Do you ever wish that you knew more about personal finance earlier in your life? If not, you are in the minority, my friend. So many people say that their biggest regret is that they didn’t start earlier, so I’m here to stop the trend. Here’s my How-To Guide for creating generational wealth for your family!

To me, it’s really a two-pronged process. I don’t think it’s some super complex process where if you answer yes to questions 110, go to questions 24,567 and if you answer no, go back to question 15. It’s just two simple steps to make sure that yourself and your family are on the right track:

Take Care of Yourself First

This might seem controversial but I really think it’s pretty simple to be completely honest. Yes, obviously, monetarily helping your kids with financial success is amazing, but if you’re robbing yourself to help pay for their retirement then it might be setting them up in a bad situation later in life. Think about it.

If you’re choosing to give your kids money instead of yourself, and that choice is going to make you have to delay your retirement age to 70, 75 or maybe even later, then is it worth it?

Not only are you robbing yourself and your partner, if you have one, of spending those years together, but you’re also robbing your kids and potential grandkids of being able to spend more time with you.

But think about it from a monetary perspective as well – if you’re monetarily providing for your kid’s retirement, and in turn you need to work to 75, but for health reasons you can only work until 68, where is that money going to come from?

It will either come from your kids or you’re just simply not going to get the money that you need. And likely, the money coming from your kids is going to be the same money that you gave to them previously.

But, they likely had been banking on that money for their own retirement, so now they’re going to not only be even in terms of the money that you’re providing to them, but they’re also going to be behind because they likely had changed their mindset of investing, banking on what you were going to provide for them.

Personally, my motto is to under promise and overperform. Yes, I am saving for my son’s retirement currently, but guess what – if crap hits the fan then we are going to use that money because we will need it!

I know that might sound ruthless, but I hope that the situation that I just explained to you shows that we actually would be doing him a major, major favor.

Nudge Your Family in the Right Direction

So, I’ve talked about monetarily providing for your kids, but what exactly does that mean? Obviously, it means buying them diapers, food, paying for sports and activities, clothes, and everything else that your child and family might need throughout their life, but I am talking about creating GENERATIONAL WEALTH!

Let me backup – what even is generational wealth? To me, generational wealth is simply accumulating massive wealth that can then be passed down from generation to generation. Hands down, the best way to do this is to take advantage of compound interest and maximize the amount of time that our money is in the market.

I recently went through a quick example that shows how your money could grow so incredibly fast if you start saving for your children’s retirement, simply because of how much time it would be in the market, so the sooner you can start the better off that they will be.

I am going to take that example and then just compound (pun intended) on top of that to really show you the power of this generational wealth.

Let’s pretend that you are able to save $100/month for your kids from now until they retire at age 65. I assumed you will receive an 8% Compound Annual Growth Rate (CAGR), which is conservative since the S&P 500 average since 1950 is 11%. I also backed out 2.5% for inflation as that is a conservative estimate as well, so essentially, you’re making 5.5% at the end of the day.

Following this example, your child would end up with $765,358 at age 65, and that’s on a POST-inflation basis as I mentioned.

If you’re familiar with the 4% rule, then you’re likely already a step ahead of me here, but essentially the rule is that you can take out 4% of your income every year and never run out of money, as is back tested against history.

So, 4% of $765,358 means that your child would have $30,614/year to live on, solely based on YOUR help! That’s pretty cool. You deserve a big pat on the back for being that great of a provider of generational wealth.

But that’s only one step. That’s only one generation. Think about how this might apply if it was going to stretch across multiple generations.

For simple math, I assumed the following for this example:

- You will have a child at age 30

- Your child will then have a child at age 30, meaning you have a grandchild at age 60

- Everyone will contribute $100/month for their kids, $50/month for their grandkids, and $25/month for their great grandkids

- Everyone will pass away at age 90. Sorry this is so morbid

- Once you pass away, the money will continue to compound at a 5.5% CAGR but no further contributions will be made

If you are to follow these rules exactly, your grandchild will end up receiving $765,358 from your children (their parents), which will make sense as that’s the example I provided above, but they will also receive $378,319 from you! That’s a grand total of $1,143,676!

That is a huge chunk of change if you ask me. By using that same 4% rule, that means that your grandchild will be able to withdrawal $45,747 every single year and never run out of money as long as they’re using the proper stock/bond allocation.

That would be such an amazing thing to be able to provide to your family. But, what if instead of having kids at 30 years, you had them at 25 years? There would be a great grandparent that could potentially help contribute as well!

That grandchild would then receive $1,224,466! They would get that same $765,358 from their parents, $350,299 from their grandparents and then $108,809 from their great grandparents.

That is the power of compound interest! Collectively, between the parents, grandparents and great grandparents, a total amount of $106,500 was invested for this incredibly lucky grandchild and now they will have the ability to retire, very comfortably, while taking out $48,979/year per the 4% rule.

See – I called this child “lucky” but it’s really not luck at all. It’s nothing more than you are creating a change in the future of your family tree RIGHT NOW! That’s all that it takes. You have the ability to start this incredible tradition to setup your entire family for years and years of success for an infinite amount of time!

If you’re anything like me, you might be questioning the likelihood that generations down the line will actually continue to invest for the future children and continue paying it forward, and I don’t disagree with that concern. You only can control the things that you can control and you need to take peace in the fact that something like that very well could happen.

You theoretically could save over a million dollars for your family and then have it squandered but guess what – you did your part and you are a much better person for it. But providing generational wealth doesn’t just end with giving them a lump sum of cash when they turn 65.

You can do other things like give them a 529 so that they can continue to pursue higher levels of education, whether that’s college for most, private school growing up or maybe even a trade school! The fact is, you’re opening doors that might not have been opened otherwise, but I still don’t think cash is the best way for you to provide this generational wealth.

It’s with education.

Teach a Man to Fish

Have you ever heard of the teach a man to fish quote?

“Give a man a fish and you feed him for a day; teach a man to fish and you feed him for a lifetime.”

I think this applies so well in this situation. It’s not just about monetarily providing for your family, it’s about providing them education so that they can apply it years and years down the road, teach their own family and friends, and continue spreading the great knowledge that you bestowed onto them.

I know, this is going to sound awful, but what if I had this great plan to invest for my kids until I was 90 but something awful happened and I passed away at age 35? There goes that plan, right?

Well, first off, thankfully I have term life insurance (and if you don’t but you have a family then you’re making one of the most irresponsible, selfish decisions someone could make) so that will cover some of the expenses, but I can no longer implement this awesome plan that I had for great great great great grandchildren!

But what I would have had, is a few years to really teach my children about personal finance. Yes, they’re likely too young to really understand personal finance and numbers, but you can never implement saving at too young of an age.

Now, I’ll admit, I am a new father, so I really have no idea how I am going to do a lot of this “teaching” per se, but I do know some things that I plan to implement:

- Teach them the value of savings with interest

- Of course, I am going to have to skew this drastically because telling them if they keep their $10 of birthday money in a high yield savings account then they will have an extra $.13 in a year isn’t going to move the needle. Maybe I’ll do it with bedtime. I’ll say something like they can stay up past their bedtime a total of 20 minutes in a week but if they wait until the weekend, it will build interest up to 30 minutes!

- Obviously, I understand that interest doesn’t work this way, but I am teaching them that if they hold onto this valuable ‘stay up late time’ then it’s worth more in the future, so, don’t blow it now!

- Teach them the value of a 401k

- “Ok Andy – you just went from the value of savings to a 401k”

- I know, I know…lol. But it all goes together. When they start working, I will teach them about a company match. If they earn $10 mowing the yard, maybe I’ll tell them that if they save half of it until they’re 18 then I will also put in $5 for them for when they turn 18. I’m sure that this won’t immediately work and it will take some time and coaching, but these are the types of lessons that I want to instill in my child. I mean, not maxing out your 401k match is the biggest 401k match that someone can make in my eyes. I mean, it’s a 1600% ROI. So…yeah, you could say it’s kind of a big deal.

Like I mentioned initially, I definitely don’t have all the answers and am just starting to try to figure things out myself, but I will teach them the basics – the backbreaker of having debt, the importance of compound interest and how it relates to investing, the mindset of creating assets instead of bringing on liabilities, and then the best ways to avoid (not evade) taxes by utilizing tax-advantaged accounts like a 401k, IRA, HSA, 529 for their own children and so on!

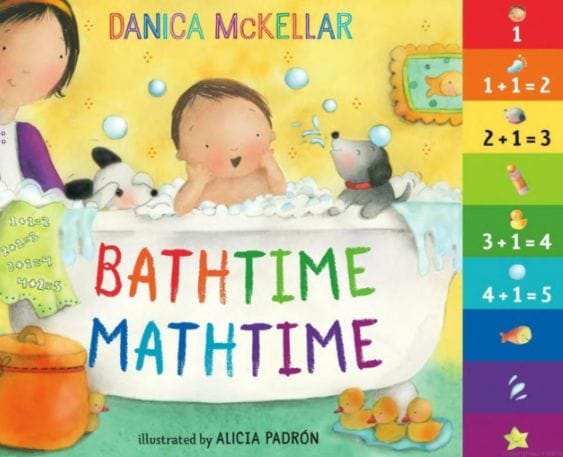

I definitely don’t have the answers but I do have a plan. A plan that I am acting on right now. My son is very young and I just got him a book called “Bath Time Math Time”.

He doesn’t even know what other people look like (thanks, COVID) but he’s going to know his dang numbers! Or at least I am going to try to get him to know them!

Maybe he’s going to resent me for all this math that I’m putting on him at such a young age. That’s fine. I’ll just keep that little $765,358 that I saved for him…. ?

Related posts:

- Sure I Save Taxes, but is the 401k Worth It? Updated 3/28/2024 The 401k is one of the most popular tools for investing for retirement because so many employers offer it. But, believe it or...

- There are Several 401k Alternatives Available to You Are you stressed about your company not offering a 401K retirement plan? Don’t worry, there are tons of 401k alternatives for you to choose from....

- Best Investment Plans to Consider for Your Children’s Future [Pros and Cons] There are many different options including 529 college savings accounts, a simple stock account for your child, or a standard savings account. The short answer,...

- The Key to Using the Rule of 25 to Plan Your Retirement Properly As a young teenager, all you can think about is moving out of your parent’s house. Then as you hit your early twenties, it turns...