Not going to lie – the title of this article is so good that it almost seems like clickbait, am I right? Good news for you – it’s not! I am going to continue through my book review of ‘What Works on Wallstreet’ and go through Chapter 19 to identify how to find the most important growth factors!

Previously, I have talked about Value Factors and their importance as well as how Multifactor models outperform the market and this will stay right on trend.

I know, I know – this sounds extremely in depth and hard to comprehend, but it’s really not. Not only does James O’Shaughnessy do a great job at making it easy to comprehend, I try to go even another step further to make it easily readable for all investors!

Well, enough of me talking about nonsense – let’s get to the meat and potatoes!

Previously I have written about O’Shaughnessy saying that a Price/Sales (P/S) under 1 is one of the most important factors when evaluating a potential stock but we’re going to add to that here.

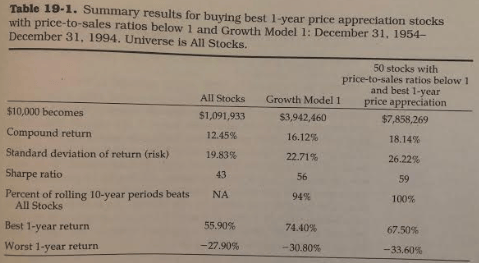

The first example that O’Shaughnessy compares is the following three stock groupings:

- All Stocks

- Growth Model 1 which meets the following

conditions

- Comes from the All Stocks Universe

- 5-year Earnings Per Share (EPS) growth above the average

- Have profit margins above the average

- Each year has increasing earnings

- We will take the 50 stocks with the best 1-year relative strength in this grouping

- 50 Stocks with a P/S <1 and the best 1-year appreciation

Take a look at the results below directly from the book!

Growth Model 1 looks really strong and absolutely killed the market, but the last grouping is nearly double even that Growth Model 1! Those are absolutely monstrous returns.

One thing that O’Shaughnessy points out that he learned during his research is that a positive earnings growth is much more important than the magnitude of growth.

To be completely honest, this seemed backwards for me because I typically think of ‘growth stocks’ as being those that are going to grow rapidly throughout time rather than growing slow and steady, but the data proves that he is right, and I am wrong (again).

O’Shaughnessy now feels like he has identified two areas of stock evaluation that are extremely important for finding future opportunities for great stock performance, and they consist of a low P/S and consistent YOY earnings growth.

So, he then begins to develop what he refers to as the Cornerstone Growth Approach.

The Cornerstone Growth Approach has the following requirements:

- Stocks must come from the All Stocks Universe

- Have EPS that are higher than the previous year

- Have a P/S < 1.5

- Display the best 1-year performance in this All Stocks Group

You might immediately notice that the P/S has been increased from 1 to 1.5 and that’s because he feels that you still can capture some great companies with a P/S under 1.5. It makes sense that as you add these more restrictive qualifications to a stock, you’re going to need to relax some of the qualifications because it’s just going to get harder and harder to find stocks that actually meet all of the qualifications that you’re looking for.

It is very important to note that if you’re going to implement this sort of strategy, which I can tell you that I 100% will be doing in about 30 minutes, that you should be mentally prepared to stomach hardship and be able to handle those hard times.

While this strategy has a very strong record of out performance, it also has had lower lows than what the market experienced during the 40-year timeframe, from 1954 – 1994, that O’Shaughnessy evaluated.

When looking at growth stocks, you need to be prepared to watch your portfolio get absolutely destroyed and have the stomach and mindset that you haven’t yet lost anything because you haven’t sold.

If you buy 100 shares of a company and the share price is cut in half, you still have 100 shares of that company. You only lock in those losses if you actually sell.

That’s exactly what happened in 2009 when the stock market crashed.

People sold their investments and locked in their losses, where if they had just hold on they’d be in the middle of a decade long bull market like we’re currently in, with the S&P 500 reaching levels that is more than twice as high as it was BEFORE the crash.

If you think you can stomach the risk, don’t try it. I need you to KNOW that you can stomach it because it’s not worth it. If you don’t look forward to seeing your investments drop in value because they’re now “on sale” and you can buy more at a cheaper price, then this likely isn’t for you.

O’Shaughnessy does not that the Cornerstone Growth Approach works much better on All Stocks because you’re going to get some smaller, riskier, stock picks rather than just looking at large-caps. So, maybe that is a way that you can get the best of both worlds if you like his strategy but are nervous to jump all in.

You’re likely going to experience smaller gains but also smaller losses.

Personally, I am someone that has a very long time to invest still, so I am going to jump in head first with the All Stocks Universe because I will have the time to allow these investments to recover if things ever do take a turn for the worst.

I love this strategy that O’Shaughnessy goes through because it really is a good mix of evaluating undervalued stocks that also are showing strong growth. More often than not, we focus a lot on value-investing, but I really do think that sometimes you can try to blend strategies to take advantage of the market.

If this is the type of information that you love to read, please go out and buy this book .

This is BY FAR the best investing book that I have ever read because the information is just so easy to read and really makes sense to me. If you’re a number driven person, then you will absolutely love the read and it will be the best investing book you ever read as well.

I know that sounds somewhat sales-pitchy, but I promise you – my commission off buying that book is $0.00. I just want you to become a better, more knowledgeable investor!

So stop waiting – go buy it!

Related posts:

- Historical EPS Data for the S&P 500 – 20 Years of Average YOY Growth Comparing a company’s historical EPS (earnings per share) data with the S&P 500 helps give insight on a company’s growth. It can tell investors whether...

- Stock Market Data on the January Effect: Is it a Reliable Indicator? Have you heard of the January Effect before? The January Effect is a very common topic this time of year in the investing world where...

- Price to Sales is NOT Relevant When Margins Are High – 20Y [S&P 500 Data] The price to sales ratio (or the P/S ratio) has long been a reliable metric for uncovering value because (1) sales tend to be more...

- Real Data Shows What the Best Times to Be Bullish and Bearish Have Been We know when investors are bullish the stock market tends to go up, and when investors are bearish it goes down. But have you ever...