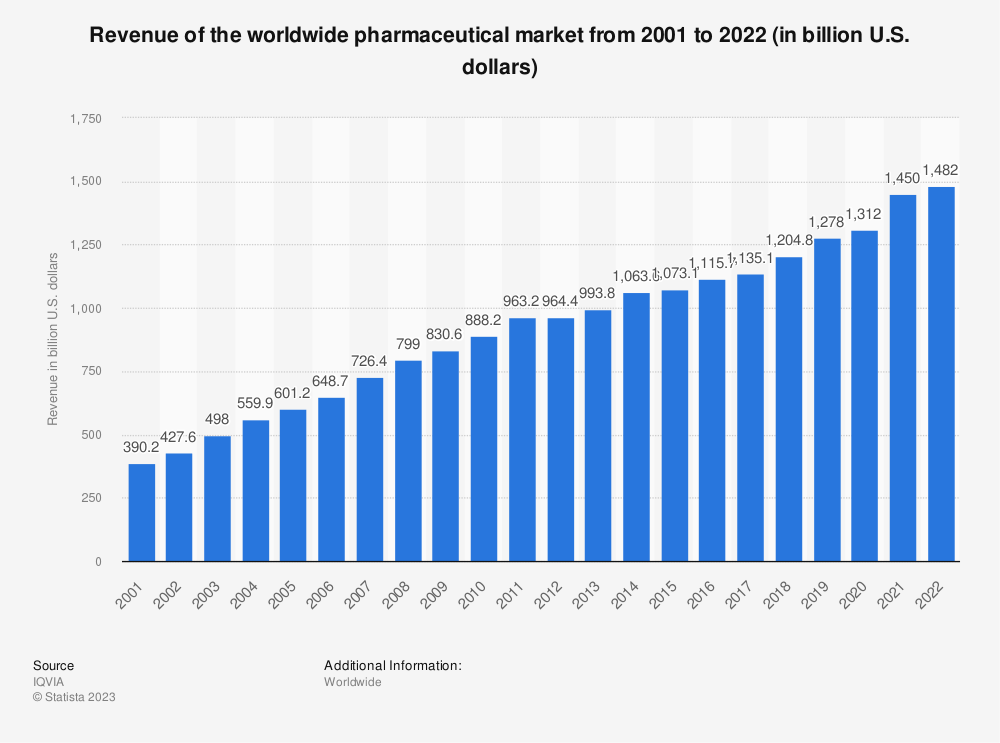

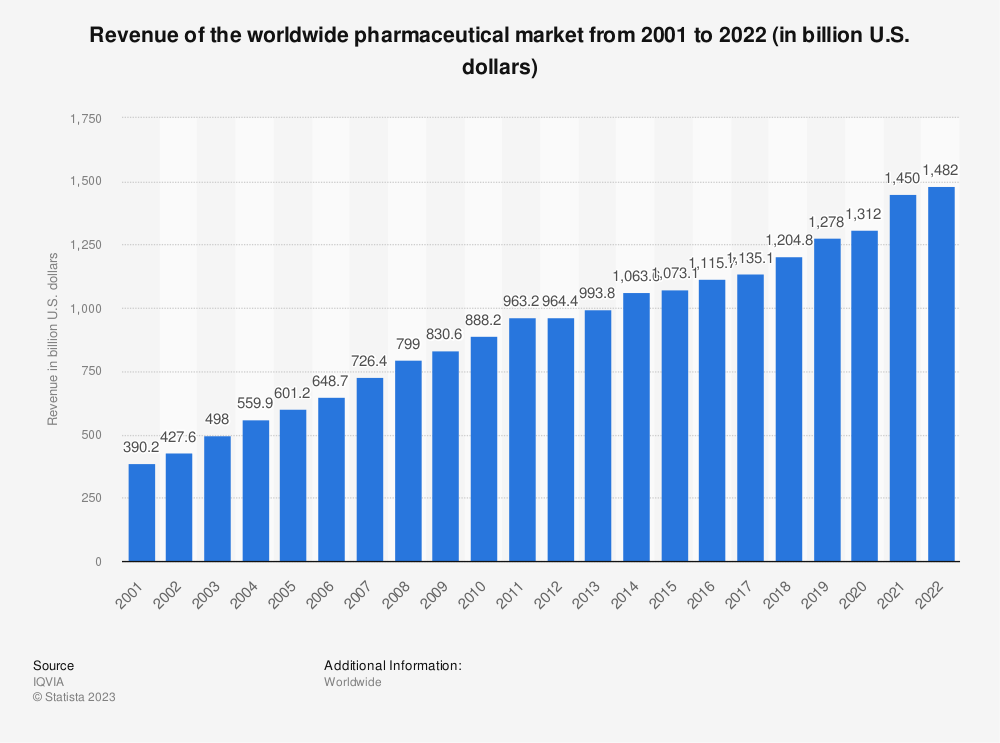

Did you know the revenues for the global pharmaceutical markets in 2022 equaled $1.48 trillion? It had grown from $390 billion in 2002, a CAGR of 7%.

To invest in this growing market, we need to understand the industry. This guide will cover some basics to understand the pharma industry better.

Some top investors, such as Terry Smith, Chuck Akre, and Tom Gayner, own various pharma companies.

The pharma industry has upsides, many dividend payers, and some risks. So we must understand the business models, how they make money, and the costs and risks associated with the companies.

We all had a front-row seat to the impact of the pharma industry during the pandemic. The creation, production, and distribution of the various Covid vaccines were amazing and it strongly indicated how big the industry could impact society.

As with the banking or the semiconductor industry, the pharma industry has some particulars to understand.

In today’s post, we will learn:

- What is the Pharmaceutical Industry?

- The Differences Between Drugs and Medicines

- Types of Drugs: Branded and Generic

- The Importance of R&D

- Pharmaceutical Available Market

- Who Are the Big Players in the Pharma Industry?

Okay, let’s dive in and learn more about the pharma industry basics.

What is the Pharmaceutical Industry?

Wikipedia describes the pharmaceutical industry as follows:

“The pharmaceutical industry discovers, develops, produces, and markets drugs or pharmaceutical drugs for use as medications to be administered to patients (or self-administered), with the aim to cure them, vaccinate them, or alleviate symptoms.”

The pharma industry involves many different types of drugs, branded or generic, along with devices.

The industry hopes to solve medical problems from diabetes and heart disease, to cancer. It uses many of the historical and scientific breakthroughs to current discoveries.

It has come a long way from the early 1800s and the discovery and production of morphine and quinine.

The pharma industry has seen rapid growth and growing profits over the past few years. Some of the top-selling drugs on the market earn billions in sales.

But the costs, as we will see, require a huge investment and testing to bring any drug to market.

Speaking of testing, the pharma industry faces tremendous regulations and restrictive laws to help manage the industry. For a good reason, we all want any drug we take to face rigorous testing before we take it.

Other factors involved in bringing any drug to market include:

- Testing

- Patenting

- Safety

- Efficacy

These steps help ensure the drugs remain the safest for us to consume.

The Differences Between Drugs and Medicines

Many terms in medicine have overlapping meanings. For example, side effects and adverse effects mean the same thing. We have all heard the commercials with the potential side effects. If you think about them, most of us would consider them adverse or undesirable.

Drugs and medicines have the same overlapping meanings.

So then, what is the difference?

To better answer the question, we need to think about the purpose of each.

For example, the purpose of a drug is to prevent, cure, or alleviate a symptom or ailment. Pharma companies create drugs to help give the patient a positive medical effect.

A medicine typically contains many different components. Medicines have active ingredients and excipients that assist in the formulation and efficacy of the medicine.

So what is a drug?

Drugs, as opposed to medicines, can positively or negatively affect the recipient.

For example, drugs like heroin cause a specific effect on people taking it. Heroin, unlike medicine, does not prevent, cure, or alleviate a symptom.

Thus, heroin is not a medicine.

Drugs and medicines can act as poisons, depending on the dosage. Paracelsus (1493-1541), the father of toxicology, once said, “All things are poisons, and nothing is without poison; only the dosage makes a thing, not a poison.”

The bottom line is that all medicines are drugs, whereas not all are medicines.

In the pharma world, we will refer to all medicines by their drug name. For example, Ozempic is a drug name that acts as a medicine for diabetics.

Types of Drugs: Branded and Generic

The pharma industry works with two types of medications:

- Branded

- Generic

Branded

The innovating pharma company gives a discovered molecule a brand name after researching, discovering, developing, and patenting it.

For example, Ozempic, a drug created by Novo Nordisk, helps patients with diabetes control their blood sugar levels.

To create Ozempic, Novo Nordisk spent billions in research and development to bring the drug to market. It typically takes five to seven years to bring a drug to market.

These big research and development costs lead to higher costs of branded drugs in the marketplace.

Generics

Pharma companies have ten years from the first date of a patent before that patent expires. For example, Novo Nordisk has until 2028, when Ozempic’s patent expires.

Once the patent expires, other pharmaceutical companies can build and sell it on the open market.

Other than the branded drug (Ozempic), any product related to the molecule falls under generics.

Because these generics don’t involve the same research, development, and marketing, they typically have much lower prices than branded drugs.

Here are a few examples of branded drugs versus generics.

A generic drug used to treat diabetes is metformin, while the branded name of metformin is Glucophage. On another note, most brand names carry capitalized names, while generics are lowercase.

Another example is metoprolol used for hypertension, which has a branded name of Lopressor.

Branded drugs and generics only have two main differences:

- Generics cost less than branded drugs

- The inactive ingredients, such as flavorings, may change, but the active ingredients remain the same.

The U.S. Food and Drug Administration ensures generic drugs work the same as branded drugs with the same benefits and risks.

In 2023, the generic drug industry generated $53.8 billion in sales, with experts expecting the market to grow by 14.23%.

The Importance of R&D

Research and development of a drug take a long time and a ton of money. The probability of success remains low, with a possible outcome of 1 in 22,407 probabilities.

To create a drug, pharma companies must go through two steps:

- Drug discovery

- Drug development

Drug discovery involves how a pharma company discovers or designs a drug. Today, most companies rely on biotech to help them understand the diseases in question. And then, they can manipulate their understanding using molecular biology or biochemistry.

Many of today’s early-stage drug discovery occurs in universities or research facilities.

Depending on the disease, drug discovery costs can range from $250 million to $6 billion.

Remember that the success rate for drug discovery comes with a high failure rate, with 1 in 10 making it to market. That fact helps explain the high risk of drug discovery and the tremendous costs. For example, it can take up to 12 years for drug discovery at the cost of $2.6 billion.

Drug development involves the activities a company will take once they identify a molecule and the creation of a potential medicine.

The drug development part of R&D involves:

- Identifying formulation

- Potential dosings

- Efficacy or safety

Drug development occurs in stages:

- In vitro studies (lab tests)

- In vivo studies (biological tests)

- Clinical trials

Once a drug reaches the clinical trial phase, it will undergo phases 1 thru 3 before the company can file the drug for market sale. The clinical trial phases include testing on humans for dosage, effectiveness, side effects, and efficacy.

Because of the high failure rate, every pharma company must have a continuous pipeline of potential drugs. Combined with the turnover associated with patents, they face pressure to continue to innovate.

For example, one of the leading diabetes pharma companies, Eli Lilly (LLY), currently has six drugs in Phase 2 and 3 levels. One, Basal Insulin, started Phase 3 trials in 2022/2023. The company states in its annual report that “failure can occur at any point in the process, including in later stages after substantial investment.”

Drug discovery research and development remain costly investments in the pharma industry. For example, only a few compounds make it all the way.

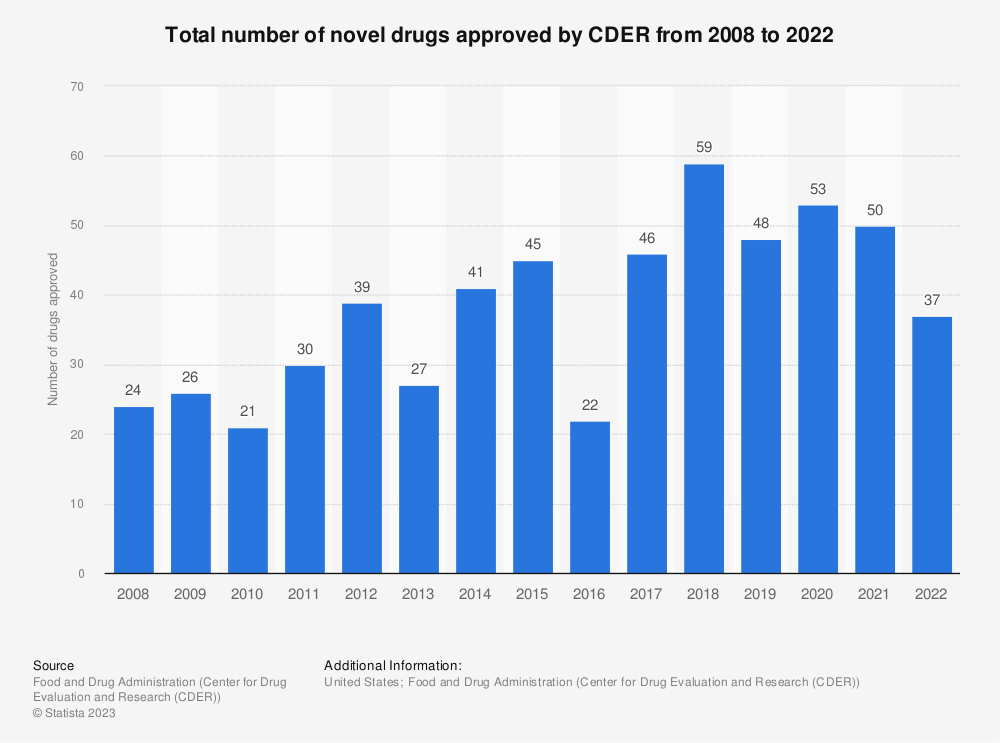

In the U.S., they need to go through the approval process from the Federal Drug Administration. We can see from the above chart that only 37 drugs were approved in 2022, with 50 and 53, respectively, in the previous years.

These approvals only come after expensive investments in pre-clinical and clinical trials. Plus, the companies must commit to ongoing safety monitoring of approved drugs.

For example, the risk for Eli Lilly remains the high failure rate at a high cost, all while generating zero revenue.

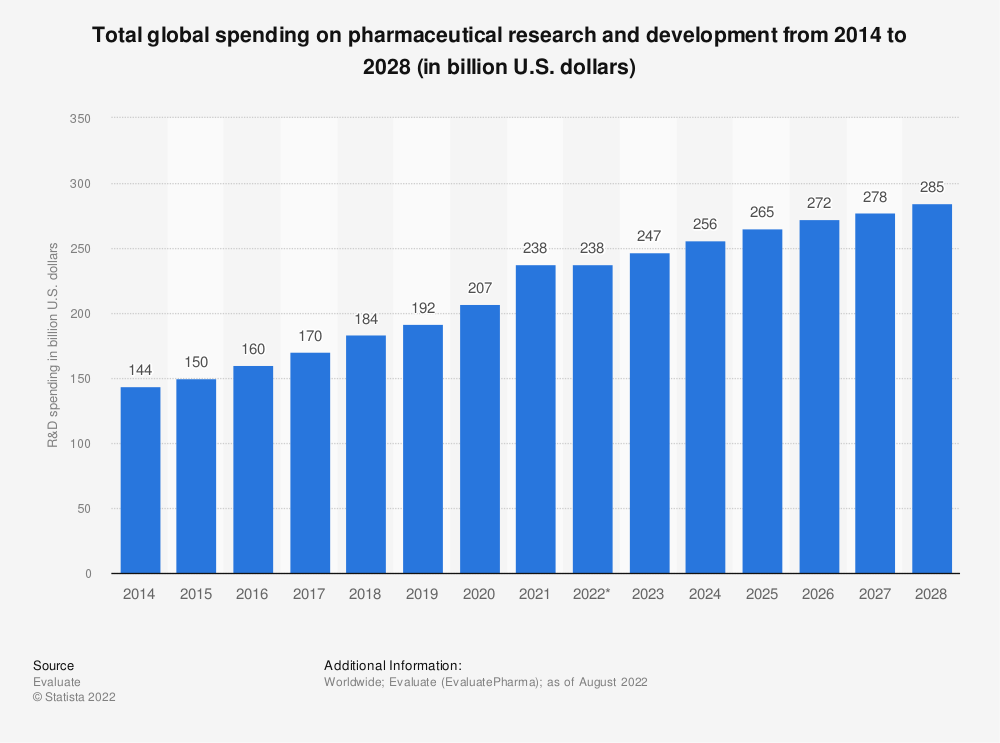

In the U.S. in 2021, the pharma industry spent $101 billion on R&D, with the average spend of R&D compared to revenues reaching 21.2%. These same businesses generated over $483 billion in revenues during the same period. Over the last 50 years, the costs to develop a drug have grown from $179 million to approximately $2.6 billion.

Bottom line: one of the biggest pluses and minuses in the pharma industry is the spending on R&D. It is necessary to achieve growth and continue developing the pipeline. But it also leads to plenty of failures and wasted resources.

Pharmaceutical Available Market

The pharmaceutical market currently sits at $1.25 trillion, with the largest market in the U.S. at 49.1%. The range of available products, from antibiotics to the latest gene therapies and individual treatments, has increased by leaps and bounds.

The increasing use of big data, available with the growth of cloud platforms and AI, allows pharma companies to accelerate the innovation of new drugs and therapies.

All of these innovations have helped the pharmaceutical industry grow at a faster pace than in the past.

While the pandemic certainly put the pharma industry front and center, we continue to see innovations and breakthroughs. Despite the continued revenue increase, the pharma industry hasn’t seen any major revenue drops over the past two decades.

The growth in the pharma industry expects to expand from $1.4 trillion to $1.7 trillion by 2026, a 3.88% CAGR. Experts expect the branded segment to contribute 9% CAGR over the same period.

The bigger pharma players will have a bigger impact on the industry’s overall growth, giving investors a bigger opportunity.

Some of the top drugs on the markets today, by sales, include:

- Comirnaty (Pfizer) – $40.8 billion

- Spikevax (Moderna) – $21.8 billion

- Humira (AbbVie) – $21.6 billion

- Keytruda (Merck & Co) – $21 billion

- Paxlovid (Pfizer) – $19 billion

Popular pharmaceuticals frequently have a significant effect on the producer. Pharmaceutical businesses are occasionally incredibly reliant on their sales results.

Humira accounts for more than 36% of AbbVie’s overall income, while its top three medications account for more than 53%. Businesses that rely on a select few blockbuster medications may face significant income loss.

Adalimumab (Humira) biosimilars are now accessible and will continue to gain market share. But, contrary to certain predictions made years ago, Humira has surpassed the 20 billion-dollar revenue threshold.

These blockbuster drugs will continue to have an outsized impact on their respective companies. If you come across a pharma business with one of these, you must understand when the patent expires and what else they have in the pipeline. Because once the patent expires, the generics will have their day in the sun, which will eat into the revenues and profits of said drug.

Who Are the Big Players in the Pharma Industry?

Vertical integration remains common across many multinational pharma firms, which engage in various medication discovery and development activities as well as manufacturing, quality control, marketing, sales, and distribution.

On the other hand, smaller businesses frequently concentrate on a particular area, like finding drug candidates or creating formulations. Cooperative agreements between research groups and major pharmaceutical firms help investigate the potential of novel medicinal ingredients.

Recently, multinational corporations have increasingly relied on contract research groups to oversee the development of new drugs.

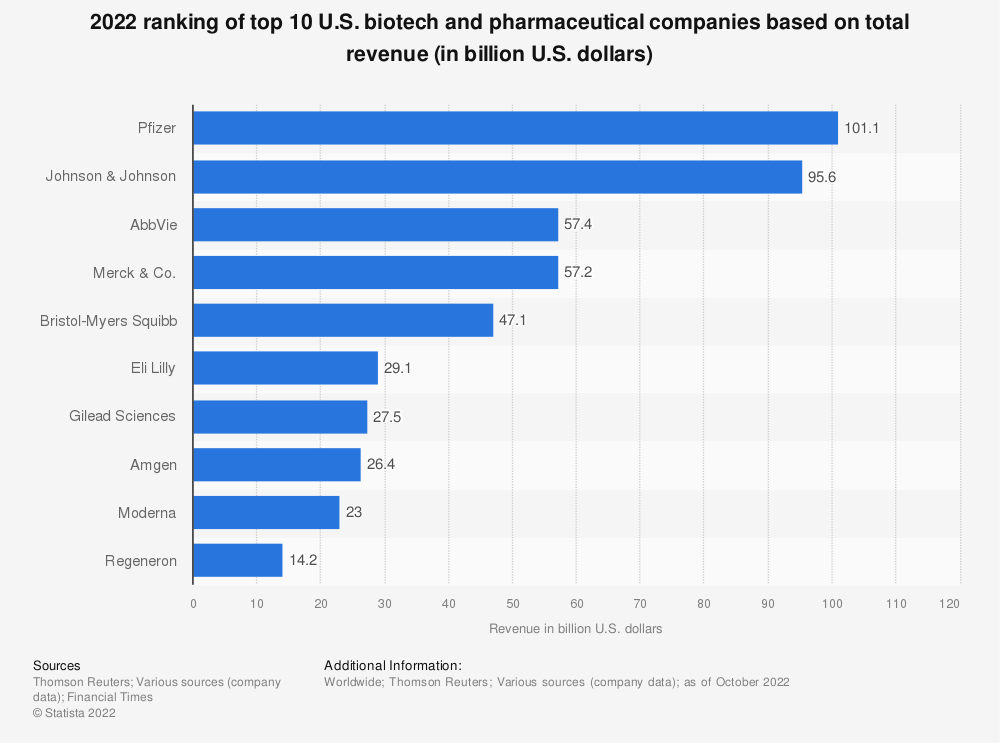

Some of the top pharmaceutical companies in the world reside in the U.S. but are not confined here. Below are a few of the top names in the industry:

- Pfizer

- Johnson & Johnson

- AbbVie

- Merck & Co

- Eli Lilly

But others outside the U.S. include:

- Novartis

- Novo Nordisk

- Sanofi

- Roche

Any of the above would offer a great place to start your analysis. Remember, we need to assess them the same way we would any other company. Try to find companies with a strong, competitive advantage selling at a fair price with great management.

Investor Takeaway

When looking for quality companies to buy, consider looking into the pharmaceutical industry. They have many strong businesses with great financials and long runways of growth.

But as with any industry, we must understand the fundamentals, and I hope this brief primer can help get you started.

And, like any other industry, it comes with some internal and external risks.

A great practice would be to employ Porter’s Five Forces to help you grasp the potential risks associated with particular companies and the industry.

As always, thank your for reading today’s post. I hope you find something of value here. If I can be of any further assistance, please don’t hesitate to reach out.

Until next time, take care, and be safe out there,

Dave

Dave Ahern

Dave, a self-taught investor, empowers investors to start investing by demystifying the stock market.

Related posts:

- Difference Between Operating Leverage and Economies of Scale “Do you know the difference between operating leverage and economies of scale? Seriously, take a moment to define the terms clearly (I did not know...

- What are Selling, General, & Administrative Expenses? In the tech world, SG&A costs occupy a large part of the company’s costs. For many companies, these costs will inevitably occupy a high cost...

- What are Cost of Goods Sold and What’s Included in it? Controlling costs remains one of the more important jobs of management. They must control the costs of producing revenues, which reflect their profits. One of...

- Warren Buffett’s Railroad Investment Updated 9/15/2023 2007, Warren Buffett revealed he had bought over 60 million shares in Berkshire’s first railroad. Buffett continues as our generation’s greatest investor. And...