Updated 12/19/2023

Fintech or financial technology describes new tech that seeks to enable and improve financial services. Despite the uptick in fintech and how we use our money, many consumers and investors remain unclear about what “fintech” means.

From the latest headlines proclaiming the latest disruption in business to the emerging crypto landscape, fintech occupies a large market presence today.

How we buy things, transfer money or even invest changes daily, and fintech leads those changes. To better understand the changing landscape and how we can invest in those changes, we need to understand FinTech 101.

The fintech sector blends many different technologies, making it relatively easy to understand, but putting our fingers on exactly the boundaries of fintech remains a bit murkier.

We need to understand the major players, what new services or technologies they offer, and how fintech eases the navigation of monetary transactions. Answering all of those questions will make us better investors.

In today’s blog post, we will learn:

- What is Fintech?

- How Does Fintech Work?

- What Are Examples of Fintech?

- What Are the Four Categories of Fintech?

- Who Are Some of the Leading Fintech Companies?

Okay, let’s dive in and learn more about fintech 101.

What is Fintech?

Fintech is short for financial technologies and describes tech leveraging the ability to make financial processes easier, more efficient, and more profitable.

Fintech companies create various software platforms, apps, hardware solutions, and more to remove consumer friction.

At fintech’s core, they help companies and consumers better manage their finances by utilizing software and algorithms we see used on smartphones and computers.

In the early 2000s, fintech operated in the background, utilizing technology to support established banks such as Wells Fargo.

But more recently, there was a shift toward focusing more on consumers and redefining consumer-orientated services.

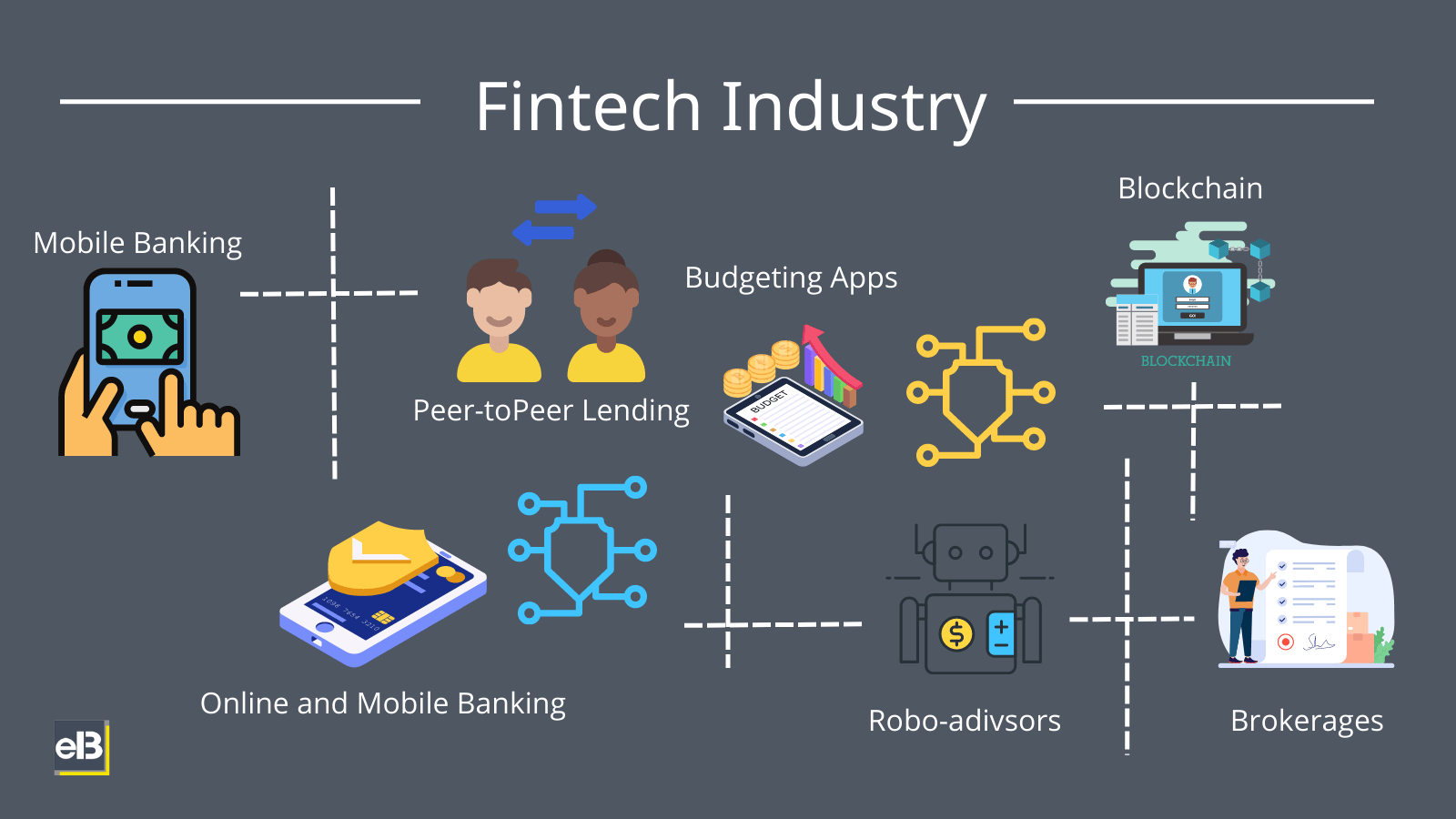

Fintech now encompasses a wide range of services and sectors, such as:

- Education

- Retail banking

- Fundraising

- Non-profits

- Investment management

Fintech also includes the growing field of cryptocurrencies such as Bitcoin and Ethereum. And while crypto grabs all the headlines, big money and the opportunities in those fields remain in the traditional banking industry. For example, today, the crypto market is worth $1.92 trillion, while traditional financial services hover around $22.5 trillion.

A Brief History of Fintech

Even though fintech seems like a newer concept, it began in the 1950s with the introduction of credit cards, eliminating the need to carry cash to make purchases.

From there, fintech evolved to help maintain bank mainframes and online stock trading platforms.

But in 1998, PayPal was founded, creating the first fintech company, a discovery leading to the launching of mobile tech, social media, and data encryption.

The fintech revolution has sprouted mobile payment apps, blockchain networks, and online payment options we use daily.

Fintech Trends for 2022

As fintech has grown and technology has improved, fintech has grown with the need to reduce friction and make using money easier and faster.

In 2022, a few new trends continue to emerge:

- Digital banking: Digital banking delivers easier access than ever before. Many consumers now manage their money, apply for and pay loans, and purchase insurance through digital-first banks such as Ally Bank. The continued ease and value will drive additional growth in the sector, with forecasts of compounded annual growth (CAGR) of 11.5 percent by 2026.

- Blockchain: Blockchain tech allows decentralized purchases, excluding public entities or other financial businesses. Blockchain technology has grown leaps and bounds over recent years, and 2022 will be no exception with the increasing popularity of Web 3.0.

- Artificial Intelligence (AI) and Machine Learning (ML): AI and ML technologies have allowed fintech to explode in scale, redefine the offered services, and enable even more innovation. AI and ML can help reduce operating costs, increase value, and detect fraud, increasing profitability. AI and ML will lead fintech into the future as the use cases develop.

The Tech That Powers Fintech

Modern fintech, driven by AI, ML, big data, and blockchain, has completely altered how businesses store data, transfer assets, and define digital safety.

AI leads the charge, changing how businesses look at consumers and redefining how they offer new services and products.

The access to bigger data on their customers allows businesses to have better insights into how their customers behave, allowing them to create new, data-driven strategies.

Big data will remain an area to watch as fintech evolves.

How Safe is Fintech?

Consumers generally trust fintech, with over 68% willing to use financial tools developed by non-banks.

Remember that many of these new products have far less oversight and regulation than traditional financial services, and taking care when embracing something new remains a good policy.

How Does Fintech Work?

Fintech describes a wide range of financial activities such as money transfers, depositing checks with our smartphones, applying for credit from an app, or managing our investment portfolio from our phones, all without the assistance of an actual person.

Fintech works by unbundling offerings by fintechs and offering new markets for those services.

Fintech startups disrupt incumbents in the finance sector by expanding inclusion and using technology to cut costs.

The most talked-about fintech startups, such as Stripe, share the same characteristics. Those companies create threats and challenges and eventually replace entrenched traditional financial services. Fintechs do this by becoming more nimble, serving underserved segments, or providing faster/better service.

For example, Affirm, the BNPL (buy now, pay later) company, attempts to cut credit card providers from their online purchases by offering consumers a way to apply for immediate, short-term loans. While Affirm rates tend to be higher, Affirm offers a way for consumers with poor or no credit to buy on credit and build their credit.

Other examples, GreenSky offers to link home improvement borrowers with banks by helping consumers avoid the big banks and saving the consumers on interest by offering zero-interest promotions.

Then Tala offers help to consumers with no or poor credit to develop credit by doing deep data digs on customers’ smartphones, looking for transaction history and basic financial behaviors. Tala uses the information gathered to offer better options than local banks, helping build credit and save them money.

In short, fintech seeks to make our lives easier by removing or reducing the friction associated with financial services. For example, applying for a mortgage is far from an enjoyable experience at Bank of America, but Rocket Mortgage can make the process easier.

For example, the mystery of our credit score or FICO, and how do I improve that score?

Upstart seeks to make things like FICO scores obsolete by using different data to help determine creditworthiness. Upstart includes employment history, education, or whether the borrower knows their credit score.

The company uses the above information to determine whether to underwrite the consumer and pricing for their loans.

Disruption drives many changes in financial services today, and fintechs use technology to enable the different services they offer. For example, many use data gathering to provide better insights into customer behavior and design better offerings for those customers.

The race for greater, deeper data insights will determine who becomes the leader in different fintech sectors. Services such as insurance, banking, bill-pay, airline tickets, and lending continue to evolve with the rise of many fintechs looking to disrupt these services.

What Are Some Examples of Fintech?

Fintech examples abound with the rise of many services, including pet insurance, pool maintenance, online shopping, ordering movie tickets, etc.

Any space, including money, remains ripe for disruption, and many provide great services replacing incumbents.

Modern fintech ranges from simple to complex, including:

- Mobile payments

- Online and mobile banking platforms

- Peer-to-peer (P2P) and other fintech personal lending platforms

- Person-to-person (P2P) payment apps

- Contactless payments, allowing consumers to pay in-store without swiping or inserting their cards

- Budgeting apps

- Account-to-account (A2A) transfers

- Blockchain and cryptocurrencies

- Brokerage services, including investment trading apps

- Any software automating previous tedious or frustrating processes

Other companies such as Robinhood and Dave began as fintechs seeking to eliminate brokerage trading and overdraft fees.

In both areas, they succeeded, with Robinhood’s popularity helping encourage other brokers like Charles Schwab and Fidelity to eliminate stock trading fees, saving consumers billions.

And Dave started as a way for consumers to do their banking using their platform without overdraft fees, which some banks use in a punishing way. Dave’s popularity helped encourage the elimination of overdraft fees, leading big banks such as Bank of America, Wells Fargo, and Ally to eliminate their overdraft fees.

So, fintech helps create better services for consumers and helps drive social change, saving people money.

The services listed above represent a drop in the bucket of possible services, and consumers looking for better services in fintech can find them if they look.

What Are the Four Categories of Fintech?

In the fintech sector, there are four main categories of fintech:

- Digital lending

- Payments

- Blockchain

- Digital wealth management

Let’s explore each segment of the fintech sector.

Digital lending

Digital lending refers to tech-driven lending from nonbanks. Access to data, algorithms, and powerful computing enables new companies like Upstart to compete with the big boys like Bank of America.

Companies such as Upstart use digital platforms to enable funding. Many borrowers include consumers and small businesses, with individuals and institutional investors providing the lending capital.

Digital lending ranges from student loans to small-business loans, with mortgages and auto loans emerging areas.

Digital lenders such as Upstart or Carvana match borrowers and lenders, benefitting from loan relationships (interest) and processing transactions (take rates).

The digital lending addressable market continues to grow, from $10.7 billion in 2021 to an estimated $20.5 billion in 2025.

Digital lenders have two primary business models:

- Direct lenders who originate loans to hold in their portfolios on the balance sheets

- Platform or marketplace lenders who partner with banks to help originate loans, who purchase them from the platform lender or platform investor

There are three main publicly traded digital lenders:

- LendingClub: the marketplace lender focusing on consumer loans

- Upstart: focuses on consumer loans, connecting banks and credit unions with borrowers with their AI

- Square: lends to its merchant clients via Square Capital as short-term working capital loans, which its merchants repay using their payment receipts

Payments

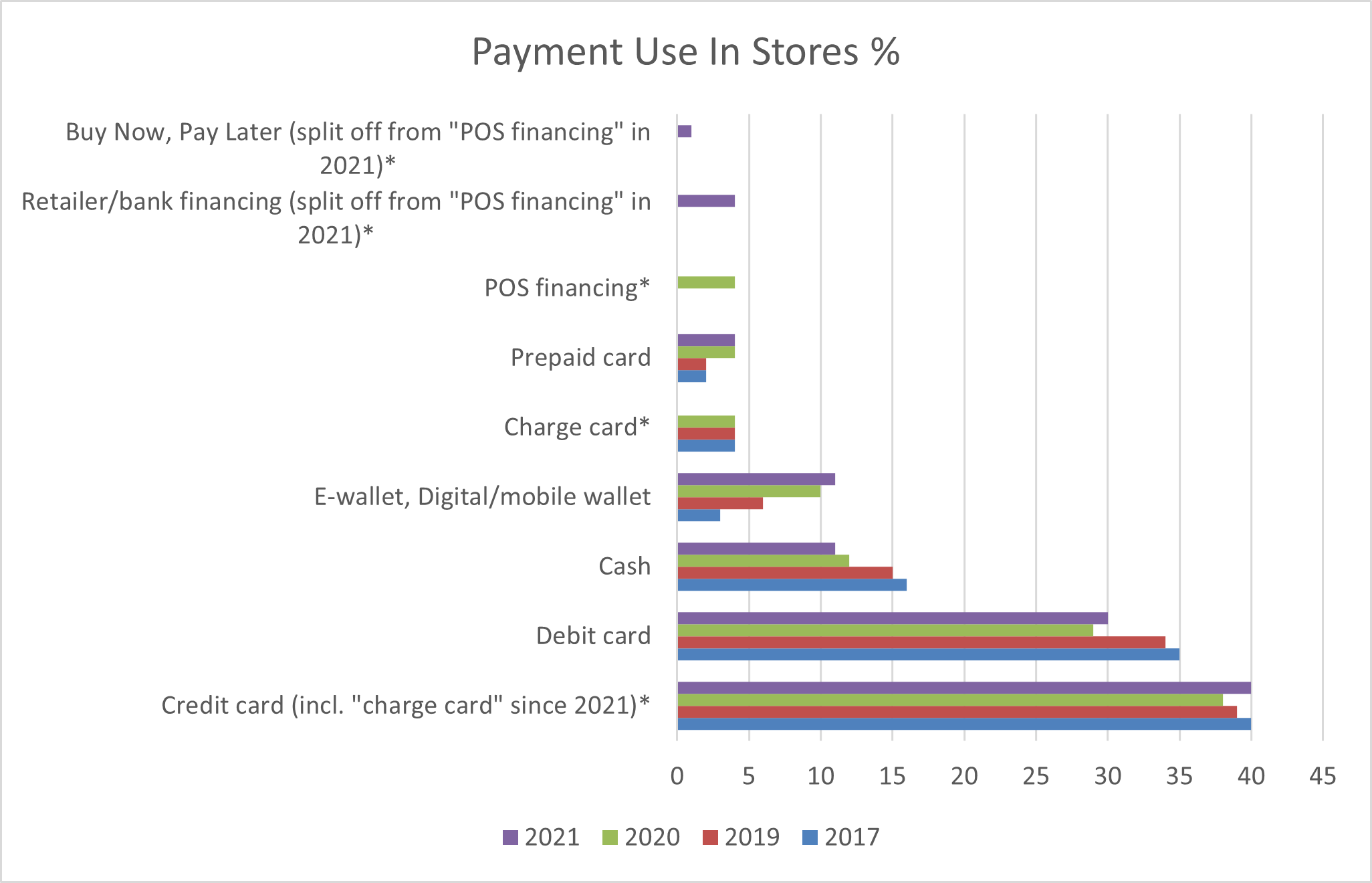

Payments, my favorite fintech segment by far, increased usage in 2021, up to an average of 34 payments per consumer.

The US payments system maintains a hornet’s nest of different banks, fintech companies, social media, and retailers. Between evolving technologies and social changes, the payments system saw a dramatic shift in initiating and processing payments.

The explosion of smartphones and the growth of mobile payments have unlocked innovation across the system, with three particular areas of growth:

P2P or person-to-person payments refer to transferring funds from person-to-person accounts using ACH (Automated Clearing House) or debit/credit card systems. Many providers in the space, including banks (Zelle) and fintech companies such as PayPal and Facebook.

The ACH system costs less for transfers than credit/debit card processing. The ACH system bypasses the gatekeepers such as Visa/Mastercard, for example.

Smartphone apps enable the rise in in-store payments, using a variety of methods for the payments, for example:

- Near-field communications (NFC)

- Quick reference codes (QR)

- Barcodes

These payment methods eliminate the need for a physical or gift card, making the checkout process much easier.

The most popular apps in the ecosystem:

- Apple Pay

- Amazon Pay

- PayPal (in-store and online) checkout

- Starbucks apps

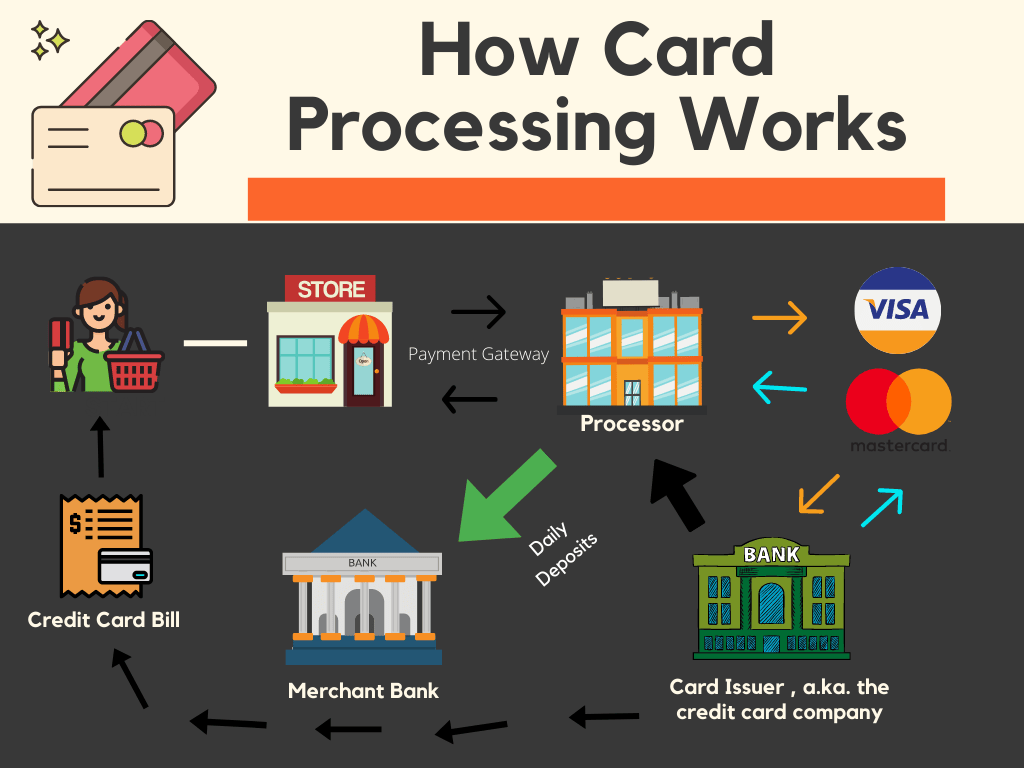

The payments web contains many players in the US, some fulfilling particular roles, others taking on many different sides of the payment wheel.

To process payments, credit or debit, a cycle moving through the process includes:

- Merchant (Target)

- Merchant processor (Fiserv)

- Gateway or Scheme (Visa)

- Merchant bank (JP Morgan)

All these players in the payment space take a piece of the pie, and some occupy dual roles; for example, Fiserv can act as both the merchant processor and bank, as can JP Morgan.

The most aggressive disruptions happening in payments occur in P2P, where companies such as PayPal, Venmo, and Cash App enable easier payments, replacing cash and checks and threatening the role of banks.

Banks continue to fight back by enabling systems such as Zelle, incorporating additional features, and using M&A to buy what they lack.

The payments space will continue to evolve while becoming a fascinating place to watch innovation continue to escalate.

Blockchain

Blockchain’s main goal in life continues to decentralize finance through a shared ledger of transactions.

Below is a good description of the blockchain, helping define what the blockchain can do.

“The three main components are a peer-to-peer network with randomized groups, or nodes; a database, or digital ledger; and third parties. When a third party submits an entry or payment, to the ledger, the nodes work together seamlessly to either approve or reject transactions. With no central authority, this eliminates the need to trust one party such as a payment processor. Everything is timestamped and protected by cryptographic signatures or complex algorithms that provide data integrity. As such, if any party attempted to retroactively adjust transactions, it would be visible to every node in the network, essentially making transactions fully immutable once submitted.”

The blockchain remains in the early innings of its evolution, and it will be interesting to see where and how this technology will evolve.

Bitcoin and Ethereum are the early winners, but the space continues to evolve quickly, and where it goes, no one can say for certain.

In general, Bitcoin and crypto continue to be polarizing topics in finance and will likely remain so for quite some time. It is not an area I am familiar with, and I haven’t spent much time diving into the space.

Who Are Some of the Leading Fintech Companies?

The fintech space remains wide-open, with many different players occupying leadership in the many types of fintech.

For example, in the P2P payments space:

- PayPal

- Venmo

- Square Cash App

- Zelle

- Google Pay

Some of the top fintech stocks, for example:

The above graph outlines some of the bigger names in fintech, but thousands of companies are fulfilling the payment needs of customers and businesses.

Companies such as Robinhood enable easier stock trading, Wealthfront enables wealth management, and Lemonade enables insurance.

Much of the focus of today’s article centered around US-centric companies, but the whole world has joined the fintech parade, including India, China, Africa, Europe, and Latin America, to name a few countries and regions.

India, for example, uses a Unified Payments Interface (UPI) that differs from the hybrid system embraced in the US. The legacy public infrastructure uses a semi-open ecosystem of tech giants (PayPal) sitting on top of the infrastructure in the US.

The UPI system contains no single private company access to data and identity in India. Connecting to other companies is in the public good instead of a system manipulated for profit.

India’s UPI system virtualizes accounts and facilitates customers undertaking merchant payments and fund transfers.

Investor Takeaway

The fintech world continues evolving and changing, and many companies offer interesting investment ideas.

The guide will help you understand the language of fintech and how to find the best opportunities. Understanding the differences between payment processors and loan originators will help you find good possible investments and how these companies generate income and profits.

Understanding fintech 101 and what drives each of the different segments of fintech will go a long way toward finding good, long-term investments.

The fintech world remains exciting, with lots of growth, innovation, and disruption. And with the accelerating adoption spurred by the COVID-19 pandemic, how people use their money will only continue to adapt.

And with that, we will wrap up our fintech 101 discussions.

Thank you for reading today’s post, and I hope you find something of value. If I can further assist, please don’t hesitate to reach out.

Until next time, take care and be safe out there,

Dave

Dave Ahern

Dave, a self-taught investor, empowers investors to start investing by demystifying the stock market.

Related posts:

- Embedded Finance: The Services Revolutionizing the Financial Industry Updated 9/27/2023 The coronavirus pandemic accelerated businesses’ decisions about payments and how they would accept payments easily for both consumers and the business. These decisions...

- What is Banking As A Service (BaaS)? Finally the Future of Banking? Updated 4/4/2024 One of the hottest scenes in the market today is fintech, with $266 billion in new investments in the first half of 2021...

- Peer-To-Peer Payments: What To Know Updated 9/27/2023 “Mobile devices, high-speed data communication, and online commerce are creating expectations that convenient, secure, real-time payment and banking capabilities should be available whenever...

- Real-Time Payments: A Guide to the Next Big Thing Updated 9/27/2023 When most think of payment systems or rails, we think of Visa, Mastercard, or American Express. The real-time payment system gets lost in...