It may be surprising, but companies today are still using the same mark-to-market accounting that led to Enron’s fraud and bankruptcy in 2001.

Mark-to-market accounting is a special way to record assets on a balance sheet.

I will try to explain the basics as simply as possible.

While it’s hard for any investor to predict an accounting fraud, there are still valuable lessons from Enron’s scandal. Their mark-to-market assets swelled in the year right before bankruptcy.

I will show you what that looked like in the 2000 annual report [Click to Skip to it].

We’ll also cover the implications for today’s stocks.

Companies today which have disclosed the use of mark-to-market accounting include Tesla, and many of the big banks such as JPMorgan Chase and Bank of America.

Mark-to-Market vs Traditional Asset Accounting

Traditionally, you record assets at cost on the balance sheet. They then stay at that cost indefinitely, or see their values reduced from depreciation.

Typical assets that stay at cost are long term assets like investments or securities; typical assets that are depreciated include tangible long term assets like property, plant and equipment.

Recording assets at mark-to-market means these assets do not stay constant in value or see their values reduced by depreciation on the balance sheet, but see their values fluctuate year-to-year.

Since some assets can see changes in value, mark-to-market accounting tries to estimate these changes. Sometimes these changes in value can be more straightforward, like stocks and bonds, while others are more open to interpretation—such as estimating value from future cash flows.

Why Enron’s Bankruptcy Was So Shocking

At the time of Enron’s bankruptcy, the stock was the 5th largest by market capitalization in the S&P 500.

On the outside, it looked like a wildly successful company.

Probably the biggest tragedy around the Enron accounting scandal was how many people lost their entire life savings. As was sadly depicted in the documentary, The Smartest Guys in the Room, Enron’s CEO at the time, Jeffry Skilling, publicly encouraged employees to keep all of their 401k in Enron stock. He was jolly and laughing about it.

That stock went to zero.

Before the tragedy hit, CEO Skilling and Chairman Kenneth Lay were adored by the business community. They won awards and were famous. I mean, how could you not like these guys, their stock was multiplying all the time!

And who could resist such personable people like these gentlemen:

By 2021’s growth stock standards, the company would’ve checked all the boxes.

- Diverse board of directors

- Leading edge technology (successful web-based system)

- Huge Total Addressable Market (“$3.9 trillion opportunity”)

- Value System of communication, respect, integrity, and excellence

- Catchy marketing slogan (“Ask Why”)

- A stock that 5x’d in 4 years

Yet behind the scenes was a ruthless culture. One that prioritized profits over everything else. One with no qualms exploiting energy shortages to make profitable arbitrage trades.

One that used clever mark to market accounting to prop up revenues and profits.

As explained in the documentary, Enron had taken advantage of the newly deregulated energy sector to create a new type of business model. Essentially, they had created a sort of futures market for energy, which was new to the world at the time.

They used these innovative business models to expand into broadband and transportation services, and plant a global reach to Europe, Australia, Japan, and more.

As Lay and Skilling wrote in their last annual report (bolded emphasis mine):

“Our talented people, global presence, financial strength, and massive market knowledge have created our sustainable and unique businesses.”

It turned out that their claims of outdistancing the competition, along with their 59% growth in energy deliveries, were, in fact, too good to be true.

Use this lesson as a warning to how much you listen to managements.

While a great TAM sounds sexy, it may be delusions of grandeur rather than a deliverance of future returns for shareholders.

While a business may claim to have a better, unique, and brand new way of doing business, it may also be stretching ethical and financial (accounting) bounds.

Examining Enron’s Annual Report Right Before Bankruptcy

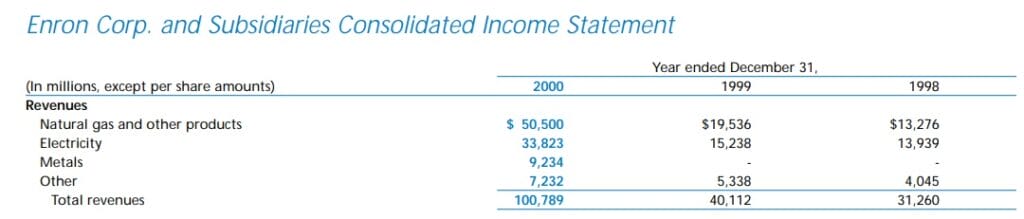

From an income statement standpoint, Enron appeared to back up all of their claims of being a growing business with great potential.

The top line (revenue) numbers show how their higher trading volumes were contributing to growth:

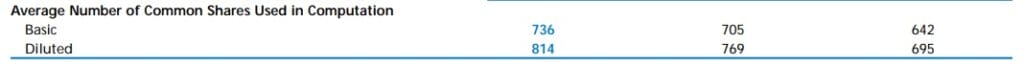

One small detail, which by no means foreshadows bankruptcy, was the amount of dilution the company went through to prop that top line growth:

The first place you should look when seeing great revenue growth is a company’s shares outstanding. If it is increasing, that revenue growth might be not as impressive as it seems.

Enron’s increase from 695 to 814 in just two years indicates that shareholders are paying for the company’s growth by seeing their stake in the business shrink.

This could be a great strategy for a company who needs to get to scale to become profitable, like a low cost retailer (Amazon).

But many other businesses don’t need scale for profits, and diluting shares could be a way to sneakily steal value from shareholders to make the business look great.

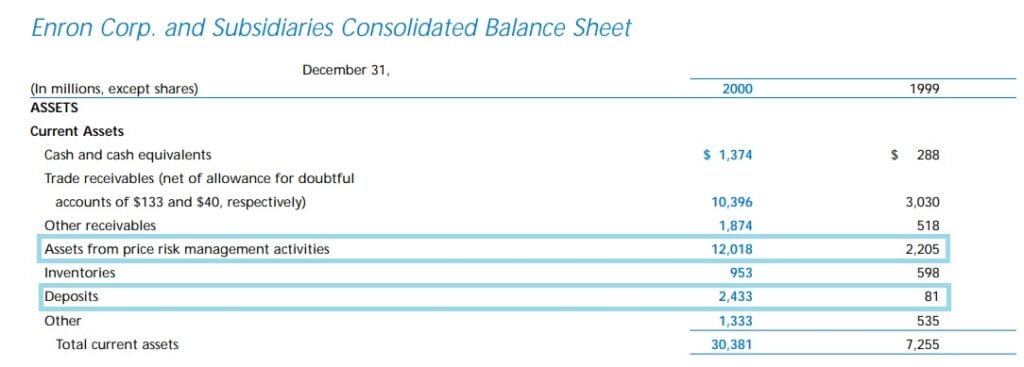

Next we can look at the balance sheet to make any observations.

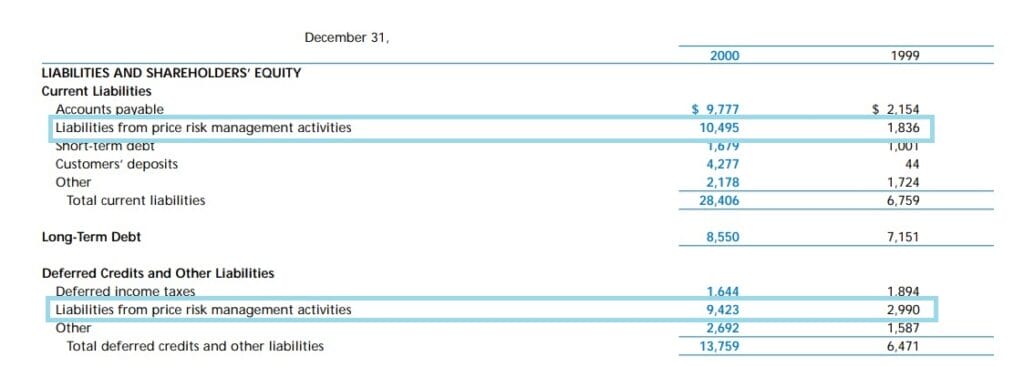

Starting with the liabilities side, notice the huge jumps which I’ve highlighted:

These are increases in “price risk management activities.”

Now, an increase in liabilities by itself does not indicate a red flag, especially if it’s accompanied by an increase in assets. Looking at the assets side of the balance sheet, we do indeed see an increase in assets from price risk management activities, and “deposits”.

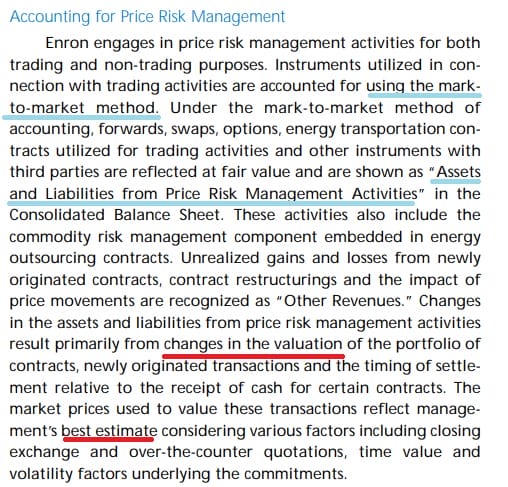

Enron was not a bank, yet was starting to use terms associated with banks. We can use “Ctrl+F” to search for “price risk management” to see further explanations on just what kinds of assets these really are.

Usually, you’ll want to see explanations for accounting terms in the Notes to the Financials section of a company’s annual report. Enron did do so in a section they called “Financial Risk Management” (page 27).

I will quote a key sentence from that section so you can see how the company defined “price risk management”:

“These [price risk management] services are provided through a variety of financial instruments including forward contracts, which may involve physical delivery, swap agreements, which may require payments to (or receipt of payments from) counterparties based on the differential between a fixed and variable price for the commodity, options and other contractual arrangements.”

Again, financial instruments sound like something a bank would engage with rather than an energy company.

I’m not trying to imply that the use of financial instruments alone indicate a fraud.

But these particular instruments added ambiguity to the company’s financial statements, which is troubling in this case because of just how high of a percentage those assets and liabilities ended up being on the balance sheet.

The company goes on to divulge that their price risk management services added additional risks to the business, such as:

- Commodity Price Risk

- Interest Rate Risk

- Foreign Currency Exchange Rate Risk

At the very least, this should indicate to investors that their “price risk management” assets might need further investigation.

Continuing down the annual report with our “Ctrl+F” trick for “price risk management,” we see this section in the footnotes which explains how these assets are recording on the balance sheet:

Notice how the company specifically says that they use the mark-to-market method to account for their instruments described above.

This seemingly small detail ended up, in hindsight, being a major wrecking ball to the Enron house of cards.

Note how management describes “changes in the assets and liabilities” of these activities.

They changed with the changes in valuation, which was based on management’s best estimate. Again, this is problematic not because of its nature per se, but because of how big these financial instruments were relative to the rest of the company’s financials.

The change in short term liabilities from 1999 to 2000 from these activities was $8.66 billion. For the long term liabilities, it was $6.43 billion. That’s for a company who earned an average of $803 million over the last 3 years, and so it was not pocket change.

If the valuation of the liabilities was a “best estimate,” then the supposedly offsetting assets were also a “best estimate.”

If either side of the equation was wrong, it could be disastrous.

And it was.

Now, these mark-to-market assets might not have been the only place of fraud for Enron. It turned out, in hindsight, that the company was able to hide bad assets off-balance sheet through special financial vehicles.

That could be discouraging. As investors, even the most knowledgeable of us may never be able to shield ourselves from every type of future accounting fraud.

But that doesn’t mean we can’t learn from Enron, and look for strange changes in financial statements moving forward.

Updates to Accounting Standards Since Enron

Fortunately for investors today, the SEC has taken big steps to protect investors from the kinds of risks they might have previously been unaware of.

In 2005, the SEC required all SEC regulated public companies to disclose their most significant risk factors in every 10-K. Today, there are eight stock market exchanges regulated by the SEC, including the biggest in the U.S. such as the NYSE, NASDAQ, and American Stock Exchange.

As investors, we should not take this advantage for granted.

If Enron was required to list mark-to-market accounting as a risk factor in their annual report, you wonder if they would’ve been so brazen to let that line-item get so out of hand.

Maybe it still wouldn’t have prevented Enron from duping investors, but it might’ve saved some of the more astute and prudent investors who didn’t notice the mark-to-market accounting taking place on those major Enron assets/liabilities.

That said, mark-to-market accounting is still widely used today in different industries and different financial instruments.

Let’s examine a few examples.

Big Stocks Today with Mark-to-Market Accounting in Their Financials

Now that you are an investor educated about the dangers of mark-to-market accounting, you can proactively look for a risk factor such as this with all of your investments.

You can also, hopefully, know how to identify a potential red flag by the way we did so in this article.

Tesla

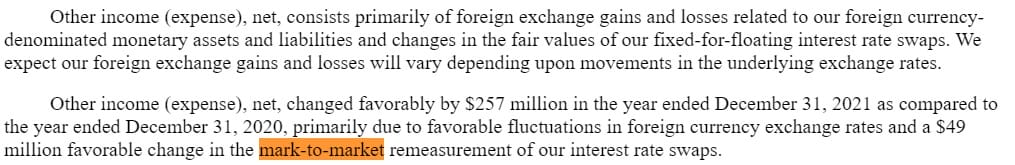

Using “Crtl+F” again, we can search for “mark-to-market” in Tesla’s 10-K to find the following disclosure:

This gives us a trail to investigate to try and quantify Tesla’s specific risks involved with their decision to use mark-to-market accounting.

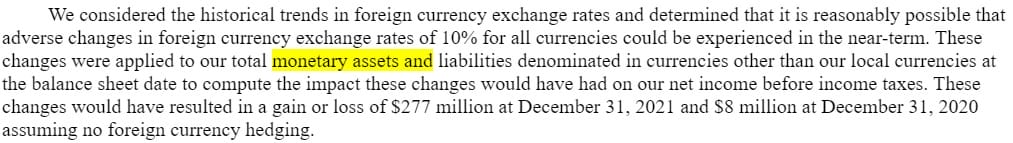

The company indicated that gains and losses are attributed to their foreign monetary assets and liabilities. We can search for “monetary assets and liabilities” to find this disclosure:

We can see that the company has explicitly quantified the risks here. In summary, a 10% swing in foreign exchange rates would swing their income to a gain or loss of $277 million for 2021.

Compare this to the company’s latest income statement, where Tesla recorded a total Net Income of $5.5 billion.

The risk does not appear to jeopardize the company moving forward, and we can thank the SEC for requiring the explicit disclosures of these kinds of risks.

Bank of America and JPMorgan Chase

You can expect companies like banks to be much more involved in more sophisticated financial instruments and accounting utilizing mark-to-market.

In this case, I’d recommend searching through any bank’s 10-K and considering how they disclose this usage for their own assets, liabilities, and general business model.

For Bank of America, “mark-to-market” is mentioned 3 times. They mention how it can affect the company’s liquidity and credit risks.

For liquidity related risks, Bank of America mentions how changes in interest rates can affect their cost of funding, which is the raw materials for a bank. Banks often raise capital before they lend it out and create a profit on that “spread.” One of the ways a bank may raise capital can be through issuing bonds, and having exposure to mark-to-market losses can make that “cost” more expensive.

No bank can really avoid that kind of mark-to-market exposure, though they can mitigate it by raising a significant portion of their capital through deposits rather than issuing bonds. Both Bank of America and JPMorgan Chase do this extraordinarily well.

With credit risks, which refer to the risks of a bank experiencing losses on its loans, Bank of America describes the lack of future mark-to-market considerations in their credit risk evaluations. So it’s not a concern here, because the bank is accounting for credit risk by other (conventional) standards.

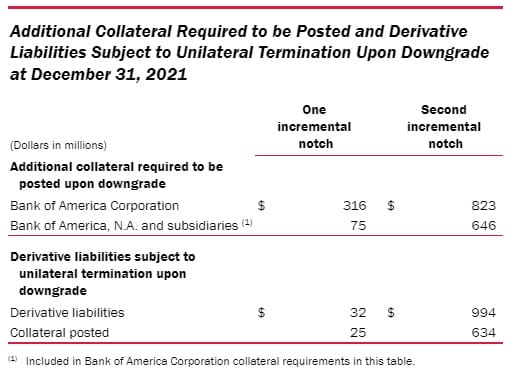

Finally, Bank of America discloses that some of their mark-to-market exposure is related to derivatives, which could create losses if some of the company’s debt ratings deteriorated.

For investors, Bank of America quantified this mark-to-market risk—which like Tesla is a relatively small concern based on today’s numbers:

JPMorgan Chase describes their mark-to-market risks in a similar way that Bank of America did, in relation to the risks of changes of interest rates on a company’s investment portfolio.

This risk is applicable to all companies which buy investment securities (such as bonds) for their balance sheet to create investment income.

Companies mitigate this risk by buying safer investment securities, and classifying a greater proportion of them as Held to Maturity (“HTM”) rather than Available for Sale (“AFS”).

None of these 3 examples really ring any alarm bells.

It hopefully shows that “mark-to-market” accounting is not good or bad.

It’s just a tool that can be misused. Hopefully you can prepare yourself against the next accounting disaster by simply being a good investigator and looking for clues in the financials that look out of place.

Andrew Sather

Andrew has always believed that average investors have so much potential to build wealth, through the power of patience, a long-term mindset, and compound interest.

Related posts:

- A Guide to the Top Custodian Banks: What They Do and How They Work Edited 3/24/2023 “Banking is a very good business if you don’t do anything dumb.” Warren Buffett Banking is a fascinating sector; it provides the lifeblood...

- How to Calculate the Loan to Deposit Ratio; Average LDR of the Big Banks Updated 3/30/2023 Deposits continue as the lifeblood of banks, and loans help generate income for the bank. The more deposits, the more loans, leading to...

- How to Calculate the Loan to Deposit Ratio; Average LDR of the Big Banks Deposits are the lifeblood of banks, and loans are the means to generating income for the bank. The more deposits, the more loans, which leads...

- What is Net Interest Margin and How Do I Calculate It? “In the end, banking is a very good business unless you do dumb things.” – Warren Buffett Investing in banks remains the same as investing...