Podcast: Play in new window | Download

Subscribe: Apple Podcasts | RSS

Announcer: 00:00 You’re tuned in to the Investing for Beginners podcast. Finally, step by step premium investment guidance for beginners led by Andrew and Dave to decode industry jargon, silence crippling confusion, and help you overcome emotions by looking at the numbers, your path to financial freedom starts now.

Dave: 00:35 All right folks, we’ll welcome to Investing for Beginners podcast. This is episode 90. Tonight we have a special guest back from a very popular episode 38. We have a full time a micro cap investor who is the CO-founder of Geoinvesting.com, and he’s going to talk to us about his special brand of investing, and he’s a really smart dude, and he’s got some great insights for us. So why don’t we go ahead and start chatting a little bit about what you wanted to talk about tonight Maj.

Maj: 01:04 Yeah. I appreciate the opportunity, and I want to congratulate you on the success you’re having with your podcast. It’s, I think we’ve been over a year since we chatted and it’s really good to see your kind long educating investors, and young investors and how to navigate the market and I appreciate that.

Andrew: 01:22 Yeah, thank you. We talked off the air before we started to record this, how we just said a million dollars today, so I’m going to be popping a bottle of champagne after this.

Maj: 01:34 Hopefully everybody is if we can help them, help them. Uh, with this podcast with. Yeah, let’s do it. I had to make some money in the stock market.

Andrew: 01:43 Something a thought it was really good timing for us. You had reached out and told us about some of the research you were doing about one of the SEC forms called the form 4. So we just did last week’s episode on the 10 K and, there’s a lot of different reports and files that, that these companies have to file. I don’t think as to be a successful investor; you need to necessarily be an expert on every little detail, every little legal kind of term. But there are some things you can pull out from some of these general forms that are freely available online. And you, you talked about the form for as being one of those that you’ve been researching, and you can teach us some good stuff on. So can you talk about the form for a little bit and tell us how we can use it to educate ourselves about stocks better?

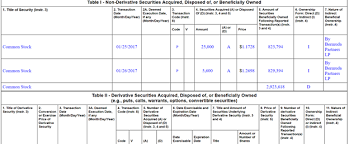

Maj: 02:39 Yeah, thank you. I’m just gonna add the SEC documents are a great place to search for tidbits of information that are omitted from press releases and other easy places to find information and you know, to find information in the market hasn’t found yet. So that’s great that you’re starting to dig into that. We kind of, we call it information arbitrage, you know, find this free public information, that investors either aren’t looking for or maybe too lazy to look for or this an Ohio look for it. And I think is one of those things. So form fours basically, track the buy and sell transactions by management and employees, board of directors in 10 percent. Owners of stocks, I call that Meebo Meb. Oh, for sure. And it’s a great way to see what management teams are betting on their stocks to go up, maybe what management teams are betting on them to go down or cashing in.

Maj: 03:44 And, you know, we’re, you know, we’re just looking for clues in this file, in this form, four filings, to that end. And it’s great; it’s a great place to get some confidence in your, in your investment decisions. Especially like right now when the market’s so volatile. Um, when, when we looked at September, October, November, December, when the market was falling apart, we were using these form four filings and see what companies were really, um, when the, when the stocks were going down, we’re telling us, hey, that the market’s overreacting. And during that period, really saw an acceleration of management teams going in there and buying their stocks, which basically conflicted of what the media was talking about, how we’re going to recession. The world is ending in all Kramer’s telling. No, I’m his viewership that he’s invested. He’s talking to his big cap companies who are telling hung on the world’s ending.

Maj: 04:43 Well, while that’s going on, all these a microcap companies we were following were buying stock, and that was an interesting clue. So it’s, it just helps you. It’s another tool to help and invest your help you gain confidence by, while markets are turbulent, are volatile, and you know, it’s, I don’t think it’s necessarily, um, these filings aren’t necessarily the easiest things to understand sometimes from my face value, there are certain codes that are associated with the transactions, and if you don’t understand the codes, you’re not necessarily going to understand some of the relevance of these filings. And um, so that’s what we do. We’re always looking at these filings we have, we, we’ve developed an internal product actually which helps us kind of track what’s going on these founders and in real time. And then we’d, sometimes we make investment decisions based on that and when we bring these findings to our premium members and help them and help understand how to use these filings. So, you know, they give you an example. There’s a when you go into the SEC.gov,

Maj: 06:08 When you type in a symbol ego, this is, see this filing lists and you won’t see the form four filings. That’s the first kind of frustrating thing for an investor like you don’t know me, might not know where to find these insider filings. And when you go to SEC.Gov, you’ll see a, a, um, a tab there, we’ll, we’ll say ownership at include or exclude or only, and you have to know the cat, the click, the right selection there, the CDs form four filings. So that’s, that’s the first thing you need to do.

Maj: 06:43 And then the real difficult part about this is these codes I alluded to earlier here, and here’s the key, and now this is a great saying by Peter Lynch. He said, you know, um, insiders in management teams will sell their stocks for a variety of reasons or shares and their stock for a variety of reasons, but they’ll buy them for only one. They think the stocks to go up. So we need to see which transactions are making our high conviction transactions. And this is important because the data supports following in the footsteps of insiders. I’m the stats show that if you do that if you found what they’re doing, you can beat the market by between seven and 11 percent annually.

Andrew: 07:42 So that’s significant over time. Now the question for you manage. Sure. So these form for just as a recap real quick, these are basically we’re talking about inside there. So this could be a board of directors, correct?

Maj: 07:58 Yes. It can be a manager meant employees, board of directors or even 10 percent owners, like large shareholders who aren’t necessarily part of the management team.

Andrew: 08:08 Okay. So what, what, what requires somebody that they need to form to file this form? Is it like there is certain net worth, they have a certain amount of shares, like how does that.

Maj: 08:19 No, if you actually, if you were an employee or a director or any capacity if you buy one share, I mean, I don’t know necessarily exactly, but I think it’s if you, if you are transacting in that stock, you know you need to file this form for us. Um, I don’t necessarily know there’s a, there might be a low threshold for different positions in the company and like if you’re an employee versus management versus board of directors, that’s a good question and something I should look into. But, you know, generally speaking, if you’re an insider in any capacity, um, you need to file these warm force when you’re transacting in stock.

Andrew: 09:02 I would assume that the ones that pull up on sec.gov are probably going to be the higher percentage type form for us anyway. I mean I’ve, I’ve dabbled with it a little bit, and I know like when I pulled them up it was people who you’re reading about in the annual port, like the kind of like the big dogs, these guys who have a big chunks of stock ownership of these businesses. So I’m sure there’s an easy way that you can kind of filter and get the important form for us versus ones that are just, you know, ones that are like onesies or twosies. So I guess my next question about this is inside the farm for itself does, is it telling you how much, like let’s say it’s per person, right? There’s like there’s a form for per person per whatever transaction they’re doing,

Maj: 09:58 We’ll disclose the person’s name, the position at the company, or if it’s a 10 percent he or she is a 10 percent owner in the company, and it will also disclose how they bought. You know, how they came up, let’s say what’s this used, for example, it’s an increase in the position how that individual camp came. If you getting those shares, and this is really important as an investor, you really want to focus on the transactions where management is directly buying stock in the open market or through some private transaction like put it in their own money in the game, skin in the game as opposed to shares being acquired through options or awards or grants, these kinds of things. Because that’s free shares.

Maj: 10:49 And, and that’s if that’s truly the most course of what we do, we, we want to follow the magic teams were putting their money into the company, and those are the significant form fours we’re looking for. And these form fours will also tell you though; now there are codes associated with the transaction. And so there’s, there are some codes that basically let you know, okay, this was an option, or this was an award, this was a grant of, this was something, um, indirect purchase of this indirect purchase of the stock or, or they got it through some, you know, free means you have to do an option or, or a grant or something like that. Um, and those, there are trends, there are codes that let you know if it was a direct purchase or a direct sale, for example, the form will also tell you how much money was spent, how many shares were bought. And also the total position the insider has taken into account the new.

Andrew: 11:54 Okay. Gotcha. That makes, that makes a lot of sense. So there’s, there’s enough data there where you can make these, you know, you have to be smart about that obviously and compare before and afters and things of that nature. But obviously I think it’s kind of can be on as if you’re seeing a lot of these insiders and they’re buying a lot of these shares with their own money, like you said, outside of options or grants or anything that is a very bullish signal because somebody who’s inside the business, they’re, they’re dealing with this in the day to day. They’re seeing things that we can’t see as far away investors, and it can be a nice kind of a signal to us that hey, here’s, here’s a, here’s a case where maybe I already liked the stock. This is just another reason to like it.

Maj: 12:44 Yeah. And it helps build your confidence, and that’s what we need as investors continue to build our confidence and our decisions.

Andrew: 12:51 Okay. So how about like selling wise, because I’ll give an example. I use this free website called finviz.com. It’s a screener. They don’t go super in-depth, obviously like a form forward, but they have inside their transactions, and them kind of highlight here are some buys, here’s some cells like option exercises and that shows some of the big, big people in the corporation. Uh, is there a way like some of the coming in and not understanding much about these form fours, is there a way where they can differentiate some of this selling? Like is that like a code thing where maybe they’re selling significant positions that aren’t related to hey I’m just trying to cash out this option and can they use that as a signal kind of in the same way that you can use a buying signal to be bullish? Can they use like certain selling signal to be bearish on the stock?

Maj: 13:46 Yeah. I’m mainly looking at insider buying because you know, back to that statement with pure lynch in Saturdays we’ll sell stock for some reasons, but they bind only London stocks to go up. I find it more useful, you know, to look at the indicator as a bullish indicator, not necessarily as a bearish indicator.

Andrew: 14:09 Yeah, that makes sense. Do you have an example of one that you used recently where you saw a certain amount of buying and that really clued you in to, hey, this could be a stock I’m even more interested in, and then I ended up going higher.

Maj: 14:27 Funny. You should ask a lot of case studies that we’ve highlighted through June investing basically on that point. So and what’s interesting too, because there’s a lot less interest these days in the microcap universe. The delay to the, to these positive developments in the forum for kind of transactions is greater than ever. So you have a lot of time to follow the insiders, and you know, you get some decent buys, some stock, and some decent prices before the market even notice what’s going on. We’ll give you a great example, Bob if you. Before you even get to that, there’s something. These form four is when you’re looking at them, you can go deep into the forum for us past the first page you see on the sea and the sec.Gov, uh, to digging into the transaction history of the actual insider. Yeah. One thing we like to look at, for example, is if we’re seeing a significant transaction by an insider, we like to see, okay, what was the last time this I might’ve bought stock and if we see a clue leg, it’s the first time we got to like, hold on, I got a train coming here.

Andrew: 15:55 Is that money in it?

Maj: 15:58 I hope so. I hope so. It’s a three-way split by the way. Yeah. So yeah, there was one company, I’ll give you a few companies here, but it was one, it was a symbol as EVK ever glory I think is a name, and the stock was around, I want to say three bucks maybe. And we noticed, and it’s a reverse merger, China Company, that, that reverse merger that went public on the US, but there is China-based company, and that’s just the area of the market that we have not invested in a long time because of a lot of fraud there. And that’s a topic for another case study. I mean another podcast, you guys.

Maj: 16:48 But one thing we noticed was that the CEO is purchasing a huge amount of stock and because we know how to use utilize a form for us, we said, well, we were curious, okay, well when’s the last time you bought stock? And he hadn’t bought stock and several years was this first big purchase. And it was one of those things where the market didn’t pick up on it right away. And the stock, I think within a couple of weeks, you know, what the four bucks, it was a pretty quick swing trader. He wanted to utilize that. So that’s just one example.

Maj: 17:19 Another example is a company stock symbol is BXC and this is a stock that is a building, a building material company or a building supply company. And we have been covering this stuff for some time, I think this is in 2016 when we first started covering this stock and they were going through a restructuring stock was maybe, you know, nine, 10 bucks at a time and the stock really wasn’t doing much. It was going up and down as the company was in a really tight range while the company was going through restructuring to sell assets to pay down debt and get back on track again. And we really liked where management was heading, but for about a year and a half or so, we know that there was no insider buying going on at the company. And all of a sudden out of the blue, I think it was toward the end of 2017, the company did an offering to stock was around nine bucks that the company did an offering.

Maj: 18:26 A basically some. This is a great example, could you asked about earlier about how do you interpret insider selling versus insider buying? So what’s going on here was there was a a large institutional shareholder who owned about 50 percent of the stock and wanting to get out, so that’s a large chunk of stock they had to sell relative to the size of the market cap of the company. So there was, they didn’t offer the company did a off, basically organize an offering so that the large shareholder could sell a stock and an offering and it ended up pricing at $7 a share, which was significantly below where the company was trading stock was trading at the time. After that occurred, then we saw, we noticed insiders started buying stock, actual like, you know, I think the CFO bought some stock and some other directors. So we saw that as a variable shine and make a long story short a couple of months later to stock what the hint, I think 45 bucks a share pretty quickly when some things that guy catalog is that the company made an acquisition that was transformative.

Maj: 19:37 So that was a situation where, okay, a large institutional shareholder sold a big chunk of stock. We could have looked at that as a negative thing. We chose to look at the insider buying as a positive thing because we had been known that the management team had not bought any stock in two, three years and all of a sudden they’re blind stock. So that was a great clue to add to our position that we already had and basically increase our confidence in whole in that company. And it was, it was a really great win for us. And hopefully some of the members are Geo who might’ve had that too. That’s funny. That’s literally like in a perfect example, just like you said, based on what I was asking you earlier, get the differentiation there and there’s a not a great case study and this is, this is a great case study to help understand how this looking at insider buying can help increase confidence in times of trouble.

Maj: 20:37 The stock symbol was our EPR, and now I got to disclose, I own both these stocks and um, you know, I’m, I’m, I’m not an investment advisor and saying, you know, we should see anyone’s, you’ve got bodies, stocks. But I am along these companies to get that, put that on the record there. So our EPR is a stock. I uh, I owned since actually 2007, and it’s a medical device company that was attracted to. And then you think about it originally like around maybe 10 or twelve cents and um, I think it was around 2015, I believe. Stock us, you know, printing forty cents, fifty cents with. I haven’t had it was falling, making a move. They had this FDA FDA problem. Um, they received a warning letter from the FDA regarding their effort. Their medical device in the stock plummeted. It ended up; I think low twenties at one point.

Maj: 21:38 So we didn’t know what to do here, but we still believed in the product. We wanted them to leave the company, the company, when they were saying, hey, they’re taking care of this, going to resolve this issues with the FDA, know we need to see something more to help us with our confidence level here. And we noticed then that this activist investor who hadn’t been involved with the company, Joe, Joe Manko was his name and he was over a fund called Horton capital management, started bought a stock and at that time he was only an investor. He wasn’t on the board or anything or any kind of capacity with a company like that in management capacity or director capacity. Like okay, why is he bought it? But why is he still. Why’s this guy buying stock in the midst of this turmoil going on? Because this could be a zero potentially if the FDA came back and drop the hammer, then we, he was constantly buying around, you know, twenty five cents, thirty cents 30.

Maj: 22:44 It was pushing the stock up himself. He was a lot of, some days maybe only the, the only volume there. Then Mr Mack joined the board. So that was on the board and keeps on buying stock. So the stock today is a buck 50, I think you hit a buck 70 not too long ago and he’s still buying stock up here. So that was a great example of fall falling insider. Just gaining confidence that, hey, we made the right decision, this guy’s buying stock, so we’re going to stay, we’re going to stick with this. And that worked out well for us. So just another example.

Andrew: 23:24 Yeah, those are, those are great. Obviously some big moves and some of those stocks and I think when you play and kind of invest in that space in the microcap space, you can get a lot more movement as far as the price volatility and little level events. I mean not to say an FDA type deal for a company that size isn’t like a huge. I, I obviously don’t know the story behind it, but I’m sure there is a lot of uh, potential kind of things that could come out of it that could’ve been really negative. But obviously it really worked out. So you know, that all being said, Dave and I obviously have a very different, very different but similar kind of approach to the way that we look at the stock market. We both personally don’t go. And then he saw the microcap stocks ourselves.

Andrew: 24:18 Knowing that the price can kind of move a lot and you can get these huge gains and also huge losses from being in stocks like this. How do you, how do you kind of structure a portfolio and is it any different than kind of the standard portfolio advice? So as an example, I think one of the most common portfolio for some of the picking individual stocks are very common diversification strategy would be 15 to 20 stocks. Anywhere from a five to 10 percent position size. Do you do something similar with your picks? Are you adjust scene or a kind of crafting the, a different strategy based on the type of stocks you’re buying?

Maj: 25:05 Yes, I’m, I mainly invest only in these smaller companies. So what I’m trying to do is, okay, define maybe the top, you know, five to 10 high conviction stocks and I might have for my portfolio and I put most of my money and those docs around that, around that fringe I’ll, you know, make bets here and there that it may be our swing trades are some shorter-term plays around that or maybe longer term play is that I think might be good in as the series progressed I just want to have it in my portfolio to watch it and be part of it just in case things do work out. And I have had a model portfolio with NGO that we call our favorite model portfolio, which kind of outlines some of the stocks that I feel the most confident about.

Speaker 1: 25:59 What’s the best way to get started in the market? Download Andrew’s Free Ebook atstockmarketpdf.com. You won’t regret it.

Maj: 26:14 Hold on, hold on. I thought it was coming out of prison, but now it’s. Okay. So that’s, you know, I’m just trying to run as the market has become, has changed over time. My men Pi positions in my portfolio have decreased and I putting more money into my higher conviction stocks that I like because the environment’s changed so much where a, just I’ve noticed that it takes a lot longer than it used to sometimes like before 2000 and prior, before 2008 for some of these stories to catalyze because there’s just less Meyer cap investors right now out there, and it’s other things going on in the environment that are making it tougher for microcap investors to or for an ambassador to want to invest in these companies. So I need to really, really, really be confident and more than ever and some of the decisions I’m making because I have to hold these stocks longer term that I had in the past and why when I’m doing that, of course, I gained more conviction and am willing to take bigger bets and. But I’m holding fewer stocks probably than it had in the past. I mean there was a time before 2008 where I would have had anywhere from 50 to 300 stocks in my portfolio. Now it’s, you know, much, much less than 50, so I can find a lot of good stories, but it’s just a matter of I’m just trying to stick with the higher conviction stories and more so than ever before.

Andrew: 28:02 I guess it’s the philosophy. How’s it go, Dave? The buffet quote where he says something about risk is not knowing what you’re doing.

Maj: 28:12 Yeah. The luxury and the nine when I was investing in the late eighties and nineties and two thousand were a lot of, you know, stuff that probably shouldn’t have got a went up, and there wasn’t just, it was a good time to be investing. So your high conviction stuff went up, and even some of the lower convictions things will go up, but the market’s a lot different today.

Andrew: 28:38 So can you give any other sort of observations on the differences? So obviously similarities, let’s say microcap stocks and like the regular type of stocks that investors kind of think about when you think about stocks. So, you know, like the, at and ts of the world or Disney, we always like to talk about Disney. Then Netflix is, you mentioned that there’s less and less, there’s a trend of less investment, fewer people trying to be microcap investors. I’m assuming you’re talking institutionally as well as individually. Um, are there other differences, major differences that you’ve observed between those stocks other than obviously stock makes a profit, the stock price goes up that’s going to be the same anywhere you go, but when it comes to the differences between the microcap space and kind of regular quote unquote stocks, uh, how would you define some of those if you’ve observed any?

Maj: 29:37 Look, I think that the, there’s a few things have happened over the last several years than ever. Made it tougher for these, some of these stocks to go up. So I’ll give you a few examples of that. Before 2008, well of 2008 came along and just obliterated a lot of smaller investors and these were invested retail investors that use to invest in smart, capitalized companies. So we lost a lot of them. There’s a different regulatory environment going on these days where her regulation is making it tougher for brokerage firms to want to allow their customers to buy these stocks. Um, there’s probably more regulation that is limiting the ability for institutions to buy these stocks. The stocks, the microcaps are a lot less liquid than they were in the past as far as I’m concerned. There’s a lot of things working against them. And then the big one here though is that the average time horizon for a retail investor to hold a stock has gone up from six years to six months.

Maj: 30:59 So ironically when 2008 came along, you would invest, you would think that investors want not to take more risk. But what we had happened here was investors don’t want to be exposed to a lot of risk in terms of time. So what happens is they invest, a lot of investors are investing in speculative stuff like pump and dumps and you know, biotechs and really avoiding some of the more quality companies because they don’t want to wait. They’ll want to wait for these companies to their, their, their, their, their growth plans to play out or whatever the case might be. I just want to look at these really quick pump and dumps that they think are gonna, make them money really quick so they can get an out of the market and that’s hurt the um, uh, maybe like I think the quality of sector, the quality pocket of the microcap area because you know, they’re not going to pump.

Maj: 32:03 They’re not pump and dumps. So that’s the, those are some kind of trends that have occurred over the years. I think that I’ve heard. And also one thing that has really been a big player, uh, played a big part in this scenario is the popularity of Etfs, index funds and passive investing, which is basically about over well over 90 percent of the trading volume anymore. So people is. Investors aren’t just stock picking anymore and if you’re a stock picker, you’re probably gonna buy these microcap. So we just bought a lot of investors. You who might’ve done that in the pasture. It’s investing in the next one. Eventually the pendulum swings eventually when, you know, in the last, since the 2008 recession when we came out of the recession, you could invest in index funds and etfs and had a pretty good return with just investing in the market.

Maj: 33:03 Basically with market returns. There was really no, uh, less of a need to do be a stock picker. Now we think it’s going to be a little tougher and these index funds maybe aren’t going to perform to where, um, investors are probably going to want to where they want to crave more returns. So hopefully stock picking comes back as an art and um, we have by our caps come back into a, you know, in the spotlight again, which I’m hoping will happen, but I’m just going to keep investing in them.

Andrew: 33:39 But these are some of the trends that are going on right now of the ultimate irony, isn’t it? All of the big movement towards efficient market. A big reason why a lot of investors will go into index funds is because they believe the market’s efficient. So you might as well just own the whole market. Yet the bigger and bigger the percentage of investors that are passively in these indexes, the less and less efficient the market actually becomes, which actually, like you mentioned, provides more opportunity for stock pickers.

Maj: 34:09 Like you’re, you’re a. yeah, and exactly. And at some point evaluations is get to a degree where they can’t be ignored at some point, market returns aren’t acceptable anymore and those are some of the things these. So the, the I call you, I mean you want to call it value stocks, these views, there’s a lot of undervalued, a smaller capitalized companies out there and eventually they’re just going to have to eventually they will get the attention of more investors over time and I don’t know what that cows so they’re going to be, but maybe it is hopefully one day that the, the, the market returns aren’t good enough and they need to go find better returns and they can find them here anyway. If it does happen and when it does happen and you know that it can happen quickly. So you kind of. I’m taking the vision where I want to be in these stocks.

Andrew: 35:04 When it does happen, that’s the thing with value, right? You don’t know what the costs will be, but as long as you buy a relatively low, eventually stock should return to what it really should be. Value that.

Maj: 35:16 And that’s obviously for some gains as long as you’ve done your homework, you know, and you couldn’t believe some of these stocks, sometimes we come across there are selling other cash per share just sitting around waiting for a catalyst, and it’s pretty amazing. It’s pretty amazing. You would think that in quote-unquote more efficient market, you’d have less opportunity, but like you’ve made a good point that the pipe layer of index funds etfs have created, in my opinion, more inefficiency for these microcap stocks.

Andrew: 35:52 Absolutely. I think it spreads through the whole market as a whole. Um, you mentioned doing research that’s huge. And at the very beginning of the show you, you kind of briefly just said how you have a product related to the form for which we’ve been talking about in this episode. So I know like I mentioned, finviz has that feature which you know, it’s, it’s very bare bones and I’m looking for an alternative defendant is because I’ve recommended them many times in the past and earlier episodes, they’ve gotten to the point now where it’s a free tool, and they’ve just gotten so annoying with the ads that I am actively looking for a new stock screener website. So any listeners out there, if you have a free one that you know is good and it’s better than this let me know because then they’ll start promoting them instead of fineness. The ads are just very, very annoying. But. So finviz has an option. I know Guru Focus has something which like they report on what the insiders are doing and then they’re like, well if you want more information, you gotta you gotta pass more. So I can’t comment on the functionality or the ease of use of either of those tools. So talk about what your form for a product does and how it helps investors, the ones that are looking to research in this way.

Maj: 37:19 Sure. So our product is going is allows investors to a, get a real time feed of the form for transactions, but you know, I still, it could be a lot of information coming through so we give them a lot of investors, a lot of filters to be able to narrow down their focus from making filter through, you know, direct purchases versus options filled with size of company microcap, size of transaction, different codes. Um, you know, as you can, we can get very, very granual, um, what the, what the event, a narrowing down, what the investors looking to, um, to get out of that and they’re filtering process. So that’s really what we’re, we’re, we’re working on with the product is getting the filter into a point where it can really save you time to really get at what you’re looking for. And as the product grows, we plan on having a lot of really cool data analysis going on where we can start really trying to rank insiders and how and how and if they’re predictive in terms of where the stock’s gonna go based on how they’re transacting in their stock and things like that.

Maj: 38:41 But the cool thing, all we do here too though a Geo is we don’t just provide a tool without giving any navigation and what we think going on here. So for example, if we see like an EVK situation and we have the tool, we’re going to maybe talk about why that was important. So we going to walk you through some of them will what we think the most important for form for his being. So we’re now we’re not just leaving our subscribers out to dry there on an island by themselves.

Andrew: 39:16 Yeah. So I guess if we’re not clear, you have a, a newsletter service as well. You’re talking about some of your favorite ideas and how is that coming out like once a month?

Maj: 39:29 Well actually the product is pretty intense and I like to say that it’s, you know, you know, the retail investor and really doesn’t have access to great research unless you have a million bucks, and you want to open an account with Goldman Sachs or something that, I mean there’s really what we do is we try and give good institutional research to the everyday investor, and that’s really important. And we’re very; we’re always in constant communication with our members. So our product, our general product starts with a morning email every morning and then that premium email, uh, you’re, you’re, you’re getting calls to actions which, uh, which are maybe some information on stocks were thinking about buying or closing out somewhere, positions. You’re getting information on our new re, our research pipeline. Well before we might even buy a stock to let you know we’re looking at, you’re getting a lot of earnings coverage in that morning email, like some of the, what we thought were the best earnings reports in the morning of the morning, when the prior evening after the close.

Maj: 40:35 So that’s where everything starts with Geo as a morning newsletter. And then from there, we have a premium portal where we have all of our articles, research calls, the actions, everything archived. We have a position area where you can look at all of our positions that, I mean maybe we’re looking at are we-we currently own. Then we break out those positions and may be different portfolios to make it easier for our members to serve on deciphering. For example, we have a favorite portfolio which I mentioned earlier. We have a contrarian portfolio which is like a Biomed pullback portfolio which has maybe four to five, four or five stocks that pulled back that we think should not have pulled back because maybe the market misunderstood something or there was just the market turbulence. We have a run to one model portfolio which are stocks trading on the quality. What we think our quality stocks under one that we think can run to one, one to one model portfolio. We have a special situation portfolio which is talking about, um, you know, companies that are going through restructurings. So we do. That’s realistic take the information and categorize it to make it easier for our members to and make their own investment decisions based on the research we’re providing and maybe in what we’re doing.

Andrew: 41:58 That sounds interesting. So I had one of your tech guys, sales guys reach out to me, and he gave us special URL for this episode. So he said if you go to geoinvesting.com/ifb-top five, you can get more information about, uh, what you guys do at Geo, what kind of, what the features are. And uh, I believe it’s your top five favorite stocks for 20, 19 included for those people who go to, to learn more and subscribe to your, your, uh, geo premium. So that’s something that you guys are offering. And that’s pretty cool. Uh, I guess again, the URL is geoinvesting.com/ifb-top five

Maj: 42:47 So, thanks for, for extending that out to them, to the audience there. And it’s a great way to get a look at for your listeners to take a look at what we’re doing so they can decide if it’s something for them. That’s how he created the product. You created this offer for you, for your listeners.

Andrew: 43:09 Yeah. Cool. Uh, I guess, you know, obviously we’re short on time, but we kind of alluded to the the top five favorite stocks for 2019. Um, we don’t have time to talk about all of them and it’s something that you’re saving for, for premium subscribers. But do you have one that pops in mind where you can kind of talk about maybe like a general theme or a big reason why you’re getting excited about this stock?

Maj: 43:38 There’s an intro, interesting company here. Let me see which one I’ll give you here. Let’s see. You don’t have to give a ticker. I mean the general idea. So it’s a c, a-c, a s, m chasm. And I own the stock. And of course, again, it’s not a definite advice or. So you rears, have to do your own homework, but we all, if they sign up for this special offer, they can read the report. So this is a medical device company led by a, I call it a top tier top to your product when it first class CEO and the CEO, Thomas Patton has an incredible history of turning around or running medical device companies and getting them sold for premiums for their shareholders. So he basically, he has, he came into this company several years ago to turn it around and the um, the company is quickly taking market share away from its competitors and we’re basically, we think there’s a good chance that over the next year and a half or so, the company becomes the acquisition target, um, because it’s just, we believe the numbers or the data is showing that their product is well ahead of the competition and they’re just, uh, probably about to release some news here soon.

Maj: 45:08 Hopefully regarding, um, uh, inking an agreement with a partner who’s gonna help sell this product to expedite its popularity and in the market. And basically, they sell the special medical device to hospitals. Basically to help monitor the level of oxygen in the blood during surgery. Um, so it’s, you know, so it’s your basic razor razorblade things. So they sell us to monitor, but they also have these sensors that are, you know, disposable sensors. So you have this recurring revenue theme going on with the company, and that’s what we want. We love you. We love, right now we know when you have uncertain markets, finding companies where you have a recurring revenue stream, predictable revenue stream and so that we liked a lot and that’s one of our top stocks in that portfolio.

Andrew: 46:06 Does that happen to be one of those where you see insider buying too or is that a completely different idea?

Maj: 46:13 This one hasn’t in both. There are some stocks in that portfolio. I do have that theme. Yes, the theme of the know I would say the themes are there some insider buying themes. Recurring revenue is a big theme. We have a cybersecurity stock in this, in this portfolio, which is about to hit, we think a major inflection point and this ethically undervalued. Um, we have a company that’s serving um, modular server space that is our space and the telecom company. So

Andrew: 46:51 I love you have love everything in there, and you’ve got tech, you’ve got something in tech, cyber tech. That’s cool. Recurring revenue. It’s a fantastic opportunity. Just, I mean from the sheer compounding, right, you got a base of customers and then if it’s recurring now anyone that you add is adding to that base and think you can multiply a lot quicker.

Maj: 47:17 Go ahead. I like it; I love predictability and uncertain markets. So the more that we have, I think the more confident your portfolio can be more cause you got your portfolio.

Andrew: 47:32 Yeah. Well, it’s been great talking to you. Image a really gave us some good insights on the forum for stuff and some of the stuff you’re doing with the microcaps uh, really appreciate your time and hopefully, hopefully, you know, combining this episode with the episode we had last week, people can maybe have a little bit of confidence to get in there, get into the SEC filings and have like a deeper understanding than just what’s on the surface. You can go there, any stock website and you can kind of pull up a ticker and, and see a bunch of numbers and not know any of that means. Um, but if you have the courage to learn maybe a thing here or there and build your knowledge base, you can really start to get a much better picture of what’s going on with the business, how business is performing, all of these different things rather than just, okay, I see a number is, and I see a chart, and that’s all I know you actually asked you.

Maj: 48:38 Correct. By the way, I’ve written two articles on the form for a subject so I can. That’ll be. That’ll be available in this offer, and I can probably send those to you so you can maybe share them with your readers if you want or and I’m listening to if you’d like to.

Andrew: 48:57 Yeah, Dave, I think we can get that on the show notes, and it will be something easy for people to. Yeah, that’d be awesome. Read it too.

Maj: 49:06 Great. I appreciate you taking the time to do this again.

Andrew: 49:11 We appreciate it. Maj was awesome. I, I learned a ton. That was great. It was fun. Awesome. Well, thank you.

Dave: 49:24 You’re welcome. All right, folks, will. That is going to wrap up our conversation for this evening. I hope you enjoyed our conversation with marge. I know I certainly did. I learned a ton about the form for a that was very, very interesting. These things can definitely help you when you’re using them with your investing, so at information you can find out there, again, continuing our conversation about financial statements and all the things you can learn about your company’s, so without any further ado, I’m going to go ahead and sign us off. You guys go out there and invest with a margin of safety, emphasis on the safety, and have a great week. We’ll talk to y’all next week.

Announcer: 50:00 We hope you enjoyed this content. Seven steps to understanding the stock market shows you precisely how to break down the numbers in an engaging, readable way with real life examples. Get access today at stockmarketpdf.com. Until next time, have a prosperous day.

Announcer: 50:25 The information contained for general information and educational purposes only. It is not intended for a substitute for legal, commercial, and slash or financial advice from a licensed professional review. Our full [email protected].

Related posts:

- IFB38: Financial Reporting and Press Releases Interview with Maj Soueidan Welcome to Investing for Beginners podcast, this is episode 38. I’m Dave Ahern, and we have Andrew Sather here with us tonight. Tonight we’re...

- Learning to Invest with Maj Soueidan of GeoInvesting Welcome to the Investing for Beginners podcast. In today’s show, we discuss: *How to start investing with Maj Soueidan of GeoInvesting *The similarities between learning...

- IFB160: Buying U.S. and Capital Light Compounding Stocks with Braden Dennis Announcer (00:00): You’re tuned in to the Investing for Beginners podcast. Finally, step by step premium investment guidance for beginners led by Andrew Sather and...

- Tips For Buying Cheap Land Remotely and Flipping It With Jessey and Kevin Welcome to the Investing for Beginners podcast. In today’s show, we discuss: *Land investing with Jessey and Kevin from REI Conversion *What land investing is,...