I am now a few years into my investing journey and while I feel like I have a pretty good grasp on what sort of quantitative and qualitative data I should be looking for in a company, it dawned on me that I don’t have as good of a grasp of just high-level economic data as I think I should, and I figured you might be in the same boat. So, let me introduce to you… Economy 101!

Overall, there are really five different areas that I want to focus on, that are all different but also correlated to one another:

- The Fed

- Money Supply

- Debt

- Inflation

- Deflation

Andrew and Dave recently gave us a really thorough explanation into the Fed on the Investing for Beginners Podcast, and he did a great job at making it simple to understand. In essence, the Federal Reserve is the bank for the United States, and they have two goals:

- Stimulate the economy

- Slow down inflation

In other words, they’re either pumping money into the economy or they’re trying to slow it down, so it doesn’t diminish the value of the dollar. Lately, we have been seeing the Fed pump a lot of money into the economy by slashing interest rates.

If you’re thinking, “well that’s great, but how does that affect me?” Well, think about it – the cheaper the interest rate is, the more that someone, or some company, is incentivized to borrow money because it is less expensive debt than what it might have used to cost.

So, you could borrow money to do that home improvement project you’ve been wanting to do, refinance your mortgage, consolidate debt, anything! But even if you don’t want to take out a loan, you still can have some major benefits, such as:

- Your employer is motivated to borrow money to grow their business, therefore requiring more people to be hired and increasing the likelihood of your job security

- Your companies, and I mean all of the companies that you own, because investing isn’t buying a ticker symbol but rather owning a small portion of a company, are also more incentivized to grow, meaning that they can expand at a less expensive cost of debt than what they might have been able to do previously

In other words, money is cheaper. Of course, on the flip side is that now your high-yield savings account, like I have with Ally, is likely going to go down, as mine has dropped from 2.3% to 1.5% within the year, but that’s just the market. You take the good with the bad!

The other side is slowing down inflation. On the flip side of decreasing the interest rate, the Fed can increase their rates and it has the exact opposite effect – debt is more expensive, and companies are less incentivized to borrow to fund their growth. It is a constant balancing act that the Fed must do to make sure that they’re not tipping the scale one way or the other.

Inflation rates are something that you absolutely need to be aware of because they have a direct impact on your life, especially if you’re planning to retire at any point in the near future. If you’re using the 4% rule for a good estimate of your needs, and today you need $50,000/year to survive, that number will surely rise throughout the years, so you need to be planning ahead.

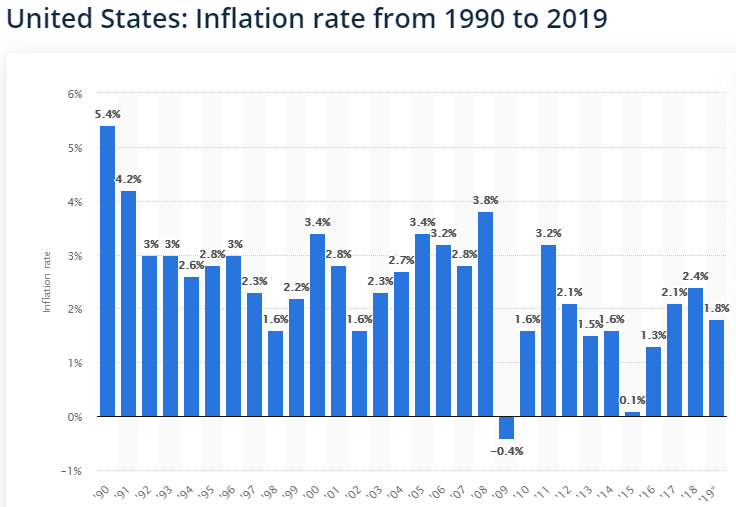

Statista had a nice graph that shows the inflation rates since 1990. The high is 5.4% in 1990 and the low is -.4% in 2009, but overall, the average is likely in the 2-3% range.

In other words, that means your money is worth 2-3% less next year than it is right now, so that’s one of the main goals of the Fed, to minimize the amount of inflation that occurs.

On the contrary to inflation, deflation can also occur like it’s showing in 2009. When deflation occurs, it’s debatably even worse than inflation!

Essentially, the value of the dollar is now worth more than what it was previously, which might be a good thing to a consumer, right? You can now buy more with your dollar today than you could yesterday, and that certainly seems like a positive, but think about it from a company’s perspective:

They paid a certain amount for goods to produce their end-product to sell to the consumer. Those raw materials that have already been purchased were bought with a less valuable dollar and now are being sold at a lower price because the dollar is worth more – aka, costs have gone up and revenue is staying the same, which all means lower earnings.

Not to mention, an employee that was being paid $10/hour is likely still being paid that same amount, or maybe will even get a raise at some point. But if the dollar is worth 5% more due to deflation, then will the employer shrink their salary by 5% down to $9.50/hour?

The answer is likely no.

So, the labor that the company is now, theoretically, even more expensive than it was before simply if they maintain the same rate!

Deflation is harder to control because the Fed cannot go to a negative interest rate, theoretically, but it’s only over long periods of time that this is to be considered worrisome. As you can see from the chart above, this is very infrequent, so I wouldn’t fret about it too much!

You see, the Fed really has free reign to manage their money supply as they deem necessary. Of course, anyone and everyone have opinions on what the Fed is doing, and a lot of times it is driven by political opinions, unfortunately, but such is life.

The Fed really can manage their money supply by increasing/decreasing rates as I discussed, by changing the reserve ratio or by opening market conditions.

The reserve ratio is simply the amount of reserves that the Fed requires a bank to hold onto. So, if they were to decrease that, then the bank could lend out more money. Increasing it would mean that the bank would need to hold onto more money and keep the money out of the hands of those that are seeking loans.

By opening market conditions, they are essentially able to purchase or sell government securities. I think that Investopedia summarizes it best by saying:

“Today, the Fed uses its tools to control the supply of money to help stabilize the economy. When the economy is slumping, the Fed increases the supply of money to spur growth. Conversely, when inflation is threatening, the Fed reduces the risk by shrinking the supply. While the Fed’s mission of “lender of last resort” is still important, the Fed’s role in managing the economy has expanded since its origin.”

So, all of this buying and selling, being the lifeline and backbone of the US economy, sure does come at a hefty price, as you can imagine and I’m sure you have heard. As of 4/13/20, that price is $24.22 trillion, as that is the total US Government Debt.

Just think, if you were to invest $100 for 30 years at 10%……I’m kidding. Compound interest joke since I know that those scenarios really rile some of you up ?

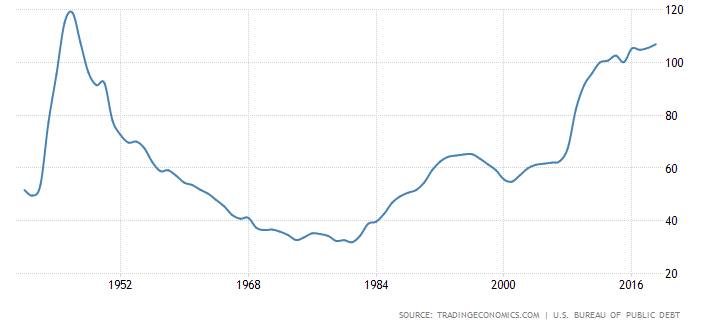

$24.22 trillion is bonkers, but it’s important to remember that you can’t simply look at the national debt – you need to make sure that you’re comparing it to the GDP, otherwise you’re not even getting half of a full picture.

The reason that I like to look at Debt/GDP is because it’s essentially telling me what the US owes vs. what it’s producing. I think that makes it a fair balance to really understand the debt situation, because theoretically, you should be ok with more debt as you’re producing more, meaning that you’re essentially covering your obligations.

Below shows a graph of the debt/GDP ratio since the early 1900’s:

I hate to see those levels climbing back up since the 1970’s but it looks like the growth is starting to flatline a little bit and we’re slowing the curve. Man, I have been looking at coronavirus information too much if I’m saying things like “slowing the curve”.

Sure, I will never say $24.22 trillion of debt is a good thing – I’m just saying that a lot of people will take a look at one number and then fire off a tweet before they actually understand what they’re looking at – don’t be that person! But you’re on einvestingforbeginners.com, so I know you’re not that person ?

So, there you go! There’s your Economy 101. To have a general understanding of how these all come into account is very important, especially in times of such uncertainty like we’re in today. The best way to plan for this uncertainty, in my opinion, is to make sure that your Emergency Fund is fully stocked, otherwise you’re really just playing with fire!

Now the next time that you listen to Fast Money you might understand a little bit of what they’re trying to say!!

Related posts:

- The Effects of Inflation and Its Role on the Economy and Your Money We’re living in super uncertain times right now and if you’re anything like me, you’re likely wondering about how all of this coronavirus and stimulus...

- How Coronavirus Stimulus Could Cause Deflation Rather Than Inflation When money is pumped into the economy, like it is right now with stimulus checks, it is oftentimes a question of how it will impact...

- Types of Inflation: Demand-Pull vs. Cost-Push Inflation With inflation now running over 4% in the U.S. and other developed countries, investors are wondering how to classify the seriousness of the situation. As...

- How Fed Economic Stimulus Works and Its Effect on the Economy The Central Bank of America is the Federal Reserve, responsible for deciding how much money is in the economy. To most people, that means that...