Fair value measurement is an important accounting policy to understand as assets (and liabilities!) carried at fair value on the balance sheet can represent significant portions of book value that shareholders are investing in.

Also, fair value’s influence on reported net income normally flows unadjusted to the widely viewed price/earnings ratios reported on the most popular financial website, so it is important to understand what is likely embedded in that metric.

It is critical for investors to understand what they are looking at and be able to adjust book value and net income for their own analytical purposes.

This article will talk about how fair value measurement occurs, where fair value measurement effects can be seen on the face of a company’s financial statements, as well as what additional disclosure should be provided in the notes to the financial statements.

The Revaluation Model and Fair Value Measurement

Understanding fair value measurement of both asset and liabilities is hugely important when a business uses the revaluation model for their accounting policies. Depending on the industry and asset or liability in question, such a fair value accounting policy will be common place.

Accounting standards can allow for assets to be carried on the balance sheet using either the cost of revaluation model. Under the cost method, assets are initially recorded at cost and depreciated over their useful life through net income. While under the revaluation model, assets are originally recorded at cost but then subsequently revalued upwards to their fair value through fair value gains, or down through fair value losses, write-downs, or impairments. Of course, the revaluation method can only be used if fair value can be reliably measured.

A business might chose the cost model over the revaluation model in order to keep costs low. The cost model can easily be carried out by the accounting department but the revaluation model will need valuation teams, external appraisers, and will lead to a more expensive audit come the end of the year. If the assets are likely to appreciate over time, such as with real estate properties, the revaluation model is likely the more ideal accounting policy from a business perspective and worth the added cost.

Investment Insights from Fair Value

Reading through a business’s financial statements to understand which accounting policy is used for which assets can lead to valuable insights for investment purposes. For example, a business which chooses to carry long-term assets at their historical cost could be under-reporting the asset’s value and also income. Estimating the true fair value of such assets (using one of the methods to be discussed later) and adjusting them on the balance sheet, could lead to different price-to-book value ratios and the opportunity to make a bargain purchase.

On the opposite side, if a business reports assets under the revaluation model at fair value, reading through the disclosures in the notes to the financial statements might give insight as to whether management is being biased. This could take the form of either aggressiveness, such as through the use of low discount rates to value assets which would result in higher asset values and fair value gains; or conservativism, such as through the use of higher discount rates to value assets which would results in lower asset values and less fair value gains. Comparing a company’s chosen discount rates to those of competitors in the industry can help yield these valuable insights.

How are Assets and Liabilities Being Carried?

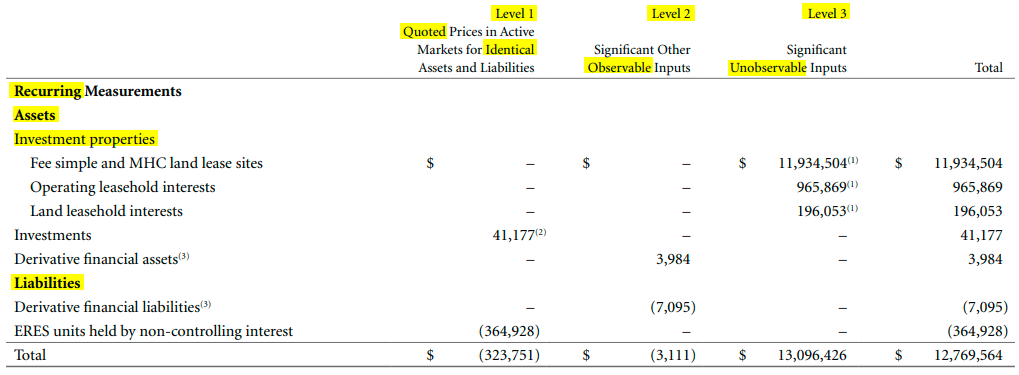

In the notes to the financial statements there should be a description of accounting policy choices and a breakdown of significant assets carried at fair value. Below is an exert of what a good summary table looks like from one of Canada’s largest REITs, simply named Canadian Apartment REIT, or CAPREIT for short. Items to pay attention to in this first exhibit are the hierarchy levels based on the observability of inputs (which we will discuss in more depth later), the fact that recurring measurements need this additional disclosure, and also that both asset and liabilities can be measured at fair value.

Click to zoom2019 Annual Report for Canadian Apartment REIT

Fair Value Hierarchy Levels

The reason behind the fair value hierarchy levels is to establish a scale by which readers can determine reliability and techniques. Based on the mixture of observable inputs and estimates, fair value measurements are given a level in the hierarchy with 1 being the highest as its inputs are most identical to active markets and observable.

Level 1: Uses quoted prices for identical items in active, liquid, and visible markets such as stock exchanges.

Level 2: Uses observable information for similar items in active and inactive markets.

Level 3: Reflects a best estimate valuation based on inputs and assumptions that are unobservable in the market yet significant in the valuation technique.

Approaches to Fair Value Measurement

Fair value measurement is covered under U.S. GAAP’s ASC 820 and IFRS 13. There are 3 general valuation techniques that can be used to measure fair value for financial reporting. The chosen technique should maximize the use of observable inputs when data is available and minimize the use of subjective and unobservable inputs or estimates. More than one technique can be used to gain an indication of fair value with the various results from all techniques weighted according to their relevance. However, available and relevant market-based data should not be ignored in favor of more subjective approaches.

Market Approach – Techniques that would fall within market approaches include quoted prices in an active market as well as market multiples from a benchmark of comparable assets. Example: Market quoted equity/debt securities, options, and futures, as well as unlisted investments, measured through market multiples of comparable securities.

Income Approach – Future expected cash flows and income streams are present valued to determine the fair value on the measurement date. The income approach would also include the Black-Sholes model for pricing options. Example: The income approach would be commonly used for unlisted equity/debt investments and intangible assets acquired in a business combination.

Cost Approach (Replacement Cost) – Fair value is determined based on the amount it would cost to replace the asset being measured with the theory being that an investor or company would not pay more to purchase the asset in the market than they could pay to construct a comparable asset themselves. Example: The cost approach would be commonly used for factory assets and equipment.

Disclosure of Inputs and Techniques is Important

If assets and liabilities measured at fair value represent a significant and recurring part of the balance sheet, proper disclosure is hugely important.

For Level 2 and 3 in the hierarchy, a description of the valuation techniques and inputs are required as well as changes and reasons for the change in the valuation technique used. As we move towards level 3 in the hierarchy scale, the amount of additional disclosure provided in the notes to the financial statements grows to the point where quantification of significant unobservable input is required for Level 3 items.

This additional disclosure allows investors to make their own judgment on the fair value measurements being made and potentially conduct their own sensitivity analysis on the fair value in question.

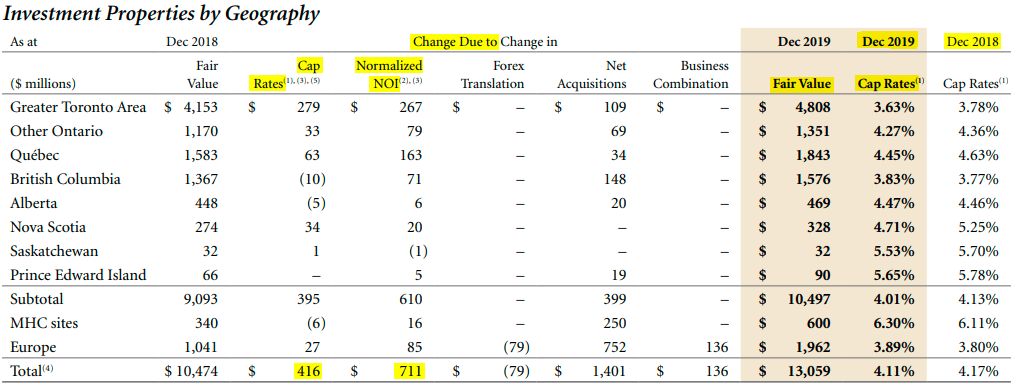

Below is the geographic segmentation of CAPREIT’s real estate portfolio with the cap rate/discount rate used for income approach based fair value measurement provided for each geographic segment. As expected, cap rates have declined year-over-year as interest rates have gone down.

Also important is that the breakdown between fair value increases due to cap rate changes ($416M) or changes in normalized net operating income (NOI)($711M) that are being discounted at the cap rate. These cap rates by location could be compared to others in the industry to gains an understanding of the relative valuation and quality of the real estate portfolio.

Click to zoom 2019 Annual Report for Canadian Apartment REIT

Related posts:

- What is Net Book Value? Net book value (NBV) is an accounting term which refers to the value of an asset as it can be seen on the balance sheet...

- Tobin Q Ratio – CFA Level 3 The Tobin Q ratio is an asset-based valuation model that has found its way into many value investor’s playbooks due to its economic logic based...

- How to Test Goodwill & Intangibles for Possible Impairments As technology increases and goodwill and intangibles continue to get more common on the balance sheets of companies, it becomes ever more important to understand...

- Enterprise Value Formula and Definition – CFA Level I & II Fundamentals A company’s enterprise value (EV) is an important point of understanding for investors and is a fundamental learning point in many business schools, as well...