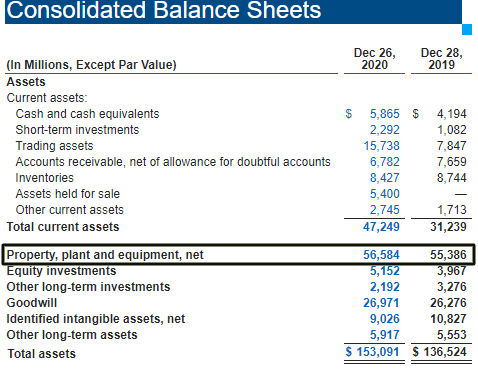

As with the income statement, not every company will list accumulated depreciation directly on the balance sheet. It is part of the company’s fixed assets, and you will see it as part of the Property, Plant, and Equipment or PP&E, also listed as net PPE.

The above balance sheet from Intel is the common listing of accumulated depreciation. It is not listed specifically; instead, it is inferred by the “net.” To dig deeper, we need to look at the notes to the financial statements; here, the company will break down the total accumulated depreciation and the types of assets they depreciate.

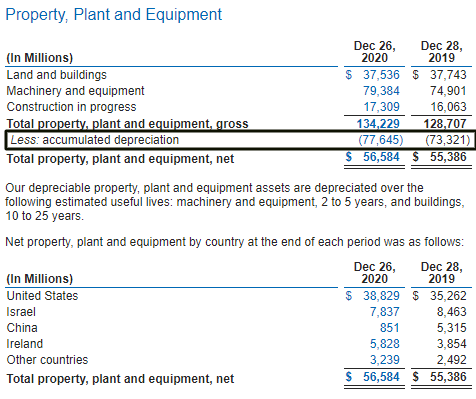

In the note from Intel’s financials, we can see the total accumulated depreciation for the last two years and reduce the gross PP&E for the company, giving us the net number on the balance sheet.

Notice also the different fixed assets Intel buys. Items such as land, machinery, and construction are in progress. Other items, such as designing new semiconductor chips, fall under the research and development arena. Fixed assets are supporting items helping Intel create more revenues.

For example, buying computers or office chairs doesn’t lead directly to more sales, but it helps support the people who create that new technology by giving them a reliable computer to work on and a comfy chair.

Impacts on Cash Flows

Depreciation impacts the cash flow statement as a cash inflow, meaning the company has no cash flow to pay for the expense.

Depreciation helps pay for a lot of the capital expenditures of a company. Net capital expenditures, or capex, impact how fast or slow a company grows its revenues.

Depreciation impacts the company’s growth by reducing capital expenditures’ cash outflow, such as PP&E or acquisitions.

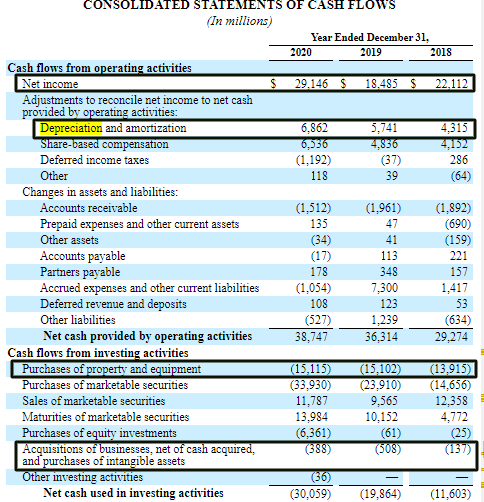

For example, to calculate free cash flow, we take the company’s net income, which lists at the top of the cash flow statement. We add back the non-cash depreciation expense and subtract out the capital expenditure, or PP&E and acquisitions.

Let’s look at a quick example to illustrate.

Using Facebook’s latest 10-k and its cash flow statement, we can calculate the company’s free cash flow:

|

Item |

2020 |

2019 |

2018 |

|

Net Income |

$29,146 |

$18,485 |

$22,112 |

|

+Depreciation |

$6,862 |

$5,741 |

$4,315 |

|

-PPE |

($15,115) |

($15,102) |

($13,915) |

|

-Acquistions |

($388) |

($508) |

($137) |

|

Free Cash Flow |

$20,505 |

$8,616 |

$12,375 |

Other quicker, easier ways to determine free cash flow include taking the line item, Cash From Operations, and subtracting the PPE to find your number. I like the above chart because it helps me see the depreciation, PPE, or capital expenditures impact the company’s cash flows.

Without going completely into the weeds on ratios and formulas, one great idea to analyze the company’s free cash flows is to compare the depreciation and PPE to the revenues to see how much of an impact they have on the company. And to do it over a longer period to get a sense of impact.

To do this, we set up a quick chart and divided the depreciation and PPE by the company’s revenue. For example, we will do this for Facebook over the last five years to give you a flavor.

|

Item |

2016 |

2017 |

2018 |

2019 |

2020 |

|

Revenues |

27,638 |

40,653 |

55,838 |

70,697 |

85,965 |

|

Depreciation |

2,342 |

3,025 |

4,315 |

5,741 |

6,862 |

|

PPE |

4,491 |

6,733 |

13,915 |

15,102 |

15,115 |

|

Dep % of Revs |

8.47% |

7.44% |

7.72% |

8.12% |

7.98% |

|

PPE % of Revs |

16.24% |

16.56% |

24.92% |

21.36% |

17.58% |

The above chart is a good way to examine how Facebook creates revenue growth. Of course, capital expenditures are not the only revenue driver, but they are part of the mix and a great idea to analyze.

When reading through the financials, another tidbit to remember is the difference between depreciation and PPE on the cash flow statement. That is not a good sign if the company’s depreciation is higher than the PPE. It means the company is reducing its capital expenditures which are crucial to growth. A company must spend money to grow because its assets wear out and need to be replaced at some point.

Investor Takeaway

Depreciation is an important accounting definition to understand, both from an accounting standpoint and an economic standpoint.

The cash outlay for capital expenditures such as buying land, equipment, factories, or office chairs impacts the business. If we don’t understand that impact, we underestimate the impact of the capital expenditure decisions of the company.

Depreciation is one of those items that connects all the financials, from the income statement to the cash flow statement to the balance sheet.

Remember that the cash flow statement is the connective tissue that ties the income statement to the balance sheet. And cash flows are the best way to value a company, and depreciation impacts any company’s capital decisions and the same company’s cash flows.

With that, we will wrap up our discussion on depreciation today.

As always, thank you for taking the time today to read this article, and I hope you find something of value in your investing journey. If I can further assist, please don’t hesitate to reach out.

Until next time, take care and be safe out there,

Dave

Related posts:

- Depreciation and Amortization – A Complete Financial Statements Guide Updated 8/7/2023 Buying businesses and equipment for operations is a part of business, and using depreciation and amortization is how companies account for those purchases....

- Basic Cash Flow Statement Breakdown (by Each Component) Updated 4/21/2023 Cash is king, and finding companies that generate cash is the holy grail of investing. The basic cash flow statement provides answers to...

- How Amortization of Intangible Assets Works; When it Unleashes Higher ROIC The amortization of intangible assets can sometimes be hidden in the consolidated financial statements because amortization is grouped in with depreciation. But as the economy...

- Maintenance Capital Expenditures: The Easy Way to Calculate It (With Calculator) Updated 4/21/2023 To continue our series on owner earnings, I thought we would do a deeper dive into maintenance capital expenditures or maintenance CapEx. When...