Updated 6/7/2023

Have you ever tried to buy a car or home? If you have, you have gone through having your credit checked, which is not always a fun process. When companies borrow or lend money to raise funds, they go through the same process known as bond ratings.

Many investors have heard the term “triple AAA-rated,” but not all of us understand where that phrase originated from and the meaning behind the term.

The debt market or bond market is multiples larger than the stock market, and the business behind all those bonds is the ratings of those bonds. One of the more effective methods for companies to sell their bonds is to advertise their bond ratings, and business is good. But most of us are unfamiliar with the bond rating process and how to interpret those ratings.

The ratings of bonds were also front and center during the Great Financial Crisis in 2007-2009, as there was a LOT of discussion around the ratings of many “questionable” bonds.

In today’s post, we will learn:

- What is a Bond Rating?

- Bond Rating Definitions

- What is a Triple-AAA Bond Rating

- Where Do I Find Bond Ratings?

Okay, let’s dive in and learn how bonds are rated.

What is a Bond Rating?

A bond rating, according to Investopedia:

“A bond rating is a grade given to a bond by a rating service that indicates its credit quality. The rating takes into consideration a bond issuer’s financial strength or its ability to pay a bond’s principal and interest in a timely fashion.”

Investopedia

The ratings of bonds are the job of bond rating agencies:

- Moody’s

- Standard and Poor’s

- Fitch Ratings

- DBRS

The above companies are acknowledged leaders in the bond rating world and are international presences. The company mainly provides investors with quantitative and qualitative descriptions of the available fixed-income securities, i.e., bonds.

All of the above use a rating system, with the three U.S. firms rating companies on a scale using a range from A to C, with differing ranges, which we will cover in a moment, with AAA being the highest and C ratings the lowest.

The metrics help investors understand the relative strength or weakness of the company’s debt offering; let’s look at the underlying analysis that helps shed light on the different bond qualities.

These bond ratings are credit ratings like you and I receive from personal credit agencies like Experian.

Method of Bond Ratings

Bond rating center around two forms of risk:

- Interest rate risk

- Default risk

Bond investors buy bonds for two main reasons, dependable coupon payments, think dividends, and safety from investment loss. The bond rating agencies set up proprietary systems to rate all publicly traded companies’ bonds, such as Microsoft. The main goal is to analyze the business based on the likelihood of default on the interest rate and default risks. Depending on the underlying business’s financial strength, it helps assess the possibility of default or not paying the coupon payment.

Each rating agency has its system, but it all comes down to a few basic principles.

All aspects of the company’s financial situation are analyzed, including future expectations for the company and the economy. Three main types of bonds are rated; let’s look at those for a moment:

- Corporate

- Federal government

- Municipal government

Corporate bonds ratings

As with analyzing a company’s equity, bond rating agencies use the same ideas with their debt offerings (bonds). The agencies look at the company’s cash flows, earnings, future growth possibilities, and the industry in which it operates. They also assess the company’s balance sheet, looking closely at the liabilities, assets, and debt load.

Along with the quantitative aspects, they also assess the industry the company is in and its prospects and competitors in the industry. Additional aspects are the company’s and industry’s long-term prospects, plus any macro impacts that might affect them. Additional resources are reports on bond issuers’ financial health and management discussions about operational performance and risk management.

Once establishing a rating for the bond, any factors that come along might affect that rating, such as a loss of cash flow or revenues declining, leading to a downgrade of ratings. Likewise, anything good such as paying off debt, can cause ratings to upgrade.

Government bonds

U.S. Treasuries’ ratings are fairly simple and straightforward as the debt is AAA rated and will always remain because the likelihood of default is low.

Municipal bonds

Unlike Federal bonds, the bonds issued from a municipality such as Chicago are subject to much of the same scrutiny as a corporate bond. Analysts examine the city’s revenues and spending, debt obligations, and the community’s current economic situation.

Bond Rating Definitions

The current bond rating agencies, Moody’s, Standard and Poor’s, and Fitch, control 95% of the bond rating industry’s market share. Moody’s and Standard and Poor’s are publicly traded companies, with Fitch reaming a private business.

Each of the above companies has its rating system, but all the rating agencies grade their ratings by quality, investment, or non-investment grade. They also grade them on risk, from default to the highest quality.

Investment grade is the goal, as they are the safest with minimal default risk, along with minimal yields. At the same time, non-investment grade offers higher default risk but higher yields. The non-investment grade is also known by the unflattering term “junk bonds.”

Bond investors use these bond ratings to make investment decisions, as they are a reliable source of information.

Let’s look at each company’s bond ratings.

S&P Global Bond Ratings

S&P is the oldest of the three bond rating agencies and is registered with the NRSRO (Nationally Recognized Statistical Rating Organizations), accredited by the SEC. Standard and Poor’s covers more than one million ratings of government bonds and corporate bonds.

The S&P offers long- and short-term bond ratings and its main goal is assessing the possibility of default.

Bond Rating | Grade | Risk |

AAA | Investment | Lowest Risk |

AA | Investment | Low Risk |

A | Investment | Low Risk |

BBB | Investment | Medium Risk |

BB, B | Junk | High Risk |

CCC/CC/C | Junk | Highest Risk |

D | Junk | In default |

For a complete outline of the ratings of S&P, click here for a detailed explanation.

Moody’s

Moody’s is the second-largest of the bond rating agencies, also registered with the NRSRO. Moody’s covers:

- 135 countries

- 5000 non-financial companies

- 4,000 financials (banks, insurance)

- 18,000 public finance issuers (municipals)

- 11,000 structured finance transactions

- 1,000 infrastructure projects

Moody’s focus of analysis is evaluating projected losses in the event of a default on the bond.

Bond Rating | Grade | Risk |

Aaa | Investment | Lowest Risk |

Aa | Investment | Low Risk |

A | Investment | Low Risk |

Baa | Investment | Medium Risk |

Ba | Junk | High Risk |

B | Junk | High Risk |

Caa | Junk | Highest Risk |

Ca | Junk | Highest Risk |

C | Junk | Default |

Moody’s, like S&P, offers numerical modifiers to separate the different ratings; for example, you can have a company with a Baa1 rating and another with a rating of A2. The number one indicates a higher rating, a two in the middle range, and three with the lowest rating.

For more on Moody’s bond ratings scale, please click here.

Fitch

Fitch, the smallest of the “Big Three” rating agencies, covers multiple sectors such as financials, insurance, sovereigns, and global infrastructure. One big difference, Fitch has a more limited exposure than the other two main competitors. Like S&P, Fitch focuses on the probability of default and uses a scale similar to S&P.

Bond Rating | Grade | Risk |

AAA | Investment | Lowest Risk |

AA | Investment | Low Risk |

A | Investment | Low Risk |

BBB | Investment | Medium Risk |

BB, B | Junk | High Risk |

CCC, CC, C | Junk | Highest Risk |

D | Junk | Default |

For more detail on the ratings Fitch uses, please click here.

What is a Triple-AAA Rating?

The AAA rating from any “Big Three” rating agency is the highest approval a company can receive. A company with the AAA rating has the lowest risk of default on the bond, making it the highest credit rating globally.

Currently, there are only two companies with a AAA rating:

- Microsoft (MSFT)

- Johnson & Johnson (JNJ)

As bonds are a loan from the company to use in the form of debt, the investor buys the loan with the expectation that Microsoft will pay us back, plus any interest payments along the way.

When one of the rating agencies grants a AAA rating, they tell us the investor that they believe Microsoft will return our money at the end of the loan term, plus will honor the interest payments during the loan term.

It is extremely difficult to attain an AAA rating, as, since 2009, there have only been two companies, with General Electric (GE) losing its rating in 2008.

AAA-rated bonds are part of the investment-grade ratings that the agencies assign. Investment-grade bonds are any above the BBB-(S&P and Fitch) and Baa3 (Moody’s) ratings. Anything below those ratings is in the junk or non-investment grade classification.

The ratings matter to investors, both big and small; from a regulatory standpoint, many trusts and pensions are forbidden from investing in junk bonds. The risk of default is too high to be viable for investment.

The grading system is not without its faults and slight controversies. For example, Microsoft is considered the safest of corporate bonds with its AAA rating, but U.S. Treasuries carry the Federal Government’s full faith and back. So which is “safer?”

That is where the controversy enters, and who is right? You can argue on both sides, but many consider the Treasuries the safest, albeit with the lowest returns; Simultaneously, Microsoft is certainly safe; it offers slightly better returns.

On the other side of the scale, from AAA-rating in the field of junk bonds. Non-investment grade bonds, with their low ratings and high yields, offer a more attractive return but with a higher risk of default. The reason behind the higher yield is the bond offering, with its low credit rating, needs to offer higher returns to encourage investors to invest in that lower credit rating.

To encourage that investment, junk bonds offer higher yields than higher-rated bonds. For example, Microsoft offers higher safety but lower yields. Whereas Tesla, which has a junk rating, offers a higher yield to encourage investment.

Junk bonds fall into two different categories:

- Fallen angels – bonds that were once investment grade but have fallen to junk status because of liquidity issues from the company’s poor credit quality.

- Rising stars – a bond with its ratings improving because of the company’s credit quality and liquidity. The company may still be a junk bond, but its ratings are improving.

Where Do I Find Bond Ratings?

To find the company’s bond ratings, the easiest method is to Google the company, but if you want a deeper look at the company and what the analysts think of its potential, then using one of the “Big Three” agencies is the ticket.

I use Moody’s to analyze any company’s debt I am considering buying, and it is free for the beginner level. All it requires is an email address and password, and voila!

Let’s look at a few reports to give us a sense of how this works. The first company I will look up is Microsoft (MSFT).

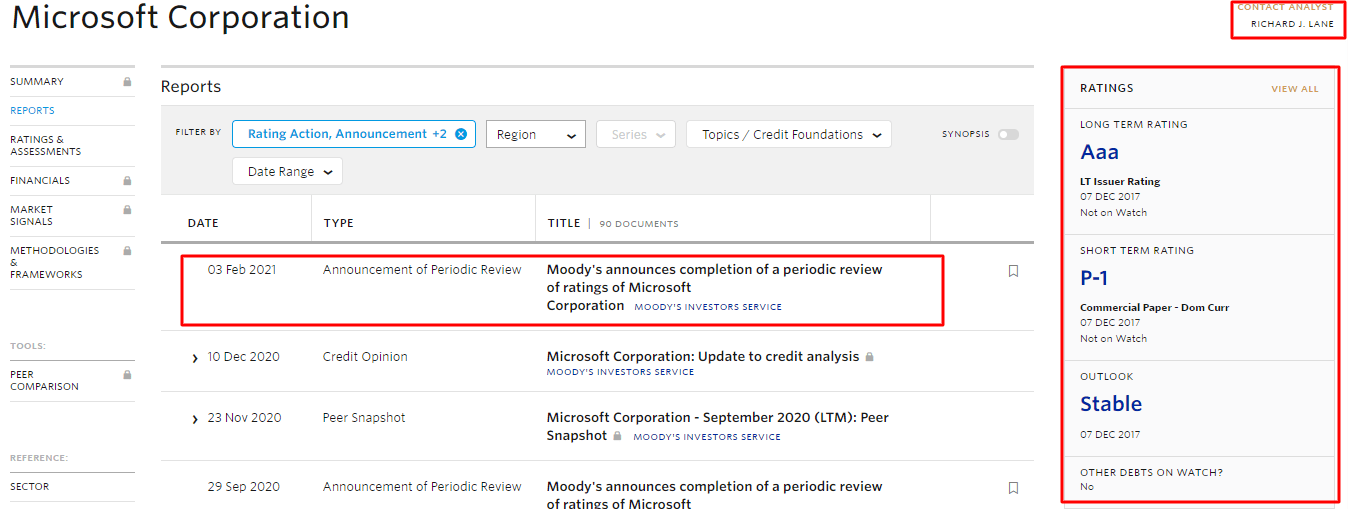

After logging in and searching for the ticker, we see this:

After clicking on Microsoft, we arrive here:

All the highlighted areas include the following:

- The bond ratings of Microsoft, when it was last rated, and the Stable outlook

- The name of the analyst doing the bond rating

- Plus, any articles outlining any updates on the company.

As you click around the different articles, you find out more about Microsoft’s credit rating and whether Moody’s anticipates any change in credit rating. This can help the investor see if something is coming that might affect Microsoft’s long-term prospects.

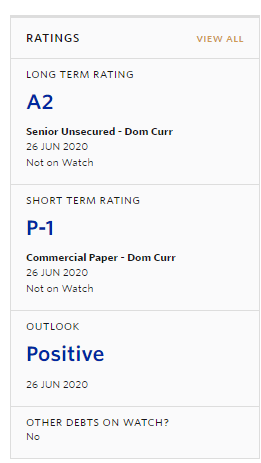

If we look at Amazon, we see:

As we can see from the above picture, Amazon carries a bond rating of A2, which indicates low risk, and the analyst has a positive outlook for the credit rating.

Remember that the ratings don’t indicate whether we should invest in Amazon; instead, it tells us how strong the company’s credit quality is and if the liquidity is adequate to meet its debt obligations.

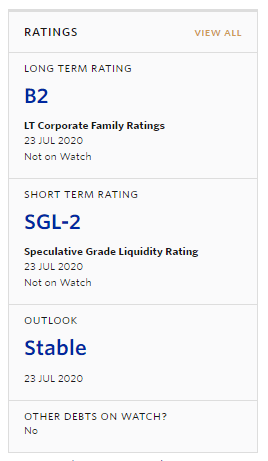

Lastly, let’s look at a junk-rated bond.

According to Moody’s analysts, Tesla carries a junk bond rating for its debt, with high default risk. Again, this is not a statement about the investment in Tesla’s stock; instead, it’s the analysis of the company’s debt offering and ability to pay us back for our investment.

Investor Takeaway

As investors who want a complete picture of a company’s strength and liquidity, we must understand the credit quality of any company we buy. The “Big Three” rating agencies offer us the ability to get a snapshot of any company’s credit quality and liquidity by looking at the bond rating scale.

Using those scales helps bond investors and those of us investing in the company’s stock. As a measure of safety margin, finding good investments with an investment-grade credit rating helps comfort me that the company is in a strong financial position.

The bond ratings are not a basis for investing in a company’s stock, but they are a great part of analyzing any company. Looking at a company’s credit rating gives us an overview of Microsoft’s financial strength, for example.

Using the bond ratings is part of my analysis of any company I consider, and using the bond ratings helps me understand the company’s debt obligations. A company’s debt offerings are bond offerings to raise capital for projects. And with today’s low-interest rates, more and more companies turn to debt markets to raise capital. And with that increase, it is a great idea to understand your company’s credit score. The credit agencies such as Moody’s offer us a glimpse into that credit score for our benefit.

And with that, we will wrap up our discussion for today.

As always, thank you for taking the time to read today’s post, and I hope you find something of value in your investing journey.

If I can further assist, please don’t hesitate to reach out.

Until next time, take care and be safe out there,

Dave

Related posts:

- Corporate Bond Trading for Beginners: How to Buy Bonds Online Ben Graham, the father of value investing and the creator of security analysis, was a huge proponent of investing in bonds. His seminal book, The...

- Bond Valuation Overview (With Formulas and Examples) Updated 6/15/2022 “An investment in knowledge pays the best interest.” Benjamin Franklin As investors learn more about our investments, we become better investors. One of...

- How to Find and Invest in Tax Free Municipal Bonds “I’m proud to be paying taxes in the United States. The only thing is – I could be just as proud for half the money.”...

- Corporate Bond Yield, Yield Curve, and its Impact in Fixed Income “Both from the standpoint of stocks and bonds, an investor wants to go where the growth is.” Bill Gross Considered the undisputed master of bond...