“Wait – Andy, are you telling me that there actually are disadvantages of credit cards?”

Yes, I certainly am.

I know that sounds facetious, and it mainly is, but everyone always talks about the advantages of credit cards, and that includes myself.

I mean, there’s the obvious ways that you can make money with credit cards such as rewards, but there are also some more hidden ways that you can make money too! And of course, you can actually improve your credit too if you’re using them properly!

The thing about all of these ways to make money are assuming is that you make on-time payments every single time. If you’re late just once, you’re going to get a ding on your credit and likely pay a late fee that will be worse than any rewards that you have saved up.

So, what exactly are some of these disadvantages of credit cards? Well, let’s start with the easy one!

The Insanely High Interest Rate

In 2019, the average interest rate was 17% according to Nerd Wallet. Honestly, I thought that the interest rate was going to be a lot higher than that, too! I know that I personally have cards with a higher interest rate than that, but I pay them off every month so I don’t care about the rate.

But what exactly does a 17% APR actually mean to you?

Well, you know how compound interest works with investing? If you invest $1000 and you make 10% in year 1, then you have $1100. Then in year 2, if you make another 10%, you now have $1210, because you’re making 10% on your initial $1000 plus 10% on the $100 in interest you made in year 1!

So, your interest keeps compounding, which is a great thing when you’re being paid that interest. When you’re the one paying it, it’s not good.

Just go to a credit card payoff calculator online like Bankrate and then you can try out some various scenarios.

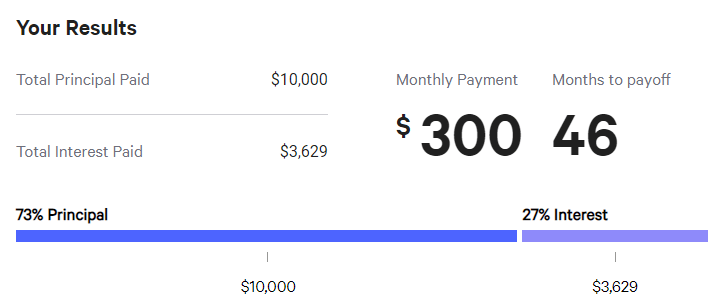

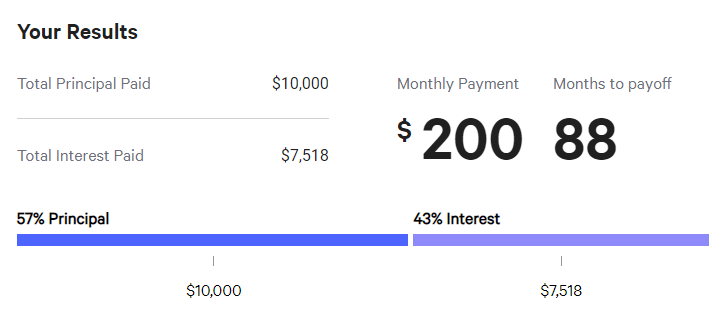

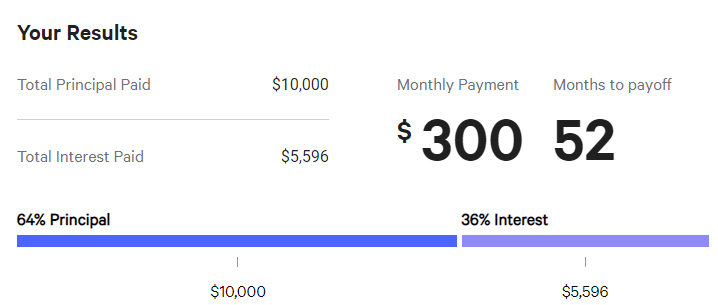

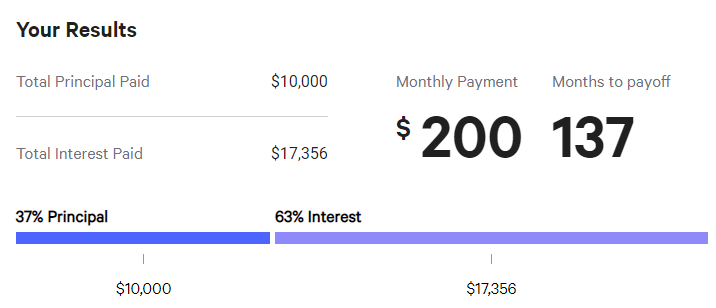

I decided to do 4 different scenarios: $10K balance with a 17% APR making either $200 or $300 monthly payments, and then a $10K balance with a 22% APR making either $200 or $300 monthly payments. The results were as follows:

17% APR

22% APR

I like doing this because it shows me just how much money I am going to waste by paying interest. If you were simply able to add 50% to your payment then you’re going to pay less than half of the interest on a 17% APR loan and less then 2/3 the interest on a 22% APR loan…that’s freaking huge!

You see – the interest will just continue to stack and stack and stack and stack. You’re really never going to pay it down. In the 22% APR example paying $200/month – you’re going to pay nearly twice as much in interest alone as you would for the $10K that you owned.

That is just disgusting to even think about!

While the interest rate is absolutely the biggest, most important impact that you need to consider, it’s definitely not the only thing. In fact, we have four more major disadvantages of credit cards!

Fees

Fees might seem minimal, but they’re not. A lot of the credit cards that have fees are also the ones that are offering up greater rewards, which makes sense – but you need to make sure that you’re actually using the cards the right way then.

People will talk about a credit card shuffle where they use different cards for different purchases, and while that’s great, that means you’re opening a lot of cards. Personally, I like to find a credit card with the best cashback and the lowest fees, preferably none, and move forward.

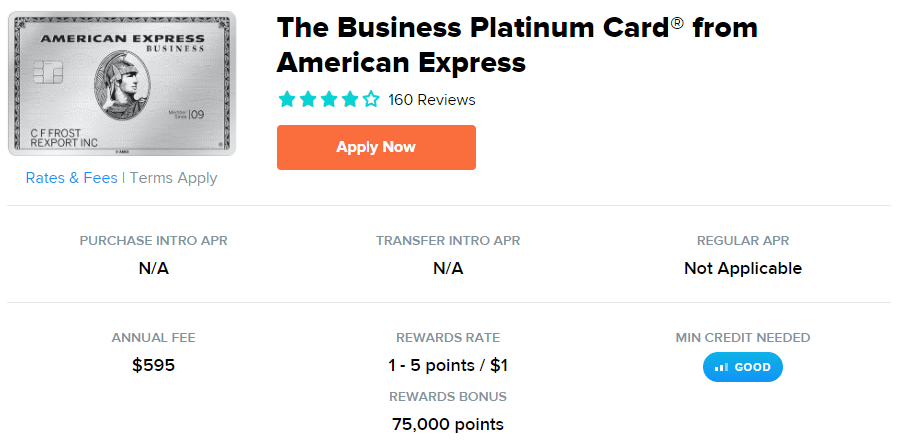

Most of the “prestigious” credit cards that have some insane fees are giving great rewards for travel redemption…but you have to travel. Don’t just sign up for The Business Platinum Card from American Express and pay that $595 fee if you’re not going to travel…

The full list from Wallethub just is mind-blowing, but maybe it will make sense for you depending on the card! For me, I’ll just stick with my Chase Freedom card and call it a day!

Oh yeah, the total fee is $0.00.

Temptation

The temptation is real with credit cards. It is soooo easy to just swipe your credit card and never think about that purchase again. I mean, honestly, we don’t even swipe credit cards anymore…we just pull out our phones and use Apple Pay – it’s that simple.

You never actually even have to look at the total. I know that there have been times where I have left Meijer after a grocery trip just to realize I have no idea what I spent. I used Apple Pay, instinctively just threw away the receipt on the way out, then realized I wasn’t sure what I actually spent.

So, I opened up my Chase card to see the amount and it dawned on me then – how many people do exactly what I just did but never open up their app?

At least I was doing it on a need for groceries! Some people do this for dumb things like TVs, an XBOX, sporting events, drinks at bars, anything!

And when I say “some people” I mean that this is what I used to do in my mid-20’s. I was reckless!

I spent money on anything and everything and at the end of the weekend I was too scared to open up my app to see my spending on my credit card – so I just didn’t.

I just never looked. How do you think that worked out for me?

Eventually, enough was enough, and I changed my habits to finally fix the way that I was mindlessly wasting money. Sure, my mid 20’s were a ton of fun, but it’s depressing to think about some of the decisions that I made because I was such a bad spender.

Like, cashing out my 401k and getting a 401k loan…really just things that you should try to avoid at all costs because I was missing out on super valuable time in the market! 2021 Andy is very disappointed with 2015 Andy…

But that’s ok – we all make mistakes and then move on. Hopefully you can learn from my mistakes rather than making them on your own.

It all comes down to a mindset – you have to get into the mindset of being in control of your finances. Just as I think it’s important to look at your investments daily, I think that it’s important for you to look at your spending daily if you’re really struggling to get on the right path.

The more that you force yourself to have transparency into what is going on, the better that you’re going to be at staying on track, and that’s why I like Doctor Budget. It forces me to track my spending but doesn’t take some insane amount of time.

The manual efforts (like 15 minutes/month) are a necessity to be a better money manager, and I know that I thrive off of it because it takes the temptation of buying things away!

Tricky

Credit cards can be tricky! Then can lull you into thinking something is real but, in all actuality, it’s not. You might not understand how some of the various aspects of the credit card work because you’re given this massive user agreement and let’s be honest, nobody ever reads that…but you should know some of the key things to look for.

One of those is the APR – it is not uncommon at all for a card to have an “introductory period” where the APR is 0% for 12 months but then skyrockets to something insane like 22%. You need to know that so you’re not just blindly carrying a balance, making minimum payments, thinking it’s a free loan.

You’re going to find yourself in a situation like I described earlier where you have $10K on a credit card and it’s going to take years, and tons of wasted money on interest, to get that thing paid off.

Another common thing that can be tricky is with a balance transfer. Personally, I have used balance transfers many times and I think that they can save tons of money, but you have to know how to use them properly!

Oftentimes a credit card will allow you to transfer a balance for X months and pay 0% interest on that transfer, but you have to pay a 3% fee.

So, you could transfer that $10K balance where you’re paying 22% interest onto a card and pay a 3% fee upfront and then pay no interest for the year. That’s a huge savings!

I think that taking advantage of these introductory offers and the transfer balances can be a great way to save money, but you need to understand the fine print. One of the common things that I have seen people come across is that they have to pay off that ENTIRE balance transfer or they have to pay interest back on all of it.

So, if you transfer $10K and pay off $8K before the introductory period is over, you owe interest from those 12 months (or whatever the timeframe was) on the entire $10K!

Not only do you now have to pay interest on $8K that you weren’t planning on paying, it’s backdated to the earlier months so it’s a massive charge, AND you paid that 3% balance transfer fee at the beginning to even be able to transfer your debt to this card in the first place.

Personally, this is why I will NEVER do a balance transfer that has this type of clause in place, regardless of how little I would be transferring. Take some time to read the fine print and if you don’t feel comfortable reading and interpreting it, you might want to think twice about signing up for the card.

Never sign anything without completely understanding it – especially from a credit card company that makes money off of you missing payments. Your goals and the credit card company’s goals are misaligned from the get-go.

Credit dings

If you miss a payment, either because you don’t have any money to pay or because you simply forget, your credit is going to get dinged and it’s going to stay on there for a long time!

According to Credit Karma, a missed payment can stay on your report for 7 years! OUCH!

That is just brutal.

Personally, that’s one of the main reasons that I will use a budget calendar . Every time that I get paid, I simply look to see my upcoming expenses, make sure I have a little extra buffer built in there, and then pay the rest on my credit card.

It honestly can be some back of the napkin type of math, but I find that simply including it in my budget (I used Doctor Budget cause it’s the GOAT), it makes me keep my eyes on it and pay attention to what’s going on. This way, I am making weekly payments on my credit card and it keeps me from ever missing a payment!

The thing is that you just need to have a process in place. I know some people prefer to do the automatic payment each month but I don’t like doing that because my payments change. I always pay off 100% of my card, but my spending changes, so the payment has to change as well.

I think that automatic payments are great for something that’s a fixed expense and not changing month-to-month, but credit cards do not fall into that category like cable, phone bill, or Netflix would.

Summary

While I am a huge credit card advocate because I think they’re great tools to boost your credit and get free rewards, those things only apply if you’re spending within your means and making on-time payments.

You can wipe out ANY benefits with just one missed payment from overspending or simply being careless so you need to make sure that you have your money goals aligned prior to opening a credit card. Once you’ve got your spending under control, go ahead and open a credit card up! Don’t be shy – you can actually make a lot of money!

Related posts:

- Make Life 2% Cheaper with Cash Back Credit Cards! Credit cards can get a bad wrap, but when using the right card and paying your account down to zero on a monthly basis, cash...

- Handy Andy’s Lessons – How to Save Money WITH Credit Cards Welcome back to the second of the most anticipated series of all time, HANDY ANDY’S LESSONS! In the first episode of Handy Andy’s Lessons, we talked...

- A Deeper Look at all of the Credit Card Pros and Cons that Exist We now live in a world where most people solely use credit cards, cash is a blast from the past. Check out these credit card...

- Your Credit Score: Where It Starts and How to Raise It A person’s credit score can majorly impact big financial purchases in someone’s life. This post discusses common questions about credit, such as: What is credit?...