Andrew and Dave recently went in depth on a Family HSA in their recent podcast episode so I thought it was no better time to get a little bit more in the weeds on some great investing tools for parents!

So, you’re a parent or about to become one, or maybe already are – congrats! It is a super exciting time. Personally, I am not yet a parent but my wife and I are expecting our first in February so we’ve spent the last 6+ months making sure that we’re doing absolutely everything that we can to ensure that our family is setup for financial success. The fist step was working on our Family HSA but there are many other ways to prepare!

1 – Family HSA

I have written previous posts about the HSA and quite honestly have become a huge fanboy of them since investing. Not only do you get a triple tax advantage like I outlined in the link above, but you also can pull that money out penalty free at the age of 65 if you don’t end up using it for a qualified medical expense.

For a family in 2020, the HSA contribution limit is being increased by $100 so that means you can now put in $7100 of pretax money every year. That money will then grow tax free and you can pay for qualified medical expenses without paying taxes on the distributions from that HSA. In essence – it’s a triple tax advantage!

Personally, I have grown to love the HSA and the benefits it provides. It will likely come with a lower premium, but you will have a higher deductible than the typical plan. If you’re young and healthy, or you’re planning to max out the HSA in terms of the $7100 limit, then this plan could be for you. I encourage you to do the math on it.

When I was evaluating insurance plans, I looked at the worst case for out of pocket expenses and then looked at the total tax savings that I would save and I was still $1000 better with the HSA, even if I maxed out my out-of-pocket expenses as long as I maxed out my HSA contributions as well.

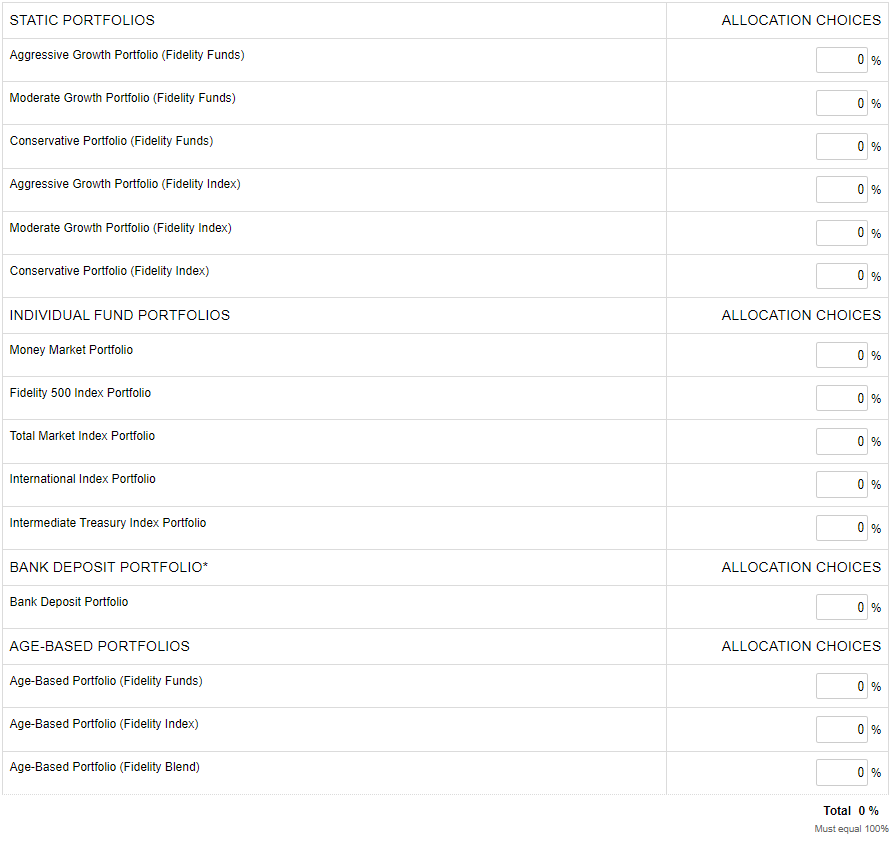

It’s just something for you to look at and evaluate. $7100 might seem like a lot to max it out, but just try to break it into contributions at the same time you get paid:

Above shows how much you would need to contribute on a pretax basis for each paycheck depending on how frequently you get paid. I also added in an “After Tax Cost” which is where I assumed a 25% cost impact so if you got paid Biweekly and decided to not input the $273.08 needed into your HSA, you would only get ~$204.81 in actual money because you’d have to pay taxes on that, so that’s where the major benefit of the HSA comes in!

2 – 529 Plan

A 529 plan is another great plan if you’d like to be able to have the option to send your child to school. With a 529, you put after-tax money into an account that then can grow tax-free until the time when you need it to pay for school. I wrote a really in depth article with a 529 calculator to give you a chance to play around with the numbers and see the value for you, personally.

People typically associate a 529 with paying for college, and that makes sense because that is likely the most common use of them. This is by no means a fact, but my guess is that most people are going to first experience paid tuition when they enter college, so that is when this because useful although you can use a 529 plan for many other things such as vocational and trade school tuition and fees, private grade school, books and supplies, computers, etc.

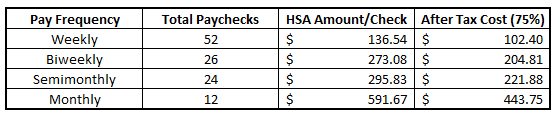

My 529 plan is through Fidelity and while it’s a little less individualized than a normal brokerage account, you can still invest in a few different Fidelity portfolios, shown below:

Like I said, not a ton of great options, but due to the fact that I get a major tax advantage by using the 529 plan, I am going to overlook the deficiency of not being able to invest in individual stocks for this plan.

3 – Custodial IRA

A custodial IRA is very similar to an IRA that you might have in the sense that it can either be a Roth or a Traditional IRA and you must have earned wages to contribute. In a perfect world, the child might have a W2 from a job to have proof of the earned wages but that is definitely not always the case.

Many of my first jobs as a child were doing things like washing cars, mowing yards and shoveling the snow off of driveways. Of course, none of those things will have a W2, so it is important to keep very detailed records of the total earned wages in case the IRS ever came calling. So, now that your child has earned wages, the rest is what you’re familiar with where you can simply put that money into the IRA and let it continue to grow.

You will be the account holder until your child becomes of age (either 18 or 21 depending on the state) and at that point, the entire IRA is turned over to the child.

Something that I have seen people do is simply match whatever the child’s earnings are and put it into the IRA. For instance, if the child earns $2000, you can let them spend that money however they would like and then you put $2000 into the IRA for them. Personally, I think a plan that I might implement when my child becomes of age is to tell him that I will give him a 2:1 match of whatever he puts into the IRA.

For instance, if he earns $2000 and puts all $2000 into the IRA, then I’ll put $4000 in. if he puts nothing in, I will also put nothing in (theoretically – I might cave lol). The goal here is not only to set my child up for success but this is also a great opportunity for a strong learning lesson about money.

All in all, I recommend you take hard dive into these three different options and see what is best for you and your family. They all have great tax advantages – you just need to take advantage of them and setup your child for success!

Related posts:

- Hey Andy – Does HSA Roll Over My Savings from Year to Year? Recently I was having a conversation with a friend and they told me that they didn’t use an HSA because they didn’t want to lose...

- Important HSA Rollover Rules: How to Utilize them Efficiently Have you found yourself in a situation where you might need to rollover your HSA? If so, no worries! There are a few HSA rollover...

- Maximize Your Tax Savings with This Amazing Traditional IRA Calculator 401k’s are OLD NEWS! Kidding…kinda…not really. Personally, I am a huge fan of the IRA and think that everyone should be utilizing them whenever they...

- How the HSA and its Wonderful Triple Tax Advantage Builds Wealth If you don’t know what an HSA is then you have come to the right place. HSA stands for a Health Savings Account, but in...