Who says you can’t have fun AND save money? Here are some great frugal living tips that keep money in your wallet without killing your lifestyle.

The best part? They take almost no time at all…

Click to jump to a section:

- Living in a Non-Frugal Place

- Having a Frugal Mindset

- Tip #1: Frugal Eating Out

- Tip #2: Frugal Entertainment

- Tip #3: Frugal Grocery Shopping

- Tip #4: Online vs. In-Person Shopping

- Tip #5: Frugal Home Improvement

Living in a Non-Frugal Place

For the last two years, I lived with my wife in Lincoln Park, a downtown neighborhood in Chicago. We paid $1800/month in rent for a 1 BR/1 BA, 800 sq. ft. apartment. We paid outrageous taxes. We paid crazy prices for food and drinks. We had to pay for soooo many things that I never thought I would have to pay for. For instance, this was the process of going to buy a two liter of diet coke at the store:

- Walk to my car, where it was parked somewhere on the street as close to my house as possible, usually at least a few minutes away. The monthly cost to STREET PARK was about $10.

- Drive to Walmart. Pay to street park.

- Buy a two-liter of diet coke. Pay $.68 in the sweetened beverage tax ($.01/ounce). Pay over 10% in sales tax.

- Put the two liters in a plastic grocery bag. $.07 tax for the bag.

- Drive home. Hope that I find a place close to my apartment to street park. Pay $10/month for that privilege. Spoiler – I never did find a good spot.

Based on this introduction, you might think that I hated living in Chicago… but you’d be wrong. There were so many amazing things to do. The restaurants, bars, festivals, access to all kinds of entertainment, the ability to be on a beach and in a city within a five-minute walk, and so many others were absolutely incredible. But nothing was ever easy. Everything was always a hassle.

We knew that living in Chicago was going to be short-term as my company typically moves us around every 2-3 years. So we wanted to make the most of it and truly experience all the city had to offer.

Chicago is extremely expensive, so I did everything I could to save as much money as possible on our activities. I was the most frugal person you could imagine.

I would literally go to Walmart, look at Kleenex, pull out my phone, and check the price on Amazon. Whichever one was cheaper was the one I would buy.

My wife would laugh at me, but even if I could save $5, that was $5 that I could use doing a Chicago activity. An activity I might not have the ability to do ever again without traveling back to Chicago.

When we moved from Cincinnati to Chicago, we were used to spending money as we pleased and spending money with no regard. We both quickly learned that had to change if we wanted to fully enjoy Chicago – so it did.

Having a Frugal Mindset

Some of the most powerful advice teaches you to “fish” instead of just giving you a single fish. You can learn to “fish” in any situation by learning how to shift your mindset. Things like positive money mindsets are powerful tools to create your own systems instead of patching up an individual problem.

I’m purposefully not going to list out a ton of specific applications that you can use, but more so talk about some of my logic. You can use this logic to find your own ways to make it work for you…below are some “hacks” to living frugally.

Remember, every dollar works towards spending on something you actually want to do. If you think of those $10 saved as a meal with a friend, it becomes far more meaningful.

Tip #1: Frugal Eating Out

I would frequently look for good deals when going out to eat or get drinks. This was my favorite part of Chicago – all of the amazing opportunities for good food and cool bars will be something I’ll always miss. Unfortunately, this also was extremely expensive, so I spent a lot of time trying to find ways to continue to do this while saving money.

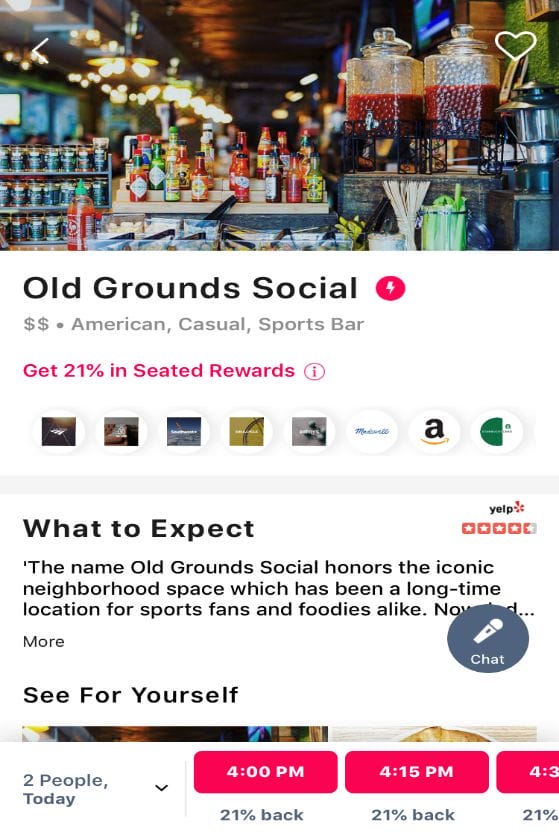

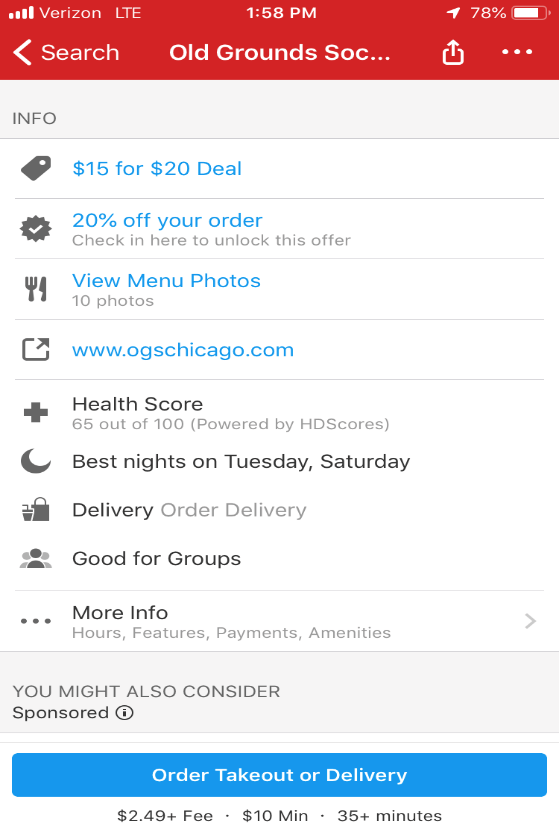

Two apps that I used, Yelp and Seated, are great tools for getting discounted meals/drinks. I frequently visited a restaurant in Chicago called “Old Grounds Social.” When we went, we’d watch various football games for hours. We’d get a good group of people together and easily rack up a significant tab. Looking on Yelp and Seated, both of them had great offers, as noted below:

As you can see, the Seated App (left) shows that you can get 21% back in Seated Rewards and Yelp (right) shows 20% off your order. So, I’d combine these two together…imagine this:

6 people at the restaurant/bar for 4 hours (normal when watching multiple games)

Step 1: Make a reservation on Seated

Step 2: Have fun. I will assume that the average spend is $75/person or $450 total

Step 3: Show Yelp coupon to server when cashing out

Your $450 bill has now been reduced to $360, and then you get another $75.60 in Seated Rewards, saving a total of $165.6, or $27.60/person. Again, this might not seem like some ridiculous savings, but I literally spent an extra 15 seconds and saved 36.8% on my bill. This adds up when you go out with your significant other and pay for two.

Another simple way is to simply Google happy hour deals in your area. There are so many websites that show you all the happy hour specials so you can try out a new place. Chances are, you’ll find a deal at a place you wanted to try anyways!

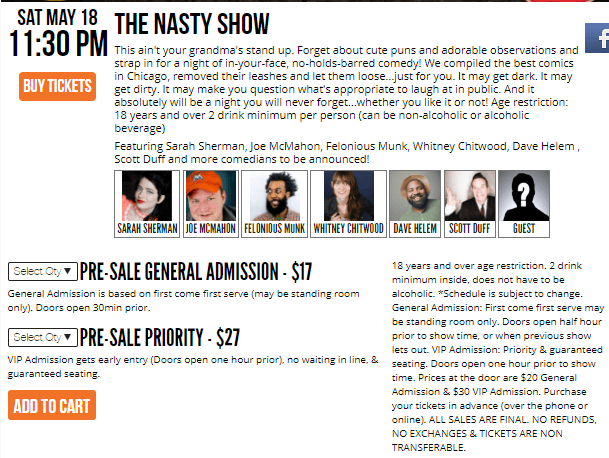

Tip #2: Frugal Entertainment and Comedy Shows

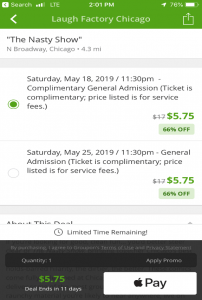

One of our favorite activities in Chicago was to go to comedy clubs. We’d always go to the Laugh Factory for a cheaper show than some other locations…only $17 a show!

But wait…then I did a little research…$17? Ha, forget that! I found a great deal on Groupon for the Same. Exact. Show.

So instead of paying $17, I’m now paying $5.75/ticket. Not too shabby for me again, doing almost nothing.

Tip #3: Frugal Shopping for Groceries

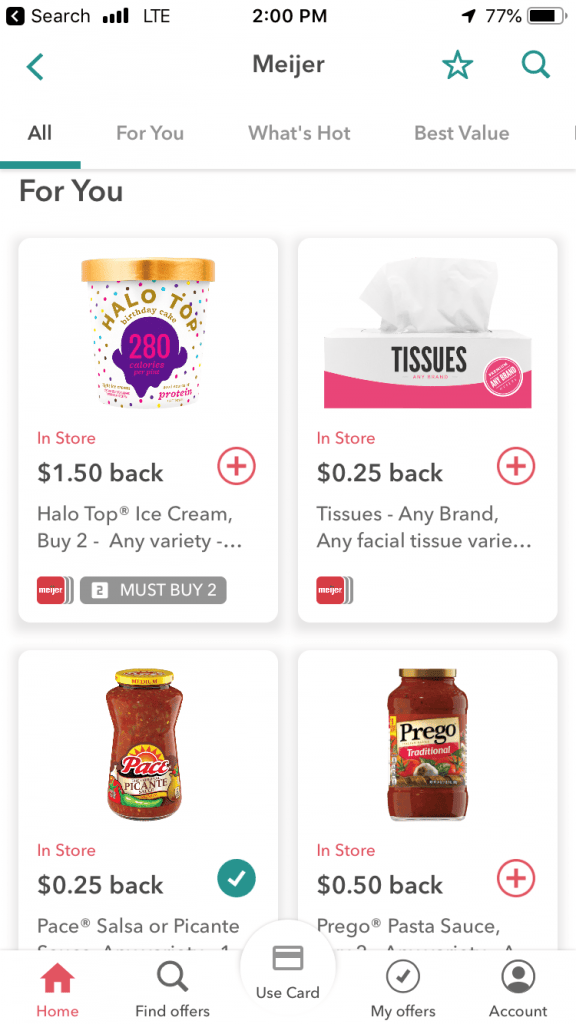

This deal is, admittedly, the slowest deal to realize any true value, but it does help. I use an app called Ibotta. All I did was link my credit card and select which items I intend to buy before grocery shopping. Literally two minutes before I leave, I select them.

I receive cash back for any of the products I purchase from their recommendations.

Think of this as a more passive frugal living tip. Make it a part of your weekly grocery endeavor and save money without thinking too much about it.

On average, I probably only save about $2 – $3/grocery trip, but that can be over $150/year.

Tip #4: Online vs In-Person Shopping

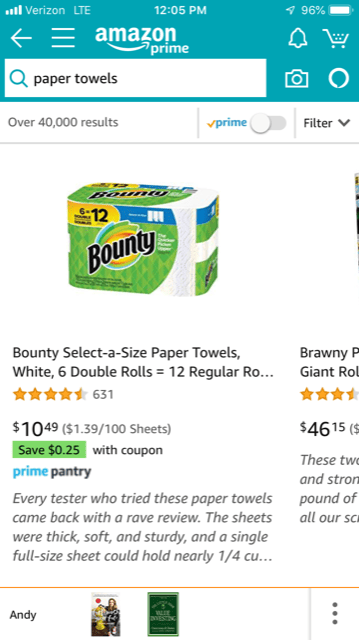

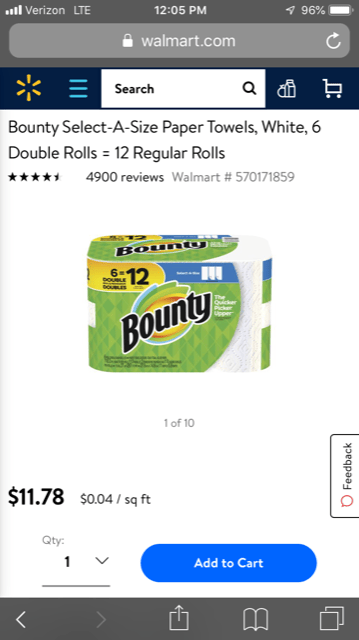

Earlier, I said I would get on Amazon and price shop from my app while at the store. I’m not lying. I would literally do this. I would do the math, and if I could buy 48 rolls of TP online for a cheaper price than buying it at the store, I would. Here’s an example of Paper Towels:

Again, I know this probably seems like such small savings, but to me, it was worth it. It took 30 seconds.

Yes, I only saved $1.54 (w/ the $.25 coupon), but that was $1.54 that I could then go spend doing other things I wanted to spend it on. Our savings rate was nonnegotiable, so this money was returned to our “fun fund.” For many people, their savings isn’t a nonnegotiable, or might even be nonexistent, so a few bucks can really make or break the future for them. That’s the mindset I’m trying to hammer into everyone’s mind.

Tip #5: Frugal Home Improvement

When I rented in Chicago, I never cared about Lowe’s. Like ever. I had a landlord fix all of my issues.

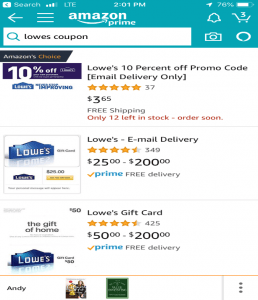

Well, now I have a yard that needs mowing, a driveway that needs a snowblower, a porch that needs a grill, and a yard that needs fertilizer. The list goes on and on. I thought to myself… “There has to be a better way!” That’s a little Shark Tank joke (to myself, really), but when I was considering paying $1,500 for a riding mower and couldn’t find a coupon anywhere, I really thought there had to be a better way…and there was. My personal hero, Amazon, comes through again:

I literally just searched for a Lowe’s coupon on Amazon and found a 10% off code. The code costs $3.65, so I’m saving money as long as I spend more than $36.50. I will say I’ve only used this online, but I’ve done it twice, and it works like a charm.

Closing Thoughts

As I mentioned earlier, this article is not meant to be a guide for all the apps and hacks for everyone to implement…it’s more or less trying to motivate you to think differently and think outside of the box.

Chances are, there are different apps and methods to find cheap deals in your city, too; you’re just not looking for them.

I strongly encourage you to spend some time looking at these various methods of saving. Do some research on your own, and then go out there and have some fun. Chances are you’re going to find ways to save on things you’ve already wanted to do and some new ideas too. Your wallet will thank you for it.

Related posts:

- 17 Simple Minimalist Living Tips for a Maximum Life The Financial Independence, Retire Early (FIRE) community is all about cutting all expenses, maximize income, and retiring ASAP. While that in theory sounds great, I...

- Start Investing Now, Because Even Small Investments Add Up! One of the most common excuses that I hear for why people don’t invest is because they don’t have enough money to do it. Well,...

- 7 Simple Tips to Avoid Lifestyle Creep Have you ever found yourself being a victim to lifestyle creep? It might seem like a ridiculous thing but it’s most definitely not. Fortunately for...

- Curious How Much Of Your Paycheck Should You Save? I Got You Covered! One of the most controversial debates that occur in the Financial Independence Retire Early (FIRE) community are ones that are based on your savings rate....