Before you get too far into this blog post, I just want to let you know that you should buckle up because I am absolutely going to fanboy over this budgeting strategy. I have tried various budget programs and processes and I think that the Zero Based Budget process is second to none, except I do have one little, small, baby, minor change that I have to add in…because that’s how I do it!

Zero based budgeting is a method where every single dollar that you earn has a predetermined destiny for where that money is going to go. So, if you make $4000/month, then you will allocate every single dollar for where your spending is going to go.

In essence, you’re going to start at the top with $4000 and then deduct the monthly expenses all the way through the month, then move onto extra debt payments, investing, charity, savings, etc.

The key is that every single dollar is going to be placed into a certain bucket so as soon as you receive your paycheck, you already know what you’re doing with it and you don’t have to think about it for a single second.

So how do you get started?

To do so, you really need to know two pieces of information – your income and your expenses.

Income is going to be significantly easier to determine than your expenses are. If you’re paid a salary, you likely have been paid the same-ish amount of money every paycheck, so you can go back and look at your bank account to see how much you have been taking home each paycheck.

For expenses, this is going to be harder to track. Personally, the absolute best thing that you can do is post-audit your expenses. If you’re like the other 99999999% of people that use credit cards for their day-to-day purchases, you can actually download your monthly expenses into an Excel file.

Please don’t cringe at the fact that I just said “Excel file”. I promise that by the time we get to the end of this article, I am going to have a great solution for you.

Personally, I use two different methods to pay for 100% of my spending – Fifth Third for my banking, and then I use both Chase and American Express for my credit cards depending on what offers the best cash back.

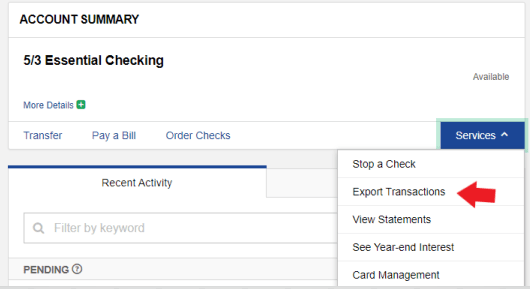

Fifth Third allows you to pretty easily download these transactions. Just login and do the following:

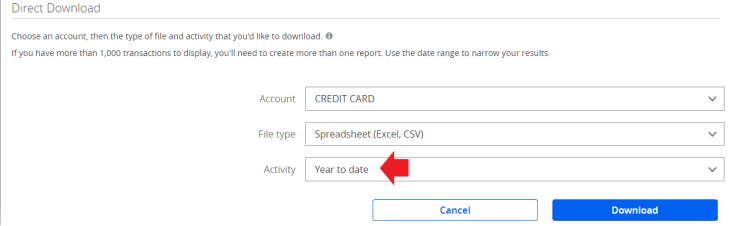

Then just change these next few items and you can download them into Excel:

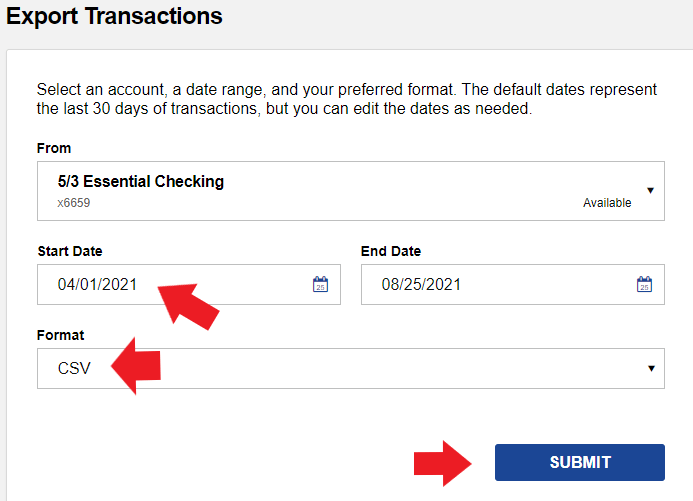

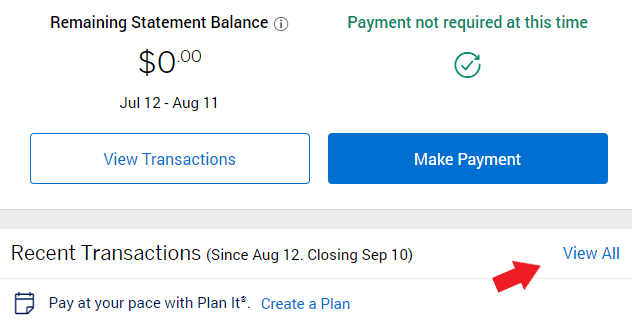

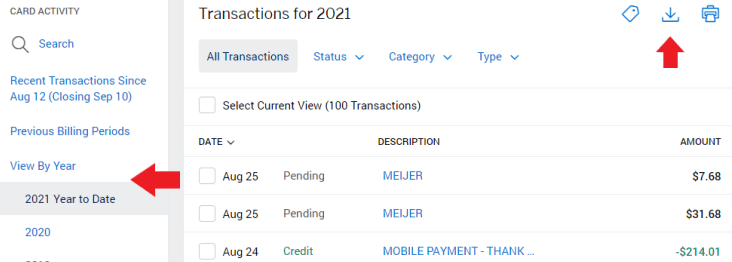

With Chase, it’s honestly not that much harder. Once you login and click on your credit card, you can simply do the following steps:

I always change the Activity section to Year to Date and then just filter away the old stuff. I think that’s easier than downloading three different statements if you want 3 months of data, as I recommend you do for a great starting point with a post-audit.

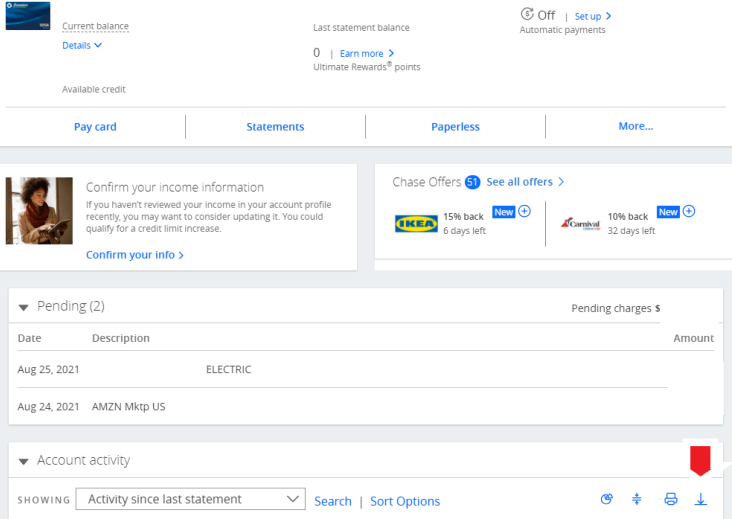

With American Express, it’s just as easy. Just login to your account and then you can follow the simple steps shown below to allow you to download your transactions:

I’d be willing to guess that most, if not all, major financial institutions have the same ability to quickly provide you this type of information. Truthfully, if I didn’t have the ability to download this info I would likely change banks or credit cards because I use this information every single month when doing my zero based budget.

The reason that I want to download at least three months of historical data is because then I can start to get a good feel for how much money I will spend month-to-month on things. For instance, I might spend $100 on clothes in a month, then $0, then $60. What should I put in for my clothing spend?

I would likely take the average of those three, which is $53.33, and then tack on some extra as a “buffer” just in case, so maybe I would end up around $65 for clothing for the month.

The key is that now that you have these transactions, you have to manually go through and code each month with what the expense is. So, Meijer or Kroger might mean groceries. Marathon or BP means gas. Mcdonalds is eating out.

I won’t lie – this process can be gruesome. It’s not fun. You’re likely new to budgeting and it’s a hard process, but it’s so stinking important to your success with your budget. You have to know what you have been spending to get an idea of where you can cut out spending, plain and simple.

You might be spending $250 on eating out each week and have no idea. Or maybe your phone bill for one person is $120 and you didn’t know that because it’s on autopay. Or maybe you’re paying for Hulu, Netflix, CBS, and cable and all you watch is Hulu. You could literally be spending hundreds on things you don’t care about.

You have to get an idea of the current situation you’re in so you can make changes going forward. That’s what this post-audit is all about!

Once you have gone through and identified where every single dollar has been going, you can start to create an action plan on whether this is the appropriate place for your money to be going. So, if you’re making $4000/month and historically you’ve been spending $4000 then you’re all set, right? nothing to do!

Wrong!!

You have a ton to do. Saving money…ever heard of it? Investing? Yeah, we need to get on that if you want to be able to reach financial independence and retire. So let’s plan for it.

While I am personally extremely against telling people that they need to have a certain percentage savings rate, I am going to do that here only to make it simple math. Let’s pretend that you have calculated the numbers and you need to save $800/month and invest it, which just happens to be 20%. That means that you need to cut $800 out of your budget!

My friend, that is no small task. That is going to take some major effort and dedication to reach this goal. So, how do we do this?

Well, start off by grouping all of your expenses into categories that seem to be recurring such as groceries, mortgage/rent, eating out, student loans, car loan, gas, clothes, cable, etc. Anything that has occurred in the last three months should be included.

Personally, I group together things that I buy at the same place. For instance, I buy groceries, cleaning supplies, alcohol, and cat food all at Meijer. Additionally, if I am trying to cut down on eating out, my grocery bill will likely be higher and vice versa, so I like to combine those two categories of groceries and eat out together. All in all, I have created a category called FACH, or Food, Alcohol, Cats, House (cleaning).

This helps me in my grouping to make the process easier. before I had a child and our lives were much more…. “extravagant”…I had a category called BED – Bars & Eating Dinner. And this was a major spending category for us because we lived in downtown Chicago.

You can make whatever acronyms that you want to make it easier on yourself.

Once you have done your post-audit, you can anticipate where your spending will occur in the future, and remember – you have to spend $800 less. So, where does that come from? Start looking at cutting out spending in categories that are way above an acceptable number and then see how the numbers shape up.

Ideally, you’ll end up with this $800 surplus at the end of the month. That’s when you add more categories such as IRA, 529, Emergency Fund, New Car Savings Fund, Presents Sinking Fund, and anything else that you want to save for. The key is to have all of these categories budgeted out and planned so when that money hits your account, you can allocate it as needed.

Personally, I track every single expense that I have and literally the day I get paid I anticipate how much I will spend the next two weeks between my fixed expenses and variable (let’s say $1500), round up that number to be safe (let’s make it $2000 total), and then take out all dollars above $2000 + a cash buffer that is always in my account.

I take that surplus and put some in savings, maybe pay down debt on a loan or mortgage, maybe add to my IRA, or do something else with it to build my wealth. All I know is that each month I have a plan setup prior to the month beginning, so if it’s the last check of the month, I can go, “Oh, I need to put $150 into my IRA to hit my goal this month” and then do that or I can say “crap, I haven’t added to my emergency fund at all – let’s do that”.

By budgeting each dollar, I have a plan lined up and know what I’m doing. It takes all the decision-making out of the equation!

Remember how I said I have one adjustment? I certainly do. I think it’s imperative that you have a “Misc.” fund. Personally, I put our Misc. Fund at $250 each month. It’s natural that there are going to be things that you spend money on that you didn’t budget for.

Maybe a speeding ticket. Maybe your Amazon Prime membership renews. Maybe you cancel cable but have to pay $200 to get out of the contract.

It can be anything, but trust me, crap happens. I’d much rather plan on $250 for a miscellaneous, non-recurring item and it not happen than the other way around.

“Andy, this budget of yours sounds like the absolute WOAT!”….which stands for Worst of All Time, of course. Opposite of GOAT, you know 😉

Well, honestly, I get your complaint and it’s valid. There are platforms out there that you can purchase such as Dave Ramsey’s Every Dollar program for $100/year. While I’m sure it’s great, that’s not exactly cheap.

In turn, I have been creating, failing, adjusting, tinkering, and FINALLY succeeding with my own budgeting plan that I have deemed Doctor Budget to do this literal exact process for you. You will still have to go in and code your transactions as I noted, but once you do that you’re in the clear.

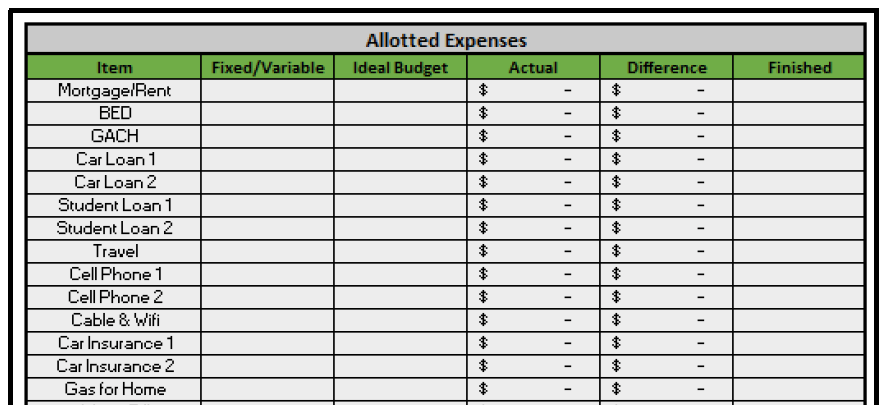

Below is a screenshot that shows part of the layout for Doctor Budget:

As you can see, the “Item” column is a column that you can easily change to fit your needs. Literally just change the name on any column to any Item that you want and as you code those items, it will automatically fill in the “Actual” column. Even if you change the name of the Item, it will still automatically calculate.

Personally, I think that being forced to track things is the best way to learn and succeed at anything. Losing weight? You need to track calories and exercise. Studying for an exam? You need to track what you want to study over the timeline that you have.

The key is to manually track, and that’s what Doctor Budget does. It allows you to track things as you want to see them and once you’re adding in your expenses each month (which you downloaded automatically to eliminate the heavy lifting) it will take you a total of 15 minutes to complete.

That’s not only time saving, but it’s more customizable and more efficient than many other budgeting platforms that are out there on the market. And you don’t have to pay a monthly fee to use it…it’s $29, one-time, never to pay anything again. And you get access to all updates and changes such as the Budget Calendar and Net Worth Tracker that have both been added.

Hopefully the excitement about Doctor Budget has you motivated to give zero based budgeting a try. I promise that it can work for you because it worked for me and I was an AWFUL spender that made a ton of money mistakes…like a ton.

The key is to get started. Go out to your banking websites and start downloading your info. Start to finish you can be done in well under an hour and then start crafting your magic plan. Still need some convincing? Let me tell you why Doctor Budget is the best Budget program on the market!

Related posts:

- If You Forget These Personal Budget Categories, Your Budget WILL FAIL! The easiest way to fail on your personal budget is to not plan. That’s it – that’s how to fail. Or, maybe you plan but...

- The Best Budget Planner Online Today (That’s Also the Simplest to Use) This blog post is something that is really near and dear to my heart. I truly think that so many people are in debt because...

- Budgeting for Beginners: An Easy 5-Step Plan to Making a Budget in Excel One of the most common things that I hear from people is, “I don’t have any money.” The advice from most personal finance people is “just...

- Apps? Excel? NO – I need a PRINTABLE Budget Planner! Let’s be real – Mint is a great app for budgeting but does it actually help you budget? Personally, I got way more from being...