If you’re addicted to checking your portfolio multiple times a day, and I personally don’t think that’s a bad thing as long as you have some ground rules in place, then I guarantee that you’re familiar with earnings guidance.

Wikipedia defines earnings guidance as “publicly traded corporation’s official prediction of its own near-future profit or loss, stated as an amount of money per share.” In other words, the company is simply coming out and giving an update prior to their next scheduled formal financial release, whether that’s a 10-k or a 10-q.

For the most part, I am investing for the very long-term, with the exception of a few “play money” stocks that I like to tinker with, so I don’t really care about the earnings guidance. As long as nothing is materially changing with the company then I am likely going to keep my position and continue to focus on that early retirement goal!

But, like I said, I do have some short-term investments, so let’s dive deep into three different situations to see if earnings guidance has led to high returns:

Roku Guidance – 4/13/20

This is one of the examples that comes to mind for me because personally, Roku is a company that I love as a purely speculative stock and have loved it for quite some time now and yes, I know that the financials do not look good. I. Know. It’s purely speculative, and that likely means stupid, but let me live my life with my very small amount of play money!

Sorry – I felt attacked. By my blog audience. Who isn’t even actually responding to me? Lol.

Although it’s not earnings, on 4/13 after the market closed, Roku came out and rose their guidance for the quarter as they expected revenue guidance to be higher than initially anticipated. The stock soared in the afterhours trading as one would think.

Then, when the quarter came to a close on 5/7 and they reported their earnings, it was a great quarter on both user growth and revenues, but the stock slumped. But, let’s assume that you were the most perfect investor and bought and sold at the perfect times:

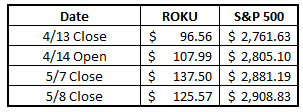

This would mean that you bought at the market close price of $96.56 and then sold at the market close on 5/7 at $137.50, locking in a return of 42.4%! That is a great win.

During that exact same time, the S&P 500 provided a 4.33% return, which is still very strong, but of course the 500 companies in the S&P 500 didn’t come out and raise guidance.

Of course, that is very unrealistic scenario to buy perfectly, so let’s take a look at a few others:

Either way that you skin the cat, the return that ROKU provided during this time period was significantly better than the S&P 500, even if you simply held the entire time.

MSFT Guidance – 12/14/2000

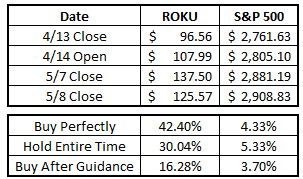

This is an old one – 2000! Microsoft provided some guidance that things weren’t going to be looking great in the quarter earnings upcoming, so how did it translate over? Well, let’s see:

Using the same chart format as the previous example, you can see that even if you bought perfectly you were still going to underperform the S&P 500. Holding the entire time makes it look way worse!

This is absolutely a situation that I would’ve been nervous to be buying MSFT after their bad news, but guess what? MSFT is now worth $186 and change, and that doesn’t include dividends or a 2:1 stock split that occurred in 2003!

So, yeah – maybe buying and holding is a good idea!

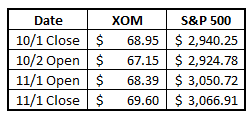

XOM Guidance – 10/2/2019

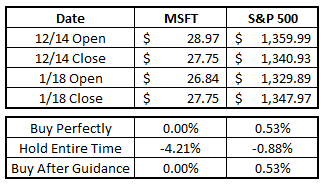

XOM gave earnings guidance that was bound to disappoint investors as they were anticipating earnings that were $400 million below expectations. This guidance then caused the share price to drop significantly as you might think.

Hilariously enough, XOM then went on to beat expectations and saw the stock rise when they reported. So, the question is, did their earnings guidance actually provide an opportunity for you as an investor?

Well, let’s assume that you were the most perfect investor of all-time and you bought shares right when the bad news was announced and then you sold at the end of the day after the surprise earnings beat from XOM – what would that look like?

If you were this perfect investor that I talk about, you would buy the shares after the bad news comes out and then hold all the way through, he good earnings and sell at the end of the day, right? So, you would buy at $67.15 and then sell at $69.60, meaning you would have a 3.65% return. That’s not bad for owning a stock for only a month, but what if you did that same thing with the S&P 500?

You’d buy at $2924.78 and then sell at $3066.91, meaning a gain of 4.86%. So. you’d be a loser in this case vs. the S&P 500. Womp womp.

So, overall, I personally do not think that making a buy/sell decision off of earnings is going to workout well for you. The thing that you need to learn, and I had to learn this the hard way, is that you are a NOBODY!

I am not trying to insult you, but how do you know if a company even beats their earnings? You likely need to wait for someone to write a short article or an update as you sit there and refresh Yahoo Finance.

I have done that a thousand times (literally) to see how the earnings shake out and I’ve learned that I’m better to literally just look at the pre/post market move based off when the company reports for my “preliminary look” at the earnings.

My point being is that thousands of people already know before you do and they’re making buy/sell decisions, not to mention you will still have many hours to be able to trade until the market even opens, so you’re just going to be so far behind the 8 ball if you try this.

Do yourself a favor and stick to finding companies that are undervalued vs. their intrinsic value. You will be much happier that you deployed that strategy instead of the latter.

Related posts:

- Beginner’s Guide: 7 Steps to Understanding the Stock Market Updated: 4/06/23 This easy-to-follow beginner’s guide will help you learn how to invest in the stock market. We’ll be leaving out all the confusing Wall...

- Stock Repurchases: How They Work and Their Effect on Earnings Updated 3/6/2024 In today’s market, share repurchases are the choice that most public companies use to return value to their shareholders. Investing giants such as...

- Dividend Reinvestment Plan Example — When Total Return Multiplies The compounding from dividends can be an incredible force. I have a dividend stock I’ve held and reinvested dividends in for over 5 years. I...

- The Big Guide to Little Dividends Dividends are one of the best ways companies can return value to shareholders. Share buybacks have become all the rage in the investing world, pushing...