As technology increases and goodwill and intangibles continue to get more common on the balance sheets of companies, it becomes ever more important to understand the accounting category. It is essential to be able to differentiate between what is healthy goodwill and intangibles and what is toxic goodwill and intangibles that are not being supported by cash flows.

This article will go over what goodwill and intangibles represent, how they are created, as well as how to spot potentially toxic balance sheets.

Intangibles on the balance can either be internally generated or created through an acquisition. Examples of some intangible assets would include a company’s brand name and trademarks (ie. Coke), patents, licenses, customer relationships and lists, and other proprietary technology.

Goodwill is essentially a catch-all figure created only through the process of purchasing another business. Goodwill could be considered to represent the reputation, human capital, and growth potential of the business being purchased and thus the reason why the purchase price was greater than the net identifiable assets of the company.

How Are Goodwill and Intangibles Created?

Intangibles: Internally generated intangibles can be capitalized on the balance sheet under both IFRS (IAS 38) and U.S. GAAP (ASC 350) but as always, U.S. GAAP has more specific rules-based standards. Like all asset capitalization, costs incurred in the research phase should be expensed and only when the project enters its development phase can costs potentially begin to be capitalized.

Under IFRS, internally developed intangibles can be capitalized only if 1) it is probable that the expected future economic benefits of the assets will flow to the entity and 2) the cost of the asset can be measured reliably.

Under U.S. GAAP costs should generally be expensed when incurred and not capitalized with certain exceptions for computer software intended to be sold, website development, computer software developed for internal use, among other specific examples.

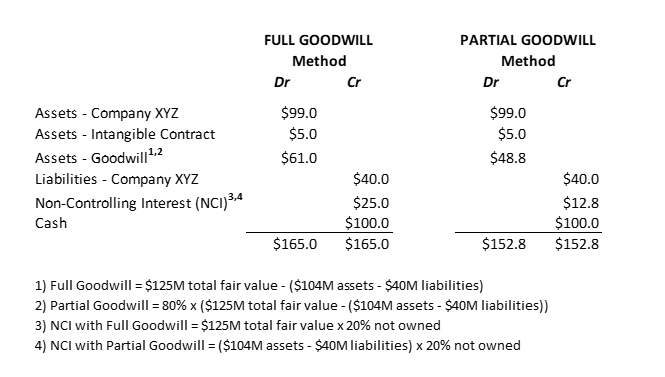

Goodwill: Can only be created on the balance sheet when a company purchases another existing business and the purchase price paid is greater than the net identifiable assets (including intangible assets) of the business being acquired. The amount by which the purchase price is greater than the net identifiable assets of the company represents the amount to be considered goodwill. There are two methods to calculate the amount of goodwill to be recognized during the purchase of another company. The full goodwill method is mandatory under U.S. GAAP but IFRS allows the choice of either the full or partial goodwill method.

- Full Goodwill (U.S. GAAP & IFRS): Under the full goodwill method, the amount of goodwill recognised on the balance sheet will always be more than the amount recognized under the partial goodwill method as the non-controlling interest’s portion of goodwill is being recognized as well.

Full Goodwill = Total Fair Value – Net Identifiable Assets

- Partial Goodwill (IFRS Only): Under the partial goodwill method, only the acquirer’s share of goodwill is recognized. As such, goodwill under the partial goodwill method is always less than the amount recognized under the full goodwill method as only the purchaser’s share of total goodwill is being recognized.

Partial Goodwill = % Purchased x (Total Fair Value – Net Identifiable Assets)

- Example of Full vs Partial Goodwill: Company ABC is acquiring 80% of Company XYZ for $100M. Company XYZ currently has total assets of $100M and total liabilities of $40M on the balance sheet. As part of Company ABC’s due diligence, it was discovered that Company XYZ has a lucrative 10 year contract with a supplier to purchase in bulk at a 20% discount. Company ABC estimated the present value of savings from this contract is worth $5M. However, it was also discovered that $1M of accounts receivable currently on Company XYZs balance sheet are from a customer who recently filed for bankruptcy.

Solution: Company XYZ’s total fair value is $125M given that Company ABC is willing to buy 80% for $100M. The total fair value of Company XYZ’s assets are now $104M given the initial book value of $100M plus the $5M intangible contract asset less the $1M accounts receivable write-down. The net identifiable assets are $44M as calculated by the $104M new fair value of assets less $60M fair value liabilities. The detailed journal entries that would need to be made under each method of accounting for goodwill can be seen below.

Side Note: In our example, the company being purchased was being valued at 1.95x price-to-book value ($125M purchase price/ $64M net identifiable assets) which resulted in the creation of goodwill. However, the situation can arise where a company is purchased for less than the value of its identifiable assets in what is referred to as a “bargain purchase”. In a bargain purchase, both IFRS and US GAAP require the difference between the fair value of the acquired net assets and the purchase price to be recognized immediately as a gain in profit or loss.

Carrying Value

Under U.S. GAAP, intangible assets are measured at historical cost and amortized over their useful life with the carrying value also needing to be tested for impairment. Impairment testing under U.S. GAAP is done at the level of the reporting unit which can be an operating segment or one level below. Goodwill is not amortized, as it is assumed to have an indefinite lifespan, but is tested for impairment at the level of the reporting unit which can be an operating segment or one level below. An asset is impaired if the carrying value exceeds the expected future cash flows to be derived from the asset on an undiscounted basis. Unlike IFRS impairment testing, U.S. GAAP looks at the future value of cash flows on an undiscounted basis so that changing discount rates do not have any effect.

Under IFRS (IAS 36), intangible assets can be measured at historical cost less accumulated amortization similar to U.S. GAAP or, alternatively, intangibles can be measured using a revaluation model as permitted in certain instances. Impairment testing under IFRS is done at the level of the cash-generating unit (CGU) which is the lowest level that is monitored for internal management purposes. Goodwill is not amortized, as it is assumed to have an indefinite lifespan, but is tested for impairment at the level of the reporting unit which can be an operating segment or one level below. An asset is impaired if the carrying value exceeds the expected future cash flows to be derived from the asset on an discounted basis.

Either way, the important take away is that both intangible assets and goodwill need to be tested annually for impairment or more frequently if events or circumstances arise that indicate potential impairment.

The Hint a Write-down is Coming

Goodwill and intangibles need to be tested annually for impairment by analyzing their future cash flows. To get a smoke signal of upcoming impairments, we can look at profitability ratios (such as return on invested capital) to see if the assets of the company (which includes goodwill and intangibles) are generating a sufficient return. Here are a couple articles from myself and site founder, Andrew Sather, using the presence of unsupported goodwill and intangibles to point out frothy balance sheets in Kraft Heinz and General Electric.

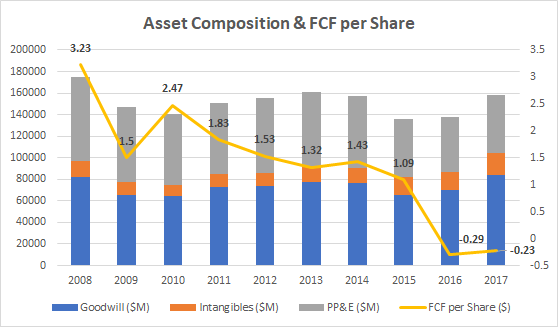

Below is an ugly graph of General Electric’s declining free cash flows per share which left the company’s inflated balance sheet looking increasingly at risk. Ultimately, General Electric would see tens of billions of dollars in write-downs.

Keeping an eye out on profitability ratios and the composition of the balance sheet can help investors avoid being caught up in asset impairments.

Related posts:

- What is Net Book Value? Net book value (NBV) is an accounting term which refers to the value of an asset as it can be seen on the balance sheet...

- Investment Insights from Fair Value Measurement Fair value measurement is an important accounting policy to understand as assets (and liabilities!) carried at fair value on the balance sheet can represent significant...

- What a Good Debt to Asset Ratio Is and How to Calculate It Updated 1/5/2024 Many businesses use debt to fuel their growth in today’s low-interest business world. Because debt costs are far lower than equity, many companies...

- Tobin Q Ratio – CFA Level 3 The Tobin Q ratio is an asset-based valuation model that has found its way into many value investor’s playbooks due to its economic logic based...