Updated 1/18/2024

One of the biggest mistakes that I see with people is that they lack a food budget. Honestly, that is mind-blowing to me because food is usually people’s third-largest expense behind their housing and transportation expenses, and quite frequently, it can even be the second-largest expense!

Personally, I aspire to be in a situation where my food budget is the most expensive category that I have every month… because that means that my mortgage and vehicles have all been fully paid off!

Imagine the wealth you could have if your primary spending were food 🤑

Even if you are single and have a $300 car payment, I would anticipate that you spend more than that on food. Food spending isn’t a minor financial concern.

The issue with people having no idea what sort of money they are spending on their food is that it can become a bottomless pit where their money just disappears. I know that I have certainly felt that.

My Failures with a Food Budget

During COVID, the grocery bill for my wife, my 15-month-old son, and myself had drastically increased to over $1000/month at the grocery store only. Yes, $1000/month in groceries for like 2.25 people because my son eats so little.

Now, in fairness, that also includes things like paper towels, toilet paper (when you can find it!), cat litter (I married into two cats), and alcohol…which has also coincidentally picked up since COVID began. It’s not that the consumption increased, but the quality certainly did, and so did the price tag.

So, that puts us at around $225/week on food-related spending. On some weeks, it can be $150 if we’re just getting groceries. Other times, we have spent nearly $300 if we’re stocking up on many things at once. It’s just a law of averages.

This was up about $200/month from COVID, but our eating out budget dropped about $400/month, so overall, we were actually spending less. My wife and I LOVE to go out and get a nice meal, an appetizer, a couple of drinks, and wham – you just spent $100…easily.

It’s a quick hundo down the drain, but it’s something we value a lot as high-quality time with just us. Never be afraid to splurge on things that bring you value as long as they fit within your budget.

COVID certainly took that away from us, and we were forced to save because we couldn’t go anywhere.

Well, COVID is finally on the backburner. When you combine that the world is opening back up with the fact that I recently got a new job and my wife and I have been traveling a bit to look at housing, we have quickly racked up some of those $75-$100 meals that I have talked about.

In addition, our best friend asked us to go to a steakhouse to celebrate his birthday in a couple weeks. It’s our first indication of times changing from back when we were too locked down to go out to dinner with anyone.

It’s a catch-22.

A Trick: Split Up Groceries and Eating Out

But this transition has opened my eyes to something – breaking up your grocery spending and eating out expenses is silly – they need to be the same!

If they’re separate and you go an entire month without eating out, you’ll likely overspend at the grocery store and then underspend at restaurants, right? But you only know that because you looked at both lines and then compared the two, so why even break them out in the first place?

The same goes for if you only ate out and never got groceries. It’s skewed!

I know this might seem obvious, but I always break them out and think it puts me at odds with our budget.

If I would instead group them, I could see eating in as making a money-conscious decision rather than leaving the grocery store and going, “Ugh, we just spent another $200,” when I might spend that on just one dinner in a couple of weeks!

I am getting so in the weeds about this because I want to show the importance of understanding how your mind works and ensuring that your budget considers that. Personally, this is why I use Doctor Budget because it’s extremely quick and simple to make the changes from my categories of “BED” and “GACH” to just change it to “Food.”

Don’t know what BED and GACH are? They’re just some of my Doctor Budget acronyms 🙂

How to Reduce Your Food Budget

But when it comes to reducing your total food budget, there are two different areas that you can focus on – groceries and eating out.

The #1 way to reduce this entire food budget is simply to eat out less often in favor of cooking meals at home.

I have sometimes gotten the argument from people that dollar menus are cheaper than cooking, which is hard to argue. Additionally, if you only eat off the dollar menu, then you don’t even need to worry about saving for retirement because you’re likely going to die when you’re 40.

That’s my cynical side coming out but please, do not ever sacrifice health for wealth. A common cliche in sports is that “the best ability is availability,” and the same exact concept applies to your life. Your money doesn’t matter if you’re not here to use it.

We eat extremely healthy in our family, and we implement some of the following tips:

Tip #1: Shop the perimeters of the store

I guarantee that you have heard this before and it’s one that I resonate with. This means that you’re sticking to dairy, meats, veggies, and fruits, and I think that’s mainly what you should be eating in your diet. Also, when you do this, you’re going to get cheaper items than if you were buying prepackaged items that just need to be thrown in the oven.

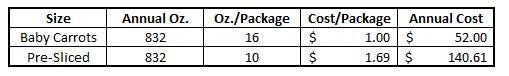

Heck, I literally will buy my own baby carrots and cut them into pieces for salads instead of buying the ones that are already sliced. I know this is ridiculous, but I get 16oz for $1 vs. the pre-sliced kind, which is 10oz for $1.69. It might not seem like a ton of money, but over the year, it is:

Expand this out to the rest of your fruits, vegetables, meats, etc., and you can quickly see $1,000s in savings piling up.

By simply looking at the labels, I have found a way to save over $90/year simply by slicing my own carrots. No brainer right?

Tip #2: Take a Lap

Before you even start shopping, take a quick lap around the store and see what’s on sale. Of course, you can see the weekly specials on a grocery store’s online app or in their ad, but they also likely have certain special items that might expire. Don’t hesitate to clear out those items, use them that day or the next, and freeze anything remaining.

I was texting with Andrew and Dave a couple of weeks ago, and we were talking about buying meat in bulk (we’re pretty cool, right?). I said that the store that I go to usually has a buy one get one free deal on pork chops every 2-3 weeks. So, even if we’re not eating pork that week, I will buy 2-4 pounds and just freeze it so we have it at a price of 50% of the normal price.

But when I take a lap before my grocery shopping begins, I can get a feel for the things on sale and then create my meal plan for the week while I am still at the store.

If you don’t take a look for deals beforehand, you may have a cart full of stuff when you find a deal, and decide to sacrifice that few extra bucks instead of putting some of your cart back.

Tip #3: Be Strictly Flexible

“Andy, that makes no sense.”

I know.

But I am saying that when you go into the store, have an exact idea in your mind of what you need and then holes that you need to fill in. What do I mean by that?

A “need” would be if you’re out of something you must get, like coffee, milk, eggs, etc. Something that is typically always the same price and you don’t want to, or can’t, swap in and out.

But the “holes” consist of things like lunch and dinner. Maybe you plan with your significant other that if beef is on sale, you do burgers; if turkey is on sale, you do an oven-roasted turkey meal. You might know that chicken is always $1.88/lb (as it is at Meijer), so that can be a dinner or lunch, depending on the other options.

Maybe you decided to do a grilled chicken salad for lunch, and then you’re flexible on the types of greens, vegetables, and dressing depending on the sorts of deals that you find.

In other words, you’re meal planning but with a lot of asterisks and room to be creative. This is how you can still plan and be prepared to move in the moment to save money.

And guess what – even if you go buy that turkey that’s on sale and your significant other says, “Nah, I want chicken instead,” just freeze it and now you make chicken instead. Be flexible. It makes life a little bit more fun anyway!

But groceries are just half of it – you have eating out to worry about!

Tip #4: Find the deals

When you’re eating out, always start with the deals. Look for happy hours for both food and drinks and find ways to be creative with them. Maybe you hop between restaurants to capitalize on different times of deals that are going on. Maybe you eat an early dinner somewhere because it’s their happy hour and then go to a place late at night for their half-priced apps after 10 PM.

What I love about this is it’s forcing you to get out and try new places, do new things, and just be a bit spontaneous. You don’t have to plan it – just google “late-night happy hour” and see what you can find.

When I lived in Chicago, I would always find websites showing me the times and their happy hour specials, and if one looked enticing, I would call the place and confirm it was true.

The point is deals are out there – just find them.

Tip #5: Make the deals

Why not meet some friends for drinks, then go home and have a dinner party, or maybe even order something to-go? By doing that, you’ll save so much on the food, and if you get it to go, you’ll likely miss most of the tip and not buy the drinks you might otherwise have gotten. That $40 bottle of wine can be picked up at your local liquor store for $8.

I experienced that firsthand when we ordered a $70 bottle of wine, and I googled it to read reviews and saw it was sold nearby for $11…

But again, as with all of these, be creative in having fun with your friends and still staying within your budget.

Remember, you are the average of the five people you hang out with most, so if these people aren’t in your camp on some of these strategies you’re trying to implement, then it may be time to expand your friend base.

They need to be supportive – you’re trying to better your life!

Summary

In summary, your food is your food, and you should think of it that way – one cohesive expense. It will be the quickest budget category to decrease as long as you track your spending and make an active effort to identify those “leaks” of where your money is going.

But your food leak is likely just one area where you’re losing money each month – I’d be willing to bet you’re forgetting about these categories as well!

Related posts:

- Figuring Out the Right Amount to Spend on Groceries Each Month Are you trying to figure out where all your money is going each month? Is one of your biggest spending categories at the grocery store?...

- Monthly Budget Busters: Saving Money by Cooking at Home Sometimes the smallest thing can make the biggest difference. See how saving money by cooking at home can have more than one positive effect. Have...

- 11 Grocery List Items You Can Buy Online to Save $100s on your Budget Do you know if you’re being overcharged at the grocery store? With the advent of online shopping, there are things you probably buy at the...

- Tips on Mastering the Art of Eating Out on a Budget Are you a person who has a hectic evening life? Are you constantly running around in the evenings and thinking about what you can eat?...