As the election approaches, investors naturally grow nervous with the uncertainty. With Joe Biden’s promises to increase corporate taxes and capital gains taxes, investors wonder about the effect to the stock market as a whole, and whether they should sell ahead of the election.

Because this is a financial website, I will not bring my politics into this article. Instead, I will try to present all known facts and estimates without bias and using some common sense.

For the following breakdown, I will be referencing statistics from two specific sources:

- Joebiden.com – Biden’s campaign website

- Tax Foundation – a website that generally leans libertarian

First, let’s summarize the current tax environment. Since President Trump took office in 2016, the Tax Cuts and Jobs Act (TCJA) changed corporate, capital gains, and individual taxes.

Broadly speaking, taxes in all areas were cut across the board, with additional tax credits and deductions applied as well.

Today, the rates most likely to impact investors sit at:

- Corporate Tax Rate = 21%

- Capital gains (long term) = 23.8%

The potential bigger impact to companies in the stock market, which will be reflected in fundamentals and prices, is the corporate tax rate, which will be the focus in this article.

How a Higher Biden Corporate Tax Could Move the Stock Market

Contributor Cameron Smith wrote a great article outlining how the 21.5% of Net Income savings for U.S. companies from the corporate tax rate being cut from 35% to 21% due to the TCJA led to a similar 29.3% S&P 500 gain in the index.

Two possible scenarios stem from the results of the 2020 election:

- Trump retains presidential seat, the 21% TCJA corporate tax rate stays unchanged.

- Biden is elected and passes a bill to increase the corporate tax rate to 28%.

Note: Of course, Trump could also make a surprise change, or an elected Biden could surprise by failing to follow through on his promise, but let’s ignore those for simplicity sake.

For some context on today’s corporate tax rates versus the past, these tax rates are historically low even if Biden changes them to 28%.

As shared by a website called The Balance, corporate taxes were as high as 53% (max rate) during the Nixon administration and have been falling ever since, with the biggest drops happening in 1988 (from 40% to 34%) and from the TJCA (from 35% to 21%).

Though Biden’s 28% corporate taxes would be lower historically, they would still represent a significant increase that would directly impact profitability and free cash flows for all public corporations in the U.S.

An increase from 21% to 28% would be a change of +33%.

For a simple illustration of this impact, take a corporation with $1,000 in profit for the year. The difference between a Trump Corporate Tax and Biden Corporate Tax:

- 21%: Gross = $1,000, Net = $790

- 28%: Gross = $1,000, Net = $720

Right off the bat, a -8.9% haircut (from $790 to $720) is quite substantial. A company who grew revenues at 10% a year under a 28% corporate tax rate would actually see a drop in Net Income in Year 2 from the transition from 21% corporate taxes to 28%.

With -8.9% less in total Net Income for the year, that would represent -8.9% less available for the public company to either reinvest in the business, pay dividends, or buyback shares.

Though a big number, the impact over the long term lessens over time.

The Potential Long Term Impact of Continued High Corporate Taxes

Like I mentioned, the consequences of higher corporate taxes would naturally decrease investor returns in a market priced on fundamentals.

There’s no question of that.

The question is by how much.

It’s impossible to estimate this precisely for every company, as the impact would likely vary quite a bit between industries and companies. But in general, less profits means less reinvestment, which leads to lower revenues for companies across the board.

With less reinvestment of profits, generally, comes less future growth.

So, with the -8.9% less available profits for reinvestment (per year) due to Biden’s higher corporate taxes, it’s reasonable to revise a 10% growth rate into a 9% growth rate (1.0-0.089)= 0.91; (0.91*0.10 = 0.0911) = ~9%

Note: This 10% is nothing special but we are using it for demonstrative purposes, to acquire appropriate percentages.

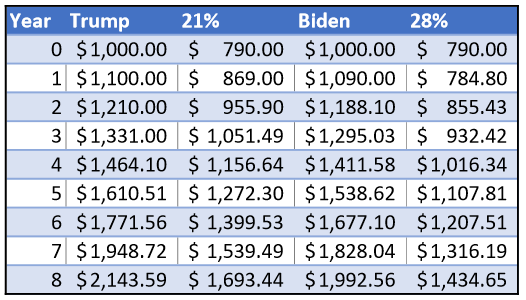

With the lower future revenue growth baked into a future earnings estimate, doubly compounded by the continued higher 28% rate on Net Income, would result in the following difference between the incumbent 21% corporate tax rate and the proposed 28% corporate tax rate:

From this, we can make a few very general judgments.

Assuming a full 8 years of this proposed corporate tax policy (2 presidential terms), we’d be looking at a -15.3% decrease in Net Income by the time Year 8 arrives (from $1,693.44 to $1,434.65). In other words, the compounding effect of the -9.7% difference in Net Income from the first year of the new corporate tax structure would accrue to eventually reduce future Net Income by -15.3% by year 8.

Not catastrophic, but not insignificant.

Using a compound interest calculator, we can see that the difference in growth of Net Income is the worst during the beginning of the new tax rate change.

For example, in Year 1, Net Income reduces from $790 to $784.80 (a negative CAGR), while the Net Income continues at the hypothetical 10% CAGR with no changes on the 21% corporate tax rate.

As time goes on, the change in CAGR of Net Income improves as Net Income also starts to compound (and grow exponentially), albeit from a smaller base than if it had been unchanged.

By Year 4, the CAGR of Net Income since the corporate tax change would rise to 6.5%, and would settle at around 7.75% CAGR by Year 8 (close enough to around 8% by Year 10).

How Would That Change Today’s Valuations?

With many financial valuation models dependent on the expected growth rate to estimate the value of a stock, the change in growth rate over 10 years (from 8% at the new 28% tax rate, to 10% if left unchanged) would impact stock market valuations in the following way:

- AAPL valuation at EPS growth = 10% –> $83.49

- AAPL valuation at EPS growth = 9% –> $77.66

- AAPL valuation at EPS growth = 8% –> $72.24

In other words, a decrease in the long term growth rate (10 years, 8%) would result in a -13% drop in the perceived valuation of Apple’s ($AAPL) stock today ($72.24 instead of $83.49).

Solely from the increase in the corporate tax rate and the resultant effects to growth, the bottom line impact to the stock market’s valuation at a whole could be a one-time hit of around -13%, excluding any other outside factors and looking at the impact to corporations as a whole.

The implication is that valuations will eventually recover, as they always do, but there would be softness in the growth of earnings—which leads to weakness in stock prices.

Whether this would come in the form of subdued stock price growth over time, or a one-time hit to valuations leading up to the election is anyone’s guess.

Adding Biden’s Proposed Fiscal Policy Impact to Stock Market Prices

Looking just at the corporate tax rate changes doesn’t encompass the entire picture when it comes to Joe Biden’s major policies and the potential impacts to the markets.

Of course raising tax rates should increase government revenues, which if spent by the government efficiently to create economic growth elsewhere should offset some of the loss in Net Income bore by public corporations due to higher taxes.

According to Investopedia, the two potential Presidents have outlined a desire for the following spending plans on infrastructure (meant to spurn the economy):

- Biden: $1.3T in Infrastructure spending over 10 years

- Trump: $2T in a “very big and bold” plan

Putting context into these large numbers again, the U.S. government is projected to spend between $4T- $5T in 2021.

An increase of $130B from Biden ($1.3T divided by 10 years) or $200B from Trump would represent anywhere between a 2.5% – 5%+ increase in total government spending.

Ignore Trump’s spending bill, which Investopedia doubts the feasibility of, and just apply Biden’s proposed infrastructure spending back into the hypothetical impact to the stock market (since that’s what we’re examining anyways).

With Biden, the $130B per year in infrastructure spending would add 2.5% – 3.5% to total government spending. Assuming that this equates to an equal percentage increase to the revenues of the companies in the stock market as a whole (which is probably a stretch, but let’s illustrate it)…

Revising the Biden Corporate Tax Rate Effect with Infrastructure Spending

In effect, the -8.9% decrease in Net Income from increased corporate taxes could be offset by 3% growth from infrastructure spending, bringing the net effect to corporate revenues and profits to somewhere around -6% per year.

Now take that percentage and apply it to the (old) base rate of 10%.

(1.0 – 0.06) = 0.94; (0.94*0.1) = 0.094 = 9.4%

Remember from above that lower Net Income will likely result in lower revenue growth for the future, which will compound into a greater discrepancy compared to if corporate taxes stayed the same—which we defined as a -9.7% difference in Year 1 and a -15.3% difference by Year 8.

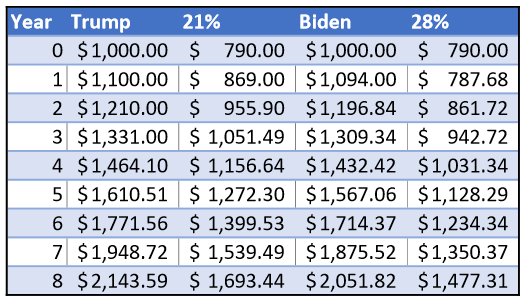

With a new 9.4% growth rate of revenues, we can update the table from above like so:

Using these updated inputs, assuming the infrastructure spending spurned great economic activity by a significant amount, the Net Income of a company by Year 8 would be $1,477.31. This would represent a -13% compounded difference, vs the -15.3% we assumed with just the impact of Biden’s corporate tax rate alone.

Reality is probably somewhere closer in the middle, but now we have a good, common sense (and hopefully unbiased) idea of where valuations could lie—and profitability could land—if Biden is elected president and the corporate tax rate is updated to 28%.

Like with all models, projections, and estimations, this solely tries to examine the impact of tax changes on a statistical basis and must therefore assume no other outside forces.

The real world, as we should know, doesn’t fit tightly into a box like this (thankfully).

I think that a reasonable estimation of the impact of a new Biden corporate tax rate to the average investor holding stocks would be reiterated succiently by what I said at the top:

“Not catastrophic, but not insignificant.”

Investor Takeaway

However, over the long term the consensus is that the President of the United States doesn’t really matter all that much to stock market returns.

The stock market follows the economy and business profitability, and short term adjustments to tax codes and regulations are to be expected over the course of long periods of time. In the aggregate, companies learn to grow and adapt to rapidly changing environments, thus creating significant returns to long term shareholders over time.

While an investor is powerless to the next president elect and the resulting short term impact to the markets, the investor has great amounts of control over his or her behavior and habits.

By sticking to long term principles of sound investment management, you greatly increase your chances of compounding your wealth at great rates, regardless of what happens, politically or otherwise.

These long term principles are as old as time, and have worked to provide sound retirements and financial freedom to many individuals over many decades.

Best of all, these principles are timeless, as relevant today as they were 100 years ago. They include:

- Adequate diversification, to mitigate the risk of any one business going bankrupt

- Dollar cost averaging, to smooth out the effects of short term market timing as you enter positions

- Investing for the long term, through ups and downs (and bear and bull markets), in order to completely absorb the benefits of the long term returns of the stock market.

As much as I love digging into the numbers and getting very specific about companies and their financials, I know that it doesn’t take that level of intensity to earn great returns from the stock market, in a safe and reasonable way.

It’s my hope that as you digest all of the uncertainty that political instability creates, you also have the practical solutions in place to secure your financial future into a lasting source of peace and prosperity.

That’s a REAL plan for life, liberty and the pursuit of happiness.

Related posts:

- How Interest Rates and the Stock Market Are Intricately Intertwined “The most important item over time in valuation is obviously interest rates.” –Warren Buffett Quite a statement, and my thought is, how much do we...

- How Unemployment and the Stock Market Have Been Linked Through History Updated – 11/17/23 You might want to know how unemployment affects the stock market. It would seem that logically, high unemployment should lead to a...

- 7 Insightful Keynes Quotes about Economics and the Stock Market John Maynard Keynes was a British economist who really changed the thought process on macroeconomics over time, and as you might expect with any great...

- How Fed Economic Stimulus Works and Its Effect on the Economy The Central Bank of America is the Federal Reserve, responsible for deciding how much money is in the economy. To most people, that means that...