Reading the 10k of a company is required reading if you want to invest in the company, and part of that reading is scouring the financial statement footnotes.

In fact, many seasoned investors read through the financial statement footnotes first to get a feel for the financial condition of the company.

On many occasions, the financial statement footnotes contain some of the juiciest information contained in the financial reports. Many of the important details concerning subjects including debt and components of that debt, such as terms, interest payments, and different components of that debt, are in the footnotes.

The footnotes are a treasure trove of information, and the company sometimes includes items in the footnotes, knowing that investors or analysts won’t read them. As investors, we must understand what is contained in this section, as well as what items to look for when reading.

As we continue learning the language of investing, or accounting, we study the financial statements which contain the income statement, balance sheet, and cash flow statement. The final step is to analyze the financial statement footnotes, which includes more detailed information that may enlighten us about items such as debt, inventories, dividends, earnings, and much more.

In today’s post, we will learn:

- What Are the Financial Statement Footnotes?

- Where Do You Find Financial Statement Footnotes?

- Financial Statement Footnotes Checklist

- Walk Through of Financial Statement Footnotes

Ok, let’s dive in and learn more about financial statement footnotes.

What Are Financial Statement Footnotes?

Footnotes to the financial statements are the additional information below the financial statements that help enlighten investors on how the company arrives at its financial figures in their statements.

The footnotes also help explain any irregularities or inconsistencies in the year to year accounting methods.

We can think of it as a supplement to the financial statements, providing additional clarity to the financial statements.

The information in the financial statement footnotes is important, and they may reveal any underlying issues concerning the company’s health.

The reason for the inclusion of footnotes in the annual or quarterly is the attempt at clarity and brevity of the financial statements. The footnotes are quite long, and inclusion in the main text of the report could muddy the data presented in the annual or quarterly report.

Using footnotes allows readers to absorb the general flow of information of the financial statements while allowing the investors to access additional information if we feel it is necessary for our analysis.

These notes are important because it contains information related to numerous subjects such as:

- Accounting methodologies

- Pension plan details

- Stock option compensation information

- Debt schedules

- Inventories

All of these subjects may have material impacts on the bottom line of the company and are, therefore, important to analyze.

Also, footnotes can explain certain irregularities or unusual activities such as one-off incomes or expenses and their impact on the company, as well as further information regarding its possible future impacts.

Where Do You Find Financial Statement Footnotes?

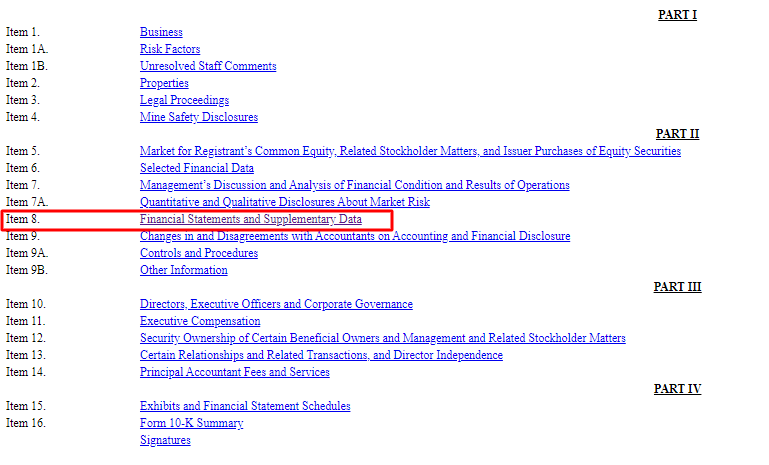

Item Eight of the quarterly or annual financial statements contain the footnotes, along with all the other financial statements.

In every financial statement released, you will find the footnotes in the same position, below the financial statements. Sometimes select information contained in those footnotes is in section seven, or management’s discussion of financial conditions.

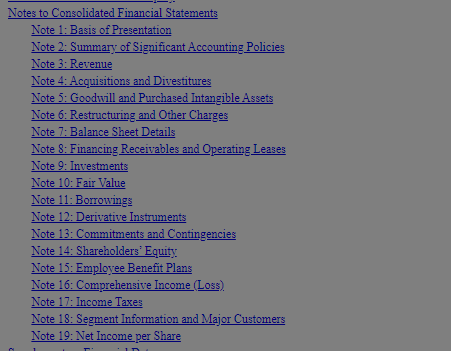

After reading through the main financial documents, you will arrive at the financial statement footnotes; in the cash of the example I will show below, Cisco outlines each footnote in a table of contents, which is nice to see and makes it easier to locate the specific footnote you want to analyze.

However, a note of caution, not every company is quite so considerate; in fact, of the last fifty or so financial statements I have read through, only Cisco has gone to the trouble of laying out the footnotes in such a way.

Financial Statement Footnotes Checklist

The list of items included in the footnotes is quite long, and the following list touches on some of them.

- Accounting policies

- Accounting changes

- Contingencies and commitments

- Risks

- Business combinations

- Fair value

- Cash

- Receivables

- Investments

- Goodwill

- Debt

- Segment data

The above is a snapshot of the list of possibilities, and the list can go on for miles. Clearly, if all the information listed above were in the text of the financial statements, it would overshadow the statements.

The treasure trove of information contained in the above line items is staggering and would be overwhelming to try to absorb all at one sitting. Like eating a pizza, it is best to focus on the area at a time and work your way through the notes, picking the section that you want to focus on and moving on to the next section.

The footnotes can generally be divided into two camps. The first camp involves the accounting methods the company employs to determine its financial position. It involves items such as revenue recognition, for example.

The other camp focuses more on operational and financial results such as earnings, segment results, or debt.

Walk Through of Financial Statement Footnotes

Let’s take a walk through the financial statement footnotes of a company, say Cisco, to get a flavor of how these notes work.

As we mentioned above, the organization of the notes falls into two camps, with the accounting sections presented first, followed by the operational and financial conditions next.

The footnotes regarding the accounting policies are broken up into specific areas such as revenues, inventories, and fair value, which tells us what the company’s policies are in that area and how they account for its value.

For example, revenue recognition is one of the most important aspects of any company, and in the footnotes, the company will outline how and when they recognize revenue. At first, you might think well, ok, that appears pretty obvious. However, it is not as cut and dry as you might think.

For example, Ford recognizes the sale of a car when the dealership takes possession of the vehicle, not when the customer purchases the vehicle. So when you look at the revenue for Ford, it is booking that sale when the car leaves Ford’s plant and moves the dealership, not when you take it home.

For our purposes today, I am going to walk through ten of the more common notes to financial statements to give you a flavor of what kind of information we might find in the notes. The list we are going to present is by no means comprehensive; rather, it is a guide to more common sections of the footnotes to help educate us on the possibilities available in the footnotes.

Note 1: Basis of Presentation

Here we will find a thumbnail sketch of the business and what it is they do to generate revenue. Common comments may include what the company does for the business and the way it does that work. For example, does it produce the products itself, or does it farm out the products?

In Cisco’s notes, we find that they inform us about the business cycle of the business, which runs on a 52-week cycle and ends its fiscal year on the last day of July. It also outlines the geographic scope of the company and outlines how it divides its segments, and relates all business only to controlling interests of the business.

Note 2: Summary of Significant Accounting Policies

In this note, we see an outline of each accounting method contained in the financial statements and helps investors better understand the company’s financial statements. Each note uses a notation regarding any significant accounting decision made by the company.

At the very least, we should see notes explaining how a company handles accounting for depreciation, ending inventories, the basis of consolidation, treatment of income taxes, employee benefits, and intangibles. The list is a small sampling of the presentation offered in the notes.

Cisco presents up to 27 notes in this section; they include topics such as cash, revenue recognition, depreciation, employee benefits, and much more.

For example, in relation to cash and cash equivalent,s Cisco states that they recognize cash as any security purchased that is highly liquid and has a maturity of three months or less.

Regarding revenue recognition, the company adopted the latest FASB accounting rule, which eliminated all industry-specific guidance. The new guidance dictates that revenue recognition begins when a customer obtains control of said goods or services at the agreed to purchase price. The ruling also applies contract sales, which require any subscription sales to be capitalized and amortized according to a set schedule.

Note 3: Revenue

In this section, Cisco lays out the revenues collected for the company and gives a deeper breakdown of the different products sold. The benefit of this section is it allows you to see if a current product is driving the revenue for the company, or to see how a new product is impacting the revenues of the company.

For companies such as Cisco, Intel, Nvidia, or Apple, it is nice to see a breakdown of the individual products that are sold and how those sales drive the revenue of the company.

If the company is discussing the new product in the management discussion, but you see that it is only 2% of revenues. Which helps understand management’s focus and to see the direction they think the company might pivot.

Note 4: Acquisitions and Divestitures

In this section, we see all the information related to any acquisitions that Cisco has done for the period, whether annually or quarterly.

In Cisco’s case, acquisitions are a major part of its growth strategy; the company uses acquisitions to add different parts to its company. For example, in 2019, the company acquired five companies in total for a grand total of $2.86 billion for the year.

Also listed are any divestitures the company might have performed, which account for any decreases in revenues because of the sale of those companies.

Note 5: Goodwill

The goodwill note breaks down all information regarding goodwill for Cisco. It breaks down the information by segment, goodwill schedule, intangibles, and outlines all the amortization tables. Any questions concerning the goodwill of Cisco are answered here, including what the company expects to list as goodwill in the upcoming five years.

Note 6: Borrowings

One of my favorite notes in any company’s financials, here you will find anything and everything related to the debt of the company.

In Cisco’s case, the company outlines both the short-term debt and long-term debt in different sections. Here we can see the effective rate the debt carries, as well as the expected maturity dates of both the short-term debt, commercial paper, and long-term debt.

We can also see a schedule of maturities of the debt, which helps you see not only how much overall debt Cisco carries, but also when that debt becomes due. Which, in turn, helps see how the need for free cash flow impacts the repayment of the debt.

Also included is any information related to any credit facilities the company might have, which allow it to borrow in the event of some sort of calamities, such as a natural disaster or global pandemic.

Note 7: Commitments and Contingencies

The above note contains any information regarding any contingent liabilities that may arise. In this section, you will find any information regarding, for example, litigation that may lead to a loss of income in the future. Or the company may have an income tax dispute that has a bearing on the future results of the company.

In Cisco’s case, the note here consists mostly of the contracts it uses to purchase supplies to produce the products it sells; also included are any warranties on its products, leases, and guarantees.

Note 8: Income Taxes

Here we will find all we want to know about the income taxes Cisco pays each year. Included are items such as federal taxes, state, and foreign taxes, all broken by current and deferred status.

Also listed are tables outlining the tax rate the company pays, plus any allowable offsets for the company. Later in the section, there is additional information regarding the deferred taxes and the liabilities and assets associated with those deferred taxes.

Note 9: Segment Information and Major Customers

Here Cisco outlines the major segments the company reports its financial operations, which include each of the three segments. In this section, we can see the breakdown of the segments by revenue, as well as the gross margin for each segment. That information helps us see what areas drive the profitability of Cisco.

Also, Cisco details the major customers for the company, which at the time, no company accounts for more than 10% of the company’s revenues.

If you are looking at utilizing a relative valuation of a company based on its segment revenues or doing a sum of the parts valuation, then this is the note for you. Some companies will break down the segment revenues by costs, EBITDA, and other metrics to help you better understand the operations of the company.

Note 10: Net Income Per Share

In this note, we see all the information breaking down the net income per share, including the revenues, costs, and shares outstanding. In some cases, the company will list out the results by quarter so you can see the quarterly progression of the company.

That wraps up the progression of the financial statement footnotes and how we read through them.

Final Thoughts

The financial statement footnotes are a treasure trove of information; there is so much detail outlining the financial condition of the company.

To truly understand any company, we must work through the financial documents of the company. Included in that work is reading the financial statement footnotes, which include so many nuggets of information.

Many experienced investors that have a lot of familiarity with a company might focus solely on the footnotes as a means of their analysis.

Unfortunately, not all investors take advantage of this section and focus solely on management’s discussion or the big three financial documents. But to truly get your arms around the company you want to own, reading the footnotes is a must.

I will leave you with this thought when recently asked how to get smarter, Buffett held up a stack of papers and said, “read 500 pages like this everyday. That’s how knowledge builds up, like compound interest.”

With that, we will wrap up our discussion today regarding the financial statement footnotes.

As always, thank you for taking the time to read this post. I hope you find something of value on your investing journey.

If I can be of any further assistance, please don’t hesitate to reach out.

Until next time, take care and be safe out there,

Dave

Related posts:

- Simple Income Statement Structure Breakdown (by Each Component) Updated 8/7/2023 The income statement is the first of the big three financial documents that all public companies must file. But what do we know...

- Basic Cash Flow Statement Breakdown (by Each Component) Updated 4/21/2023 Cash is king, and finding companies that generate cash is the holy grail of investing. The basic cash flow statement provides answers to...

- Deferred Revenue: Debit or Credit and its Flow Through the Financials Basic accounting for public companies can get confusing with different terms that mean the same thing (like deferred and unearned revenue), vs opaque definitions (such...

- How to Look Up Debt Covenants: A Real-life Example from a 10-k Out of the many aspects of fundamental analysis, reading debt covenants is probably among the most arduous, discouraging, and ignored part of the job. But...