Have you started your home savings account and aren’t sure what to do with the funds? Do you feel like you’re not doing enough with that down payment fund and wonder what move is best? With the current market, a down payment can be as much as a year’s salary. This post is a story covering my process of buying a home and what I learned from the process.

Click to jump to a section:

- Backstory

- Options for How to Save for a House

- Mortgage Options

- Why You Must Avoid PMI

- The Best Mortgage Option Based on the Math

Backstory

Less than a year ago, my wife and I found ourselves in a situation where we were moving to a new city and were in the housing market. I was expecting to move in March next year, but I was offered a great new opportunity in late October that I couldn’t pass down.

While both my wife and I were excited about moving and the excitement that going to a new place brings, I was also extremely stressed out about money.

You see, in my eyes, I was operating under the assumption that we wouldn’t move until March. I thought I still had 4-5 more months of saving and really increasing the amount that we could put down on a house. It turns out that we didn’t have that time, so we had to make do as best as we could.

Luckily, we had been financially planning for a move for quite some time, knowing that my company will typically move employees every 2-3 years. So, we were planning for the next move before we even unpacked our boxes in Chicago.

This was the first time we were buying a house instead of renting, and we had absolutely no idea where to begin.

I spent countless hours researching all the different types of down payment options. I wanted to ensure we maximized our savings by selecting the right down payment option. Picking the right one could easily mean $10,000s saved.

As I mentioned, we had planned to buy a house for a while. While living in Chicago, we got engaged and married, both of which are extremely expensive — to get a ring and to pay for a wedding. Living in Chicago is even expensive by itself.

So, while we had been saving for a while, it wasn’t a shoo-in that we would just put 20% down. I spent a lot of time budgeting, saving, and researching to ensure we were optimizing our home savings.

First, any extra money that was leftover from the budget went into our “down payment fund.” But what should we do with the money saved for our next home?

Options for How to Save for a House

Let’s cover the three options for saving for a house:

Home Savings Option 1: Fifth Third savings account with .01% interest

I don’t feel bad putting Fifth Third on blast about this because they deserve it. Actually, I feel as bad about calling them out by name as they do by only giving .01% interest – not at all.

If I put $350 into the savings account every paycheck since moving to Chicago and took it out on the day that we closed on our new house, that $19,250 would be worth $19,252.

Wow. I actually laughed out loud when I ran this math.

Home Savings Option 2: Invest it in the stock market

I was really getting into investing in Chicago, and I sooo wanted to do this. I even convinced myself that I could just put it in the Roth IRA since you can take it out for first-time home buyers using it on a down payment on a house. I am ecstatic that I didn’t.

This is where I am so incredibly happy that I did research and learned that if you’re investing only in the short-term, the stock market can be very volatile and is likely not a good idea. A dip, as we have seen due to COVID, could cut your available down payment by 20% nearly out of nowhere. That volatility is fine for long-term savings but not for a down payment next year.

If I put $350 into the S&P 500 every paycheck since moving to Chicago and took it out on the day we closed on our new house, the $19,250 that was put in would be worth $18,546, or a loss of $704. Ouch.

Home Savings Option 3: Open a high-yield savings account

This is what we chose to do. It seemed like a good combination of both options. It was no risk for a decent return and a guaranteed return at that.

Most high-yield savings accounts offer between 3-4% returns. Read more about what these accounts are and how to start them here.

In total, if we put $350 into the savings account every paycheck since moving to Chicago and took it out on the day we closed on our new house, that $19,250 would be worth $19,696.

Overall, a small increase of only $446, but that’s $444 over the next best alternative.

Very happy this is the decision that we made.

Mortgage Options

Now that we had decided on the saving method, the next topic was what we were saving for. What sort of down payment could we handle? I looked into tons of options and narrowed it down to the ones that stuck out most to me:

Mortgage Option 1: Put 20% down (or more)

This likely seems obvious, but this is always the preferred option. Not only does putting 20% down allow you to have lower monthly payments, but most importantly, it keeps you from having to pay Private Mortgage Insurance (PMI).

PMI is essentially an insurance to the lending company in case you default on the mortgage.

Because you’re paying 20% or more of the house value upfront, the risk that you will default is much less than if you were putting in less than 20%. This lower risk means you get to avoid PMI and trust me, you really want to avoid PMI.

Mortgage Option 2: Piggyback Loan (80-10-10) – 10% Down

I view this as 1B to paying 20% down. A piggyback loan is where you take out a mortgage for 80% of the home value, take out a second mortgage for 10% of the loan, and then put 10% down.

This is one of the options that we really strongly considered.

The offer extended to us was:

- 3.5% APR on the first mortgage for 80% that lasted 30 years

- 5.5% on the second mortgage for 10% of the loan that lasted 10 years

- Putting 10% down.

The major pro of this loan is that it allows you not to have to pay PMI while not putting down 20% for the down payment.

The major con is that for the first 10 years, you’re going to have much higher payments because you’re paying that second mortgage at a higher interest rate.

This type of loan is uncommon, but I think it’s truly a diamond in the rough when used properly. It can take some of the stress off of saving for an entire 20% down payment which can easily be $60,000 nowadays.

The key is not to overextend your means with that second mortgage, but it can really come in handy for those that might have a good salary but haven’t saved up enough for one reason or another.

Mortgage Option 3: Conventional Loan with 10% Down Payment

This loan simply puts down 10% and takes out a 30-year mortgage on the remaining 90% of the home value.

Overall, this option isn’t the worst thing you can do if you can afford the payment. However, you should anticipate paying PMI at least until you get 10% of the principal paid off in addition to the down payment.

Other Options

Other options, such as a Rural Housing Loan (USDA Loan), FHA Loan, Conventional 97/3, etc., offer many benefits on their own. However, these were loans we either didn’t qualify for or entertain because of the lower down payment.

Which Mortgage Option is Best?

In general, I know a lot of people use 20% as a threshold for a down payment, but I fall more in the 10% camp. I will be treating 10% as the baseline for down payments.

I highly recommend option 1 (20% down) and option 2 (piggyback loan). In my opinion, avoiding PMI is an absolute must. PMI can set you back as you’re paying a lot of extra money each month because you’re a higher risk to the lender.

Many people think, “I’m paying $900/month now for rent. I can get a house with a $900 mortgage too.” That sounds great in theory until your AC breaks, you need a lawn mower, your home floods, etc. You have to pay for 100% of that, compared to 0% when you’re renting.

In our first few months of home-owning, we’ve had to replace our driveway and AC. At the same time, non-home-related expenses keep coming. The car needs new tires or I have a doctor’s visit.

Why You Must Avoid PMI

Please, save up enough to avoid PMI. You’ll be happy you did.

Let me prove it to you.

I found a calculator online at https://www.hsh.com/calc-pmi.html, and it allowed me to project loan payments with PMI. Let’s look at one specific example:

- Assumptions

- Your credit score – Fair (700-719)

- Interest Rate – 3.5%

- 30-year mortgage term

- $200,000 home value

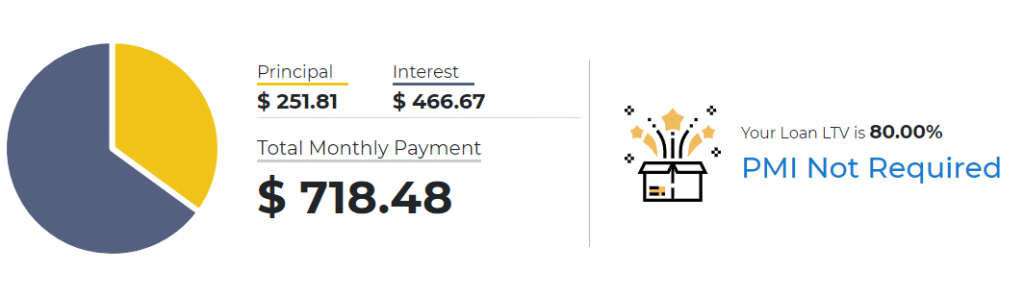

20% Down ($40,000)

Entire Mortgage Loan – $160,000 (80% of $200,000)

Piggyback Loan (80-10-10) – 10% Down ($20,000)

First Mortgage Loan – $160,000 (80% of $200,000)

Second Mortgage Loan – $20,000 (10% of $200,000)

Note that I’m also assuming the interest rate is 2% higher than the 1st mortgage, which is common for this type of loan, and that it’s a 10-year payoff period.

Total Monthly Payments for the Piggyback Loan:

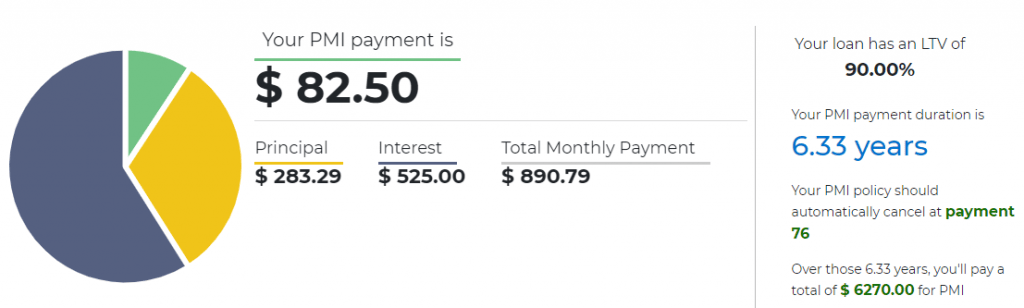

10% Down – ($20,000)

Entire Mortgage Loan – $180,000 (90% of $200,000)

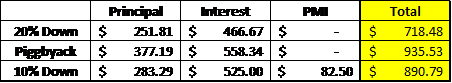

In summary, your total payments would look like this for the three loans:

The Best Mortgage Option Based on the Math

As you can see, your payments are considerably cheaper each month if you put down 20% and avoid PMI.

This is why putting down 20% is always the #1 best choice, without a doubt.

The next best choice might seem like the 10% down option, but I disagree. With the 10% loan, you’ll notice that you’re paying $82.50/month in PMI, which is just being flushed down the drain vs. $0 PMI with the Piggyback loan.

Think of this as buying in bulk – the upfront cost of buying something in bulk is obviously more, but it might be less on a cost/item basis.

This is very similar here. You’re going to pay $45 more per month with the Piggyback, but that’s all going towards the principal and house interest, instead of being wasted on PMI.

Paying the least per month isn’t always the most important factor. It is also important whether your money is going towards the home or something like interest or PMI. Putting money into these is like flushing it down the drain.

So, what is the best loan to go with?

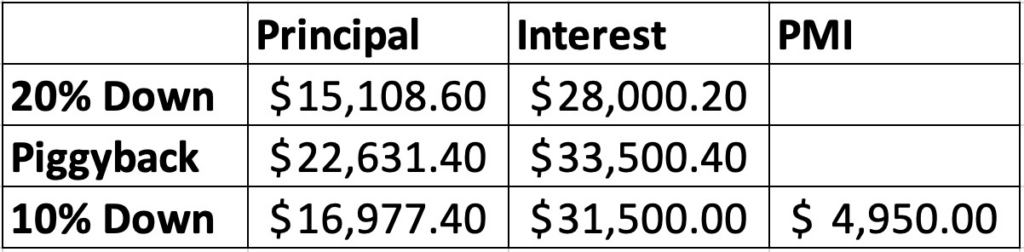

Let’s fast-forward 5 years and see how much you would’ve paid in Principal, Interest, and PMI with each of these loans:

Now the Piggyback loan might seem like a better option, right? You’ve paid that extra $45/month, or a total of $2700 in 5 years. But your Principal is $5,634 more paid off than the simple 10% down loan, and that’s because you’ve paid $4,950 in PMI with the 10% down loan.

So, if you went with paying 10% down, you’ve paid $2,700 less over those 5 years, but your house has $5,634 less paid off than the alternative – not ideal.

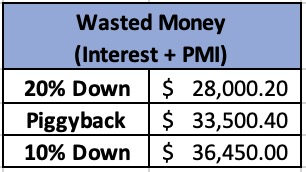

All in, let’s take a look at the total “wasted money”, which is the Interest + PMI:

As you can see, there is a clear loser here…

If you only take away one thing from this article, it’s to make sure that your home savings are enough to avoid PMI. I normally hear people say to ensure you have 20% down, but I don’t 100% agree.

In my opinion, the best part of 20% down is to avoid PMI, and you can do that by only putting down 10% as well, but you have to be smart and disciplined about it.

Just as I did, take some time to research, crunch your own numbers, and save up enough money so that you’re making the best decision for you. Good luck in your house-buying journey!

Related posts:

- How Much Should I Budget for a Car? At times you need to treat yourself, but always make sure to calculate how much you can spend on a car before you go crazy!...

- Don’t Think You Can’t Save Money Quickly With a Low Income? Updated 1/15/2024 Have you been told that you can’t save money quickly with a low income? Are you tired of living paycheck to paycheck? Are...

- Key Things to Save up for as you Navigate Through Life No matter what stage of life you are in, there are always things to save up for. Here is a short list you should consider...

- What Are the Rules on your Income to Rent Ratio in Today’s World? I remember being 16-years old and thinking that moving out from my parents’ house was going to be the best day of my life. While...