Updated 4/21/2023

Screening for stocks using different metrics remains one of the best ways to search for companies to investigate. For defensive investors, one of the best screeners is the Graham Number.

The Graham number equals a formula created from the writings of Graham in “The Intelligent Investor.”

Using different methods to estimate the fair value of investments remains part of the toolbox; each investor must find valuable investments.

Putting our Sherlock investigative skills to the test to determine the intrinsic value of businesses remains a complex process, but a formula like the Graham number allows for a quicker process.

Unlike the DCF or other valuation methods, the Graham number does not account for growth in its calculations. Instead, the Graham number focuses on the company’s earnings power in its valuations.

In today’s post, we will learn:

- What is a Graham Number in Stocks?

- How Does Benjamin Graham Value Stocks?

- How to Use the Graham Number

- Investor Takeaway

Okay, let’s dive in and learn more about the Graham number to value stocks.

What is a Graham Number in Stocks?

The Graham number, according to Investopedia:

“The Graham number is a figure that measures a stock’s fundamental value by considering the company’s earnings per share and book value per share. The Graham number is the upper bound of the price range that a defensive investor should pay for the stock. According to the theory, any stock price below the Graham number is considered undervalued and thus worth investing in.”

Generally, the Graham number is a conservative way to value a company. The Graham number only works on companies with positive earnings and book value.

The Graham number originated from Ben Graham’s writings; although attached to his name, Graham never wrote about the formula directly in his writings. Instead, the formula was created from the criteria he developed for defensive investors.

“Current price should not be more than 11⁄2 times the book value last reported. However a multiplier of earnings below 15 could justify a correspondingly higher multiplier of assets. As a rule of thumb, we suggest that the multiplier’s product times the price to book value ratio should not exceed 22.5. (This figure corresponds to 15 times earnings and 11⁄2 times book value. It would admit an issue selling at only 9 times earnings and 2.5 times asset value, etc.).”

Benjamin Graham, The Intelligent Investor, chapter 14

Graham is often referred to as the “father of value investing” based on his writings “The Intelligent Investor” and “Security Analysis.”

The Graham number gives investors a general test we can use to find stocks selling for a good price, i.e., underpriced or undervalued. As geared more towards defensive investors, the Graham number represents a value the upper-range investors would pay for a company.

How Does Benjamin Graham Value Stocks?

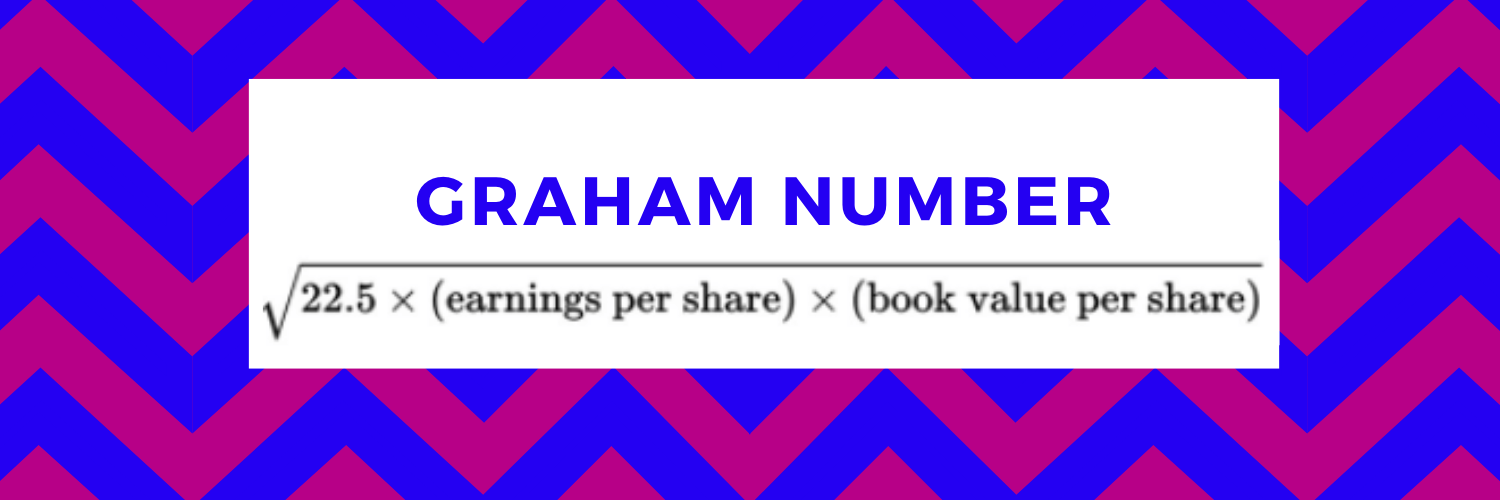

The Graham number is a formula assembled from Graham’s criteria for defensive investors. The formula as created from those values:

As we can see from the above formula, we need two inputs to find any company’s value.

- Earnings per share

- Book value per share

The 22.5 in the formula comes from Graham’s idea of the price to earnings not being above 15 and the price to book not above 1.5, which equals 15 x 1.5 equals 22.5.

We can also look at the formula like this:

Graham number = square root ( 15 x 1.5 x (net income / shares outstanding) x (shareholders’ equity / shares outstanding)

The above formula equals the same, but without the ratios already calculated, earnings per share (EPS) equals net income/shares outstanding, and book value represents another way of expressing shareholders’ equity.

Another way to further refine the above formula is to replace book value with tangible book value. The reasoning behind that idea is in today’s internet and SaaS world, the inflation of book values from goodwill and branding is real.

And accounting considers those parts of a company’s book value; therefore, separating those values makes sense in attempting to be more conservative.

Please remember that Graham focused on “cigar butt” investing during his time, and the Graham number helped him locate these cigar butts.

Think of a cigar butt as a cheap company with little life left in it but still has a small residue of value you can extract, like puffing on the last butt of a cigar.

How to Use the Graham Number

Okay, now that we understand the Graham number’s makeup and some of the theory behind the formula, let’s have some fun and put it to use.

I want to analyze the first company Consolidated Edison, a utility-based out of New York.

We can easily pull the numbers to plug into the formula, but first, I would like to walk through the financials to see exactly where the numbers originate.

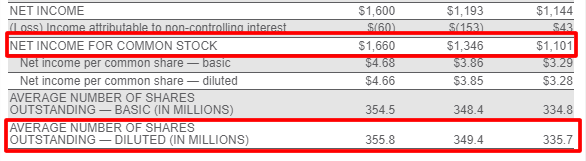

First, we will look at the annual report for the year ending December 31, 2022. Then we will average the three years’ earnings and shares outstanding to find our earnings per share (EPS).

ConEd | 2022 | 2021 | 2020 | Avg |

Net Income | $1,660 | $1,346 | $1,101 | $1,369 |

Shares | 355.8 | 349.4 | 334.8 | 346.7 |

EPS | $3.95 |

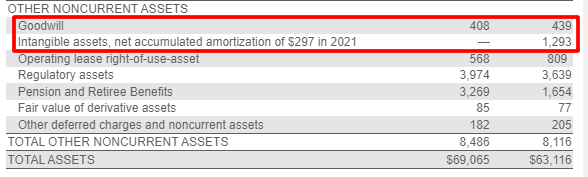

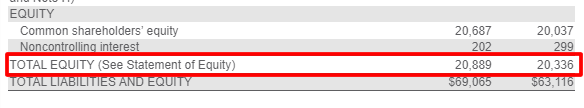

We must locate the shareholders’ equity and subtract any preferred ownership and intangible assets to find the tangible book value. Because ConEd’s balance sheet is so large in format, I will locate and highlight focus areas.

And then the shareholders’ equity next, which is below the liability section of the balance sheet.

We can now take both line items from the above balance sheet snippets and calculate the book value per share.

2022 | 2021 | Avg | |

Goodwill | $408 | $439 | $424 |

Intangible As | 0 | $1,239 | $620 |

Shareholder | $20,889 | $20,336 | $20,613 |

Tangible BV | $19,569 | ||

Shares Out | 346.7 | ||

BVPS Avg | 56.44 |

Let’s plug all our numbers into the formula and see what we get.

ConEd Graham number = square root of (22.5 x 3.95 x 56.44)

ConEd Graham number = $70.82

According to the Graham number, the current market price of ConEd is $95.67, which means the company sells above fair value.

Next, I would like to look at a few companies in the utility sector to get a sense of those companies’ valuations in that sector.

For this exercise, I will use the TTM numbers and include all the ratios for us now that we understand the numbers’ origin.

Company | EPS | TBVPS | Graham | Current |

DTE | 5.60 | 42.30 | $73.05 | $109.54 |

Xcel | 3.20 | 30.40 | $46.78 | $67.44 |

NEE | 2.10 | 22.7 | $32.75 | $77.08 |

DUK | 3.30 | 42.40 | $56.10 | $96.47 |

SO | 3.30 | 27.3 | $45.02 | $68.61 |

As a brief analysis, it appears that the whole utility sector is expensive compared to its price. And suppose you take a cursory glance at the P/E ratios of all of the companies above. In that case, you see elevated ratios, indicating expensive companies, especially in a sector that is not a huge growth.

Remember, this formula is designed to help us locate defensive investments.

Let’s look at a few others to understand how this formula works in different sectors.

Next, I would like to look at insurance companies from various industries, such as health, life, and auto.

Company | EPS | TBVPS | Graham | Current |

Aflac | 6.78 | $36.08 | $74.18 | $64.29 |

Prudential | -3.71 | 44.44 | $0 | $82.74 |

Principal | 18.39 | $27.41 | $106.49 | $74.32 |

Met | 3.18 | $23.09 | $40.65 | $57.94 |

Markel | 32.45 | $759.56 | $744.70 | $1277.44 |

Elevance | 19.09 | 3.07 | $36.31 | $482.58 |

According to the above chart, a few companies from the insurance sector qualify as defensive investments.

- Aflac

- Prudential

- Principal

- MetLife

All would qualify as good investments according to the Graham number.

Now, let’s look at the FAANG stocks for giggles.

Company | EPS | TBVPS | Graham | Current |

Meta | 8.79 | 39.62 | $88.05 | $211.94 |

Apple | 5.99 | 3.57 | $21.94 | $164.90 |

Amazon | 3.30 | 12.34 | $30.27 | $103.29 |

Netflix | 10.09 | -26.86 | N/A | $345.48 |

4.49 | 16.86 | $41.27 | $104.00 |

The above chart doesn’t surprise much because all of the FAANG companies carry high P/E ratios and low book values as they are asset-light companies. Even Amazon, which has some inventory, which you would think would carry a higher tangible asset.

But we should remember that these types of businesses didn’t exist during Graham’s time, and most are asset-light, SaaS-type companies. The Graham number works well for asset-heavy businesses such as industrials, banks, insurance, and defense companies.

Investor Takeaway

The Graham number leaves out several fundamental characteristics, many of which we must consider when analyzing a company—such as management quality, shareholders, industry characteristics, and the competitive landscape.

In terms of fundamental analysis of stocks, focusing on key metrics and economic factors such as:

- Revenues

- earnings

- business cycle

- Return on equity (ROE)

- Return on Invested Capital (ROIC)

- Profit margins

And there are many more, including debt analysis, cash flow analysis, and capital allocations.

Fundamental analysis focuses on the company’s financials, and one of the most famous fundamental investors is Warren Buffett. He is famous for championing fundamental analysis, a major theme of his shareholder letters.

It makes sense because Buffett learned from Graham, as he studied under Graham at Columbia and then worked for Graham’s partnership in his early investing career.

Fundamental analysis is the opposite of technical analysis, which focuses on charts and the momentum of prices.

Don’t confuse the Graham number with the Graham formula, used to find enterprising companies or more aggressive investments.

The Graham number is best used for defensive investing; it fits with Graham’s seven criteria in Chapter 14 of the Intelligent Investor. In the book, Graham outlines his ideas of finding investments that don’t require much investigation and can be held for a long time.

Also, they tend to be lower volatility and more of a tortoise-type investment, slow and steady.

There are a few things to remember when using the Graham number.

- The Graham number doesn’t account for growth; any company growing earnings greater than 10% will see its value underestimated in the formula. The bottom line, any of the market’s growth darlings will not fare well with the Graham number.

- If a company has a temporarily low earnings session or negative earnings, the formula doesn’t look favorably upon those results. A better option is to normalize the earnings over three to five years for better results.

- As we saw in action, companies with light book values will have underestimated values. Microsoft will fair poorly with the Graham number, whereas a company like Lockheed Martin will fair much better.

- Only works with companies with positive earnings and positive, tangible book values. As we observed with Netflix, which has a negative book value, the formula won’t work.

We can best use the Graham number to locate defensive-type stocks. Companies that have strong balance sheets, steady earnings, and pay a dividend. In other words, boring companies.

The companies that Graham had in mind represented solid, dependable companies that would produce slow, if not steady, returns for the defensive investor. During his time, index and mutual funds were not as sophisticated as today.

In today’s market, investing defensively remains easier as we can buy funds that match different markets and set it and forget it, which remains the idea behind a defensive investor.

Graham understood that not everyone wished to be an enterprising investor who studied companies and the markets. He created the defensive investor as a more conservative approach for those that wanted safety and a hands-off approach.

The best situation for success using the Graham number is in defensive sectors, such as banking, insurance, or industrial. It is also best suited for sectors beaten down in the market, such as the banking sector most recently.

The Graham number as a screening tool is its best function; it allows you to find undervalued defensive companies to help you invest and forget it. None of these companies will grow at 20% yearly, but that is not the goal.

With that, we will wrap up our discussion on the Graham number.

As always, thank you for taking the time to read this post, and I hope you find something of value in your investing journey.

If I can further assist, please don’t hesitate to reach out.

Until next time, take care and be safe out there,

Dave

Related posts:

- Graham Formula: Taking a Look at the Way Benjamin Graham Values Stocks “Using precise numbers is, in fact, foolish; working with a range of possibilities is a better approach.” Warren Buffett Warren Buffett shares much of his...

- Is The Graham Number Still Relevant Today? This guest contribution is from Ben Reynolds at Sure Dividend. Sure Dividend uses The 8 Rules of Dividend Investing to systematically identify high quality dividend...

- What is a Good PEG Ratio? Updated: 4/6/2023 The PEG ratio was one popularized by the famed fund manager Peter Lynch, who went on to post one of the best mutual...

- Is Price to Tangible Book Value Dead? A Full Guide to This Controversial Metric Warren Buffett and Ben Graham are the leading proponents of value investing. No fundamental analysis metric has a greater correlation to the company’s value than...