Updated 3/30/2023

Ever wonder why Warren Buffett buys all those stocks and what the goal is behind them? Also, why does he mention valuing Berkshire Hathaway on its earnings is not the best method?

Much of that stems from his investment portfolio and how the portfolio is treated based on gains and losses in the income statement.

We will discuss the held for trading securities in our continuing series on the different companies’ investment portfolios, such as insurance, banks, and others such as Amazon, Microsoft, and Google.

Each marketable security we have discussed is treated differently in accounting and impacts the companies’ financials.

Many of these businesses create tons of free cash flow and sometimes don’t have anywhere to put it to generate decent returns for their shareholders.

Instead, they use marketable securities to create value for its shareholders until a more lucrative project comes along.

In today’s post, we will learn:

- What is a Held for Trading Security?

- What is the Difference between Held for Trading and Available for Sale?

- Where are Held for Trading Securities Reported

- Impact of Held for Trading Securities

- Investor Takeaway

Okay, let’s dive in and learn more about held for trading securities.

What is a Held for Trading Security?

According to Investopedia:

“A held-for-trading security is a debt or equity investment that investors purchase with the intent of selling within a short period of time, usually less than one year. Within that time frame, the investor hopes to see appreciation in the value of the security and sell it for a profit.”

The held for trading security is part of the batch of marketable securities that include:

The basket that holds all the marketable securities includes:

- Available for sale

- Held to maturity

- Held for Trading or Trading securities

How companies account for these marketable securities dictates how the debt or equity securities list when purchased by the company on both the balance sheet and income statement.

As mentioned above, the held for trading securities serve two purposes. Depending on the company’s preference, they can hold for a shorter period or longer.

These securities have many different accounting treatments, depending on their classification and the company’s purchasing intent.

Because of the intent on a quick turnaround, most of the securities in this basket remain short-term or liquid investments, such as equities or stocks.

Many insurance companies use this type of investment to match the duration of their premiums, depending on the length of time customers hold their insurance.

On the balance sheet, the held-for-trading securities list in the current asset section is more liquid, meaning they can convert to cash quickly.

The held-for-trading securities report the fair value of the investments, which means they will rise and fall with the stock market’s motion. And any gains or losses from these changes in the fair value report as a separate line item on the income statement.

The reporting on the income statement leads to volatility in this line item as a stock portfolio can swing quite a lot, which leads to wild swings in earnings for that company.

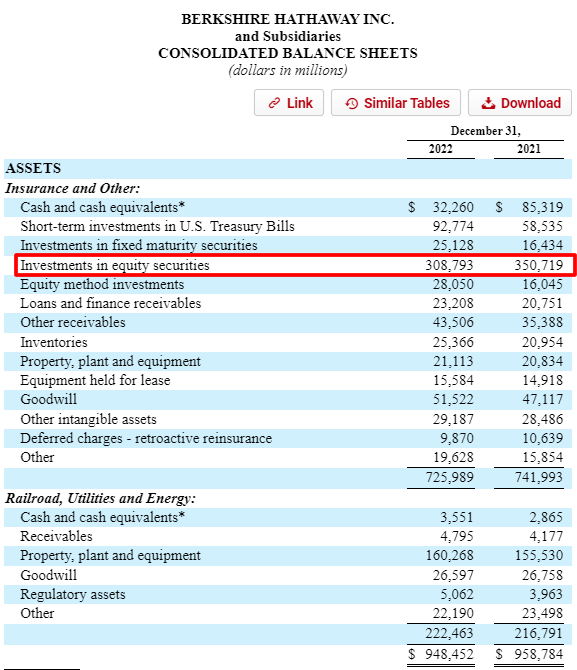

A great example of this is Berkshire Hathaway because of the nature of Buffett’s portfolio. He holds $308+ billion in equity securities, and during March, when the market fell, the earnings for Berkshire tanked along with it, leading to the company reporting a loss for the quarter.

Even though all the other aspects of the business were performing well, the line item reporting the gains or losses from equity investments was a loss, which drove down the rest of the income.

Likewise, when the market took off, Buffett’s portfolio grew by leaps and bounds, driving up the company’s income.

Held for trading securities, also known as trading securities, will list items on companies’ balance sheets. They are interchangeable terms and are both current assets.

These securities types can generate profits for the company either from selling these securities for a profit or by the change in fair value on the balance sheet, a line item on the income statement.

The gains or losses of the held for trading securities list on the income statement as unrealized or realized; in other words, if you sell the security for either a gain or loss, it will list on the income statement as such.

The changes in fair value on the balance sheet listed on the income statement as an unrealized gain or loss; unrealized gains or losses stemmed from the fact that the security was not bought or sold during that accounting period.

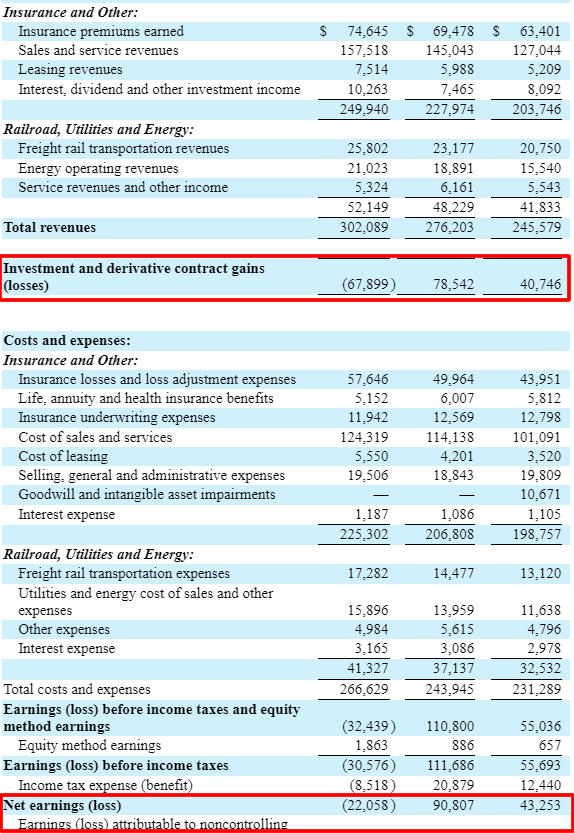

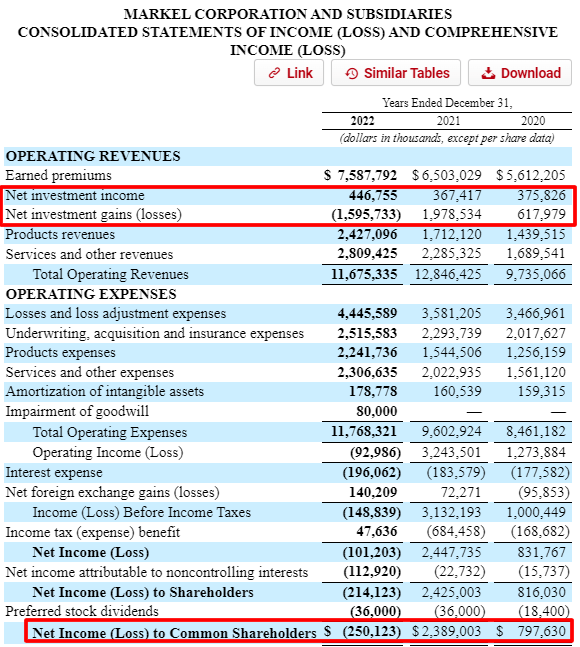

The above income statement from Markel (MKL) illustrates the point. Notice that they have separate line items highlighting changes from securities sales and any fair value changes.

Notice 2022 saw a downturn in both earnings and net investment income. Makes sense because the market was quite volatile in 2022, while 2021 and 2020 saw nothing but gains.

The initial cost basis of the investments equals the securities’ fair value at the purchase time. For example, if you buy two securities, A and B., Security A is worth $15, and Security B is $520.

Then on the balance sheet, the total fair value of those securities would total $535.

More on this in a moment.

Let’s look at the difference between held for trading and available for sale.

What is the Difference Between Held for Trading and Available for Sale?

Available for sale (AFS) securities and held for trading (HFT) are similar: securities, debt, and equity that are meant for shorter holding periods.

Debt and equity securities are available for sale on the balance sheet at fair value.

But one big difference is their treatment in accounting. AFS securities list on the balance sheet at fair value, and the reporting of fair value changes as unrealized gains/losses on the comprehensive income section below the income statement.

They are also a separate component of shareholder’s equity, reporting on the other comprehensive income section.

Trading securities or HRT are current assets, like the available-for-sale securities; they also list fair value on the balance sheet and the changes in that fair value record.

But the main difference is the unrealized gains/losses list as a separate line item on the income statement and count towards the company’s net income or earnings.

Cash flows from the trading securities also flow to operating cash flows. Cash flows from purchases or sales of AFS held to maturity are investing cash flows.

The main difference between the main three marketable securities is their accounting treatment. Many of the actual securities held in each category are similar.

Current assets such as liquid marketable securities are available for sale and trading securities.

Held-to-maturity securities are noncurrent assets.

A simple explanation of the transfer of security from purchase to sale of the security below:

Available for sale security |

Changes in the fair value list on the balance sheet and the changes listed on the comprehensive income statement |

Any changes also listed in the accumulated other comprehensive income as shareholders’ equity |

Any interest, dividends, or sales listed as net investment income |

Held to Trading or Trading security |

Changes in the fair value list on the balance sheet and any changes listed as a line item on the income statement |

Any sale for a gain or loss lists as a separate line item on the income statement |

Any interest, dividends, or any other income listed as net investment income |

Let’s move on and look a little deeper into the accounting treatment of held trading securities.

Where is Held for Trading Securities Reported?

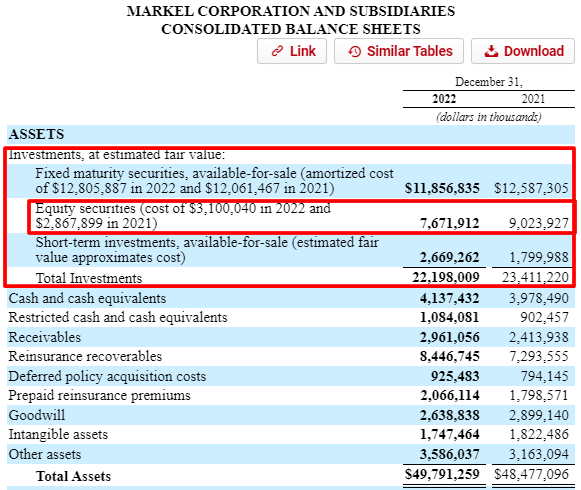

As mentioned above, the held for trading securities list on the balance sheet at fair value.

When the company buys a trading security, say Markel buys Visa for $200 a share. The company lists that purchase as a held for trading security or trading security at $200 on the balance sheet.

Now, let’s say that six months have passed, and now they are compiling their balance sheet the look at the fair value of Visa, and now the price is $220 a share, which means that Markel will list that as $220 on the balance sheet.

But now that extra $20 in value “earned” by the company goes on the line item of gains/losses on the income statement as an additional $20 the company earned.

As more time goes by, and we are now three years past the purchase of that trading security, when the company reports its balance sheet, it assesses the fair value based on the current price, which is now $310.

Then on the income statement, the line item will record $110 until Visa is sold, and the company records any changes in fair value compared to the original purchase price.

Until Markel sells Visa’s stock, any of these fair value changes are unrealized gains or losses. Once the company sells its share of Visa, it becomes a realized gain or loss.

Okay, let’s move on to the impact of these marketable securities on their financial results.

Impact of Held for Trading Securities

Held for trading securities occupy a large part of the assets of many large corporations such as Berkshire Hathaway, Markel, and Alleghany. All of those companies function in the insurance industry, for the most part.

And all three have large investment portfolios comprising debt and equity securities that are both available for sale and held to trading.

The asset section of Berkshire’s balance sheet shows that the company holds $308.7 billion in equities. That is a big chunk of change, and we may wonder why Buffett invests in equities.

Buffett believes that the investments he chooses help grow Berkshire’s value because of the method he uses to buy these stocks. His value investing style tends to grow these “wonderful” companies, building asset and shareholder value.

Instead of investing in low-yielding investments such as long-term bonds, which have returns of approximately 3% to 4%, he chooses stocks, earning Buffett around 18% to 20% compounded annually for the last 50 years.

As Buffett owns other businesses, such as Geico, National Re, BNSF, and others, grow their value and contribute cash flow and earnings to the Berkshire coffers, Buffett then takes those funds and invests them in stocks.

Because of his success as an investor, he can drive shareholder value by using those funds to invest in the market or buy other companies that will drive more value.

But the basis of all the success is the investment portfolio.

He also takes the “float,” or profits from his insurance businesses, to invest in the markets, growing their value. Most insurers invest in debt markets or bonds because they are safer, secure investments.

But Buffett is different in temperament and skill level, so his investments are not as risky as others. His cash cushion’s nature allows him to invest those funds without worrying about a run on the cash in the insurance business.

Another benefit is the liquidity available with the equity portfolio, as held for trading securities are current assets. If companies need cash quickly, they can turn over their portfolios for cash.

Granted, it could be at a loss compared to fair value, but they are more liquid than many companies’ inventories.

As the unrealized gains/losses add or subtract from the company’s net income, those earnings lead directly to the company’s retained earnings. In Berkshire’s case, those gains in fair value lead to higher shareholder equity, which is good for shareholders because that is the equity we own when we buy Berkshire.

These are all concepts to consider when analyzing these companies’ marketable securities portfolios, such as Berkshire, Markel, Allegheny, Microsoft, Apple, and Amazon.

Investor Takeaway

As investors, what can we learn from learning about marketable securities and all the different components?

The first idea is understanding the different line items and their meanings and impacts on a business.

When a company generates cash flow, they have three ways to use those funds:

- Dividends/share repurchases

- Reinvest the company with new projects

- Sit on the cash

But the final option isn’t that great, and if opportunities to reinvest in the company are lacking and you already pay a dividend, then the options are few.

The business can either put the money in the bank and wait or pay a special dividend to shareholders, which is nice—but not always the best for us in the long run.

Suppose the company is struggling to find projects to grow its value because the last thing anyone wants to do is destroy value. In that case, the option is to use marketable securities to grow the value.

Depending on the company’s goals, they have different options, and in more aggressive companies like Berkshire, the choice is investing in stocks.

For those more conservative companies, the choices are using different debt vehicles, all of which help.

Many companies choose a mixture of different classifications depending on their goals and long-term plans.

But as investors, it is a good idea to understand these types of investments and their goals to grow value for our company.

Not everyone can be Warren Buffett, which is okay because a company like Prudential, which buys bonds as its main investment, does quite well.

With that, we will wrap up today’s discussion on held for trading securities.

As always, thank you for taking the time to read today’s post, and I hope you find something of value on your investing journey.

If I can further assist, please don’t hesitate to reach out.

Until next time, take care and be safe out there,

Dave

Related posts:

- Marketable Securities In-Depth Guide: What They Are, Valuation, and Impact Updated 3/30/2023 Have you ever seen that line item on the balance sheet listed as marketable securities and wondered what they were? I know I...

- Types of For Sale Securities and Their Accounting Treatment (AFS/HTM/HFT) Have you wondered what all those assets on an insurance company’s balance sheet were? Or why do companies carry such a large balance of marketable...

- Types of For Sale Securities and Their Accounting Treatment (AFS/HTM/HFT) Updated 12/19/2023 Have you wondered what all those assets on an insurance company’s balance sheet were? Or why do companies carry such a large mix...

- Pros and Cons: Held to Maturity (HTM) Securities on Companies’ Balance Sheets Updated 3/30/2023 Did you know the majority of financial assets for most companies comprise marketable securities? Did you also know companies such as Microsoft, Amazon,...