Have you ever seen a form 8-K? Chances are, the answer is no, unless you have been investing for a little while and paying close attention to a specific stock(s).

You’ve likely heard of a 10-K and a 10-Q before, which are much more common and more important to you as an investor, but that’s not to mean that an 8-K doesn’t hold any importance!

In short, an 8-K is a form that a company is required to send out to the public. More often than not, the company likely also will hold a press conference and chances are, you’re going to read about the announcement on Yahoo Finance or whatever other forum that you use for your news before you even get to the 8-K, but that is definitely not always the case.

So, when does an 8-K need to be distributed by the company? Some common situations include:

- When a company files bankruptcy

- When a company enters into a new agreement, such as an acquisition or a divestiture

- Anytime that the rights of the shareholders are changed that would be of significant importance

- A personnel change to an office, such as a CEO stepping down or a promotion into an officer role

- Anytime a company is giving formalized guidance for the fiscal year

There are absolutely some situations that would require an 8-K, but for the most part, these are the most common times that you might see one administered.

As with anything else, the best way to familiarize yourself with anything is to dive into it headfirst. Just as with a 10-K or a 10-Q, you are hopefully going to SEC.gov as that’s the most accurate source of information, to see these formal notices. If you haven’t done it before, trust me, it’s really not too hard.

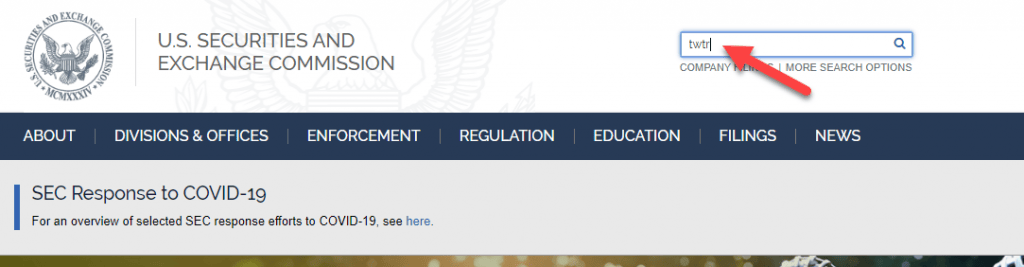

Once you go to SEC.gov, you can simply type the stock ticker into the search bar to pull up all of the forms that the company has distributed. In this case, I am going to search for Twitter (TWTR):

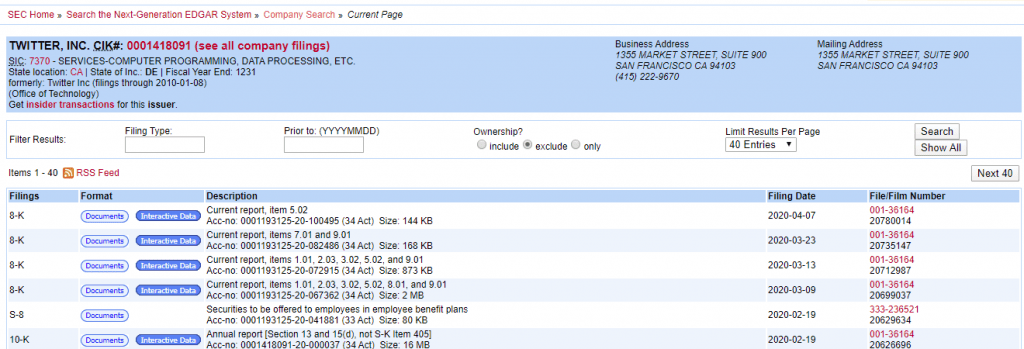

Then, just click on the link below to take you to the all-encompassing listing of all of the filings for that company:

Now you will be able to see all of the filings that the company has had. You can sort by the type of filing and dates to really narrow in on the desired data. As you can see in the screenshot below, you can see that both 8-K’s and a 10-K is on the first page for you to view. Now of course, we’re here to talk about the 8-K, so I will click on the “Interactive Data” tab that’s highlighted in blue.

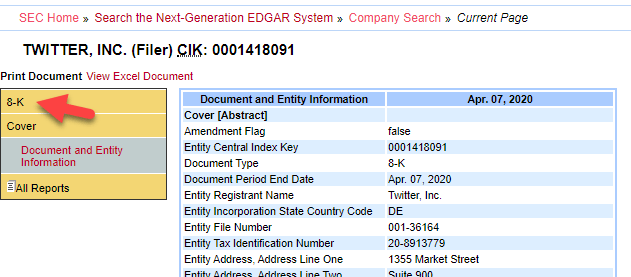

The next, and final, step is for you to click on the 8-K options in the screenshot below to take you to the actual 8-K:

And alas, you have finally arrived at your destination! I know that might’ve seemed like a lot of clicks, but the majority is just making sure that you know where to click, which is why I wanted to outline it very clearly. While SEC.gov is a great website for accurate information, it is clunky, so please do not hesitate to reach out with any questions and I’ll be more than happy to help!

Once you get in a groove, you’ll be able to navigate the website with ease like a pro!

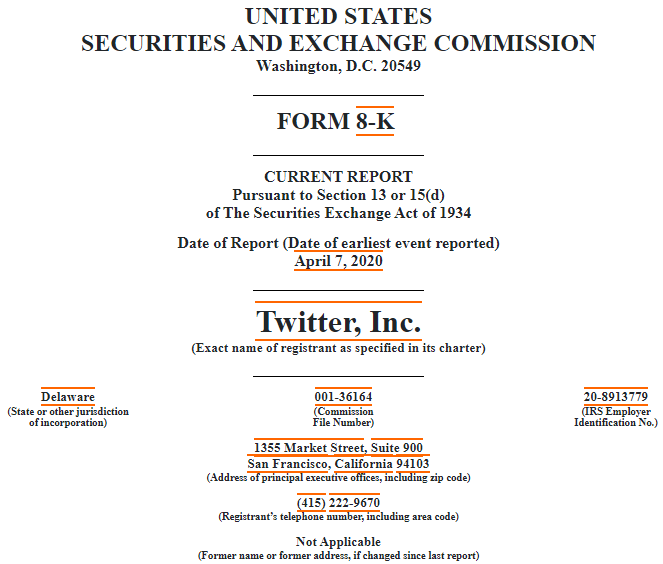

So, you clicked on the ‘8-K’ option above, and you’ve landed here. At the top, you’ll see some very generic information like the first screenshot, but if you keep on scrolling then you’ll get to the meat and bones that I’ve shown in the second screenshot.

As you can see, this was signed by the CFO and was written to tell the public that Twitter has entered into a cooperation agreement with Elliott Management and that they’re going to add Jesse Cohn to the TWTR Board of Directors. I have my own opinion activist investor companies, and Elliott Management specifically, but I’m going to withhold my opinion.

All that I am going to say is…. booooooooooo. These companies tend to be a little short-sided, looking for the fastest way to generate value for shareholders, which is great if you’re a short-term shareholder, but as you know, I’m in it for the long-term, and so are Andrew and Dave.

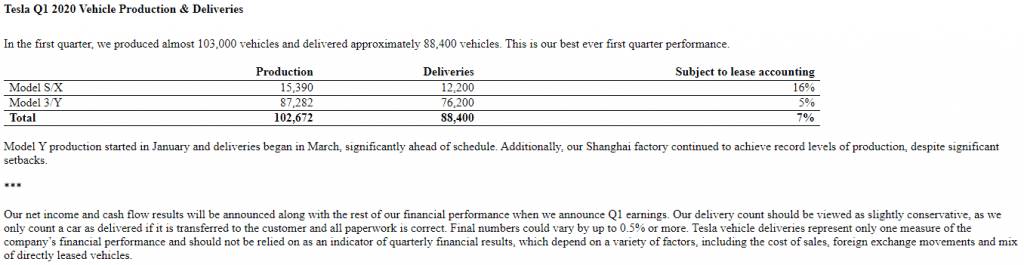

Another 8-K example that I have pulled up is with Tesla:

Click to zoomI’ll be honest, I was pretty surprised that this qualified for an 8-K, but due to the fact that this information was given to the public via a press release, it makes sense.

Tesla was essentially just giving an update on their production and deliveries of cars. They then went on and added some more color about the financial performance of the company and just added a little more color to the numbers.

I’ll be honest – I am a Tesla hater, but I thought that it was pretty cool to see this. In a time where there is so much uncertainty with the coronavirus, I like seeing companies give updated guidance.

Sure, guidance is really a short-term thing, but I like it simply because I like to know what’s going on with the company more frequently. It’s not that I’m going to make any buy or sell decisions off guidance, but more that I just like to know what to expect. I do really follow the earnings because honestly, they’re super exciting, but again, I never let a quarter of earnings drive my buy or sell decisions.

A lot of companies are yanking guidance right now so to see them give an update was pretty cool, and again, it takes a lot for me to say that…and I think that by me saying that, I am just the bigger, humbler, person. ?

At the end of the day, an 8-K is a formalized document for any material change to the company, or personnel in the company, for something that needs to be given to all of the public. I think that an 8-K was likely super important in the past, but with how fast information flies nowadays, you’re probably just as good going to Twitter for that news!

I mean, if a CEO steps down for a company, I hope I find out about it before the 4-day period that a company has to file an 8-K…

Related posts:

- SEC Form 4 Explained for Beginners Updated 2/7/2024 One of the best ways to track how management feels about their company is to watch for insider buying or selling. Form 4...

- How Schedule 13d Filings Can Help Investors Find Undervalued Stock Ideas There are two main stock market strategies where reading schedule 13D filings is essential to success: portfolio cloning and deep value investing. In this post...

- Marketable Securities In-Depth Guide: What They Are, Valuation, and Impact Updated 3/30/2023 Have you ever seen that line item on the balance sheet listed as marketable securities and wondered what they were? I know I...

- GAAP Accounting Rules: The 4 Basic Principles Investors Should Know Most think of Accounting as this dry profession we only need to consider around tax time, but as an investor, understanding how accounting works on...