Updated 1/17/2024

Understanding finance basics doesn’t mean you’ll instantly begin building wealth. There are still several attributes that can lead you to fall short of your financial goals.

Personally, the best way for me to learn is with specific guidelines and a plan of action. I know that not everybody learns best this way, but when I am given specific examples and action plans of how to get better, I am my most effective. Fortunately for me, and maybe you, too, Robert Kiyosaki outlines 5 major reasons why the financially literate cannot build wealth in this chapter of Rich Dad, Poor Dad.

If I had to summarize Rich Dad, Poor Dad to this point, I think that I would do so with the three/four following words:

- Simplified

- Realistic & Relatable

- Actionable

Kiyosaki breaks everything down in terms we all can understand by telling stories he experienced himself. The stories start in his early childhood, so the lessons, while complex, are broken down into such an incredibly simple and easy-to-understand fashion that I truly think it’s a great book for all investors and entrepreneurs.

He always finds a way to tie it back to a very realistic, actionable takeaway that you can have as an everyday person which is one of the reasons that I genuinely recommend the book. Giving actionable items at the end of chapters takes it from just a book of knowledge to words of wisdom in my eyes.

So, you’re probably chomping at the bit to learn about the five reasons why the financially literate cannot build wealth. I’ll stop making you wait…let’s go!

1 – Fear

“The primary difference between a rich person and a poor person is how they manage that fear.”

That sounds a bit harsh, doesn’t it? Take a step back and think about what Kiyosaki is saying – he’s saying that both rich and poor people are scared of things, but rich people can control their fear while the poor let the fear control them.

Think about it this way – everyone in their right mind would be terrified if they saw a shark swimming near them, right? I manage my fear by knowing the unlikeliness that a shark attack would happen and by listening to the rules of where the right places are to swim.

Others will let their fear control them by not swimming in the ocean at all! While I think it’s ridiculous to miss out on the swimming, to each their own – they’re just going to have one less fun experience.

Think about baseball players – the best baseball hitters of ALL TIME fail 70% of the time. If they were scared to fail, they would never be able to be a successful baseball player.

You have to understand the likely outcomes, both positive and negative, and then do your best to ensure you succeed in each situation.

The best personal example that I have with this is my budgeting experience. When I first graduated college, I created a budget but never stuck to it. I would spend recklessly on the weekends and just waste money like it was my job, just to get to the end of the month and not ever track my budget, telling myself, “You’ll do better next month, Andy!”

Guess what – I never did. Until a couple years later when I moved to Chicago and got my life in order. I go much more in-depth in this blog post about it, but long story short, I was able to create a tool that finally met my needs. It forces me to understand where my money is going but also is very simple and quick to update, and I’ve made it available to you all, known as Doctor Budget!

At first, I was scared to fail, so I never updated my budget. I finally forced myself to update it and track all of the money I was losing and at that point, I finally became financially responsible and in control of my wealth.

Regarding investing, Kiyosaki says CDs, bonds, and mutual funds are all for the scared investors. He recommends that we invest mainly in stocks if our money goes in the market because that’s where the true money is. Sure, it’s riskier, but over the long term, stocks are going to give you some incredible returns that bonds, CDs, and mutual funds simply cannot do.

2 – Cynicism

People come up with all different reasons why the financially literate don’t build wealth:

- I’m not smart enough

- What if the economy crashes again?

- I don’t care about the stock market

- There are too many things to analyze

Blah blah blah. Shut it. Those are nothing but EXCUSES!

If you think you’re not smart enough, talk to a financial advisor. But before you even do that, I challenge you to try to learn a little bit. I guarantee that you actually are smart enough. If you take the time to try to learn a bit and decide that it’s still too complicated, take a look at ETFs (exchange-traded funds).

They can be a great way to get your money in the market and still be diversified. I like IVV for the Total Stock Market and FTEC for some Tech exposure. Take a look at their Top 10 Holdings below:

I invest mainly in individual stocks, but I also do buy some ETFs simply for a bit more diversification in my portfolio, and they can be a great tool for you as well!

If you think there are too many things to analyze, re-read everything I wrote.

If you are worried about the market crashing, then stop. Let me ease your mind. Did you know the stock market has a 100% success rate of rebounding to new highs after crashing? Even after the horrible crash due to the coronavirus, which people said was the end of the stock market, we rebounded!

This success rate of rebounding is reason alone to trust in the wealth-building potential. The short-term risk of a drop is worth it to build wealth over time instead of leaving your cash to depreciate due to inflation.

If you say that you don’t care about the stock market, we might need words! Don’t insult me like that! Saying you don’t care about the stock market is like saying you don’t care about making money.

That’s fine if you don’t care about making money, but that’s like saying you don’t care about retirement. That’s fine if you say you don’t care about retirement, but that’s like saying you don’t care about spending time with your family or providing for them in a better, more efficient way than you do now. If you don’t care about your family’s finances, then that is NOT OK.

If you’re scared, learn. It’s that simple. People are scared of things because they don’t understand them. Take some time and try to learn from blogs, podcasts, YouTube, Instagram accounts, anything! There is a wealth of knowledge out there – you just have to be willing to put in a little bit of effort.

3 – Laziness

This goes hand in hand with the answer above to “I don’t care about the stock market.” Well, have you ever heard of compound interest? Warren Buffett, arguably the most successful investor of all time, refers to compound interest as the eighth wonder of the world.

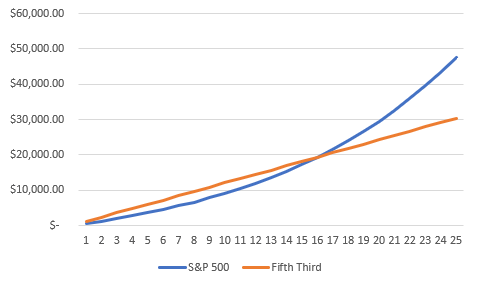

I have told the story of how my money used to be in a savings account with Fifth Third earning .01% interest annually, but now I invest it. Let’s assume two scenarios:

1 – I put $100/paycheck into that Fifth Third account that earns .01% for 30 years

2 – I put $30/paycheck into a S&P 500 Index Fund, like IVV that I mentioned above, and earn 8% annually (average since 1950 is 11%)

No contest, right? Would you rather have $30k or $47k? Easy choice.

Remember, this is with only contributing one third as much to the stock market versus the bank account. Imagine what could be done if you contributed as much to the stock market as you did to your bank account.

The initial growth may seem slow, but the compounding over the long run will be mindblowing.

But if you’re lazy and don’t take time to understand how the market works, then you’re never going to be able to get these sorts of gains. Work smart, not hard.

One of my favorite excerpts from the book is below:

“Rich dad forbade the words, ‘I can’t afford it.’” In my real home, that’s all I heard. Instead, rich dad required his children to say, ‘How can I afford it?’ He believed that the words ‘I can’t afford it’ shut down your brain. It didn’t have to think anymore. ‘How can I afford it?’ opened up the brain and forced it to think and search for answers.”

I think that sums it up better than anything else. Being lazy is a mindset. Rather than take the easy road of just saying no, try to find a way to make things happen. If it’s important enough to you then you’ll find a way. If it’s not, then you won’t. It’s that simple.

Don’t let your laziness get in the way of success in any realm of life, especially your finances.

4 – Bad Habits

People get into the habit of paying all their bills and using whatever else is left at the end of the month to fund their retirement goals or save. Kiyosaki said that in his experience, that means that people would pay their bills and then have nothing left over, and just simply not save.

I can tell you that I’ve had the same experiences, except when I did have money left over, I BLEW IT!

His recommendation is to pay yourself first instead. If you make $2000/month and you want to save $300, then take that money immediately and save it. He said that when people do this and become short on their bills because they saved some, they will naturally find a way to generate that income. When people get too close to the fire, they find a way to make it all work. Maybe that means creating more income or maybe it means stricter budgeting, or BOTH, but either way, the fact is their savings/retirement goals are on track.

Kiyosaki said, “If I pay myself first, I get financially stronger, mentally and fiscally” and to be honest, I agree with him. It’s so addicting to put that money away for saving or investing and know you won’t touch it for many years, or ideally, ever!

“And if I pay myself last, or not at all, I get weaker. So, people like bosses, managers, tax collectors, bill collectors, and landlords push me around all my life—just because I don’t have good money habits.”

Preach, Kiyosaki. Preach.

But the key is the mindset and fixing those bad habits. Pay yourself first and you’ll be setup to succeed.

5 – Arrogance

The last major reason the financially literate cannot build wealth is that they’re arrogant! People think that they know everything and when you think you know something, don’t you lose money?

Stick with what you know, and you will flourish. And as I said before, if you don’t know something, don’t just throw in the towel…take the bull by the horns and learn!

Can you imagine not understanding compound interest and not taking advantage of it?

Kiyosaki talks about how people will use arrogance to hide ignorance – man, isn’t that the truth? Haven’t you seen people in any facet of life who simply act like they know everything until they’re questioned on the topic by an expert?

I hate that “Well, actually…” crowd, but the crowd that thinks that they know it all, and doesn’t, is an infinite amount worse.

If you don’t know how something works, try to learn, and don’t hesitate to ask. One of the coolest things that I have found when investing is that people are always eager to help out one another. We’re all on this path together!

I know that I am willing to help in any way that I can, so please feel free to email me at [email protected]. Hopefully, all five, or at least even one, of these reasons really resonated with you, and you can find something actionable to take away. I learned that I have some bad habits and laziness because I always feel too busy and sometimes will not spend as much time looking into a company before buying a position as I should.

It’s not that I don’t have the time; it’s that I spend it doing other things.

I do think that I am a very busy person, but I mean, I’m freaking quarantined – if I don’t have the time now, then when will I?

It’s all about finding those small, subtle ways to improve your life and get yourself on a more efficient, hopefully shorter, personal finance journey. Don’t be afraid to take the road less traveled – it’s the better one.

Related posts:

- Don’t Work for Money and You’ll Become Rich, says Rich Dad One of the most important lessons that Robert Kiyosaki teaches in his best-selling book, Rich Dad, Poor Dad, he tells us how important it is...

- How to Identify a Cash Flow Pattern of an Asset (from Rich Dad, Poor Dad) As I continue to read through Rich Dad, Poor Dad, I must say that it’s becoming one of my favorite books and admittedly a book...

- The Surprising Disadvantages of a Savings Account (A Secret of the Rich) A lot of people will think that the best place for their money to be is in a savings account, but that’s just not accurate,...

- 10 Reasons Why Compounding Interest is the 8th Wonder of the World The words compounding interest are two of the most powerful in the investing world. Today, I’m going to show you 10 reasons why. Albert Einstein...