With all of this talk of stimulus talks being reignited, it makes me wonder if we’re about to experience some major inflation as a nation. If so, one potential way that people will try to combat that is by investing in a previous metal such as gold. So, with that being said, what would be the best Gold ETF to invest in? Let’s take a look at these top options!

Honestly, I am a big fan of watching Fast Money on CNBC. It’s not necessarily that I think that they’re giving good investing advice, but I think it’s entertaining, it keeps me in the loop with current information, and it does challenge the way I think about things.

A common topic is that inflation is likely to occur soon so they’re always talking about investing in gold or silver as a hedge.

While I do get the logic, part of me also feels like this is certainly teetering on the edge of timing the market, right? And as we all know, time in the market beats timing the market. So, let’s take a look to see what gold prices have done over history vs. the S&P 500:

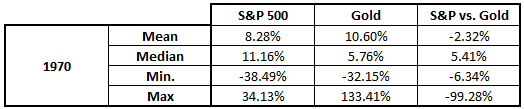

I decided to go back in time and look at the performance over the last 50 years and I’ll be honest, the results are extremely surprising, bet before we get into it, note that the S&P 500 returns do not include dividends paid, which are right around 2% or so.

Let’s take a look!

WOW! Gold absolutely kicks the butt of the S&P 500! Honestly, I never would’ve guessed that.

But wait…these numbers look a little bit fishy. The Max shows that Gold had a year where the return was 133%! Also, the median is significantly in favor of the S&P 500 but the mean is negative, showing that there are some major outliers at some point.

It turns out that this is accurate and that it occurred in 1980. While that’s great and all, that was 40 years ago, so is that something that we can really bank on in the future?

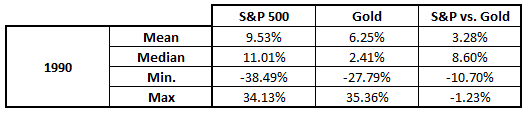

This next chart shows the exact same information but from 1990 instead of 1970, therefore showing the last 30 years:

You can see that the mean returns tick up about a percent for the S&P and drop by over 4% in gold, swinging the mean performance by about 5.5% vs. the 1970 chart and increasing the median as well.

Now things are starting to look more how I expected them to look!

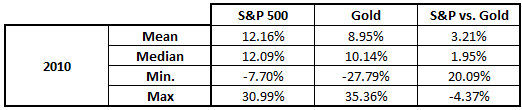

But what about the last 10 years? Gold has been on a massive runup, right?

The S&P 500 still has outperformed by about 3% (again, remember no dividends are included) and the median is about 2%, meaning that there are some more outliers in here as well. At one point in 2020, Gold was up over 35%!!

But, it finished the year up 16.7%, a 2% outperformance of the S&P 500. In 2021, the S&P 500 is up 22% while gold is down 1%, so…

To me, your money is likely better in stocks, but gold can be great in certain portfolios depending on the use!

So, if you wanted to add some as an inflation hedge and had some good logic behind it, I wouldn’t be totally opposed as it doesn’t seem as slow as a bond or CD might be. You still definitely have some risk and can get some solid returns as well!

But the question is – where do you invest your money into gold?

Well, that’s where we come in! Let’s take a look at my Top 5 Gold ETFs (in no particular order):

GLD

Chances are, this is the most common ETF if you have heard of one before. GLD is an ETF where you are directly investing in gold bars that are held in London vaults. Because of this, the ETF price largely tracks the spot price of gold, which is likely your goal if you’re looking for a hedge against inflation.

The expense ratio of GLD is somewhat average as it sits at .40%. It’s common to see ETFs that are well under that but that seems like a fairly common expense ratio.

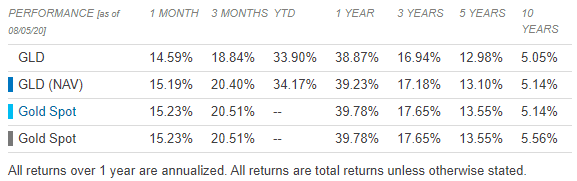

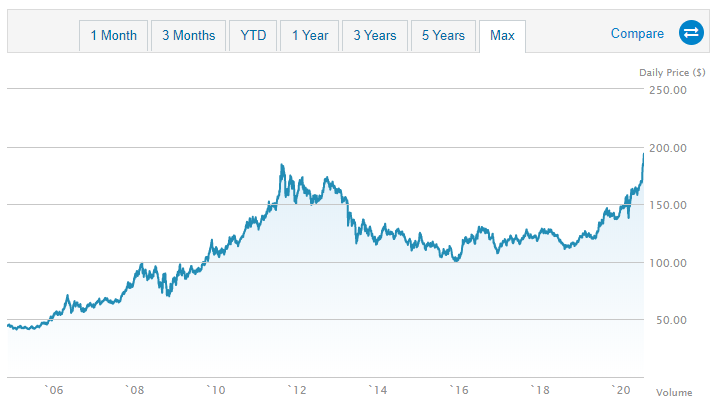

It is by far the largest gold ETF coming in at just over $79 billion in assets under management while the second highest ETF is just over $31 billion. There’s not a ton to say with this ETF as your goal is simply just to mimic what the share price is doing but I think it’s worth noting the historical performance of GLD, which I have taken from ETF.com.

Honestly, those returns are pretty good in the last few years (as my data showed as well) but as soon as you get out to the 10-year mark, you see those returns drop off significantly. To me, that means that you’re really trying to time this market even more than I might’ve initially anticipated!

I personally love going to ETF.com because you can find a ton of great data and charts, such as the chart below showing the price history, but you’re best to just check it out yourself

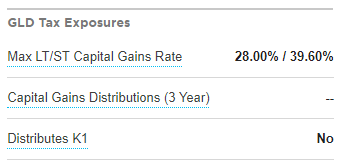

Another thing that is really important to note is that when you hold gold, the tax implications are extremely different. I was unaware of this (as I have never personally owned gold) but it’s something that can DRASTICALLY change your returns.

When investing in a normal stock, you’re taxed at your normal income rate for anything held under 1 year and then at a long-term capital gains rate for anything held over a year, which typically works out to be around 15%.

When holding gold, you’re taxed at your income rate for anything under 1 year and anything over a year is still taxed at your income rate but it’s capped at 28%.

So, if you’re in the 22% tax bracket in 2021 that makes under $85,525 as a single or $171,050 as a couple, and you sell gold that you owned for over 1 year, you’re still taxed at 22% instead of 15%.

That means if you made $1000, you now only have $780 instead of $850 like you would.

So, in other words, two things:

- 1 – you absolutely need to account for this when you’re doing the math on the potential ROI of your investment

- 2 – try to only hold gold in a tax-sheltered account like an IRA or 401k

ETF.com will tell you the tax liability that you might face as you can see below with GLD:

What this picture is saying is that the long-term (LT) capital gains are maxed out at 39.60% and the short-term (ST) capital gains are maxed out at 28%.

Like I said, this is something that is super important to know so please make sure you’re aware when investing in GLD!

GDX

Chances are this is the second most common ETF that you have heard of. GDX is an ETF that is made up of the top gold miners in the U.S.

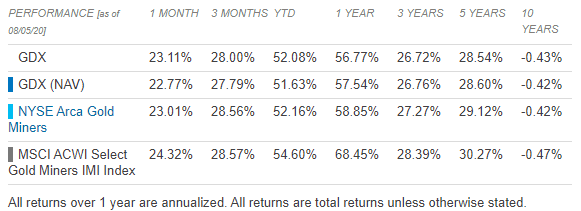

It does have a MSCI rating of A based on a score of 6.17/10, so I call that fairly middle of the pack. The returns, though…oh the returns…

I mean, those are some pretty insane returns in the YTD, 1 year, 3 year and even the 5-year look, right? But, that 10-year return makes me sick to my stomach.

Again, and I promise I am saying it for the last time…all that it seems like investing in gold is doing is really making a call on the market about what will happen to the price of gold.

While the excitement of the 5-year returns look enticing, the disappointment of the 10-year returns are equally as bad…and honestly, might even be harder to handle than the benefit of the 5-year!

The expense ratio of GDX is .52% so we’re starting to get a little bit higher than I want to be. Now, if I thought this ETF was dynamite, then I wouldn’t really sweat this expense ratio, but I try to keep it at .4% or less if possible.

The dividend yield is .43%, so not even outweighing the expense ratio, so you could basically consider that a wash for all intents and purposes.

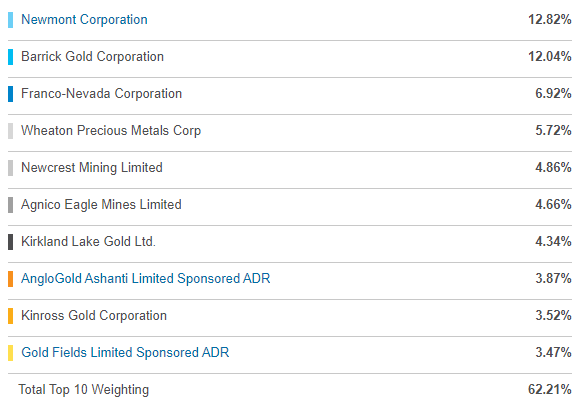

Now, off to one of my favorite parts of any ETF – the Top 10 holdings!

Honestly, I was expecting to see some pretty heavy weightings, but holy crap. I know that Newmont and Barrick are the big boys in this industry but being just under 25% combined is really heavy. I mean, honestly, even Kirkland and above is a high percentage sitting well North of 4%. But the industry is concentrated, and if those companies are really the strong performers, then you should welcome the heavy weightings.

IAU

IAU is very similar to GLD but the Fund Owner is iShares rather than SPDR (GLD). This also does result in it having a lower expense ratio at .25% which is down into a level where I am very excited.

I do want to note that at the end of the day, expense ratios are likely so small that they’re not going to have some massive impact on your returns. The point where you should really care is when you’re looking to put money into the ETF in the first place.

For instance, if you think that IAU and GLD are identical, then go with the one with the lower expense ratio. I’m not advocating for you to sell all of your GLD to go to IAU but rather just putting a spotlight on it for something for you to look at in the future.

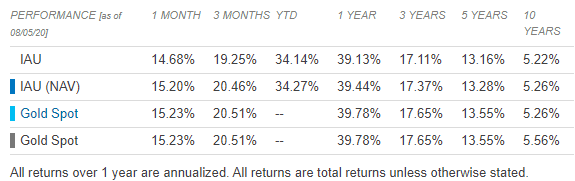

When we look at the returns of IAU, they’re essentially identical to GLD but slightly better, likely due to the expense ratio benefit:

As with GLD, you are investing in actual gold bars in this ETF, so you’re going to be subject to that higher tax rate that I mentioned above – just another thing to ponder. All things considered; I would prefer IAU over GLD.

GDXJ

The next ETF is GDXJ which is the Junior Gold Miners ETF, similar to GDX, but with companies that are of a much smaller market cap than those in GDX.

One sentence that really stood out to me in the overview is, “The fund’s average P/E has often gone into negative territory, a tribute to the fact that many of the firms in the portfolio currently generate no revenue, let alone earnings.”

I mean…ugh lol. This is terrifying. No revenue…WHAT?

I’ve never even heard of something like that in an ETF, but hey, to each their own. I’ll keep going through my analysis but I can promise you that I’ll never invest in a company that doesn’t have revenue.

I can sometimes convince myself of the promise and the vision of a company that’s pre-income, but pre-revenue is a huge no go for me.

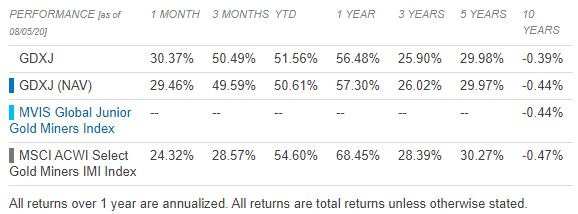

The returns of GDXJ have actually been pretty strong, similar to GDX, for the last 5 years but then we fall off the wagon again:

The expense ratio is .53% so right in line with GDX, so that’s not a deal breaker on my end.

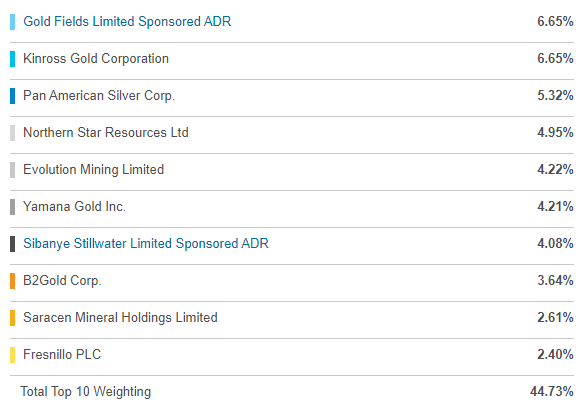

I do love that the Top 10 Holdings are not as top-heavy and more evenly distributed, so that makes me feel good. I mean, the goal of an ETF is to diversify your risk, so investing in an ETF like GDX where two companies make up 25% of that ETF doesn’t exactly do that in my eyes.

The dividend yield is lower than GDX at .26% but that’s so low that it’s truly negligible.

All things considered, if I really wanted some sort of exposure to gold miners, I am going GDX 100 times out of 10. Yes, I know I said 10. I would never invest in anything pre-revenue. Ever.

GLDM

The final ETF that I am reviewing today is GLDM. Similar to GLD and IAU, GLDM tracks the price of gold by investing in actual bars of gold meaning, that’s right you guessed it, the higher tax rate.

The main difference is that GLDM is a much newer ETF and the expense ratio is only .18%.

I won’t even go into the rest of the details, but the fact is that I would gladly choose this ETF with the lower expense ratio than both IAU and GLD if it’s tracking the same thing – which it is!

Summary

So, all things considered, I think the top two ETFs are GLDM and GDX. Personally, I would really only think about an investment in gold if I was trying to do some sort of inflation hedge as I mentioned and if that was the case, I think that GLDM is the way to go because it’s a direct relationship to the price of gold.

In the case of gold, I would be a huge fan of ETF investing, but are ETFs the way to go for all investments? As with anything, it always depends, but if you’re looking for some stable dividends then VOO might be the way to go!

It’s so nice it might even make you go, “VOOOOOOOOOOO!”

Ok. I’ll stop.

Related posts:

- Fiat Money vs. Commodity Money: A Breakdown of the Pros and Cons Updated 3/6/2024 “Money, it’s a crime.” Pink Floyd My grandparents used to say that money makes the world go around, but what do we know...

- The History of the Federal Reserve: Its Creation and Role during Tough Times Is there a more controversial function in finance than the Federal Reserve Bank? From its beginnings, history, and purpose of a bank, there are tons...

- Election 2020: Effect of the Proposed Biden Corporate Tax to the Stock Market As the election approaches, investors naturally grow nervous with the uncertainty. With Joe Biden’s promises to increase corporate taxes and capital gains taxes, investors wonder...

- Global Wealth, Money, Real Estate, Bond, and Stock Market Statistics With so many trillions and billions of dollars changing hands around the world today, how can the average investor make sense of it all? Follow...