“When a management with a reputation for brilliance tackles a business with a reputation for bad economics, it is the reputation of the business that remains intact.”

Most investors understand the importance of analyzing a company’s financials. And the importance of finding great management to run the same company.

But, evaluating management is difficult. Many of the jobs management do remain intangible or difficult to check.

Avoiding the next Enron, Worldcom, or Valeant helps show the importance of the qualitative aspects of any company.

Great CEOs like Warren Buffett, Mark Leonard, Jeff Bezos, and Sayta Nadella are great examples who help illustrate how powerful good CEOs or managers sway company results.

The management team leads the company, and a significant risk factor a company faces is selecting the wrong leader. Sometimes the wrong leader is the founder, who may develop great products but remain a poor leader, and other times become a great leader.

In today’s post, we will learn:

- What is Management’s Job?

- The Five Keys to Assessing the Quality of Management

- Analyzing a Management Team: Microsoft

- Investor Takeaway

Okay, let’s dive in and learn more about evaluating management.

What is Management’s Job?

Most textbooks state the manager’s jobs include items such as:

- Planning

- Organizing

- Leading

- Controlling

And while these are all important jobs for the company’s effective functioning, they don’t represent the most important task the CEO remains responsible for.

The CEO’s number one job remains capital allocation, period.

For long-term shareholders, investing in stocks should remain no different than delegating your money to the company’s management team to generate future profits.

For example, Warren Buffett has generated 20% returns since 1965. That compared to the S&P’s returns of 10.5% over the same period.

Not many individual investments can overcome those returns for the same period.

Another great example is Mark Leonard of Constellation Software. The Canadian software-focused company has generated 30% annualized returns over the past decade.

In the above sense, C-level management functions as a fund manager who needs to deploy capital to achieve superior returns.

All of which highlight the importance of capital allocation and the skill necessary to generate higher returns.

The easiest way to measure a company with good capital allocation skills which we can use is:

We can look at the company’s returns over longer periods and track management’s results alongside those returns. Companies that can compound their returns over long periods generate the best returns.

Using those two metrics helps investors assess management who can allocate the company’s resources to generate great returns.

Over the long term, a company that can generate high returns on its capital or equity will produce great returns in the market. All because of the power of compounding.

It is not enough to have a great product, like Microsoft Office or the iPhone; you also must reinvest well to continue to grow.

In the 1987 Shareholder letter, Buffett shared some statistics highlighting the importance of capital allocation.

He references a study in Fortune magazine focusing on the 1,000 largest U.S. stocks:

- Only 6 of the 1000 companies averaged over 30% ROE over the previous decade (1977-1986)

- Only 25 of the 1000 companies average over 20% ROE and had no single year lower than 15% ROE

- These 25 “business superstars were also stock market superstars” as 24 out of the 25 outperformed the S&P 500 during the 1977-1986 period.

The last statistic offers a remarkable view. It’s telling that 96% of the group outperformed over the ten years.

If you went back and observed which companies led the way in returns, all of them had “superstar” managers, including Warren Buffett.

Many of the best companies over the past decade or two have generated high returns on capital or equity; for example:

- Visa

- Microsoft

- Facebook (Meta)

- Many more

Using metrics like return on equity or capital can help investors narrow down a list of good companies and find great management teams who run them.

The Five Keys to Assessing the Quality of Management

We can use five keys or short checklist to help us determine the quality of management.

These keys/checklist are:

- Length of tenure

- Strategies and goals

- Insider buying/share buybacks

- Compensation

- ROIC and ROE metrics

The goal here remains to find strong management teams led by a CEO we trust. We need to find the key leader with the vision and desire to grow the company—both for shareholders and the company or stakeholders.

Length of Tenure

One great indicator remains how long the CEO and top management have served the company. For example, on average, Jack Henry’s (JKHY) management has served the company for over 20 years. The CEO, David Foss, has served since 1999.

The average tenure of most S&P 500 CEOs remains less than five years. And the best performing CEOs occupied their spots for over fifteen years.

Warren Buffett has occupied the top spot at Berkshire for over 50 years. In contrast, Jeff Bezos occupied the CEO office for over 27 years at Amazon. Satya Nadella of Microsoft worked for the company for twenty-two years before occupying the top spot for the last eight years.

Berkshire Hathaway remains a model for finding great management. For example, Warren Buffett’s successor Greg Abel has worked for Berkshire since 2000. And Ajit Jain has worked for Berkshire’s insurance arm since 1986. Both of these men, along with Todd Combs and Ted Weschler, joined Buffett in 2010

Because of how Berkshire works and decentralization, the company pushes individual company decisions down to the company level.

Strategies and Goals

When analyzing the strategies and goals of a company, a good rule of thumb; avoid buzzwords and corporate jargon. Instead, focus on a few questions to help.

For example:

- Does the company have a mission statement?

- How simple is the mission statement?

- Does the mission statement create goals for management, employees, and stakeholders?

A good mission statement will create goals for the above parties.

How the company communicates its goals goes a long way toward the success of those goals. CEOs, by their nature, are good communicators. And Warren Buffett remains one of the best.

Buffett uses his annual shareholder letter to communicate the company’s goals. He and Charlie Munger also use their annual meetings to communicate. Buffett likes to say he worries more about shareholder concerns than analysts’.

Look for management who communicates with all parties, including stakeholders. For example, when Steve Jobs ran Apple, he communicated a simple goal. “Apple existed to ‘delight customers’ first – benefits to other stakeholders, including shareholders followed.”

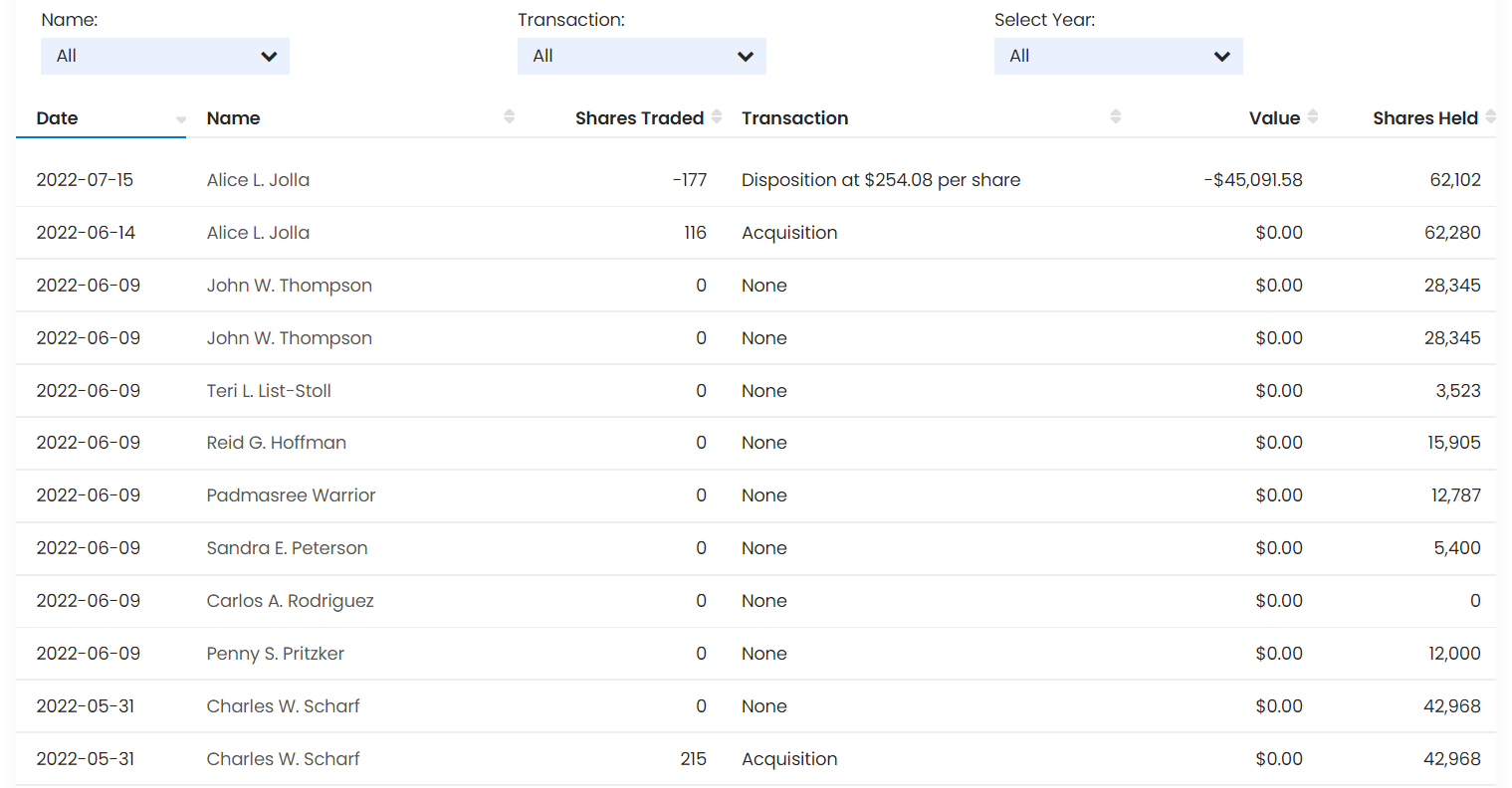

Insider Buying / Share Buybacks

Insider buying can reveal what the management thinks of their company. When we discuss insiders, these people hold management or board seats.

When insiders conduct buys or sells of their shares, it can state strength or weakness.

If insiders buy or sell, it’s because they know something others don’t.

If insiders buy stock regularly, it shows investors they are willing to put skin in the game. A key remains to pay attention to how long insiders hold their shares. Insiders flipping their shares is one thing; holding for the long-term is another path.

A good way to track insider buying uses two methods. One is to reference the company’s Form 4 filings. You can access these forms at sec.gov or bamsec.com.

Another method uses a financial website, such as Stratosphere.io. Sites such as Stratosphere track insider buying and selling for you.

A company’s stance on share buybacks will tell you a lot. If the company states buying back shares remains a good use of capital. We can agree, IF, and a big if, the shares remain undervalued.

One of management’s main goals should be to return capital to shareholders. And buybacks can increase shareholder value if the company remains undervalued.

Too often, management buys back shares because they feel they must. They feel pressure from Wall Street to keep pace. Or the company bases some of its compensation on earnings growth. Which buybacks can improve without real economic gain.

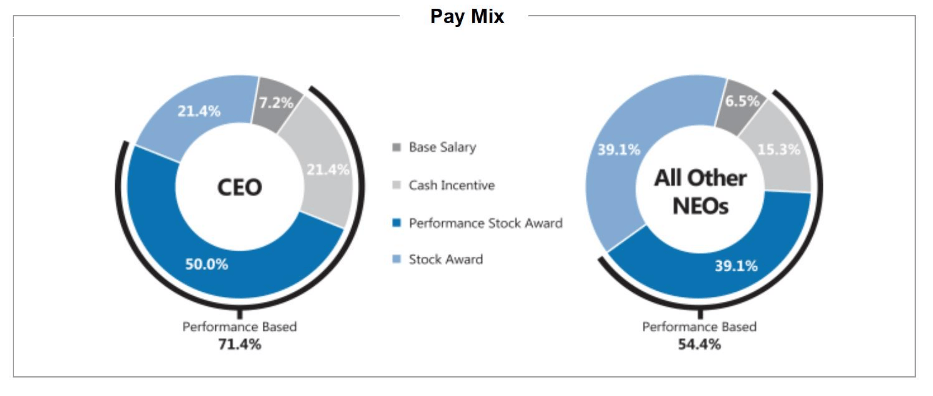

Compensation

Compensation remains the elephant in the room. It remains one of the best ways to assess management, but it has some controversy.

C-suite management often pulls in six to seven-figure salaries. And often because they earned the pay. Good management more than pays for itself by growing shareholder value.

But determining what level of pay remains too high is difficult to calculate.

One of the better ways to determine appropriate pay uses comparing similar industries. For example, CEOs in the banking industry often make more than $20 million. In contrast, CEOs in retail make $1 million.

Generally, you want to see CEOs in similar industries making comparable salaries.

We must be suspicious if we find management making obscene amounts while the company struggles. If management cares about long-term shareholder value, would they pay big amounts?

It is all about incentives. As Charlie Munger says, “show me the incentive, and I will show you the result.“

The next elephant in the room is stock options. We can’t discuss management pay without talking about stock options. Many companies tie managers’ performance to options. And these options have grown in use and value. Many feel the company’s overpay management is to the detriment of shareholders.

Over the years, the abuse of stock options has given management pay and incentives a black eye. Some managers choose to abuse their positions by manipulating the incentives. They were able to drive up share prices to maximize their vesting options. Unfortunately, sometimes use shady methods to “cook the books” for their benefit.

Another drawback to stock options remains dilution. The stock options aren’t free, and issuing additional shares dilutes our value. Meaning our shares lose value with every option offered and exercised.

As with our ownership, we want to see if management uses the options to enrich themselves. Or if they choose to increase their long-term value.

We can track stock options through the DEF 14A or the proxy statement. The proxy can tell us about management salaries, options, and insider ownership.

We can also find some option information in the 10-k under the financial notes.

ROIC and ROE Metrics

The best way to use the metrics is by comparing companies or historical performance. You can use ROIC to measure how well the company uses its capital to grow. The higher the number, the better. The same rules apply to return on equity; the higher, the better.

One of the best practices when using profitability metrics remains comparisons. We can use Visa’s historical performance and its peers.

For example, we can see how Visa has performed over the past ten years. And then compare those results to Mastercard’s over the same period.

We can also look at the overall industry for Visa payments and see how they stack up. By using these comparisons, we can see how well the company uses its capital to grow.

Capital allocation remains the CEO’s prime directive for you Star Trek nerds.

A quick check on your favorite financial website can determine how well a company performs. If you see, Visa continues to underperform compared to peers. The underperformance might give you a reason to dig deeper or avoid the company.

Always remember to compare apples to apples. Or, don’t compare Wells Fargo to Apple; not a fair comparison. Instead, compare Bank of America to Wells Fargo or Microsoft to Apple.

Analyzing a Management Team: Microsoft

The easiest way to assess company management remains by working through our checklist. First, we work through the company’s financials and determine its returns. Next, we work through the “soft” skills and end with compensation.

Let’s work through Microsoft’s management team and give them a thumbs up or down.

First, we will consult the company’s financials to see how well they have created growth.

Here are some 10-year numbers for reference:

- Revenue growth – 10.4% CAGR

- Free Cash Flow – 8.3% CAGR

- Gross Profit – 66.8% CAGR

- ROIC – 22%

And then to give us relevance to peers using ROIC over the same period:

- Google – 15.2%

- Meta (Facebook) – 19.3%

- Apple – 28.1%

- Amazon – 6.8%

- Adobe – 15%

On a profitability measure, Microsoft stacks up quite well. You could compare various metrics and numbers if you wanted to dive deeper. But for our purposes of comparing management, using ROIC or ROE will work.

Next, let’s determine how long each of the top three c-suite managers has been with the company and in their positions.

- Satya Nadela, CEO and Chairman, has worked for Microsoft since 1992 and became CEO in 2014.

- Amy Hood, CFO, has held her current position since 2013 and is the first woman to hold her position. Ms. Hood has worked for Microsoft since 2002.

- Kevin Turner, COO, has worked for Microsoft on this stint since 2021. He held the COO role previously from 2005 to 2016.

Microsoft’s core c-suite team are all long-term Microsoft employees, which bodes well for stability and desire to perform well for shareholders and the company.

Now we can look through the company’s financials, shareholder letters, and earnings call transcripts to determine Microsoft’s goals communicated by the team.

The company’s stated goal remains three core ambitions:

To achieve our vision, our research and development efforts focus on three interconnected ambitions:

- Reinvent productivity and business processes.

- Build the intelligent cloud and intelligent edge platform.

- Create more personal computing.

If you read through Sayta Nadella’s shareholder letter and listen to their recent earnings calls, you can hear the focus on the above-stated goals, which drive the company’s reinvestments and growth.

These goals help drive the company to execute on growing their cloud business, Azure, along with the transformation of the Office suite of products. As Microsoft executes, revenues grow, and the company becomes more profitable, enabling larger reinvestment and more capital allocation.

For the next two checklist items, insider buying and compensation, we can use a combination of websites and company financials to determine.

To determine insider buying, I look through Stratosphere to see that many board members, including the CEO, have been buying Microsoft shares over the year. There has also been selling activity, but we aren’t seeing dumping of shares.

Nothing in the insider activity screams anything unusual; sometimes, no activity is also a sign. If you see insiders dumping shares or lots of sell activity, it might indicate something bad or give you a reason for getting out.

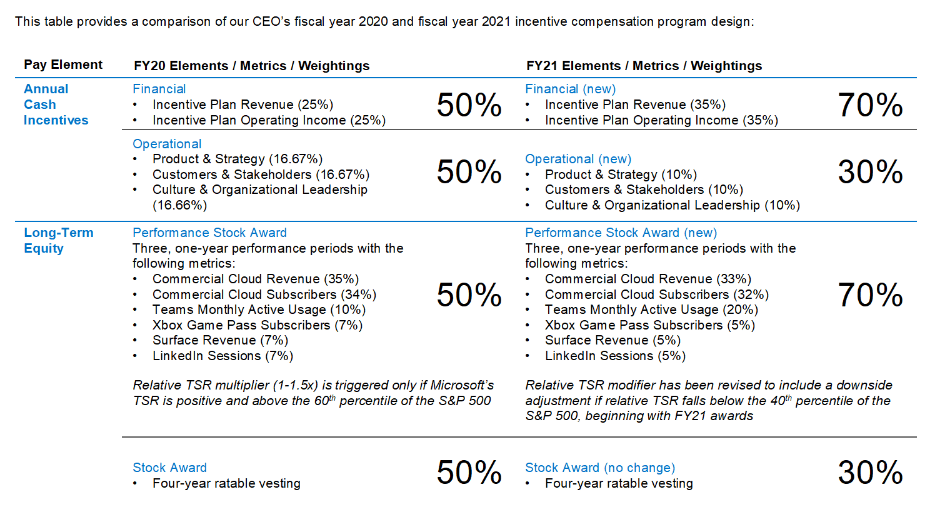

Focusing on the CEO’s pay for a moment. In 2021, Sayta Nadella earned $49.8 million in total compensation, of which $2.5 million was salary, $14.2 million as a bonus, $0 in stock options, and $33 million in stock.

Microsoft bases the CEO’s pay on a peer group and a mixture of incentives, performance stock awards, and stock options. They also base it on metrics and weightings, focusing on revenue and operating income among Microsoft’s products.

Let’s compare Microsoft’s compensation with a few peers:

- Sundar Pichai, Google CEO, made $6.3 million in 2021, a combination of $2 million in salary and other compensation.

- Tim Cook, Apple CEO, made $107 million in 2021, with $3 million in salary, $83 million in a stock award, and $12 million in a cash bonus.

Overall, if we compare Microsoft’s compensation to others in the peer group, they stack up favorably. Not the most expensive, but not the cheapest either, and considering they have one the largest market caps in the world, well earned.

Apple currently has the largest market cap in the world, justifying Tim Cook’s large payouts, while Microsoft ranks second and Alphabet third.

Microsoft’s leadership ranks well based on the checklist we use to give us a better overall understanding of the management and their leadership.

Investor Takeaway

At this time, there remains no single template or easy way to evaluate management, but the simple checklist we worked through above will give you a great starting point to understanding management and the company’s performance.

Reading through company documents and analyzing the financial statements tell part of the story. But using soft skills such as listening to how management treats analysts during earnings calls, or listening to investor presentations, will give you some insight into management’s personality and how they treat others.

Sometimes those “soft” skills can provide deeper insights than mere numbers.

Analyzing the financial numbers is important because they will tell us a story. But just as important is evaluating management to ensure they are the right stewards of our capital.

And with that, we will wrap up our discussion on evaluating management today.

Thank you for reading today’s post; I hope you found something of value. If I can be of any further assistance, please don’t hesitate to reach out.

Until next time, take care and be safe out there,

Dave

Related posts:

- What is a Def14A Statement and Why is it Important for Investors? Updated 12/12/2023 Did you know that Warren Buffett made $380,000 in 2020, of which $100,000 was his salary, and the balance was security protection for...

- Breakdown of Warren Buffett’s Valuation of Coca Cola in 1988 “I never buy anything unless I can fill out on a piece of paper my reasons. I may be wrong, but I would know the...

- Understanding Why a Company may Decide to Complete a Share Buyback Companies will often take part in a share repurchase program. However, the reasons for the share buyback are often unknown and can lead to different...

- How to Use Jensen’s Alpha to Measure True Investor Performance Updated 1/5/2024 Measuring investment returns continues to be something everyone looks to do when investing in the markets. The search for “alpha,” or market-beating investment...