Mutual funds are a great vehicle for growing your money. Keep reading to find out more about them and what types of mutual funds may work best for you.

When you first began investing, you may have opened an investment account online and started to look through all the individual stock opportunities. That is certainly a great option, but another one that exists is looking into mutual funds.

What is a Mutual Fund?

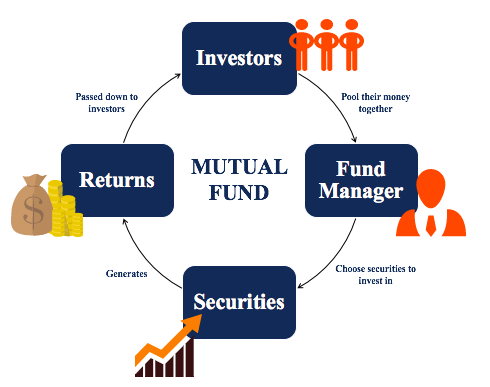

To keep things simple, a mutual fund is an investment vehicle that pools investors’ money together and invests it in funds with multiple stock markets financial options such as stocks and bonds to generate returns. The cool thing about mutual funds is that you can include commodities like oil, metals, or even raw materials as a part of your investment.

There are different types of mutual funds that are run by professional money managers who then pick which investments (stocks, bonds, etc.) to pool together and invest. This allows an individual to have a small amount of exposure to many different investments without having to fork over a ton of capital.

A mutual fund allows you to diversify your portfolio in all types of investments and helps spread some of your risks. There is also a convenience to a mutual fund because the large brokerage firm has already created their own plans and all you must do is pick one. The costs can also be substantially less in a mutual fund compared to individual shares of each company because of the buying power of the brokerage company.

I must admit I enjoy making a lot of my own financial decisions when investing, but it’s also nice to have a professional manage a part of your money and make their own decisions. If there is anything I have learned, diversification is key. Having someone else manage a part of your money with any different type of philosophy is a great way to diversify.

As with any investment, there are certain mutual funds that are considered a higher risk, and there are also some lower-risk options where the returns may not be as great. So, you still can decide what makes the most sense for your money.

As you have likely figured out by now, there are hundreds of thousands of different types of mutual funds and it can be overwhelming to decipher between them all. Keep reading to see if you can figure out which one (or ones) may work best for your needs. I’ll attempt to break them down into four simple categories, as well as cover some sound strategies.

- Equity Funds

- Bond Funds

- Hybrid Funds

- Money Market Funds

Equity Funds:

One of the most common types of mutual funds that exists is an Equity Fund. These are mutual funds that buy a collection of stock from publicly traded companies. Most types of mutual funds that you will discover in your investing career will be equity funds.

Given their volatility from being so heavily involved in the stock market, equity funds can provide hefty returns, especially over long periods of time. However, if you are looking for something that is shorter-term, you can always hit a volatility window and end up losing on your investment.

Inside each equity mutual fund, you will find companies that are included in the investment broken down by capsize.

Large-cap fund refers to companies with a market value of $10 billion or greater. Mid-cap funds are companies in the range of $2 billion to $10 billion in value, while a small-cap fund is an investment in companies with a value between $300 million and $2 billion.

You will see all different types of strategies within mutual funds. Some brokerages will focus on the large-cap guys, while others will feast on earnings from small-cap funds.

In these types of mutual funds, you will typically see a major focus on a certain industry such as oil and gas, health care, industrials, financials, or technology. Then it’s up to you to pick the one that works best.

A prime example of using an equity mutual fund to diversify risk is the technology sector. Yes, typically the industry will somewhat move in sync, but often certain companies can skyrocket or plummet depending on how they perform.

You could buy 20 stocks of Apple (APPL) for roughly $170 and risk that they have a malfunction with a new iPhone and see it drop 20 percent, or you could buy $3,400 worth of a mutual fund that has a stake in the same company as well as others. That way if one tanks, the others are there to hopefully pick up the slack.

Inside of an equity mutual fund is four different styles of funds. I’ll keep the description short and sweet on these and save the breakdown for another day.

Growth Equity Fund – As obvious as the name, a fund that is looking for higher than average returns.

Value Equity Fund – A mutual fund looking for companies whose stock is undervalued by the market.

International Equity Fund – Another easy one, stocks of companies doing business outside the U.S.

Global Equity Fund – Investments in companies doing business inside and out of the U.S.

Emerging Market Equity Fund – Targeting Countries with smaller but growing markets.

As you can see, there are different types of mutual funds inside of certain funds (confusing I know), but an equity mutual fund can be an extremely low-risk entry to the stock market. Typically, it goes the other way around and you invest in individual companies first, but an equity mutual fund is a great way to get started investing in the market.

Bond Funds:

Different types of mutual funds are meant for different purposes. As I mentioned above, an equity fund is meant for a younger working person who has time to let their money grow in stocks. A type of mutual fund that is meant for an older working person closer to retirement would be a bond fund.

Bond funds can still have aggressive and non-aggressive funds to invest in, but the risk is considered much less than an equity bond. A bond fund is also commonly referred to as a fixed-income fund.

As with an equity fund, bond funds can also be broken down into different categories.

Corporate bonds: These are issued by corporations that mature over a period of time and pay interest if you hold the bond to maturity.

Government bonds: These are issued by the U.S. Government and include treasury securities.

Municipal bonds: These are issued by the local government and other authorities to pay for local projects that can include roads, hospitals, and stadiums.

This type of mutual fund isn’t quite as exciting with limited growth, but during your later years and through retirement, a bond fund can be a great way to provide a steady fixed income.

At this point in your life, you should have a good chunk of money in your retirement accounts and there’s no sense in taking a huge risk on your nest egg. It’s one thing to lose 15 percent of your $40,000 retirement account when you are 28, it’s another to lose even 10 percent on a million-dollar account when you are 68 years old.

Hybrid Funds:

To this point, we have covered two types of mutual funds. Both are on opposite sides of the spectrum. An equity fund that is meant for the young working-class and takes a risk in a pool of stocks, and a bond fund that is much lower-risk and is meant for retirement-aged folks who will begin to start their fixed income.

It may come as no surprise, but the next type of fund we are going to discuss is a mutual fund that falls right in the middle – a hybrid fund. A hybrid fund is exactly what it sounds like, the combination of two assets classes into one fund.

A hybrid fund allows you to have an interest in stocks and can mitigate risk with bonds included as well. Hybrid funds can also include commodities in the pool.

So if you are in your later years of working but like to take some risks, or if you are a young worker who wants to protect your money carefully, a hybrid mutual fund can be a great option that can pay strong returns and limit your risks all at the same time.

Money Market Funds:

Now that you have heard about three different types of mutual funds, I want to go over the least risky type, a money market fund. What is that you ask? A money market fund is a type of mutual fund that has investments in cash, short-term debts, and government securities.

Most investments are highly cash-liquid so an investor can get his/her cash quickly if needed. These types of funds carry a low level of risk but is certainly better than leaving your cash set stranded in a savings account earning next to nothing.

The key takeaway from this type of mutual fund is remembering a money market fund is NOT the same thing as a money market account. A money market account is an interest-earning savings account, while a money market fund is an investment, with no guarantee of your principal investment.

As with the types of mutual funds discussed above, money market funds are also broken into four different categories.

Prime Money Fund: Invests in floating-rate debt and commercial paper of non-treasury assets.

Government Money Fund: A fund that invests nearly 100 percent of its total assets in cash, government securities, and repurchase agreements that are fully collateralized by cash or government securities.

Treasury Fund: Invests in standard U.S. treasury-issued debt such as bills, bonds, and notes.

Tax-Exempt Money Fund: These funds can offer earnings that are free from U.S. Federal income tax.

While money market funds aren’t a guarantee, this is a low-risk type of mutual fund that should be considered by a person closer to retirement age.

Sound Strategies:

As with any type of investment, diversification is key to success. And while I’m trying to help with my suggestions, at the end of the day, any financial decision needs to be made by you.

If you are in your early years of working, I would recommend your accounts lean heavily in equity funds. You have plenty of time to let your money go through the peaks and valleys and ride through any hard times. History shows that if you can leave this money in an equity fund for a long period of time, it’s going to provide strong returns.

If you still have some optimism on the risk of being too big to be completely in equity funds even at a young age, a hybrid account could be exactly what you need. With so many types of mutual funds available, there is no exact science as to what kind to pick, you just need to do what’s right for you.

The hybrid account can limit your upside, but it can also limit the downside. The stock market is cyclical, and we see falls all the time. If you can’t stand the thought of watching your account drop 15 percent in one day, the hybrid model may be best for you.

The last two types of mutual funds are both focused on folks closer to or in retirement. There is a much lower risk in bond and money market funds that you can utilize. Both have some tax flexibility and I would recommend digging in further to each to find out which one works for you.

Again, just because the book says to do one thing, it doesn’t mean you have to listen. My father is 66 years old and is set to fully retire at the end of this year. I asked him what he had done for his retirement as he owned his own business and he said he put $200 a month in a trading account the last 30-years and has built it through that.

Now, that will have some severe tax consequences because of capital gains, but he has made nearly 20 percent on his money by taking a huge risk that some aren’t willing to take. Again, not recommending that strategy at all, but just imploring that you need to do what you are comfortable with for your future planning.

Remember, mutual funds must run through a professional money manager, and they can always answer any of the difficult questions you may have.

Related posts:

- How Tactical Asset Allocation Works – (With Example Portfolios) Asset allocation is arguably more important than which stocks you pick. For most investors, focusing on your asset allocation is a lot more important than...

- 442,823 Reasons to Avoid Fidelity Target Date Funds I oftentimes hear people say that target date funds are a great way for the “hands-off” investor to get some exposure to the market, but...

- How To Best Reduce Investment Risk – A Comprehensive Framework Updated 4/21/2023 After much effort, you have finally mastered value investing. You now know how to identify good companies and value them. You also only...

- Strategic Asset Allocation: Unique in Nature, Critical for an Uncertain Future “You should have a strategic asset allocation mix that assumes that you don’t know what the future is going to hold.” Ray Dalio Today we...