Have you ever heard of a Fully Paid Securities Lending Program before? No? I don’t blame you. Up until recently, neither had I! So, the benefit of you reading this is that you’re learning from me as I have recently learned this material so you’re getting a true, unfiltered opinion of mine on the matter!

So, what exactly is a Fully Paid Securities Lending Program? Essentially what you’re doing is you are lending your fully paid securities to a bank or institution and then they are then taking those securities and lends them to other clients or financial institutions.

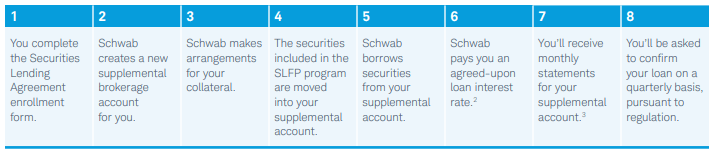

I know it might sound confusing, and trust me I was extremely confused at first, so let’s try to make it even a little bit simpler. Below is a screenshot from the Schwab website that talks about the Fully Paid Security Lending Program:

So, essentially what is happening is you are opening a new account where you’re willing to loan your securities to a brokerage who then is going to loan those securities to other investors.

The most likely consumer to then borrow these securities from the brokerage are those that are going to short the stock.

Shorting a stock is an options trade where a trader will borrow a bunch of stock and then immediately sells them for cash, hoping that the stock price will drop and then that trader can then buy back in at a lower price to repay the loan.

For an example with some extremely simplistic math, let me show you an example below:

- Step 1 – Borrow 1,000 Shares

- Step 2 – Sell 1,000 Shares

- Let’s pretend that we sold 1,000 shares at $150/share for a total amount of $150,000

- Step 3 – Let the Price Drop

- Let’s pretend that the price drops to $145

- Step 4 – Buy 1,000 Shares

- Let’s pretend that we bought 1,000 shares at $145/share for a total amount of $145,000

- Step 5 – Pocket the Difference

- You just made $5,000 because you sold the borrowed shares for $150,000 and then replaced them with new shares that you bought for $145,000

Man, that sounds super simple! Why would I ever not want to do that? Well, what if the price goes up? Now you’re having to buy shares a price that’s much higher than what you bought in at.

Options are a very dangerous game and I highly recommend you do your research before getting involved. And when I say, “do your research before getting involved”, what I really mean to say is avoid them at all costs. Seriously.

But in this situation, you’re not actually the options trader, you’re the one that is loaning to the brokerage firm who is then loaning to the options trader, so in essence you’re like the cocaine manufacturer that’s giving it to the distributor who is then feeding the addict…was that extreme? Yes, but you can likely gain my opinion on this matter lol.

In terms of a strictly monetary perspective, I could see why someone would be willing to sign up for this sort of program. At the end of the day, there really isn’t a ton of risk outside of if the brokerage firm that you’re using would go bankrupt.

From what I have read, it appears that a lot of the different brokerage firms that offer this type of Lending Program (which include E-Trade, Fidelity, Schwab and others) are willing to back you at 100% of your investment if something ever was to go wrong.

And I’ll be honest – it does appear that you have the ability to make a good amount of money off these types of programs. The brokerage firms are commonly stating that they’re going to split any sort of profits with you 50/50 which is more than fair considering that you’re the one with the capital but they’re the ones that are backing the person receiving the loan.

There are a few things to note, per the Schwab PDF that you should be aware of:

- Stock Price

- Obviously, the price of the stock that you are loaning can drop dramatically at any point. We saw this very recently with the trade wars, so it should all be fresh in our minds that stock prices can, and will, drop due to no actual meaningful impact on the business but purely for speculative purposes.

- Dividend Payments

- Dividend payments will be treated differently than you are used to receiving them. They are technically treated as payments in lieu of dividends (PILs) which simply means that they are likely going to be taxed differently. If you’re going to invest in this type of program this is simply going to be a cost of doing business that you will have to deal with.

- SIPC Protection

- I briefly mentioned this above but if your brokerage was to go bankrupt at any time you are 100% SOL. This is not backed by the SIPC, so your brokerage firm will likely offer collateral that you can draw on, but this would be as close to the worst-case scenario as possible.

All in all, I will be completely honest, I can see the desire to invest in something like this. It seems like there is a relatively low amount of risk for the potential reward that an investor can receive but at the end of the day, I am going to do what I always do – invest with a margin of safety, emphasis on the safety.

What exactly does that mean in this case? It means I am going to stay away from this for the time being. Personally, I feel like I need to continue to do more research and evaluate these programs before making any sort of decision.

I want to continue to read and hear about other people’s experiences before I go become the guinea pig to write a blog to tell other people how dumb I am and how much money I lost. Being the first person to do something is cool – not losing all of my investments is a lot cooler.

Patience is a virtue.

Related posts:

- Portfolio Leverage Portfolio leverage is the classic double-edged sword, magnifying returns to the upside and cutting deep on the downside too. Portfolio leverage needs to be understood and...

- Examples of Basic Financial Instruments At a very high level, a financial instrument is simply a monetary contract between parties. The International Accounting Standards define a financial instrument as “any...

- Save Money on Currency Conversions Using Norbert’s Gambit! Currency conversion fees can easily eat into your investment returns with brokerages taking a spread around 1.5% – 2.5%. However, investors can utilize Norbert’s Gambit...

- Understanding Why a Company may Decide to Complete a Share Buyback Companies will often take part in a share repurchase program. However, the reasons for the share buyback are often unknown and can lead to different...