One of the most powerful forces behind building wealth in the stock market comes from the compounding effects of reinvested dividends. As investors, it’s important to know what to expect from those returns when planning for the future.

This post will introduce a simple dividend reinvestment calculator to estimate how much return to expect from a given dividend reinvestment rate and starting yield. Use this to plan for your financial future in ways not possible before.

Click to jump to a section:

Dividend Reinvestment Plans (DRIP) Explained

If you have ever listened to any of the Investing for Beginners podcast episodes, then you likely have heard Andrew or Dave talk about the value of Dividend Reinvestment Plans (DRIP). I mean, Andrew is the “DRIP King.”

In essence, DRIP is when you reinvest a dividend back into your current position. This is opposed to simply holding onto it as a cash payment to invest or withdraw as you see fit.

Let me help explain this with an example.

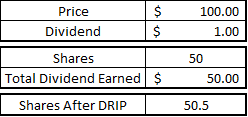

Imagine that you own 50 shares of a company that’s currently priced at $100/share. If that company pays a $1 dividend, then you could either get a $50 check, or you could DRIP it into your current position. So, in essence, that $50 dividend payment would net you another ½ share of the company ($50 payment/$100 share price = ½ share). So, now your total position for this stock would be 50.5 shares. See below:

The Advantages of DRIP

At face value, however you choose to receive your dividend payment, you are getting $50 of value. But when you DRIP your investments, there are a lot of unwritten values that you receive. For instance:

- When you DRIP your investments, you’re dollar-cost averaging future investments in the company every time that the dividend is paid, which is usually on a quarterly basis.

- You’re going to be making four purchases every year, once every quarter, which will help smooth out the fluctuation in the market price.

- Compound Interest

- You’re putting your money into the market as quickly as possible, which allows you the best chance to maximize your gains. The longer you give compounding to work, the greater your wealth.

- You have the ability to buy partial shares

- Brokerage firms typically allow you to buy partial shares, which is huge! In the above example, if you couldn’t buy a partial share, you’d have to wait until the next quarter to earn another $50 so you could then buy a share, assuming the price was still $100. Not only does this let you dollar-cost average less frequently, but it also makes you lose out on three months’ worth of compound interest.

- You avoid commissions from your brokerage firm

- Nowadays, there are very few brokerages that charge commissions on trading. However, if you happen to use one of those brokerages still, DRIP can help you avoid those payments.

- You save time as the DRIP is completely automated on your end

- When you receive the dividend, it will automatically return to your position. Nothing needs to be done on your end.

Imagine the following scenario…

- You invest $2,000 in a stock

- You assume that the stock will grow 8% annually

- The stock is currently earning a 2% annual dividend (a conservative estimate)

- You assume that the dividend yield will increase by 3% annually (another conservative estimate)

Now let’s use this to compare the value of DRIP vs. Non-DRIP. If you were to take the dividend and sit on the cash for 50 years, you would end up with $86,854.84 in equity and $72,815.75 in dividend payments.

But, if you were to DRIP your investments, you would have $0 in cash because it was all reinvested, but you would have a total equity stake of $235,755.19, or an incremental value of $76,084.60 over the non-DRIP alternative!

That, my friends, is a huge stack of cash!

I am a huge proponent of DRIP and I think that it truly is an amazing tool that you all should take advantage of in your dividend stocks.

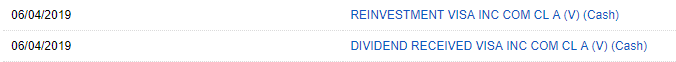

To set up your account is pretty easy, but it does vary from firm to firm. Chances are, you can probably type “dividend reinvestment plan” into the search bar and it will show you exactly how to do it. I use Fidelity, and it was very easy for me to setup. I can track my DRIP transactions when they happen, as you can see from an example below where my Visa dividend had gone through a dividend reinvestment:

DRIP Calculator (Downloadable)

I created another one of my simple calculators to help show the meaning of DRIP even more than I can verbalize. Plus, it is a tool to play around with to give yourself a better idea of the full potential of DRIP. Again, this is a really simple dividend reinvestment calculator, and you can poke holes in it if you want to, but this will help paint the picture with a broad stroke, so you can understand why you should DRIP your portfolio.

Click here to download the Dividend Reinvestment Calculator (Excel)

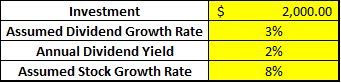

To use this dividend reinvestment calculator, you will need to input four pieces of information: initial investment amount, assumed dividend growth rate, annual dividend yield, and the assumed stock growth rate. For example:

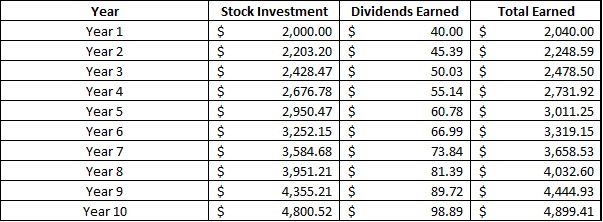

Once you enter these pieces of information, you will then get an annual look at how your position has performed.

As you can see, Year 1 has a Total Earned of $2,040 due to your $2,000 investment, earning you $40 in dividends (2%*$2000).

In Year 2, your Total Earned has increased to $2,248.59. This is calculated by taking your Total Earned in Year 1 ($2,040) and multiplying that by your assumed stock growth rate of 8%, which gives you $2203.20.

Then, you’re going to earn a dividend of 2.06% (2% starting dividend with a 3% assumed dividend growth rate) on your $2,203.20, which is a total dividend of $45.39. When you add $2,203.20 + $45.39, you end up with $2,248.59 for your Total Earned.

Again, this is a very simple tool, and some of you will say that most dividends are paid quarterly, so it’s not an apples-to-apples comparison – and I agree.

But, to be fair, all that would mean is that you’re getting your money back into the market faster and increasing the time that it will compound. So, this truly is a conservative look at how DRIP builds your wealth over time.

Hopefully, by now, you can see that the power of the DRIP is one that you don’t want to miss out on, so don’t.

Personally, I prefer to try to find FUTURE Dividend Aristocrats! There is a lot of hype around Dividend Aristocrats, so if you can make it a point to find companies before they reach that status, then you can set yourself up for some major gains both in share price and in the dividends that you will inevitably receive.

There are many reasons why you should do it, and the proof is in the pudding, as I have shown you. I encourage you to download it and maybe put your own stock picks in there and let me know your thoughts. I’m always willing to create things that help provide value and make us all better, smarter investors!

Related posts:

- 7 Compelling Arguments for Dividend Reinvestment vs a Payout in Cash Is the income stream from dividend payouts the best part of dividend stocks? Not always. Taking that cash instead of reinvesting it leaves serious returns...

- Handy Andy’s Lessons – Starting a Dividend Portfolio I’ve decided that I’m going to start a few “hot tip” type blogs and call them “Handy Andy’s Lessons.” This is likely to change because I...

- Qualified Dividends are Your Way to Minimize Tax on Reinvested Dividends! Long story, short, the answer is yes – you are going to have to pay taxes on reinvested dividends. While there are a ton of...

- Lump Sum Calculator: Investing Now vs Later (with Dollar Cost Averaging) If there’s one thing that I really have picked up on in my investing journey and I try to preach to you all is that...