As a recent first-time home buyer, I have learned (some proactively and some the hard way) some quick tips to that will help you save on the cost of your mortgage. A lot of obvious things might be “lower your APR” or “put more than 20% down,” which are great, but not always realistic.

So, I wanted to dig a little bit deeper and “get in the weeds.” To help you be able to afford your home and potentially even save some money, I have created this House Hunting Checklist to help make sure you’re covering all bases when buying that new home.

1. Shop Mortgage Rates and Closing Costs

This might seem obvious, but it’s not. A lot of people that I know will get a rate, deem it to be “fair,” and then move on with their day. Like….what?

ALWAYS get at least a few different rates.

Some employers might offer a program for you to get X amount of cash back going with a company but even after that cash back rebate, your total closing costs will still be higher.

And guess what, the same sort of concept goes with APR.

I personally found almost an entire percent difference between the high and low offers that we received when picking a lender for our mortgage.

Did you know that a .5% difference in an APR rate on a $250,000 mortgage will cost you over $25,000 over the 30-year term? So, .5% difference means you’ll pay an extra 10% of the actual mortgage.

Don’t assume your offer is great. It might be. It might not be. You won’t know until you have AT LEAST three total offers.

2. Get Your Credit in Order

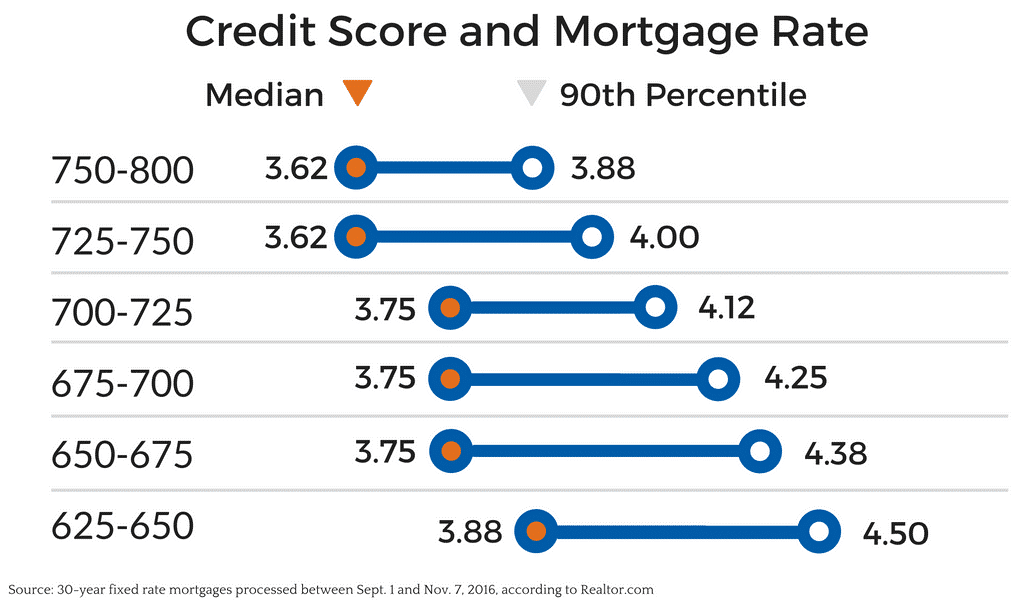

Again, this probably does seem obvious, but it’s very important. It might seem like it would be hard to actual put the numbers to exactly how correlated a low credit score is with low interest rates but turns out, it isn’t. Take a look at the chart below from realtor.com showing this exact thing.

Note that the difference between the 90th percentile loan for a 650 score and a 750 score is .62%. I’ve just told you how much a .5% difference can make, so I’m going to let you go ahead and understand why this is just so important to get in order.

If you want some help building your credit, take a look at this previous post to help you get your credit in shape.

3. Follow the Market

Understand the various market dynamics for the area where you’re looking to purchase a home. Every market is different and it’s extremely important to understand the types of things impacting that market.

$200,000 doesn’t buy you nearly as much in Chicago as it does in rural Iowa.

Lifestyles and economies are different, and so are those local housing markets. If you don’t know the market before you’re actively looking to buy, you could be blindsided and tempted to buy a house that you cannot actually afford.

When I lived in Chicago, a 550 square foot studio condo cost $379,000. That same amount of money can buy a stupid nice house in my current hometown.

Fortunately, I knew before moving what the market in Chicago looked like, so I knew that renting would be the best option.

Just as I knew when I moved to my current hometown that we would purchase a home, and we knew exactly what type of home we could get for X amount of money– this then allowed us to save properly for a down payment and budget correctly before we even were offered the opportunity to officially move here.

4. Optimize the Proper Offer/Down Payment for Your Lifestyle

This is a big one that not a lot of people think about. There are many different down payment/loan options, such as a VA loan, FHA loan, Piggyback (80-10-10) loan, etc.

You should take the time to research all of the different options to ensure that you’re making the right decision, and this will help you understand what you can truly afford before you even start actually looking at homes.

A lot of people that I know will look at homes on the market, find some that they like, and then see if they can make the mortgage/down payments work to fit that cost of a house.

WRONG. That is so backwards.

First thing you need to do is evaluate all of your loan and down payment options so that you know exactly what you can afford before you even start to look at houses. Doing this can dramatically improve your odds of not overpaying on a house.

5. Ask for Historical Utility Costs

This is something that’s very important that I didn’t think about when buying a house, but luckily our realtor did.

Utility costs might be extremely different than what you’re used to paying in your apartment or previous house. There’s so many factors that go into this, such as the size of the home, the age, the insulation, the efficiency of your air conditioning/heating units, etc.

Looking at a rolling 12-month utility cost is very important to know so you can plan.

This is almost just as important as your mortgage because this is something that can have a huge impact on what you can afford.

Moving from an apartment to our house meant an increase of $150/month in Gas/Electric bills, and thankfully we had planned, because that really could’ve stretched our budget when it was 100% preventable to simply ask the question.

6. Get Quotes on Insurance Rates

This is very similar to the utility costs in its importance. It is absolutely necessary for you to call around and get a good idea of insurance rates that you will expect to pay for the home before officially pulling the trigger on a house.

Similar to utility costs, this can put you over the top of your budget and is 100% preventable.

I recommend calling a few different local places as well as national insurance companies to get a great view of the different options. Just as you would with your mortgage rate, insurance companies will fight for your business and you should use that to your advantage.

7. Don’t Tell Your Realtor Your Top Dollar Budget

This is something that not many people will think about. It’s not necessarily that you don’t trust your realtor, but they’re getting paid off of a percentage of the selling price.

So, 3% of $150,000 is $4,500 while 3% of $250,000 is $7,500.

Do you see why this might unintentionally motivate them to sell you something at the top of your budget? Not only will this cause you to stretch your budget, but it will also potentially cause you to miss out on some great homes that are cheaper.

If your budget is $200,000 – $225,000, why not tell them your top dollar is $200,000? Or $210,000?

Let them show you some houses in that range and then if you see nothing you like, then you can “bump up” your budget, knowing that you were ok spending $225,000 the entire time.

Again, this budget is only as good as your planning, so make sure you’ve planned well in advance to know what you can afford.

Final Thoughts

This house hunting checklist will be extremely helpful when used individually, but when used together, you can be fully equipped to buy a home at a value that is well within your means.

Don’t be that person that is house poor because you didn’t plan.

If you choose to be house poor, then so be it – you can live with that choice because you understood the situation and decided to go through with it anyways.

Take advantage of these tips to help you make the best, most well-informed decision that you can, and then you will be ready to purchase your home.

Early congrats, by the way…not on buying a new home…but for being more prepared than you ever have been for your next home purchase!

Related posts:

- What Cashing out a 401K can cost you Need money now? Cashing out a 401K is an option, but not the first option you should consider when liquidating assets. All of us, at...

- 17 Simple Minimalist Living Tips for a Maximum Life The Financial Independence, Retire Early (FIRE) community is all about cutting all expenses, maximize income, and retiring ASAP. While that in theory sounds great, I...

- The Average American is Drowning in Debt – Here’s Your Life Preserver This is a guest post from Joseph Hogue. As a financial advisor, I’ve seen the frustration Andrew talks about when he hears people just don’t...

- The Key to Using the Rule of 25 to Plan Your Retirement Properly As a young teenager, all you can think about is moving out of your parent’s house. Then as you hit your early twenties, it turns...