Is the income stream from dividend payouts the best part of dividend stocks? Not always. Taking that cash instead of reinvesting it leaves serious returns on the table.

A good dividend reinvestment plan (also called DRIP) is vastly superior to taking a dividend payout as cash for most investors. It provides great levels of compound interest, which is the key to long term investing success.

In fact, there’s much evidence that DRIP investing can result in serious returns. This blog post will examine 7 of them. Hopefully you will fully appreciate its power and implement it with your own investing strategy.

1- DRIP adds “Double Compounding” for Investors

Though not talked about much, DRIPs add an additional layer of compound interest to a stock investment.

Take the average stock, for example. Buying a stock means buying part ownership of the underlying business. That business earns a profit, then uses some of that profit to reinvest in the business.

Businesses reinvest by buying assets. This unlocks the ability to earn even greater amounts of profits in the future, which enable higher reinvestment. Like a snowball, the effect compounds.

But…

Businesses don’t only use profits to reinvest in the business for future growth. They also pay some of their excess cash back to shareholders, in the form of dividends or share buybacks. This allows the shareholder to experience a compound effect in addition to the one from profits.

Just like businesses reinvest for higher future profits, investors can reinvest to juice the gains for the stocks they already own.

The longer an investor “DRIPs”, the more shares that an investor accumulates over time. As the investor’s overall share count increases, more and more shares are able to be purchased for additional reinvestment. It creates an explosive compounding effect.

Combine the two compounding forces and you have a sort of “double compounding.” Owning more shares means getting a higher return from an increasing stock price than one if you had never reinvested.

2- Dividend Growth Adds 3rd Power Compounding

There is a third part of all of this compounding talk that is unique to DRIP situations.

When a stock grows their dividend in addition to growing their earnings, the DRIP effect multiplies again.

Remember that each subsequent year of reinvestment means higher and higher levels of reinvestment. The dividend an investor receives in year 1 is going to be less if he only has 100 shares compared to a dividend in year 2 where he might have 103 shares.

The higher potential levels of reinvestment accelerate even faster if the stock dividend is growing. Say a stock pays a $2 dividend, then increases their dividend to $2.20 the very next year.

Well as a dividend investor, you don’t have to do anything to receive dividends. As long as you hold the stock, you’ll get paid a dividend.

What that means is that if the company continues to grow their dividend year after year after year, you’ll continue to get higher and higher levels of dividend payments every single year.

Again, that means higher and higher levels of reinvestment potential. So the investor sees compounding in the share price, in the actual dividend payment, and from the accumulation of additional shares through the DRIP plan.

Sounds great to me.

3- DRIP = Major Portion of S&P 500 Returns

I got the cold, hard facts for this point after being prompted by a great question from a subscriber to The Sather Research eLetter.

Daniel: I think I understand the DRIP concept and how it compounds. Your holding slowly grows with each dividend and each dividend slowly grows based on your holding. But I did not think this would be a serious part of the expected 11% of the total, at least not yet. Am I wrong about that?

Most people don’t know actual contribution that reinvested dividends have towards overall investment returns. Hence the poor public misconceptions that dividends are for old people.

There’s a great S&P 500 return calculator on dqydj.com. I ran a scenario investing in the S&P 500 for 40 years– from May 1978 to May 2018. Returns were as follows:

- Without dividend reinvestment: 8.6% CAGR

- With dividend reinvestment: 11.6% CAGR

That extra 3% is 25% of that 11.6% annualized return, which is a serious component of the overall performance.

4- Dividend Stocks Outperform During Bear Markets

We know from buy low, sell high—bear markets are the best time to buy stocks.

But if you don’t have “dry powder” when the best businesses in the world go “on sale”, it’s really hard to take advantage.

Here’s a data point I pulled from a white paper called Why Dividends Matter. In it, the academics looked at historical S&P 500 returns from 1972 – 2010. They categorized stocks into 5 buckets, and added their average return:

- Dividend growers and initiators: 9.6%

- All dividend paying stocks: 8.8%

- Dividend payers with no change in dividends: 7.4%

- Dividend cutters or eliminators: -0.5%

- Non dividend paying stocks: 1.7%

Compare all of those returns to the total S&P 500 over the same time period at 7.3%. Again, we’re seeing a couple of percentage points difference, which can make for serious differences in wealth.

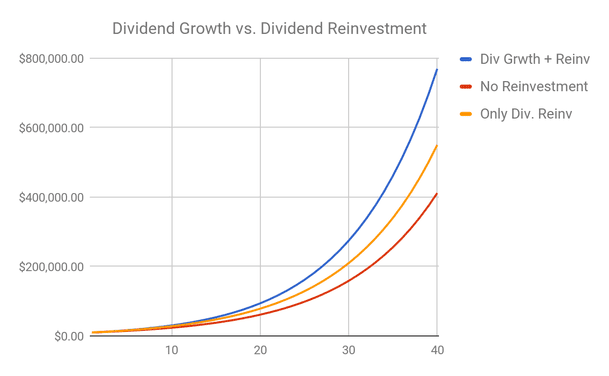

So much so, in fact, that I’d like to illustrate the difference in returns for the study above and the returns from point #3.

Let’s take $10,000 and invest it for 40 years. Using 8.6% CAGR for non-dividend reinvestment and 11.6% CAGR for dividend reinvestment, the results are:

- 8.6% = $271,139.64

- 11.6% = $806,432.06

As for the Why Dividends Matter Study:

- 9.6% (Dividend Growers): $391,221.01

- 8.8% (All Dividends): $291,847.39

- 7.4%(Stagnant Dividends): $173,848.62

- -0.5% (Dividend Cutters): $8,183.20

- 1.7% (No Dividends): $19,626.29

Amazing what you’d be able to do with one $10,000 investment if all you did was pick S&P 500 dividend stocks.

Keep in mind that this backtest was done with an ending date of 2010, which was a horrible time period for the stock market and definitely qualified as a bear market.

A bear market could be a great opportunity to sell your outperforming DRIP stocks to buy expensive growth stocks on the cheap!

But, that’s not even the most surprising result from the study.

The authors also observed that dividends comprised 75% of the market’s total return during low market growth periods such as the 1940s and the 1970s.

So in up times, performance was boosted by extra compounding. When the market did poorly, dividends helped raise investors up even further.

5- Why Dividends Help the Underdogs

“Heads I win, tails I don’t lose much.”

This is a quote from the esteemed value investor, Mohnish Pabrai, who after the first 16 years of investment fund was able to beat the market– and handily.

We can use the same type of mindset that Pabrai uses for his value stocks and apply it to any DRIP investment holdings.

Pabrai sees his stocks as low risk, high reward potential. He is buying with such a discount to intrinsic value that the stock will either revert back to its true value, or won’t fall too much (because it is already so steeply discounted).

In the case of dividend stocks, and more specifically DRIP stocks, we can approach our investment as a win-never-lose situation.

I’ll explain.

Say that an investor buys a dividend growth stock at $100. Say that after 1 year, the stock decreases to $90, then to $80 the next, then down to $75 after 5 years.

You might think that the investor lost in this scenario.

However, as long as the investor never sold his position, he didn’t lose a single dollar. In fact, each year the company paid the investor more and more dividends, which he should’ve continued to reinvest.

As long as the company never goes bankrupt, our investor can wait out his investment until it finally trades at a price he’d be comfortable selling at (with a nice gain). In that case, all of the years of poor performance did nothing EXCEPT allow the investor to buy more shares (through DRIP) at even cheaper prices.

This is a point I made with a simple example in my Dividend Compounding is the Secret Sauce blog post:

“Picture this—you hold a stock for 5 years and the price goes nowhere. It stays flat. If we were to look at the S&P 500 over the past 5 years, it is up 102.16%. Looking at an investment like this you might think it were an utter failure…

But that’s not the whole story. We also have dividends.

What I find curious is that even as the S&P 500 has returned close to 15% per year over the last 5 years, the dividend growth for an ETF which follows the S&P (like $SPY) has only been 4.9%. A wildly prosperous time in the stock market, but yet these S&P companies aren’t giving much compounding in the way of dividends.

If our stock was worth $100 and the S&P 500 was worth $200 after 5 years, our stock has a lot of catching up to do. If both our stock and the S&P 500 started with a 2% yield, paying a $2 dividend per year…

After 40 years our stock will have paid $975 in dividends while the S&P 500 paid $255. Of course, the huge head start for the S&P 500’s price helped its compounding significantly—by year 40 it would be worth $5,620 while our stock is only worth $2,810.

Remember though, it’s total return and not just stock price return which really matters to investors.”

6- DRIP Stocks Are Seriously Underappreciated

There are skeptics everywhere. An article such as this one criticizes the Why Dividends Matter whitepaper. It claims the whitepaper is not 100% representative of the impact of dividends on returns.

However, their counter argument leaves much to be desired.

While the whitepaper looked at the whole sphere of the S&P 500 stocks, the rebuttal only cherry picked certain stocks. Of course this is a poor way to make a bold declaration of either support or opposition.

It also tried to pander to the audience by not picking one side or the other. Saying dividends are probably better for those wanting income and growth stocks better for those seeking capital appreciation.

But that doesn’t explain why the non-dividend payers (many of which are growth stocks) earned a measly 1.7% average over a 38 year time period.

Perhaps the biggest “hater” of DRIP investing, however, is…

The overall market.

You don’t have to look far to see stocks with sky high valuations and stagnant or non-existent dividends.

The fact that the market (and Wall Street) focuses so much on growth and earnings means that the same type of stocks tend to get bid up higher and higher. Oftentimes this leaves “boring” dividend growth stocks left behind without much fanfare.

If anything, this creates the ultimate opportunity for investors looking to get in.

Remember the “heads I win, tails I don’t lose much” philosophy. Cheap dividend stocks create great compounding opportunities, not only from business growth, dividend growth and dividend reinvestment– but also from the simple gains from value stocks. Buying value stocks works on reversion to the mean.

Just as studies have proven the superiority of dividend stocks, studies have also shown the power of buying undervalued stocks using a value investing approach.

The problem is that there are no fancy stories of innovation and immediate riches with these types of stocks. Predictably, they don’t gain a lot of popularity like the growth stocks do.

Luckily we can take that knowledge and apply it to find undervalued dividend stocks right now. Today.

7- The Bottom Line: Exponential Growth

Some things in life are just unexplainable and awe inspiring. The concepts of life itself, consciousness, and human intelligence are too complex to pinpoint.

Rather than fight against these forces, it’s better to observe them and…

Ride ’em out.

Like exponential growth. What does that look like in nature? The metaphor I hear used a lot for compound interest is the snowball metaphor.

Think of your wealth as a snowball.

As you push it down a hill, it accumulates more and more snow, at a faster and faster rate, until it’s a massive force that you don’t need to touch.

But maybe the best way I can think of exponential growth as it relates to DRIP investments is two-fold: as a tree and a coffee machine system.

I talked about this with Dave on the podcast– how DRIP investing can be best thought of as a reverse pyramid scheme, or a family tree where each branch reproduces.

Growth leads to more growth and it expands downwards and out.

Just look at a tree branch and how branches will grow on branches, or get down to the tree’s roots and see the same thing.

Your dividends will grow from dividends in exactly the same fashion.

Updated: 10/21/2022

Andrew Sather

Andrew has always believed that average investors have so much potential to build wealth, through the power of patience, a long-term mindset, and compound interest.

Related posts:

- Dividend Reinvestment Calculator to Plan Your Expected Returns (Excel) One of the most powerful forces behind building wealth in the stock market comes from the compounding effects of reinvested dividends. As investors, it’s important...

- Handy Andy’s Lessons – Starting a Dividend Portfolio I’ve decided that I’m going to start a few “hot tip” type blogs and call them “Handy Andy’s Lessons.” This is likely to change because I...

- Qualified Dividends are Your Way to Minimize Tax on Reinvested Dividends! Long story, short, the answer is yes – you are going to have to pay taxes on reinvested dividends. While there are a ton of...

- Inheritance Investing Considerations for the Young Investor A listener to the IFB podcast recently was asking for some advice on investing inheritance money and some good tips and things to think about....