Stock splits are a really unique thing nowadays and with so many companies doing it lately, it makes me wonder if it’s also time for a Google stock split.

First off – what even is a stock split?

A stock split is simply when a company decides that they’re going to split the total shares of their company to alter the share price. The total value of the company doesn’t change but the share price will.

I wrote a pretty thorough blog post explaining stock splits that I really recommend you checking out if you want to truly understand the impact, which is pretty imperative for this blog post.

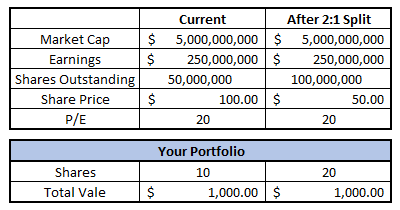

Below is an example of a company that went through a 2:1 stock split where you can see that literally everything is the same except there are now twice as may shares outstanding, meaning that the share price has been cut in half:

Most commonly you will see a company do a stock split where they’re splitting their shares into more shares but sometimes you will see a reverse stock split where the company will reduce their total outstanding shares.

A recent example was when Groupon announced a 1:20 reverse stock split meaning for every 20 shares that you owned, you now have one. Now, again, the value of the company and your shares aren’t changing, except for the fact that many times when companies do this it’s because they’re trying to stay over the $1 minimum share price needed to be listed on the NASDAQ.

Personally, I think that stock splits are nothing more than a mirage. Let me explain:

From forever until 2019, a stock split had a legit purpose. If a stock was $1000 then a person might not be able to buy that company at all and in turn might miss out on the opportunity to invest in that company. I’ve heard arguments from both sides about the pros and cons:

- Pros of a stock split – if the stock splits and the share price go down, then the shares are more accessible by the average investor.

- Cons of a stock split – if the stock doesn’t split then it has somewhat of a “prestige” by being such a highly priced stock, therefore creating demand for people that think of it as a more prestigious stock.

Personally, I laugh at both of these. If you want to invest in a company but the actual share price is keeping you from investing in them, you need to find a brokerage that offers fractional shares.

I use Fidelity and they let me buy fractional shares and I do so every other week when I get paid. Just take some time to do a quick google search to find out what brokerages will offer fractional shares. And don’t pick Robinhood because let’s be honest – there’s many better alternatives.

I simply will just pick the stock that I want to invest (or add to my position) and then buy the amount that I have set aside to automatically contribute each paycheck.

And if your argument is that a stock is prestigious because of it’s share price…then let’s just look back a couple paragraphs about my comment with fractional shares.

You know that “prestigious” Amazon stock price? Yeah, I can literally buy 5 cents of that stock. How’s that prestige for you?

Speaking of Amazon – why the heck haven’t they split their shares yet?

The thing that I loved bout stock splits is that it created accessibility to those that might not have the high funds needed to invest in a company. Or, maybe someone that really wanted to stick to a max 10% stock allocation and if they wanted to buy a $3300 AMZN share then they needed $33K in their portfolio.

Stock splits are great for that but fractional shares solve the exact same issues as long as you can get over the OCD aspect that you don’t own an entire share.

And I say that somewhat tongue in cheek because even myself, as an Apple shareholder, texted my friends after the recent 4:1 stock split and said, “Idk why but I feel so much cooler owning more Apple now”.

Think I’m lying? I’m not.

And yes, our group chat is called ‘Stonks’. I know, I know. Stop shaming me lol.

But again, the actual value of the shares and the company haven’t changed at all. So why do companies continue to split?

Personally, I think it 100% has to do with exactly what I just texted my friends. It has nothing to do with real value but really with perceived value.

So, will the perceived value of Google go up with a stock split?

Let’s look at two recent examples for a reference:

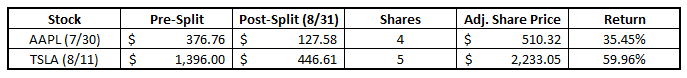

In July of 2020 Apple announced a 4:1 stock split and in August of 2020 Tesla announced a 5:1 stock split, both of which became active on 8/31. So, what happened when these two companies announced their stock splits?

Well, let’s just say that both of these companies went through the freaking roof!

The chart below shows the following:

- The stocks & their split dates

- The opening price on the day the split was announced

- The opening price the day that the split was completed

- The total shares you’d own after the split for every share owned before the split

- The Adjusted share price to show what the price would’ve been on a “pre-split” basis

- The total return if you owned the stock going into the split announcement and sold after the split was completed

As you can see, those are some pretty dang good returns! And the thing is, nothing actually fundamentally changed with the stock! As I showed in my stock split post, the actual fundamental value of the company isn’t changing at all.

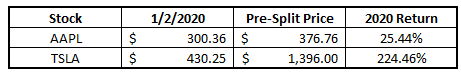

Now, this chart might be a bit misleading, because these stocks have been on a tear this year as well, so let’s look at the performance of TSLA and AAPL since 1/2/20, the first trading day of 2020:

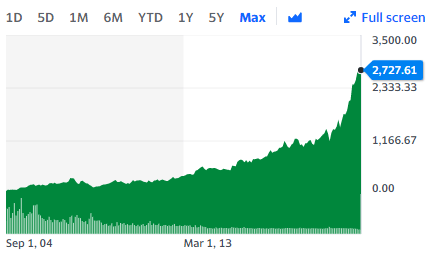

AAPL has had a solid year but Tesla, holy crap. That thing just keeps growing and growing and growing and…. pop? Is that a bubble I see?

?

So, the almighty question that we face now is – is it time for a Google stock split?

Let’s take a look at the current situation!

Alphabet, which is the parent company of Google that trades under GOOG, is currently sitting at a share price of $2,726 on 8/4/21.

Personally, I think that that share price is super high. The highest share price company that I personally own is Markel and that’s currently at $1,223 but I bought for well under $1000.

The issue is that while some brokerages do offer the ability to buy partial shares, many of the large brokerage firms still do not provide that ability.

For instance, TD Ameritrade & E*TRADE just flat out will not let you buy partial shares. Maybe they’re working on it, maybe they’re not. But if I was investing with one of these brokerages and I was only putting in a small amount of money every month or couple of weeks, I would absolutely transfer to a different brokerage.

If you’re putting in $100/month then you can only buy AAPL, even after the stock split, if you save up your money for two months! I hate that.

But if you wanted to buy Google then you have to wait for 1.5 YEARS! And that’s assuming the share price doesn’t go up at all and guess what, it does…

When you get paid you need to put your money into the market ASAP and the data backs that up! Not being able to put your money to work in partial shares is an immediate reason to cash out your shares and switch brokerages. Don’t waste time by just letting your money sit there.

There are other brokerages that do offer them like Schwab and Fidelity but they come with stipulations.

Schwab only lets you have partial shares in a max of 10 companies, for a minimum of $5 investment, and they all have to be in the S&P 500.

Fidelity lets you invest in partial shares for any amount but only on their mobile app. This is the one that’s the most confusing to me because the technology is clearly built but maybe they’re just trying to push more people to their mobile app, which I also hate because that’s when people make impulse decisions to buy and sell stocks and engage in speculative investing.

Personally, I use Fidelity and love it. If I’m ever going to invest in partial shares then I will download the app, make the partial share purchase and then immediately delete the app off my phone so I never get caught up in the moment and make some impulse decision at some point.

If you’re looking for some other options for partial shares then checkout this list of 7 by the college investor to help point you the right way, but I think Fidelity is your best bet.

So, if a google stock split were to occur, then it could theoretically reduce the need for someone to have to be with a brokerage that offers partial shares. A 10:1 split would then make the share price just over $170 meaning if you were saving $100/month, it would take two months of saving to be able to buy shares rather than 1.5 years!

But again, it’s not safe to bank on a stock split, so think about a different brokerage.

The other thing that I have concern with is that many people simply just don’t have enough money saved up to be able to buy these companies without a stock split.

Below is a chart that shows the Average American’s Retirement Saving’s by Age:

As you can see, for people in their 40’s, the average savings is $63K. That means that you could only have 37 shares of Google. My point here is that retirement savings are so small and share prices are so high that it makes it hard for diversification within your portfolio!

Obviously, it becomes even tougher the lower amount of savings that you get. If you want to make sure that all of your stocks never have more than 10% allocation in your portfolio, then you would need $17,282.80 in your account to have Google exactly at 10%.

That’s almost 3 years of maxing out an IRA at the 2020 contribution limit of $6K. That is insane!

I think that a lot of people are going to miss out on the ability to purchase Google because of its high share price…

So, at the end of the day, is it time for a Google stock split?

I think the answer is a resounding ‘YES!’ for a few reasons:

- Most brokerages do not offer partial shares, so by splitting their shares, they would be opening up the door for those that simply aren’t making a ton of money. This is exactly why Ford is so popular for new investors because it’s a brand name and under $10/share.

- People that want to maintain a strict allocation of their assets would need years of saving before being able to put Google into their portfolio. This is again causing a lack of demand for shares of the company

- Nobody actually thinks that a stock is more prestigious because of the share price, or at least I do not know those people.

- Even if partial shares are able to be bought, having a lower share prices have the appeal that a stock is less expensive (even though “expensive” has nothing to do with the share price). Even myself, as a rational investor that understands math, said that I felt cooler owning more shares of Apple even though I knew the value was the same. It’s just human nature to want to own more of something and to want to own a whole piece, such as 1 whole share, of a company.

- Lastly, Google might actually see a major bump in their market cap just as we saw with AAPL and TSLA! This could be a great opportunity to keep boosting that share price up without actually creating true value in the company.

So, just do us all a favor, Google, and split your dang stock!

Related posts:

- What Investors Can Learn from a Possible Amazon Stock Split Amazon stock split? What the heck. “Hey, I have some AMZN stock, don’t split mine in half!” Was that you just now? If so, take...

- Hey Andy – What Happens When a Stock Splits? Have you ever wondered what actually happens when a stock splits? Chances are there are two groups of people reading this right now – 1...

- Guide: How to Read Google Finance Google finance is a great tool to use in your investing arsenal. It’s a great way to get updated ticker information, as well as news,...

- More Thoughts on How to Analyze a Stock’s Growth If you listened to Andrew and Dave’s recent episode dividend growth investing, or maybe your even read my post that talked a little bit more...