As investors seeking to understand the companies that we trust our hard earned money to, a great way for us to evaluate leadership can be to learn about a company’s board of directors. The Disney board of directors in particular makes for a great case study due to their transition from Robert Iger to Bob Chapek.

Of course, the company as boasts a prominent profile as one of the country’s leading companies and closely watched stocks.

The Disney board of directors has a long history of legacy and consumer influence dating back to founder Walt Disney, and his ascendance to fame and fortune, as the company first issued stock in 1940.

For Disney’s executives, particularly the CEO, the company has seen the baton passed from Michael Eisner to Robert Iger to now Bob Chapek.

With this context, let’s first define the basics of boards of directors, their relationship with executives, and how it plays into company decisions.

Then we’ll look at Disney’s current board of directors following a critical time of company transition from Iger to Chapek.

This post will include:

- The Basics of the Board of Directors

- What Does a Board of Directors Do?

- How to Research a Public Company’s Board of Directors

- A Deeper Look at the Roles in a Corporation

- Investor Takeaway

Hopefully you learn something today—not just about Disney as a potential investment, but also how to analyze any board of directors structure to see if the company’s values align with your goals for your investment.

The Basics of the Board of Directors

First, understand that corporate structures even in the leading public corporations can vary greatly in function, form, and decision making process.

There can be diversity in a board’s size, from 5-12 members being quite common, its member mix of insider or outsider, and even in its power distribution… if you will.

Keep that in mind when researching a company’s board and management, as it requires some reading through the lines and adept searching through public documents for a true understand. But it’s not impossible. Promise.

A typical corporate board and executive structure could look like this:

- President: leads a business unit, reports to CEO

- CEO: leads the entire company, accountable to the board

- Chairman of the Board: leads the board of directors

- Board of Directors: chooses the CEO, accountable to shareholders

- Shareholders: the owners, with power through proxy voting

Now, at many popular public companies, a single individual could take one or several of those titles and responsibilities.

Examples include founders like Warren Buffett, who is the President, CEO, Chairman of the Board, and shareholder with the highest voting power.

But, companies with long legacies of continuous success tend to be more democratic, such as the makeup of the Disney board of directors and management.

Not one structure is inherently superior than the other.

A company can find wild success with one structure or the other.

What’s infinitely more important are the particular individuals in each role and whether each person is adequately placed in his or her perfect role which corresponds the most with the company’s mission and values.

And while the average investor can’t talk face to face with most company boards and executives, the best we can do is understand the sitting board members of a company.

Then, after evaluating the structure, we can hazard a guess on the competency of a company’s leadership based on their track record of decision making, their experience, their public statements, or anything else we can get our hands on.

Like my IFB colleague Dave Ahern likes to say, it’s time to put on our Sherlock Holmes hat for our research.

What Does a Board of Directors Do?

As I said, since the structure of a board of directors can vary wildly, so can the decision making process of select boards.

They may decide based on a majority vote, or not.

The leader of the board, or “Chairman”, may assume control on the decisions, or may simply fasciliate intense debate and discussion among members until a concensus is made. The success of the decision making of a board of directors can include factors like:

- Does the structure and culture of the board best place members in their naturally competent (and/or comfortable) state?

- Is the board qualified to identify key factors in the current and future business environment, and adequately using their knowledge and/or experience to help the board in this way?

- Are members of the board fully committed to the company, and making enough of an honest effort to best help the company with its success?

Again, this list can go on and on, and there’s no definitive formula to predict a company with the best structure and decision making process.

But, great insight can sometimes help investors avoid the obvious bad actors.

A few other common features of the Board of Directors of a publicly traded company include:

- Formal meetings which occur 3-6 times a year (varies)

- Stipulations to being a board member, such as a required time invested towards the role

- Compensation for membership to a company’s board

- Requirements for members to hold a specified amount of stock of a company (or not)

- Board members are usually nominated by the board or chairman, after which the shareholders vote to approve or decline a nomination

- Board members tend to have set terms, after which shareholders vote to re-instate the presiding member or not

Also, another key feature of a Board of Directors is that some boards could have lots of independent members, or a higher concentration of insiders. In other words, a Board of Directors could be filled with people who aren’t associated with the company at all, or even currently work in a related industry (and for the NYSE, a majority of independent directors is actually required, as of this publishing date).

In fact many board members have their role as a member as a part time gig, and have a place on several company Board of Directors.

It may even be encouraged to purposely include CEOs and founders from other unrelated industries in order to allow for fresh ideas and perspective that are not clear to insiders because of their (unintended) biases from working intimately in the business.

How to Research a Public Company’s Board of Directors

The Disney example dovetails nicely into the meat and potatoes of this post. This is where I give you the tools to research company boards for yourself. The fishing rod instead of the fish.

The first place you want to look for the Board of Directors is in a company’s publicly released Proxy statements, which are required to be published to the SEC.

It’s the same Proxy statement that I showed how to look up in my guide about insider ownership.

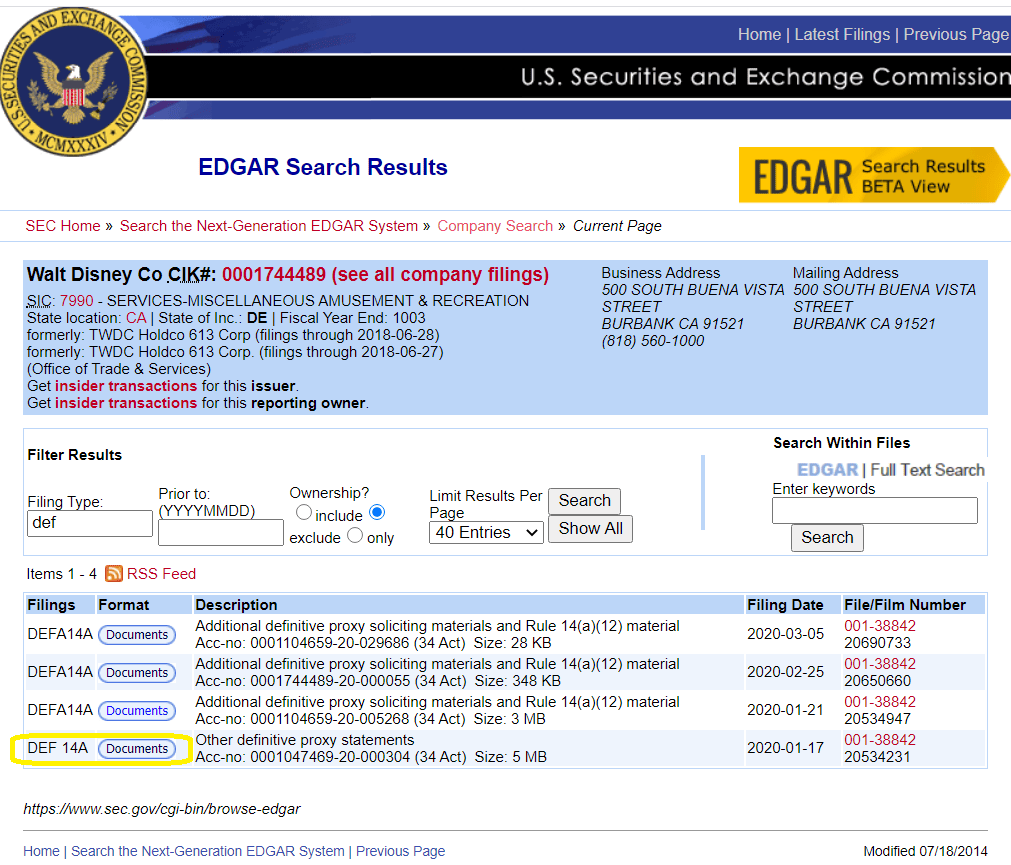

So, meander over to sec.gov and look for a company’s DEF 14A. I like to search “def” in the box, to narrow down the documents and make it easier to find. A screenshot of Disney’s Proxy as an example:

Clicking through the SEC links for Disney, we’ll arrive at the Proxy Statement by clicking on the .htm link for the DEF 14A.

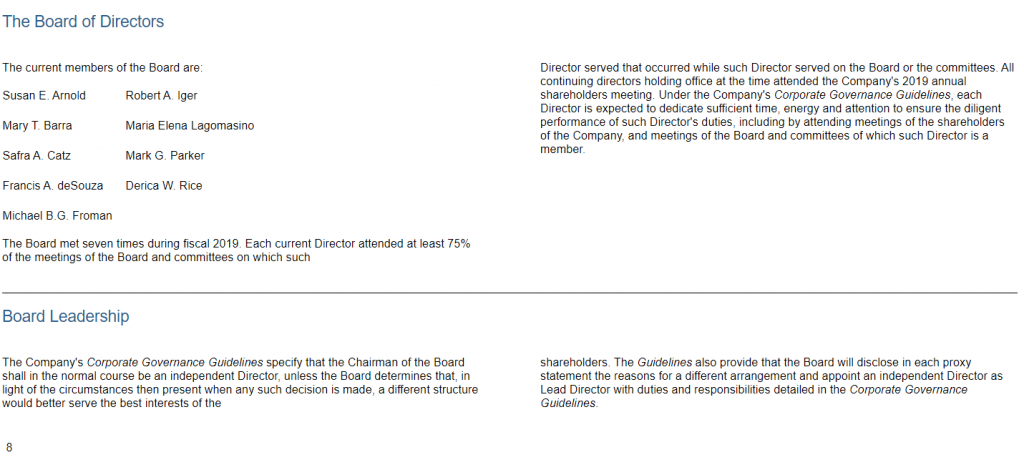

Next, you’ll want to scroll down to the description of the Board of Directors.

It’s usually pretty prominent as a table in the document and easy to find, but you can alternatively search (“ctrl+f”) for the term “board of directors” to quickly land on the section.

Here’s another screenshot of Disney’s board:

Disney has further information about the board’s chairman Robert Iger if you scroll further, and scatters their information on Director compensation and Director experience (and affiliation with the company) throughout the Proxy.

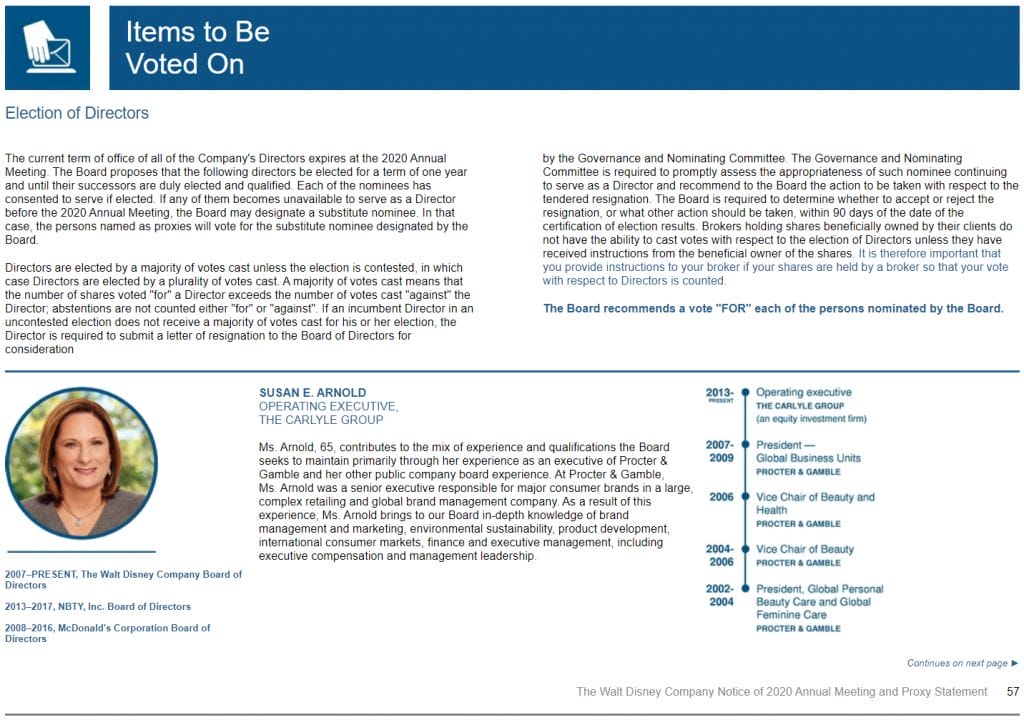

Example of what a section such as one describing the experience of the directors looks like:

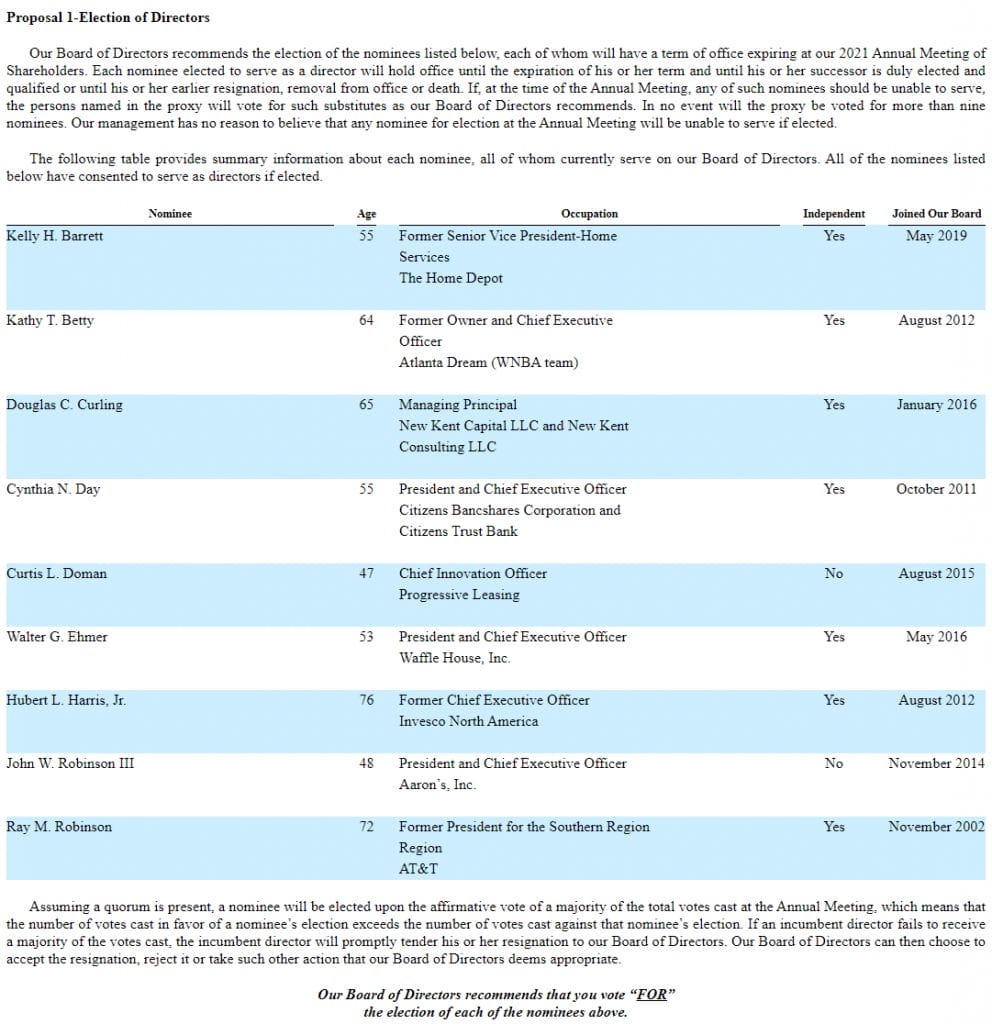

I like Aaron’s Company ($AAN) joint, pre-split proxy statement as a good example of informative disclosures of their board neatly organized into one table, but, you know, poTAto poTAto:

You can see that immediately, the investor can assess the current board member’s occupation, age, affiliation with the company and even experience.

Not to say that we can’t do that with Disney’s board just because it’s not clear on their proxy statement—luckily we have Google and LinkedIn these days.

Going Down the Rabbit Hole Even Deeper

If we go back to the Disney board of directors example, we’ll see that the company has made the following additional disclosures, under Corporate Governance and Board Matters:

“The Board has adopted Corporate Governance Guidelines, which set forth a flexible framework within which the Board, assisted by its committees, directs the affairs of the Company. The Guidelines address, among other things, the composition and functions of the Board Director independence, stock ownership by and compensation of Directors, management succession and review, Board leadership, Board committees and selection of new Directors.”

And also:

“Each committee of the Board is governed by a charter adopted by the Board.

The Corporate Governance Guidelines, the Standards of Business Conduct, the Code of Business Conduct and Ethics for Directors and each of the Committee charters are available on the Company’s Investor Relations website under the “Corporate Governance” heading at www.disney.com/investors and in print to any shareholder who requests them from the Company’s Secretary. If the Company amends or waives the Code of Business Conduct and Ethics for Directors or the Standards of Business Conduct with respect to the principal executive officer, principal financial officer or principal accounting officer, it will post the amendment or waiver at the same location on its website.”

Great! We found our next clue down the journey of understanding the Disney board.

So, let’s head to Disney’s investor relations website.

Side note: we also get rewarded with a everybody’s favorite character today, Baby Yoda.

Scrolling down to Governing Documents, we can click on the PDF link for Corporate Governance Guidelines to see a document that looks like this (for 2020):

This is where we find the REAL information about the company board procedures and how it relates to other potential structures and decision making processes we uncovered earlier.

I won’t go through every section, but encourage you to take a gander if it sparks your interest, as Disney’s governance guidelines document includes the following:

- Composition of the Board of Directors

- Functions of the Board of Directors

- Director Independence

- Business Relationships With Directors

- Stock Ownership by Directors

- Director Compensation

- Board Leadership

- Management Succession and Review

- Board Meetings

- Board Committees

- Committee Membership

- Committee Meetings

- Board Materials

- Board Conduct and Review

- Selection of New Directors

- Board Tenure Policy

- Social Responsibility

- Implementation of the Guidelines

Reading this document is definitely not for the faint of heart, and maybe something to read with a fresh, alert mind after a piping cup of Peruvian coffee.

Unrelated side note: I don’t get any compensation for this recommendation, but Atlas Coffee has a fantastic subscription program where you get coffee beans imported from around the world directly to your doorstep. I hope they maintain this offer for a long time, so I can read more and more SEC docs.

A Deeper Look at the Roles in a Corporation

Finally, let’s take each of the main roles discussed at the very top and make a few more clarifications on how these responsibilities can (or have) interplayed with each other (historically, to date).

President: Because the President often reports to the CEO, it’s a role that can be thought of as being the “#2 guy” on an executive team. This can particularly happen when a company has many business units, where the President may preside over the core business while the CEO has the responsibility to prudently allocate capital between the various business units in its most efficient use at any given time.

CEO: Of course this person is generally the leading face of a company, but some of the best CEOs of all time have been out of the spotlight, and brilliant decision makers. Not every CEO has to be gregarious to be successful; examples of CEOs who’ve attained incredible investor returns while staying relatively absent from the general public’s eye have included the people who led companies like Walgreens and Wells Fargo (when their businesses were actually wildly successful).

Now, even a CEO who appears to have complete control of a company through multiple roles may not always be free to do absolutely anything. Chief Executive Officers that double or triple, or quadruple by assuming President, Chairman, and high ownership percentages may still be voted out of his/her positions through a proxy vote of the shareholders when doing something egregious.

Chairman of the Board: This role may not be as flashy as a CEO title, but it can arguably be one of the most critical responsibilities towards leading company direction. A great Chairman can enable a wide diversity of ideas which get refined through intense debate and insight within the board; this can separate the average companies and the superstars.

I’m not one to get excited about today’s hype about “ESG”, but I am a firm believer in the diversity of good and unique ideas and vantage points and believe you should take serious consideration into its potential influence.

Investor Takeaway

Analyzing a company’s board of directors is a brilliant way to evaluate the leadership of a company. I’ll admit it’s a daunting task at first, but I hope I’ve made it easier for you with this guide.

Remember to keep an open mind when examining this information.

Not every successful board will look, act, or sound the same—just like every business, strategy, product, or industry can look different yet be successful too.

Like we love to say at IFB, don’t think of this research competnant as a definition description, but rather as another tool in the toolbox.

Other great tools to help you get deep understanding include:

- How to Read an Annual Report (10-k)

- Establishing a Circle of Competence

- How to Analyze an Industry

- The Basics of the All-Important DCF

I’ll admit that I had a lot of fun with this one, and am striving to increasingly include it as part of my analysis of a business.

I hope you’ve found it helpful, and remember, always invest with a “margin of safety, emphasis on the safety”.

Thanks,

Andrew Sather

Related posts:

- The Roles, Levels, and Salaries of C-Level Management Explained Updated 1/5/2024 C-level management, or the C-suite, includes any company’s top managers, such as Microsoft, Berkshire Hathaway, and Tesla. The C-level management remains responsible for...

- Disney 10q: Links to All Filings (+In-depth Analysis on Recent 10-q) To see all recent Disney 10q filings registered with the Securities and Exchange Commission, click this link or on the picture below. Walt Disney Corporation...

- Asset Management Stocks: Business Overview and Changing Trends Trillions of dollars move around in markets, and many of these flow through large asset management companies. To understand these stocks, and invest in them,...

- A Guide to the Top Custodian Banks: What They Do and How They Work Edited 3/24/2023 “Banking is a very good business if you don’t do anything dumb.” Warren Buffett Banking is a fascinating sector; it provides the lifeblood...