One of the biggest hurdles to stock market investing is a mindset shift. Many beginners can’t get their heads around the reasons to buy stocks with small dividends. And I don’t blame them.

After all, how can you get excited about a $1.15 payment that takes a year to accumulate? While on the surface, a small dividend may seem inconsequential…

I’m afraid that many beginner investors are missing the bigger picture. And as they miss this picture, they miss the most powerful worldly force for building wealth.

What we need is a road map towards making money in the stock market.

I’ll try to explain this in the simplest of terms. I’m hoping you’ll get a “light bulb moment” and it will help you see stocks with small dividends in a much different way.

Once you understand the power behind it, you can go out and reap the benefits yourself.

Think of the following examples.

Take the game of Monopoly, for instance. We all know that the goal of the game is to collect as much money as possible. Coincidentally, this is the same goal in investing.

However, you don’t win the game of Monopoly by hoarding cash. You need to instead buy as many properties as you can. Those of you who are good at the game know that a few well placed houses and hotels on your properties will pay you thousands of Monopoly money in the long run.

In Monopoly, it costs money to buy properties and add houses and hotels. These properties don’t pay for themselves right away, yet you know that the key is to snatch up these properties as they will more than pay for themselves in the long term.

You have to look at stocks with small dividends in this same way. You’re not buying them for the immediate return, but for the long term cash flows.

Tomatoes and Investing

Another simple example is planting a tomato garden. Let’s examine the goals and the effects. The goal of a tomato garden is for me to eat a tomato. This is obvious.

However, you don’t plant a tomato garden and expect to immediately start eating a tomato, or many tomatoes. You must plant the garden, water it, till it, and do other garden-like things to it (as you can tell, I’m not a green thumb).

But once the tomato plant has sprouted, it takes minimal work to maintain the garden. Plus you get not just one tomato, but an “income stream” of tomatoes. You must have the patience to reap the rewards, but the rewards are much plentiful than just buying a tomato at a store and consuming it.

The difference between buying a tomato to feed you once and a tomato seed to feed you indefinitely is the difference between buying a stock to make money and buying a stock for the dividend.

Notice that the goals are the same. In the tomato scenario, our goal is to eat a tomato. With investing, our goal is to make money. The difference is that you can take a long term approach for delayed gratification and greater benefit, or a short term gratification that quickly evaporates.

What’s interesting about the Monopoly example is that it utilizes a rare force in the world.

Most things in life take a great amount of upkeep and energy. The tomato plant, for example, requires maintenance– not as much effort as the initial plant but still significant. Exercise and our body takes constant effort and energy. I couldn’t possibly hope that one workout would have me “set for life”.

Money has a drain effect. It always seems to find a way to leak out of our wallets. We have to put constant effort and energy to keep an income at our jobs.

Monopoly properties don’t fall victim to this. You just buy it once, and it creates an income for you forever.

Guess what. Dividend paying stocks work the same way!!

Except in the real world, the best stocks with small dividends will increase the payouts year after year. What this means is…

As long as you pick a company with strong financials, the income stream will pay you until you or the company dies! And those payments rise, that’s some serious earning power.

Let’s play this out with an example.

Stocks with Dividends Ex: JNJ

The year is 1987. A great mathematical genius with a gift for investing and teaching is yet to be born.

Unfortunately there were no great websites to teach you about investing yet, but let’s say you did know the power of stocks with small dividends and compounding interest.

Let’s say you got a modest bonus at your job, $100. It was modest for the time.

Though you were far from a stock picker, you did know some stocks whose products you use everyday. One stock, Johnson & Johnson particularly caught your eye. You jumped in. Back in 1987, JNJ was trading at $83.00 so you bought 1 share. Their dividend at the time was about $1.25.

How stupid, right? Paying $83 to wait 1 year to collect $1.25. How can anyone ever get rich collecting $1.25?

But in our example, you were patient. And wise.

Over the years, the dividend for JNJ continued to rise. You collected those dividends, and reinvested them to buy more JNJ. This is the #1 best way to make money in the stock market, through the power of compounding interest.

You knew this because you were educated. Now how would those results look like today?

Well, after almost 30 years of compounding, your original $83 would now be worth $2,469.94. Instead of just 1 measly share, with a lowly yearly payment of $1.25, you’d have 24 shares paying you $18 a year. Remember, this is just with an original $83 investment.

The best part is that those payments will likely continue to grow. Your $2,469.94 sum would continue to grow as long as you continued to reinvest the payments.

As long as JNJ stays in a strong financial position and continues to increase its payments (as it has for the last 52 years), you’d continue to watch your money magically grow with no maintenance on your part.

See why I get so excited about this now?

Say you had started in 1972 instead of 1987. Your totals would be $7,506.70, with 74 shares and a $55.50 yearly income.

As the years go by that you hold a dividend grower and reinvest, your returns become exponentially better. The numbers just shoot straight up.

This is the power of a stock with a dividend, even a measly $1 dividend.

Double Your Money, Build Your Wealth

Like a giant snowball, your wealth will continue to attract more and more money as time goes on. It takes a long time to build, but through your efforts you can have a giant snowball of cash that never stops growing.

The majority of millionaires are older than 45, and most of them are first generation. They find success by compounding their wealth. Millionaires buy investments like stock paying dividends that will provide steady cash flow and an ever increasing return.

I’m talking to those who think the same way as me, realists who know that every dollar comes from hard work. Intelligent people who realize that wealth is built, it doesn’t happen overnight. These are the people who can benefit from the powerful strategy of (even small) dividend investing.

Let’s examine 2 different companies during 1998, to show you the power of dividends.

The first company is the poster child example of a company who has had great returns for its investors without paying a dividend the entire time. You may know the company as Berkshire Hathaway (BRK.B), famously run by Warren Buffett for years.

Ironically, Buffett’s company doesn’t pay its shareholders a dividend, because the company believes that reinvesting that money into the company is more valuable to shareholders. The benefit comes from using that money to grow the business, therefore making the share price higher.

The company is famous in its success. Many people who are against dividends refer to Berkshire Hathaway as the prime example to why dividends shouldn’t be paid. Ok fair enough, I’ll use them in this example as well.

The second company is the type that I look for in investments. A company with a stable position in the market, who has been paying and increasing dividends for decades. These are the type of investments that critics claim to have no growth left.

People looking for huge exciting gains usually pass this type of investment by. Then they look back 15 years later and wonder what happened to them. I’m talking about a company like Procter and Gamble (PG).

Dividend vs. No Dividend Example

So we have a company that has been famous for not paying a dividend, and a company that is famous for paying dividends. They are both considered perfect examples for their respective arguments.

The date is April 17th, 1998. Both companies have seen some significant share price appreciation in the past year. Berkshire Hathaway (BRK.B) is trading at $47.16, and Proctor and Gamble is trading at $42.56.

Now fast forward to the opening prices on yesterday, August 13, 2013. Berkshire Hathaway is now at $117.35, while Proctor and Gamble is at $81.78. BRK.B has gained 148.83% in this same time span that PG has gained only 89.6%.

WAIT A MINUTE. We aren’t looking at the whole picture yet. Let me show you why.

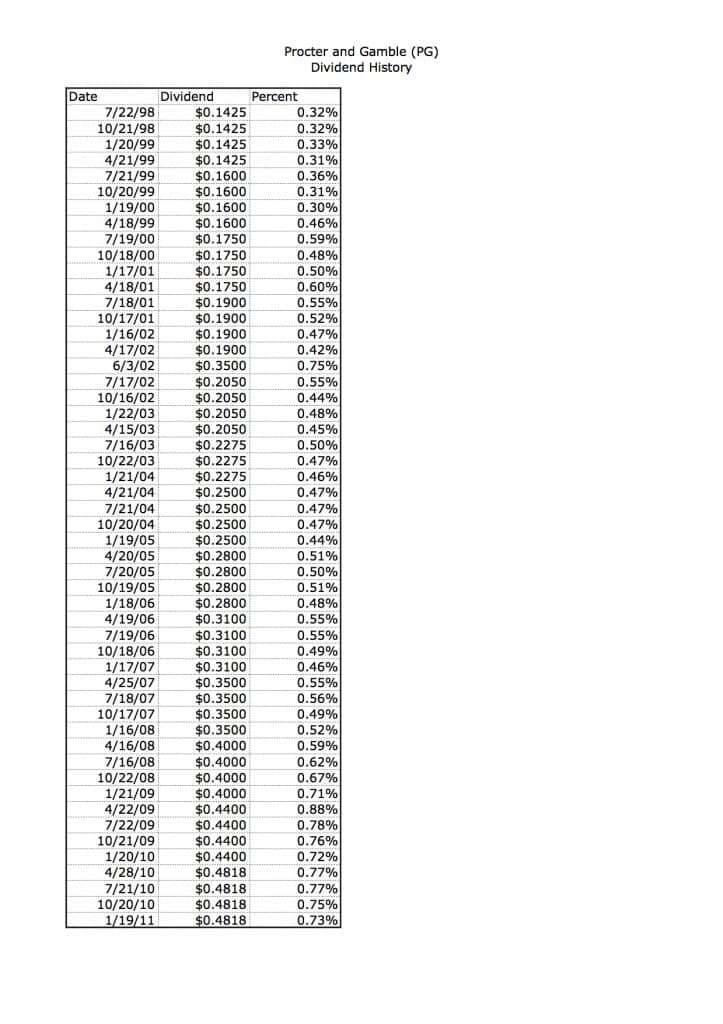

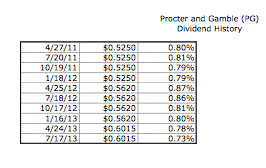

During this time, investors with PG have been collecting and reinvesting dividends every year. I’ve attached a chart below to show each dividend plus how much percent of a share was repurchased with each dividend.

Over the length of the investment, the percentage grew to 35.75%. This means for every 1 share of Procter and Gamble the investor would’ve bought, they would now have 1.3575 shares. This might not seem like much at first, but just look at the vast difference before the dividends were accounted for.

With 1.3575 shares, PG is actually worth $111.01. The return on investment with this number? It is a whopping 160.8%, almost double the first return and easily greater than BRK.B.

Double Your Money: PG Dividend History

Dividend Growth Investing

Before you think that this is just one example, check out the 5 other dividend compounding examples I’ve written about in the past. Some of those results are even better than this one, turning $10,000 into $100,000+.

There’s plenty of other small dividend growth investments that have created massive income streams over the years.

Remember how small this initial investment was. Imagine if we were investing that much each month or each year. Or even if we had greater sums to invest. The possibilities are endless!

Now let’s be clear. Not every stock is a JNJ. Some stocks do stop growing their dividend. Consecutive streaks do end.

That’s where you come in. And where I come in. If a stock is no longer giving us what we want, like an increasing dividend, that’s when it’s time to cut our losses and sell.

Sure that can and probably will happen. But again this is all theory. You don’t have to bat 100% in the stock market, and it could take just one big JNJ or PG to create wealth for the rest of your life.

Don’t take that opportunity lightly.

Related posts:

- How to Find Good Dividend Stocks: 3 Metrics It’s easy to find plenty of websites willing to share a “top ten” list of good dividend stocks for the year. Yet it’s much harder...

- Dividend Theory: For Big Tech, Dividends are a Moral Imperative The theory of dividends has long been disputed. As interest rates have declined, dividends have become less attractive. As growth stocks have reigned supreme, dividends...

- High Dividend Stocks: The Risks and Double Compounding Potential A stock that can grow their dividend payments over time consistently provides compounding like no other opportunity. Naturally, investors try to maximize this compounding by...

- How to Find High Quality Dividend Stocks that Are “Simply Safe” My name is Brian Bollinger, and I am the founder of Simply Safe Dividends, a website that helps individual investors responsibly build and manage their...