Personal Finance always begins with knowledge/learning, but even if you know what to do, it is so easy to fall off the bandwagon! You have to keep going, even when things get tough, and I think that the best way to do this is to take a look at some Financial Freedom Quotes to change your life!

Now, these quotes alone aren’t going to make you rich, but they can be that last little piece of motivation that keeps you going. I used to post inspirational quotes in my room when I was younger to lose weight and I somewhat do the same thing with personal finance. I am not posting them in our room (because my wife would kill me) but I frequently will look at them as sources of motivation and guess what – they work!

- “Compound interest is the eighth wonder of the world. He who understands it, earns it … he who doesn’t … pays it.” -Anonymous

To me, I feel like I have to start the conversation with this post. Compound interest is what really drives everything about investing, saving, etc., so it’s imperative that you understand it.

Compound interest is what got me started on my investing journey and what has motivated me so much to keep on going. If you’re looking for that same motivation, don’t worry – I have you covered with some insane compound interest examples.

- “More important than the how we achieve financial freedom, is the why. Find your reasons why you want to be free and wealthy.” –Robert Kiyosaki

I feel like this quote just has to be #2 on my list and honestly, debatably could be #1. If you don’t have your ‘why’ defined then you’re likely never going to succeed. It doesn’t just go for personal finance, but also for dieting, working out, cleaning, anything!

Anything that’s not fun but needs to be done will be procrastinated or skipped unless you have your ‘why’ defined. My ‘why’ was to provide a better life for my family and also to hopefully be able to buy a lake house at some point! Having that ‘why’ is what’s keeping us on track even when things get really tough and we just want to go blow money!

- “Money is a terrible master but an excellent servant.” –PT Barnum

Your money should be working for you, not you are working for your money. Make sure that you’re doing everything that you can to become financially independent and investing so your money can continue to grow overnight rather than you are getting more and more in the hole.

- “Wealth is the ability to fully experience life.” –Henry David Thoreau

Money isn’t going to buy you happiness but it’s going to give you the opportunity to do things that you might not otherwise have been able to do.

- “The philosophy of the rich and the poor is this: the rich invest their money and spend what is left. The poor spend their money and invest what is left.” – Robert Kiyosaki

I talk about this ALL the time! The best way to save money from salary is to have it immediately taken out of your paycheck. I think that if you have your money immediately withdrawn then you’re never even going to miss it and you’ll keep on investing like clockwork.

There are definitely other great options to save money from salary so if you’re finding yourself at the end of the month with nothing to invest, maybe it’s time to change up your strategy!

- “A good financial plan is a road map that shows us exactly how the choices we make today will affect our future.” –Alexa Von Tobel

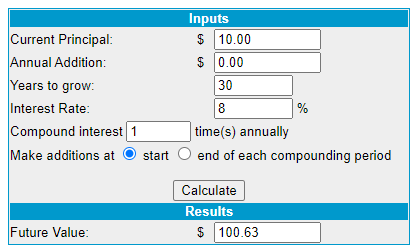

This is very true! The way that I apply this is to always be looking at compound interest calculators to make sure that I’m on track with my goals.

A general rule of thumb is that whatever you would buy today would be worth 10x that if you had invested that money instead. Want to guy to the movies for $10? It would be worth $100 in 30 years!

- “At least eighty percent of millionaires are self-made. That is, they started with nothing but ambition and energy, the same way most of us start.” – Brian Tracy

You have to start somewhere and for many of us, we’re starting with nothing or likely even something less than nothing!

Thanks college loans…

The hardest thing with anything in life is to get started. Start tracking your expenses with Doctor Budget and also calculate your personal net worth and then just follow it from month to month. You’re going to get addicted to watching your net worth grow and it’s going to motivate you to make even better decisions in your everyday life when it comes to your finances.

- “Money can’t buy happiness, but it will certainly get you a better class of memories.” – Ronald Reagan

This is very similar to one of the quotes above, but if I can use a Reagan quote, I’m going to do it.

If you’re an unhappy person then becoming financially independent won’t make you happy all of a sudden. Instead, you’re just going to be more unhappy with less to do because you quit your job.

Having money won’t make you happy, but it can allow you to do a lot more things than someone without it can do. For instance, if you hate your job, then having money will allow you to eliminate that earlier than someone without money can do.

Then you can start a side hustle, maybe look for a lower paying job because the money isn’t as important, or just sit on your butt and do nothing but hobbies that you love doing!

- “Investing is not nearly as difficult as it looks. Successful investing involves doing a few things right and avoiding serious mistakes.” – John Bogle

Investing can be as simple or as difficult as you want it to be. If you want to get super in the weeds and do a ton of analysis and read a 10k for every single company, you can!

If you just want to be 100% hands off and just pay someone to do all your investing/money management for you, then you can do that as well!

And if you want to do something in the middle of these two options, you can do that by doing some high level research or paying for tools that help make investing either (like my personal favorite, the Value Trap Indicator and the Sather Research Letter) or you can even just go buy some ETFs like VYM that are high dividend yield, which leads me to my next quote…

- “Don’t look for the needle in the haystack. Just buy the haystack.” – John Bogle

If you don’t know, John Bogle was the father of the index fund at Vanguard and he was all about providing people a low-cost way to invest in the entire stock market with something called an index fund, or an ETF.

While I personally am not a huge index fund investor, I do invest in some ETFs like WCLD and MTUM. The thing with ETFs is that they will provide you some protection from being invested in individual stocks but that also means that the returns are likely going to be less.

But if you’re not someone that’s super hands on, then you can just invest in a basic ETF like VOO that will mimic the S&P 500 and then you can get amazing returns for a super, super low fee.

Since 1928, the S&P 500 has averaged over 10% returns annually, so I would say that’s not too shabby for just throwing your money into an ETF!

- “A bad day fishing sure beats a good day at work.” – Anonymous

This one just makes me laugh but also has a great meaning. When you’re financially independent then you can do whatever you want, and yes, that means fishing as often as you want.

You simply have options that you haven’t had before, so even on a bad day you’re still likely much happier than you would be if you were still slaving away at your 8-5.

- “Someone is sitting in the shade today because someone planted a tree a long time ago.” -Warren Buffett

This is all about compound interest again! Compound interest really has two pieces to it – time and money. Even if you don’t have a lot to invest, you can still start small and you should start as soon as you possibly can.

By starting early, you can eliminate the need to invest tons and tons of money.

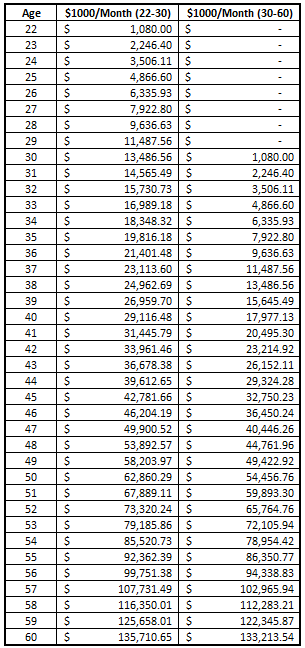

One of my favorite examples of this is that if you invest a set amount of money from ages 22 – 30, you would have more money than if you invested that exact same amount from ages 30 – 60.

Don’t believe it? Check out the math:

That just says that time is just as important, if not even more important, than the amount that you’re investing.

- “Too many people spend money they earned… to buy things they don’t want… to impress people that they don’t like.” -Will Rogers

The whole keeping up with the Jones’ thing is just stupid. Don’t do it.

I have oftentimes had conversations with one of my friends at work about how people afford the houses and vacations that they buy and the answer is simple – they’re probably in debt. You see, my friend that asks how they do it is maxing out his HSA, IRA, 401K and also going to pay off his mortgage in 10 years.

Which situation would you rather be in? He’s going to have a lot of flexibility in 10 years that those people overbuying on their house and blowing all their money won’t have.

- “Whether socks or stocks, I like buying quality merchandise when it is marked down.” – Warren Buffett

Buffett is just so clever and always making me laugh. Stocks are the only thing that people panic about when they go on sale. Instead, step back a bit and look at if things are actually changing in the business or not.

If they’re not, then find some companies that have gone on sale and increase your position in them. Or you can be like everyone else and buy high and sell low, the opposite of what you’re supposed to do.

The key is to have a high-risk appetite. If you don’t have that naturally, don’t worry – you can get there eventually with a little effort!

- “There are two ways to get rich – make more or desire less.” – Anonymous

The reason that I love this quote is because it’s super simple and even more true. It simply comes down to income and spending and you can always change both. If you’re just starting out, try to cut your expenses by living a minimalistic lifestyle! If you’ve already done this, look at trying to increase your income a bit with a side hustle!

- “Whatever your income, always live below your means.” – Thomas J. Stanley, The Millionaire Next Door

AMEN! No matter if you’re making $30K or $500K per year, live below your means. It’s really a simple equation:

If spending is greater than your income, you’re in TROUBLE! If it’s the other way around, then you’re going to be just fine as long as you’re hitting your own personal finance goals such as maxing out an IRA, 401k, HSA, saving for kid’s college, etc.!

- “If you will make the sacrifices now that most people aren’t willing to make, later on you will be able to live as those folks will never be able to live.” -Dave Ramsey

Admittedly, I am not a huge fan of Dave Ramsey but I think that this quote is spot on! If you’re willing to live a very minimalistic lifestyle for a small amount of time, then you can live like kings later in life.

Now, saying that you can “live like kings” might be taking it a step too far, but you can definitely live a much, much better lifestyle than you would be able to live if you had just kept going on with your life.

Hopefully you feel motivated after reading this post! I know that when I was researching the quotes, I kept finding myself getting more and more excited to reach my FI goal – but that’s only part of it.

Being motivated is great – now go out and do something about it! If you don’t know where to start, start with learning about the value of small investments. Even packing your lunch a few days/week can be HUNDREDS OF THOUSANDS OF DOLLARS!

Related posts:

- Quotes from 11 Billionaire Investors about Debt and Finance There’s no better place to look for financial advice than from the winners of the game. While leverage (debt) can be perceived as a useful...

- Hey Andy – Why Do People Invest? To someone that is not an investor in the stock market, beginning to invest can be absolutely terrifying, and guess what – I 100% understand....

- Reach FI Faster With The Seven BEST Compound Interest Investments! If you’re familiar with personal finance then you likely understand compound interest, but do you actually know how to apply that knowledge into your FI...

- You Will Fail Trying to Get Rich Quick. I Promise. One of the biggest mistakes that I see with new investors is that they start off with a mindset that they can get rich quick. ...