Updated 9/27/2023

The coronavirus pandemic accelerated businesses’ decisions about payments and how they would accept payments easily for both consumers and the business. These decisions were already in the works, but the pandemic only increased the acceptance. One of these methods is embedded finance, with a projected market value of $138 billion by 2026; this trend is here to stay.

Top fintech players are big in embedded finance and are leading the charge. Companies such as Venmo, Monzo, PayPal, and Stripe enable easier payments for consumers, and consumers are eating them up.

Cash is dead is a popular term, and with the rise of fintech and the ease of making and taking payments, the acceleration of non-banking firms such as Stripe will only continue. As younger generations adopt these types of payments, the way we bank will continue to evolve. The days of going to a branch to conduct business are on the way out, and embedded finance makes paying our bills, buying groceries, and investing all that easier.

Investors interested in learning more about this trend and identifying possible leaders need to understand the business models, how the fintech players make money, and how to take advantage.

In today’s post, we will learn:

- What is Embedded Finance?

- How Embedded Finance is Changing Financial Services

- Examples of Embedded Finance

- Key Players in Embedded Finance

Okay, let’s dive in and learn more about embedded finance.

What is Embedded Finance?

Embedded finance, in simple terms, is the use of tools or financial services by a non-bank. For example, if a payment company such as Affirm (AFRM) offers to lend at checkout, embedded finance is an example. Another would be Walmart offering insurance on electronics at checkout. These are all examples of embedded finance.

Embedded finance’s main goal is to make financial processes easier for consumers by designing services and products that ease payment.

Back in the old days, if you wanted to buy a couch, you had to go to the bank, withdraw the cash, and buy the couch. Or you could write a check or use your new credit card.

With embedded finance, consumers can make those decisions at checkout, online, or in person. We can decide to purchase something and get financing options at checkout, with decisions made in seconds. Compared to going to the bank, filling out tons of paperwork, and waiting days or weeks for a credit decision.

Many BNPL players such as Affirm and Klarna help consumers make the purchases at checkout, with other big retailers such as Walmart and Amazon joining in on the fun.

For the business enabling embedded finance, such as a retailer, the primary benefit is the ease of use for its customers. Because embedded finance can help reduce pain points, such as credit decisions, at checkout, it increases the likelihood of completing the transaction, increasing customer satisfaction and adding to brand loyalty.

The increased satisfaction can improve profits for the business and earn repeat business.

Embedded finance isn’t all about money; it is also a tool for helping businesses understand customer behavior, needs, and spending habits. All important data to help drive future sales, product development, or inventories.

How Embedded Finance is Changing Financial Services

For centuries, financial services of any sort were the birthright of banks. Because of many regulations, those financial services remained the domain of banks, but over time, those regulations eased, leading to the rise of open banking.

With the easing of regulations came the fintechs of the world to upset the apple cart, allowing non-bank companies to compete in the banking world.

The embedded finance revolution began with payments but expanded to other insurance, consumer lending, banking, and wealth management services. These services are now available at the touch of an app on our mobile phone or via our laptop.

The turning away from banks as the source of financial services and guidance began around the Great Financial Crisis (GFC) from 2007 to 2009. As recently as 2020, only 14% of consumers turned to their banks for financial help and guidance.

The reason for these drops is a loss of trust; in 2004, 53% of consumers surveyed said they trusted their financial institution, which dropped to 22% in 2009, during the height of the Crisis. Almost ten years later, that number has only grown to 32%, which means that less than a third of bank’s consumers have any trust in their banks ten years later.

Conversely, consumer trust in the tech sector is far greater, with over 75% trusting the technology sector.

Banks can improve consumer trust by partnering with fintech companies to enable their embedded services. The evolution of how people manage their money also highlights why banks and fintech need to work together.

There are several ways this revolution is evolving:

- Consider the increased use of mobile phones, with more than 81% of adults owning a smartphone and many consumers using their phones as their internet provider. With the increased use of fintech apps, banking is only easier.

- The development of the cloud enables greater use of fintech technology and connections via our phones, which means consumers have financial services at the touch of a finger.

- Increased online services enable greater access to financial services, such as using your Uber app for mobility or your bank app to track your spending, bills, or budgeting.

- Data security is critical during any financial transaction, and online transactions are especially risky. Partnering with fintech firms and using their expertise to help ensure transaction security allows banks to improve data security.

Banks are partnering with fintech firms to enable API (Application Programming Interface) integrations, which are instructions that connect two pieces of software, facilitating the exchange of messages or data. These fintechs are a gateway between the banks, consumers, and companies.

Enabling these APIs, businesses create a frictionless, more convenient, faster, and simpler payment process. For example, loading your credit or debit card in your Uber app makes paying for a ride to the airport or home from the restaurant seamless and painless for both the driver, Uber, and the customer.

APIs allow non-financial firms such as Uber to provide fintech services to their customers. Embedding the APIs to a website or app is straightforward; even a non-techie like me can upload and install them directly to a website.

There are many examples of how embedded finance apps are becoming part of the payment stack for businesses:

- Point of sale

- Ridesharing companies

- Large consumer tech companies

Those are just a few; we will dive into this more in the next section.

The advanced use of APIs allows Uber to pay its drivers in minutes while allowing them access to financial and non-financial benefits, such as credits, discounts, or rebates for fuel.

The increasing use of APIs to enable embedded financial services on non-financial websites and apps threatens to cut banks from this growing suite of services. Banks have choices to make and to keep up, they would be smart to partner with these firms to increase the reach and use of embedded finance.

The APIs allow every company to become a “fintech company.” Everything from grocery shopping, car repairs, doctor visits, and getting cash can become a fintech with the right API.

It is all about ease of use for consumers, and for the business, it is all about enabling quicker, easier payments for its consumers.

Examples of Embedded Finance

Many companies not in fintech seek ways to offer these financial services. A great example is Shopify, the Canadian online merchant, which has begun offering lending services through Affirm and bank accounts for businesses.

Some companies act as connectors by providing a bridge between non-financials and financials. For example, Plaid offers a data transfer network that companies can use to offer financial services. Visa thought so much of Plaid; they were in the process of buying the company before the U.S. government stepped in and stopped the sale on fears of creating a monopoly.

Below are six examples of embedded finance:

- Payments: embedded payments take the pain out of a transaction for the consumer. Paying with cash is a pain because you must carry the money in a wallet, go to the bank to withdraw, and worry if you have enough. Using an embedded app on the company’s point of sale or website reduces the friction of digging for a credit card or using cash to pay. With a punch of a few buttons, voila, the payment is made.

Some great examples of embedded payments are ridesharing services like Uber or Lyft. When you hail a ride with one of these services, the whole transaction occurs through their app, from uploading your payment method, contacting the driver, scheduling the pickup, and finally paying for the ride and tipping.

Another great example is using the Starbucks app to pay for daily coffee. The app lets consumers order and pay from their phone, plus it rewards its customers with rewards for usage, which they can redeem at the next visit.

- Card Payments: debit cards simplify paying bills or even employees. Instead of using a check to pay a bill or issuing a direct deposit, the company uses its branded cards to pay bills for employees. Companies exchange these services with providers by agreeing to pay the card issuer for some or all of the interchange fees.

A great example of these types of services is Square and PayPal, which use their cards to streamline services by allowing customers to link their bank accounts. Consumers can apply for the Square Cash App or PayPal card to access their account balances directly.

These services allow consumers to access their funds quickly instead of waiting days for checks to clear.

- Lending: embedded lending allows a consumer to apply for credit on the spot when purchasing an item with a higher ticket price, such as a Peloton bike. The consumer is given a decision in seconds, with different options to make the payment, typically with some amount down and broken up into three to six installments. Affirm and Klarna are the two biggest players in this arena.

- Investments: the rise in retail investors stems from the increasing availability for consumers to invest right from their phones, with low friction, such as account openings and easy search tools. Apps like Acorns or Robinhood allow beginners to start early and track their process through their phones. All without accessing their bank accounts, with the ability to link their PayPal account, for example.

Some super-app contenders, such as Square and PayPal, now offer trading platforms on their apps to reduce the friction of investing and keep their consumers on the Square Cash App, making it a “stickier” product.

- Insurance: embedded insurance apps eliminate an insurance broker or agent when buying a home or auto insurance. In the past, car insurance was a required part of the process, separate from the car purchase. But now, companies offer integrated services while buying your car; you can also get car insurance simultaneously, reducing time, cost, and friction.

- Banking: many non-financial companies are now offering banking services to their customers. The idea is to replace traditional checking and savings accounts using non-financial companies’ services—for example, Uber uses debit cards to pay its drivers instantly.

Shopify is also offering similar embedded banking services for its business accounts. Shopify’s goal is for businesses to use their Shopify accounts instead of their bank’s checking and savings accounts to operate their business. By doing this, Shopify can further deepen its relationships with its businesses.

Key Players in Embedded Finance

The fintech space is filling up quickly, with the industry growing quickly. Many new startups and financial service providers come online daily to fulfill customers’ needs.

To help, I will list some of the bigger players across six areas:

- Banking

- Payments

- Investment and Wealth

- Lending

- Insurance

- Currency

Some companies listed below are not publicly traded yet, but most will be soon.

Banking

- Monzo

- Starling Bank

- Ally Financial

- Tandem

- Tide

- Plaid

Payments

- Venmo

- PayPal

- Square

- Revolut

- Adyen

- Stripe

Investment and Wealth

- Betterment

- Vanguard

- Robinhood

- Nutmeg

- Wealthfront

Insurance

- Bought by Many

- Slice Labs

- Shift Technology

- Lemonade

Currency

- Ripple

- Kraken

- Coinbase

- Ethereum

Lending

- Affirm

- Klarna

- Afterpay

- Sofi

- Kabbage

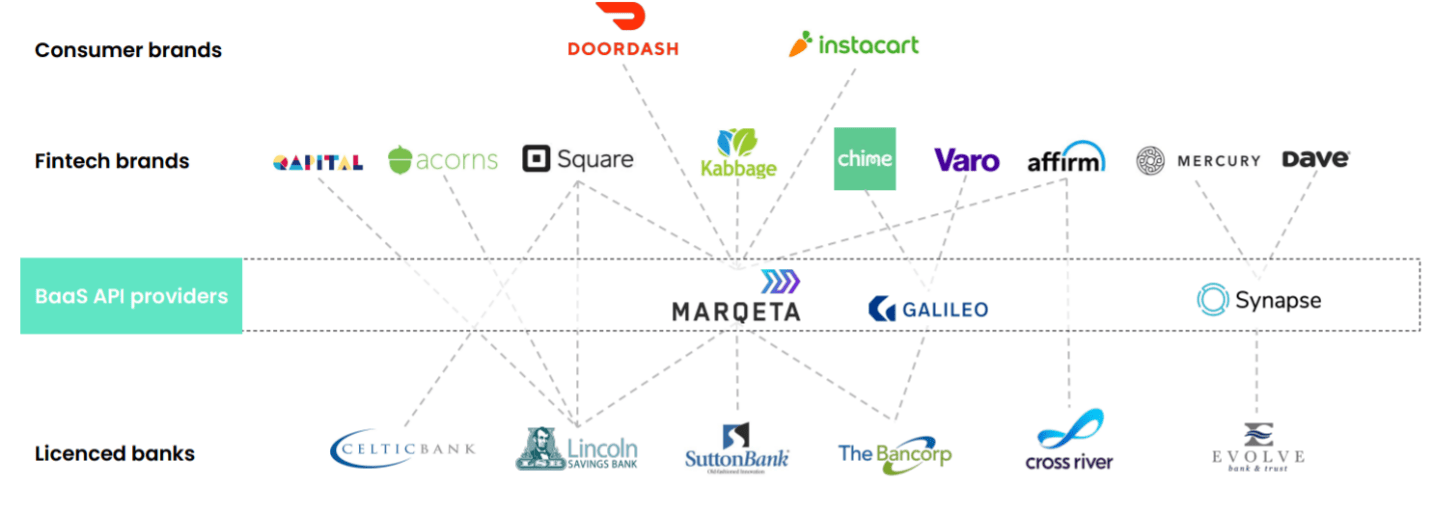

Others fall out of the above categories but gather a good head of steam. They include card issuers Marqeta and Galileo loyalty programs Cardless and Vertical and bill pay operations bill.com and GoCardless.

Some of the above companies build on top of stacks; for example, all of the companies that act as payment facilitators, such as Square and PayPal, work in conjunction with some of the core banking providers, Fidelity National Services (FIS), Fiserv, and Jack Henry, which all provide solutions for banks that allow them to balance their books daily, ATM operations, and debit card and lending operations.

Companies like Square build on top of what FIS creates to enable payments to move from merchants to Square, Visa, the bank, and back to the merchants.

Many of these additional embedded payments sit on top of different providers. The below graphic from 11FS highlights the ideas upon which I am expounding.

Among different embedded finance, there is a wide spectrum of products, some of which are built on the shoulders of others and offer additional customization. Companies and merchants that want to launch embedded finance have many options, depending on their business model and what kind of API eases their customer’s journey.

Investor Takeaway

Embedded finance is a bit of a land grab today, with multiple players entering the fray each day. With the creativity and ease of inventing new solutions via APIs, there are a plethora of companies for merchants and vendors to choose from to ease the customer journey.

Some of the stars of the embedded finance world are the bigger names on Wall Street:

- PayPal

- Square

- Affirm

- Stripe

The above are among the bigger players in the space, but we are in the early innings, and analysts expect a lot of consolidation in the coming years. As with any emerging industry, picking the winners is difficult, but you will find many choices that fit your investment criteria.

To learn more about media darling Stripe, check out this article:

Same for Square:

Hip to be Square – Marc Rubenstein

Here are some additional resources to dig deeper into this fascinating subject:

Tracking Payments – Mike Sigal

Fintech Infrastructure – Fintechna

Payments, Processors, & FinTech – Credit Suisse

And with that, we will wrap up today’s discussion on embedded finance.

As always, thank you for taking the time to read today’s post, and I hope you find some value. If I can further assist, please don’t hesitate to reach out.

Until next time, take care and be safe out there,

Dave

Dave Ahern

Dave, a self-taught investor, empowers investors to start investing by demystifying the stock market.

Related posts:

- Fintech 101: Intro to Financial Technology Updated 12/19/2023 Fintech or financial technology describes new tech that seeks to enable and improve financial services. Despite the uptick in fintech and how we...

- What is Banking As A Service (BaaS)? Finally the Future of Banking? Updated 4/4/2024 One of the hottest scenes in the market today is fintech, with $266 billion in new investments in the first half of 2021...

- Peer-To-Peer Payments: What To Know Updated 9/27/2023 “Mobile devices, high-speed data communication, and online commerce are creating expectations that convenient, secure, real-time payment and banking capabilities should be available whenever...

- Key Players in the Payment Processing Flow Updated 11/9/2023 Analysts expect global payment revenues to grow to $2.5 trillion by 2025, according to McKinsey, after returning to their historical 6 to 7...