An income stock is appealing to investors thinking about retirement because they can provide a consistent stream of income and are seen as more safe investments.

But, not every income stock is built the same.

Some income stocks end up being much better investments than others, and how investors can determine the difference often depends on how much they understand about what makes a good income stock and how they understand investing in the stock market in general.

Let me talk about the basics so that you can spot the difference between a good income stock and bad income stock, and hopefully point you in the right direction to achieving better returns for your income portfolio.

What’s an Income Stock

When you hear the words income stock in the stock market, the overall definition is any stock that pays a dividend. A dividend is simply an income stream on your investment.

The way that dividend payments are expressed in the stock market are through yields. A yield is the percentage of income you will receive if you buy a certain stock right now (at the price it’s currently trading at).

Let’s say you buy a stock that is currently trading in the stock market at $100, and it pays a $3 dividend. Since you need to invest $100 to get $3 in dividends per year, that investment is considered having a 3% yield ($3 / $100) = (0.03) = 3%.

The stereotype about income stocks is that they are “boring”, in mature industries, and have little potential for growth.

That’s absolutely not true, but it’s the reason why you’ll often see them trading at less expensive prices (lower P/E ratios).

Note: A P/E ratio is one of the most common ways to determine whether a stock is cheap or expensive, but it’s not the only way. Learning about P/E ratios is beneficial, as they help us understand the general difference between many income stocks and growth stocks.

Are Income Stocks Better or Worse Than Growth Stocks?

When you hear about income stocks, you’ll often also hear about growth stocks and how they are seen as the counter opposite to each other.

A growth stock is generally a company that it is in the beginning stages of its life on Wall Street, and often doesn’t pay a dividend because the company is so concerned with reinvesting their profits for higher growth.

Investors seeking income often shy away from growth stocks because they usually offer little or no yield.

Now, while it’d be nice to say that either growth stocks or income stocks are better than the other, that’s not really the case.

With growth stocks, you tend to see stocks that are very expensive compared to what they are currently earning in profits.

Some of these expensive stocks (and their high P/E ratios) end up being worth the price as they continue to skyrocket from superior innovation and business success.

However, the thing about growth stocks is that most don’t justify their high prices and eventually see their share price crash or their business completely fail.

It’s for that exact reason that I generally prefer an income stock over a growth stock, all things being equal.

A stock that is in a financial condition where they can afford to pay a dividend often have a stable and proven) business model that should continue to be profitable and thus continue giving the investor and income stream that even grows over time.

In fact, and this runs against what many people on Wall Street generally believe, you can find businesses that have the characteristics of both an income stock and a growth stock—and it’s happened many times before.

Some smart managements out there understand that investors should receive an income for their investment even while a company is growing their revenues and profits, and do pay dividends even as rise through their “growth stage”.

I’d like to show you some ideas for how you can find both.

Buying for Income AND Growth

Some examples of companies that have been a great income stock and growth stock include Walmart, Coca Cola, and Procter and Gamble.

These are businesses that were around for over 10 years and then continued to grow both their business and dividend payments for 25+ years.

Turns out, industries and companies can grow alongside the economy as it grows and innovates over time, and these can make for fantastic investments for those seeking income or growth, or both.

So, how can we try a good income stock with growth?

Well first we need to understand what buying a stock really means.

Buying a stock means you are investing to receive an ownership stake in a business. Just as anyone looking to buy a local small business would want to see the financials (profit and loss, assets and debts) before making a decision, we should want to look at the financials on any stock we want to buy.

On Wall Street, financial information is required to be posted every year and made freely available to investors and people wanting to invest.

We don’t have to become accounting PHDs or CPAs to understand some basics about these businesses and whether they’d make for a good income stock or not.

Let’s just ask some simple questions.

Question #1: Is the stock overloaded with debt?

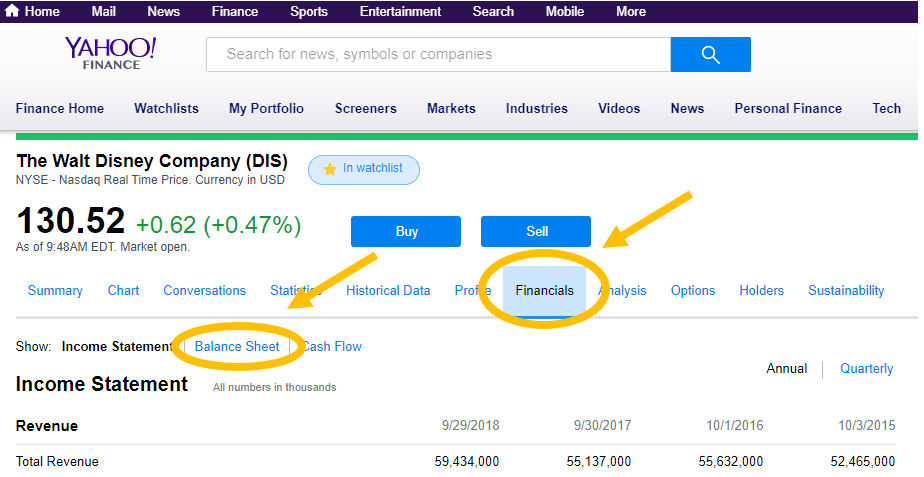

We can take a quick look at a company’s balance sheet to see if an income stock has too much debt. You can use Yahoo Finance to see the balance sheet for any stock, just enter the ticker, then click the Financials tab.

From there, we want to use a simple ratio called the Debt to Equity ratio.

Debt to Equity = Total Liabilities / Shareholder’s Equity

It’s a simple ratio. The lower the ratio, the less a company owes compared to what it owns (assets). I like to see a Debt to Equity ratio below 1, and if one is above about a 2.25 I start to get really worried.

Question #2: Is the stock profitable?

After looking at the balance sheet, let’s look at the company’s profit and loss statement—also called the income statement.

This is also a simple check. If the company has a positive number for Net Income, then they are profitable. If the number is negative, then they are not, and it’s a VERY good idea to avoid a stock like that. I’ve done research that shows just how risky non-profitable stocks can be.

You can combine this check with the P/E ratio above to find cheaper income stocks rather than expensive ones.

Question #3: Is the stock growing its earnings?

To answer this question, use the same income statement that we used for question #2. You can look out over 1 year, 3 years, 5 years, or even 10 years (my preference).

You can use a formula (like the CAGR calculation) to compute whether the company has growth.

More is better. Anything above 5% is pretty above average.

Growth in the past doesn’t guarantee growth in the future, but it can be a good indicator a lot of the time.

Question #4: Is this enough income for me?

For the final question, look at a stock’s yield and ask yourself—does this income stock actually give me the income I seek?

Whether you want the income from your investment to pay your living expenses or just provide a little stream of cash from time to time, use the yield calculation from above to calculate exactly how much income you’ll receive based on how much you’re planning to invest.

You might find that a yield from the 1-4% is satisfactory, while a yield in the 0.01% – 0.5% is not.

I’ll rarely buy a stock that’s much lower than a 1% yield since I prefer income stocks and the way they can compound my investment over time.

Be Cautious and Understand the Risks

At the end of the day, this article should be a starting point for investors seeking income through the stock market.

The more educated you are about income stocks, growth stocks, and value stocks (which I recommend greatly), the more of a chance you have to really make great investments.

You should understand that the stock market fluctuates from year to year, and that is a major risk involved.

You could buy a stock and see it drop 50% in one year, or gain 30% in one year.

What’s important to remember is that buying stocks (the right way) is about investing into part ownership of businesses, and collecting their dividends over time.

As long as you buy into a good business, you can continue to collect income and watch that income stream grow over time regardless of how their stock price moves on Wall Street.

Learning about how the stock market works and how you should evaluate stocks is likely to be a far better investment than any one stock will be, so don’t take it lightly.

Related posts:

- More Thoughts on How to Analyze a Stock’s Growth If you listened to Andrew and Dave’s recent episode dividend growth investing, or maybe your even read my post that talked a little bit more...

- Index vs. Individual Stocks The general consensus among many professionals in the financial world is that index funds are superior to individual stock picking. I have a contrarian opinion...

- How Compounding Dividends Make the “Secret Sauce” of the Stock Market Post updated: 6/16/2023 The sweetest source of returns in the stock market are compounding dividends. To generate serious wealth from investing, you need compound interest;...

- How to Calculate a Stock’s Upside Potential Got the following question from a reader: “I was wondering, how does one go about calculating upside potential?” The answer to this question is really...