If you’re looking for a dominant company with a very strong competitive advantage, it might be easy to name a few different companies out loud, but another way to identify these different companies is to find those that are part of a duopoly market.

If you do not know, a duopoly market is one where there are only two true competitors in play. Initially when I was reading about duopoly markets, I struggled to think of an example of where this might actually impact me, but then I went over to the fridge and poured myself a pop and it came to me – the very first one that came to my mind is in the soda industry!

If you’re naming soda brands it really comes down to Coke vs. Pepsi. Even in the other brands, it’s Mountain Dew vs. Mello Yellow and Mr. Pibb vs. Dr. Pepper. At the end of the day, it’s really just two different competitors that make up this duopoly.

Coke and Pepsi seem to have this intense rivalry with one another that really is more so based on their consumers than it is their own marketing efforts towards one another. I don’t think I’ve ever seen one commercial of those two companies that are talking down on the other yet how many times have you been out to eat with someone where the conversation goes like this:

Server: “What can I get you to drink?”

Person: “I’ll have a Coke.”

Server: “Is Pepsi ok?”

Person: “No. I’ll just have a water.”

Yes, I’ll be honest, they do taste a little different, but it really is more so just people being snobby than them actually tasting the difference. In fact, there was actually a study done that proves this.

So, as an investor, why do you actually care about finding a Duopoly? Well, more often than not, when you’re in a Duopoly market you will naturally find that there is less of a competitive pricing scenario and that there is a much larger emphasis on the actual quality of the product instead.

It almost seems like the two companies will universally to agree to not compete with one another via price but rather focus on the other 3 Ps of Marketing- Product, Place and Promotion- and ignore the 4th P of Price.

To continue with this example – do you ever buy Coke or Pepsi solely based on price? No! Never.

Chances are they’re priced the exact same and even if they’re not, you’re not going to notice the difference. There are off brands of soda which are cheaper, but their sales are so low that it’s really not even a true competitor in the market.

Another similar example with this is with domestic beer sales. When it comes down to it, there are really two main companies that supply the domestic beer sales in the U.S. – Anheuser Busch and Molson Coors Brewing.

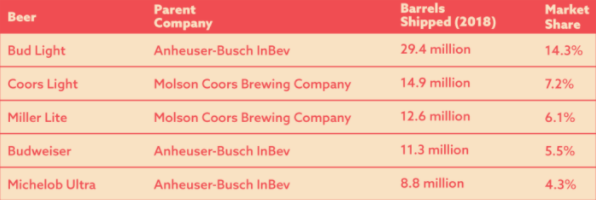

Below is chart from Vine Pair that shows the top 5 beers sold in the U.S. in 2018:

As you can see, the Top 5 beers are all sold by one of these two major companies, and just within these companies you have 24.1% market share to Anheuser Busch and 13.3% market share with Molson Coors, and that’s only with the top 5 beers, and that includes all of the microbreweries as well that sell craft beer.

Aka, that means the market share of the domestic beer sales are much higher than what’s being shown above.

Even when someone says domestic beer, I really only think about the top 4 beers that are listed above and don’t even think much at all about the others with fewer market share.

A Bud Light drinker would never grab some Miller Lite because the 24 pack of beer was $1 less. In fact, I have friends that talk a ton of smack about the other brands. They’re so incredibly loyal to their beer of choice and will choose to not drink or say that it “gives me a headache”. Maybe it does. Maybe it’s in your head.

But the thing is that these beer companies, just like the soda companies, have created an environment where the market share is so high that they can ignore focusing on price and instead market their product by the quality of the product.

The benefits of this are that you’re really locking in some margin while knowing that you’re not going to need to drop lower to retain customers. It’s not a commodity. You have built a brand that has a very loyal, consistent, steady following that has a minimal risk of leaving your brand.

These companies have a major advantage where they’re trying to get customers at a young age because they know that they’re going to be customers for life. Typically, this is going to keep competition from being able to come in and compete because the barriers of entry are so high.

Think about if you’re buying a new phone – you’re really only debating between Apple and Android, right? Sure, you might get one of those new Motorola Razors, but if you do that then you’re only really doing it to be unique.

There’s no way that you’re actually doing it because you think the quality is better – that’s why Apple and Android have the largest market share – they dominate!

And do you notice that people that have either an iPhone or an Android seem to never switch to the other? Some people do but it’s very few and far between. My wife literally got a new phone today and her debate was between the iPhone 12 and the iPhone 12 Pro or Max or whatever it is lol. The more expensive iPhone vs. the less expensive one.

She picked the less expensive one (thatta girl!) but she never considered an Android…and neither would I!

It has nothing to do with Apple being a superior product or not. It’s just that I’ve had an iPhone since I was 18. It’s worked well for me to this point. I don’t want to switch and learn something new. I like what I have and I am going to use my iPhone until it dies and then I am going to buy a new iPhone. That’s the entire process for me.

But these are both companies that are very well-established and in their roots. Another example that came to mind for me is with Uber and Lyft.

Personally, I consider that a Duopoly, but it’s a new duopoly. It used to be a monopoly with taxis but technology has disrupted the industry and turned it into a duopoly but one that is up and coming.

Personally, I will never use a taxi. I don’t want to try to hail one down and I don’t want to be in that weird situation where I get to the end of my ride, try to pay with my card, and they tell me it’s cash only. And yes, that has happened before. Many times, actually, when I lived in Chicago.

So, you will find that Uber and Lyft are competing on price because they’re also fighting the taxi industry, but I think that will change in the future as the taxis continue to diminish more and more and those taxi drivers decide to buy a new car meant for driving Uber.

Eventually, those companies are going to focus on the user experience. Maybe they mandate drivers have chargers in their car. Maybe they give you the option to control the music from the app when you’re in the ride. Maybe they give you the option to tell the driver (before you’re in the car) that you don’t want to talk at all. That would actually be amazing.

Those types of things will make people choose Lyft or Uber over the other and have nothing to do with price. Yes, they are price-focused now, but I don’t foresee that being a forever thing.

One potential issue with these duopoly markets though is that if the two competitors become lackadaisical and don’t continue to adapt, you can eventually get new competitors to come into the market.

Let’s go back to the domestic beer example – is that still a huge stranglehold in the beer market? Yes, of course! But, is it less of a stranglehold? Also, a resounding yes!

I talked about how these two beer companies really push to get their consumers to start with their brands at a young age so they become customers for life. Well, there’s really two main competitors that are infringing on this:

1 – Craft Breweries

This isn’t a competitor in regard to just one specific company, but rather a movement. The craft beer movement is definitely thriving and people are purchasing more and more craft beer than ever before. Personally, I don’t ever buy domestic beer anymore unless I am intending to consume it at an event or in a situation where more than a couple is desirable ?

Many of my friends are the same exact way and they never buy domestic beer. They now have developed this taste for craft beer and prefer to go to a brewery and watch sports all day rather than the local sports bar or a Buffalo Wild Wings.

The lack of innovation by these major companies has opened the door for new generations to get infatuated with these craft breweries and it has brought on some serious competition.

Sure, you can see that the sales are still very strong for the domestic beer brands, but as I mentioned, this movement is really with the younger generation…which just happens to be the generation that might still have 60+ years of beer buying in their life.

But craft beer isn’t the only movement impacting these companies…

2 – Seltzers

Seltzers like White Claw and truly seem to be taking over the world right now. College kids drink them like crazy over a domestic beer because honestly, they taste way better unless you have developed that taste.

These breweries had plenty of time to make their own seltzers and that’s what they did – they took their own time. Instead, Mark Anthony Brands (White Claw) and Boston Brewing Company (Truly) really got out of the gates quickly and dominated the market.

Since then, Anheuser Busch and Molson Coors have come out with their own Seltzers but they’re just so late to the game. Again, it seems like they were just so lackadaisical that they procrastinated to see if the trend was going to last rather than being proactive.

Maybe they thought it would be another situation with the Not Your Father’s Root Beer where it’s really just a fad that dies out, but this doesn’t seem to be the case at all.

Maybe they will just go buy up some of these seltzer brands and that would be fine, but Boston Brewing creating this seltzer line is the type of innovation that you might see from people clawing to fight their way into a duopoly.

So, in summary, how does this impact you?

Investing in a company that’s a duopoly is something that you need to just be aware of as there are pros and cons. A major pro is that the company is in the Top 2 of only 2 main competitors. They have a huge market share. They are likely going to be a very consistent investment that’s going to hold its value and slowly be able to increase profits and hopefully pay dividends throughout future years.

But there are some cons as well. If that company isn’t really focusing on continuing to develop and innovate their product, they may invite in competition because of their stagnancy. It’s hard to do, and as I mentioned it really takes more of a “movement” than an individual competitor, but if that company isn’t ready to react then it’s going to cause a major threat.

If you’ve ever done a SWOT analysis (Strengths/Weaknesses/Opportunities/Threats) then you know that threats are also opportunities. If Anheuser Busch or Molson Coors had been more proactive with their seltzer business then maybe they could’ve been better positioned to become the #1 in the duopoly and keep these other competitors out, but they didn’t.

So, as with anything in investing, it all comes down to the quality of the company that you’re investing in and the competence of the management for that company.

Do you trust the company and their management? If so, then you’re going to be primed for success by investing in a company in a duopoly. But if you don’t, then you’re buying a company that’s at it’s high point and has no room to do anything but fail…to me, that sounds like a value trap!

Related posts:

- 7 Insightful Keynes Quotes about Economics and the Stock Market John Maynard Keynes was a British economist who really changed the thought process on macroeconomics over time, and as you might expect with any great...

- How Interest Rates and the Stock Market Are Intricately Intertwined “The most important item over time in valuation is obviously interest rates.” –Warren Buffett Quite a statement, and my thought is, how much do we...

- Global Wealth, Money, Real Estate, Bond, and Stock Market Statistics With so many trillions and billions of dollars changing hands around the world today, how can the average investor make sense of it all? Follow...

- Election 2020: Effect of the Proposed Biden Corporate Tax to the Stock Market As the election approaches, investors naturally grow nervous with the uncertainty. With Joe Biden’s promises to increase corporate taxes and capital gains taxes, investors wonder...