Understanding the basic concepts of economics is critical to making smart investment decisions both at the stock-picking level and also at the portfolio asset allocation level. There are two major fields of economics; microeconomics and macroeconomics, and the laws of supply and demand play a factor in both which we will discuss as well.

Microeconomics has to do with the nitty-gritty of investment decisions at the business level and is very relevant in financial analysis, management accounting and operations. This makes microeconomics critical to understanding individual businesses and making smart stock investment decisions.

Macroeconomics moves beyond individual businesses to look at factors affecting industries and sectors in general. Overall asset levels and portfolio allocation across sectors and asset classes to be invested in (stocks vs. bonds) could be considered choices wrapped up in macroeconomic factors.

Microeconomics Importance to Investors

Microeconomics is of importance to investors when looking at topics such as the profitability of individual companies, where a business’s operations sit on the supply curve, and how the pace of adoption for a product alters the demand curve. Both of these factors drive the ultimate profitability of a company.

For consumers, microeconomics is important as it can explain the pricing factors consumers are seeing for various goods/services in the market and how they might expect them to change going forwards. Understanding microeconomics can help consumers save money and retire earlier.

Example of Microeconomics:

- Prices and equilibrium within a single market

- The production curve of a company

- Customer utility curves

- Individual savings rates

- Regional housing markets

Macroeconomics Importance to Investors

The relevance of macroeconomics for investors is present when dealing with general asset prices, discount rates, inflation levels, and different growth rates between countries. Macroeconomic factors tend to affect the market as a whole and stock market index price movements can be broadly attributed to certain macroeconomic changes.

Example of Macroeconomics:

- Gross domestic product (GDP) and its composition

- Foreign exchange rates between markets

- Interest rate levels and curves

- Consumption spending patterns

- Unemployment rates in the economy

- Inflation levels

- Government debt and taxes

- Fiscal spending and monetary policy

Understanding the Effects of Micro/Macro Economics

Microeconomics is more about the individual business, company, or household; while macroeconomics deals with economy-wide factors such as GDP, interest rates, and foreign exchange. Macroeconomics looks at the market as a whole in a large population such as a country or state

Through analyzing economic fundamentals under either type of economics, you can understand the supply and demand balance key competencies in a business or industry. Profitability within the sector or industry can also be explored from analyzing economics with an emphasis on supply and demand curves. Competitive factors across markets or industries can be explained through economic factors such as supply and demand curves so keep these visual aids in mind when looking at different topics.

Law of Supply and Demand in Economics

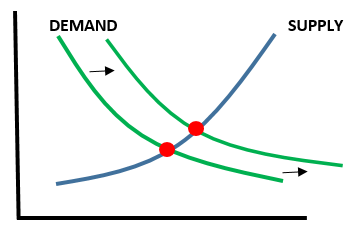

Both micro and macroeconomics can be described with classic supply and demand curves so we should take a minute to discuss these important concepts in what is termed the law of supply and demand. The laws of supply and demand state that higher prices will encourage producers to supply more products; but will conversely deter consumers from wanting extra quantity at the higher price point, and vice versa.

In general, the demand curve is the cumulative quantity of a product or service that would be demanded by consumers at any given price point on the curve. In microeconomics, the demand curve being analyzed can range from the demand for a single product at difference price points to the demand the business itself would have for raw materials at difference prices needed in the production process.

In macroeconomics, the demand curve generally describes the total amount of spending on goods and services in an economy but could also deal with other concepts such as demand for labour by businesses and demand for money/loans at different levels of interest rates.

The supply curve represents the cumulative total that the industry or market can supply at various price points. The supply curve is upward sloping as at higher price points, producers are more capable of collecting the needed resources to provide the good or service. The supply curve in macroeconomics can deal with topics such as the money supply or size of the workforce supplied at different wage levels

Where the two curves intersect is called the equilibrium and that point represents the level of output and price at which the markets will produce and consumer in equilibrium. Changes in either the supply or demand curves will cause positive or negative effects to producers and consumers in the market being analyzed.

Takeaway

Understanding how microeconomics can affect businesses and how macroeconomics can affect markets is helpful for investors in order to anticipate changes in stock and asset prices. For internal business managers and analysis, microeconomic concepts will come in handy assessing profitability and demand at different price points. Macroeconomics is an external factor for business management but something they will need to take into account when building forecasts and models.

Related posts:

- Types of Inflation: Demand-Pull vs. Cost-Push Inflation With inflation now running over 4% in the U.S. and other developed countries, investors are wondering how to classify the seriousness of the situation. As...

- 7 Insightful Keynes Quotes about Economics and the Stock Market John Maynard Keynes was a British economist who really changed the thought process on macroeconomics over time, and as you might expect with any great...

- Common Indicators of Rising Interest Rates and Its Impact on the Economy How can you tell when interest rates might rise and what the impact would be on our lives? You can use simple tools to answer...

- Inflation is Looming… Where Can Investors Hide? With the inflation genie starting to make its way out of the bottle, it is time for investors to refresh themselves on which asset classes...