“What an investor needs is the ability to correctly evaluate selected businesses. Note that word ‘selected’: You don’t have to be an expert on every company or even many. You only have to be able to evaluate companies within your circle of competence. The size of that circle is not very important; knowing its boundaries, however, is vital.”

Warren Buffett

As investors, we need to understand the difference between the too-hard pile and the companies we understand. To do this, we can study the different business models of companies.

For example, understanding how PayPal makes money can help you better understand Visa.

As beginning investors, it is hard to know where to begin. But understanding the business model offers a great place to start. And, like other knowledge, it will compound.

Once you understand Walmart’s business model, it can enable you to understand Amazon. Warren Buffett reads 500 pages daily, and when he doesn’t understand, he passes. He doesn’t swing at every pitch or force an investment.

We can learn from that patience, find things we understand, and dig deeper. Remember, because you don’t understand it now doesn’t mean you won’t later on.

In today’s post, we will learn:

- Brief Overview of PayPal

- PayPal’s Business Model

- 4 Main Ways PayPal Makes Money

- PayPal’s Moat

- Investor Takeaway

Okay, let’s dive in and learn how PayPal makes money.

Brief Overview of PayPal

Let’s start with what PayPal is.

PayPal Holdings (PYPL) offers payment processing through several platforms, and the company continues to expand through multiple services and niches.

PayPal began in 1998 as “Confinity.” PayPal started its road toward becoming a ubiquitous part of the digital payment industry.

Confinity created software-based security tools for portable devices. Max Levchin and Peter Thiel created these devices, among others, but failed to gain any success. In 1999, the founding team changed the focus to electronic payments ahead of their time. They gave the new creation the name “PayPal.”

Confinity had a security core when created. The focus on security encouraged cutting-edge payment innovation data encryption and privacy and helped it achieve early success.

Elon Musk, the flamboyant founder of X.com, a new digital bank, was immediately interested in the enterprise. The two merged at the turn of the century, and at the height of the dot-com bubble in 2002, PayPal became public.

The “PayPal Mafia,” consisted of the individuals above, as well as:

- Reid Hoffman

- David Sacks

- The creators of YouTube

These were among a group of early PayPal employees.

eBay acquired PayPal just a few months after its IPO and significant success. PayPal flourished as the platform’s payment option from 2002 to 2014 while operating under eBay’s guidance. As a result of this favorable positioning, it amassed a sizable market share.

But PayPal’s goals went far beyond being an eBay checkout option. After five years, PayPal managed to connect with MasterCard and others, allowing PayPal to increase the number of merchants PayPal could work with. PayPal was earning 150% of what eBay paid for it in annual revenue at this point (about 2008).

PayPal was once again a standalone traded corporation after eBay spun it off in 2015. PayPal trades on the NASDAQ exchange under the ticker code “PYPL.” The company’s headquarters sits in San Jose, California, at the heart of Silicon Valley.

The name-brand payment processing service offered by PayPal is its main draw. It also has many other major consumer-facing enterprises, though. These include:

- Honey rewards program

- Xoom money transfer service

- Venmo mobile wallet and payments unit

In the past 24 years, PayPal has undergone a dramatic transformation, evolving from a company offering a single payment service into a force aiming to power people’s financial lives with super-apps.

In the process, PayPal achieved stunningly constant growth, successfully democratized access to financial services, and created a market-leading niche within the competitive financial services industry.

PayPal’s Business Model

As mentioned earlier, PayPal operates in the payments industry. The company has created a two-sided global payments network. Most of us are familiar with the yellow button at checkout; that’s PayPal.

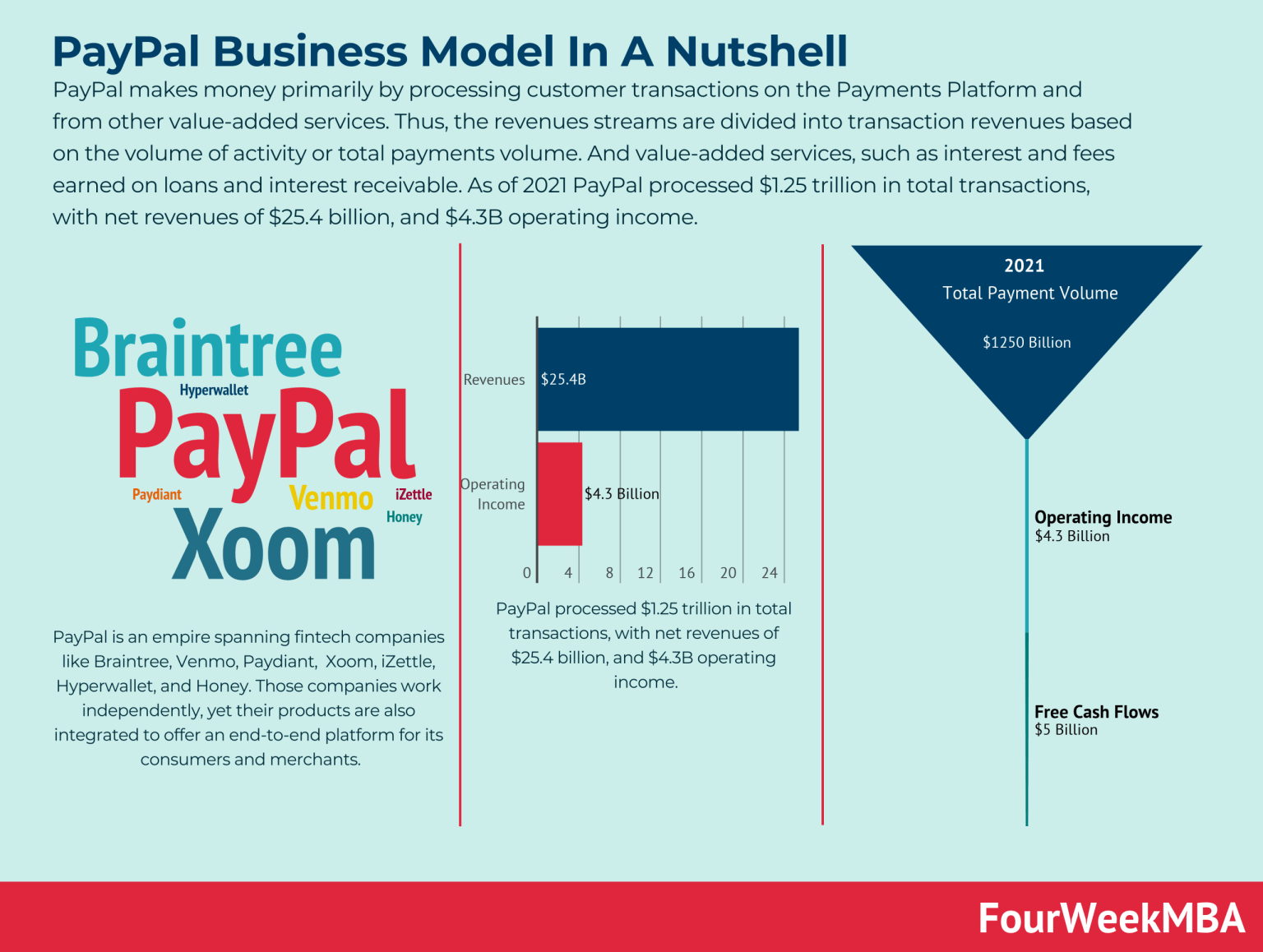

Image courtesy of fourweekmba.com

Their technology allows both merchants and consumers to make digital payments worldwide.

PayPal’s platform contains some well-known names:

- PayPal

- PayPal Credit

- Venmo

- Braintree

- Xoom

- Honey

The company also owns other names, including iZettle, Hyperwallet, and Paidy.

These platforms allow PayPal to enable digital payments in almost every digital genre, including credit, debit, buy now pay later, coupons, and QR codes.

By creating the two-sided network, PayPal has enabled a vast network of consumers and merchants to create a network effect.

As both merchants and consumers have their payment information stored on the platform, PayPal makes it easier for them to reuse the platform in the future.

PayPal’s reach is incredible. The company operates in over 200 markets and has over 400 million active accounts.

PayPal also connects to 3rd-party networks such as banks. But PayPal also offers its proprietary solutions for merchants. These different solutions help merchants earn higher profits, adding more value to the network.

Understanding the value chain for digital payments, its stakeholders, and how it fits into the picture is crucial before discussing how it makes value. Management has referred to PayPal’s online checkout service as its “history, present, and future,” and they have ingrained it into their ecosystem.

Checkout for PayPal begins when the customer finishes filling their cart. The customer can then enter their debit/credit information, or use the PayPal button, which can help auto-populate their account.

After selecting the PayPal button, PayPal tokenizes all the information.

What is tokenization?

It is a process of encrypting digital information by a gateway.

Typical gateways we would know include Visa and Mastercard.

The gateway connects much software for the rest of the payment landscape. It plugs the merchant site into online payments and integrates with card schemas (Visa and Mastercard) and digital wallets.

The gateway then passes along the digitized information to payment processors. The processors do the lion’s share of the work to ensure the payment remains fraud-free and viable.

Some examples of payment processors include:

- Stripe

- Adyen

- PayPal

- Braintree

- First Data

The next step includes sending the payment information to your bank. The bank, for example Bank of America, with a Mastercard logo on it, approves our purchase.

The above contains much of the process for processing payments. It all happens in seconds while we wait online or in the store.

When we use the PayPal button, we allow the company to send our payment details to our bank to verify we can buy the product.

And PayPal generates fees from the above process, which is the main source of revenue.

To wrap up PayPal’s business model, the company operates as a payment provider. As a payment provider, PayPal bundles the roles of the checkout flow, gateway, processor, and merchant acquirer into one offering: their yellow button.

The company continues expanding, offering physical cards through Venmo and PayPal.

4 Main Ways PayPal Makes Money

PayPal generates revenue through four main methods:

- Transaction fees

- Lending fees

- Venmo

- Partner fees

Transaction Fees

PayPal labels its revenue sources on its financials as:

- Transaction revenue

- Other value-added services (OVAS)

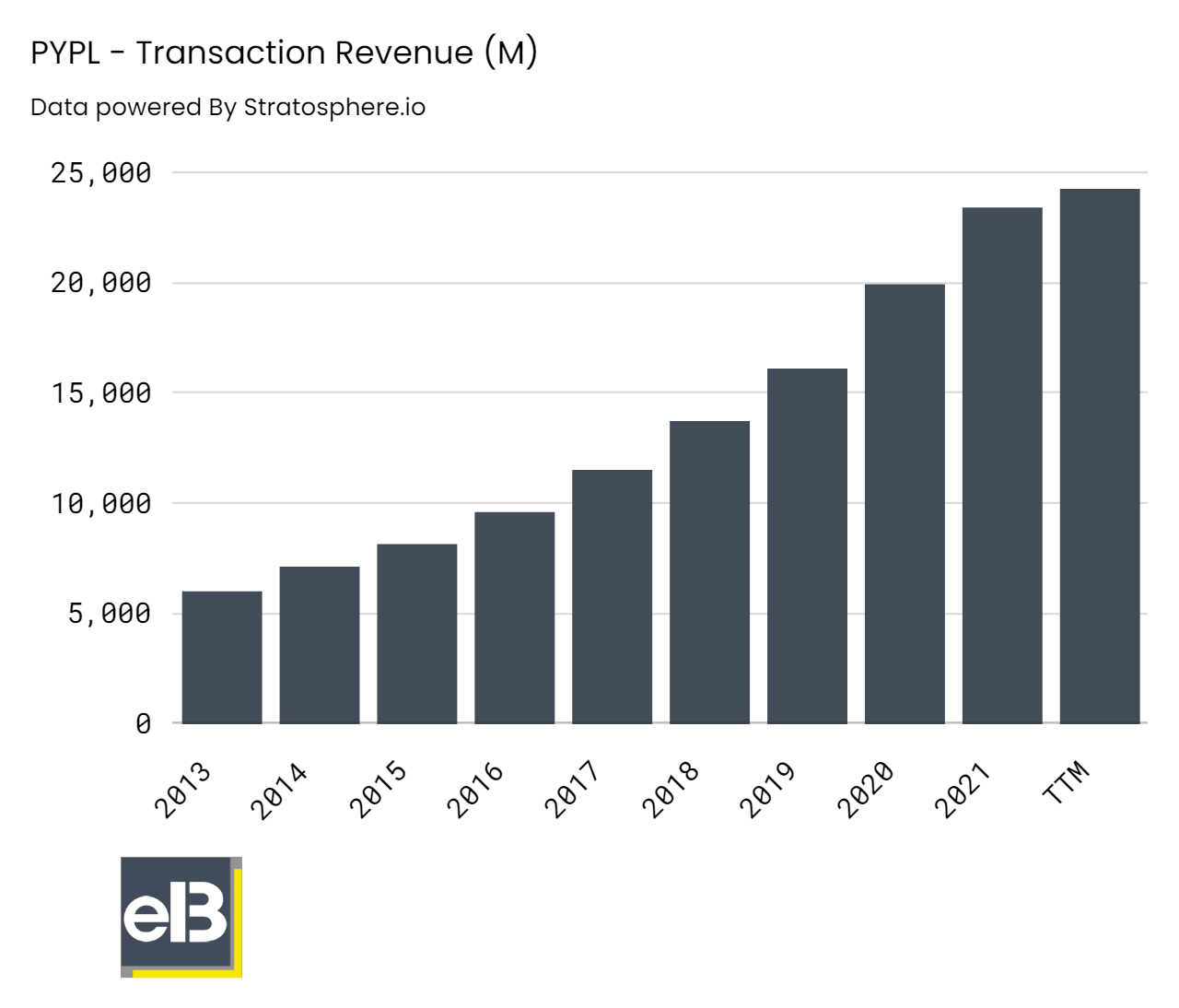

Transaction revenue generates the lion’s share of PayPal’s money. Transaction revenue represents the compensation PayPal receives for processing payments.

It includes items such as:

- Gateway

- Processing

- Checkout

- Merchant services

PayPal also generates revenues from instant balance transfers and cross-border currency conversion.

The company doesn’t operate as a low-price provider. Instead, they compete on their technology, scale, and checkout flow.

The typical rate PayPal charges merchants starts at 2.9% + $0.30 for the first $3,000 in sales. These rates compare well to competitors such as Block.

Transaction revenues account for around 91-93% of PayPal’s income.

PayPal has three key metrics or KPIs they track:

- Active account – a user who has used the system in the past 12 months. One confusing point: PayPal considers accounts different from users. For example, one user can have multiple accounts.

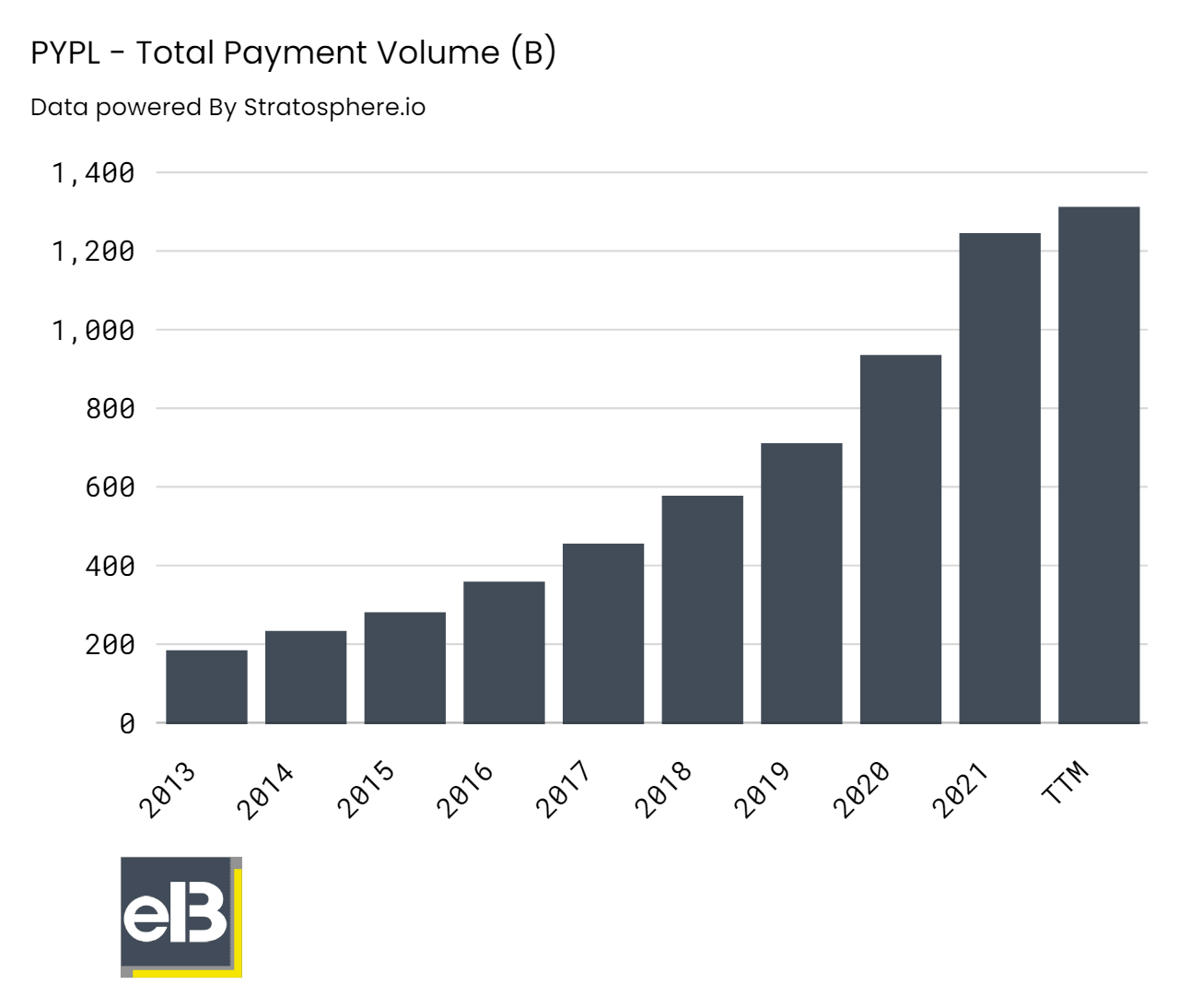

- Total Payments – total payments flowing through PayPal’s platform

- Total Payments Volume (TPV) – equals the total payment volume flowing through the platform’s or partner’s volume.

PayPal generates a large share of these revenues from the checkout button via PayPal or Venmo.

The company also generates a growing revenue stream from Braintree.

Braintree is a leading API in the payments space. It allows PayPal to offer back-of-the-office payment processing. For example, when a merchant allows PayPal to use their checkout button, PayPal generates fees from that use case.

But with Braintree, they can operate as other links in the processing chain. Braintree allows them to capture more revenues from the value chain.

Before acquiring Braintree, PayPal processed their payments through Wells Fargo. But now, they can generate revenue beyond checkout.

Braintree now competes on an equal footing with Stripe and Adyen and Fiserv with Clover. These additional revenue streams will help PayPal continue to grow.

PayPal doesn’t disclose specific details on its payment processing and checkout revenues. But what we do know is PayPal operates on a high-volume, low-margin business model.

Lending Fees

Some of PayPal’s merchants have access to financing solutions. PayPal may lend to merchants with a lot of confidence in their capacity to repay since it has a high level of visibility into a merchant’s revenue stream.

These loans can assist businesses with short-term money crunches, for example, covering working capital requirements for inventory before the holidays or idle periods of the year. PayPal also provides small business loans in addition to these sales-backed loans.

There isn’t much information on PayPal’s lending programs for the public. For example, we don’t know much about these contracts’ typical annual percentage rates (APRs).

It appears the service is supplemental for merchants to support their growth and loyalty to the PayPal platform rather than a significant part of PayPal’s revenue.

Venmo

Venmo began in 2009 as a peer-to-peer (P2P) payment provider. PayPal bought the platform in 2013 as a part of the Braintree acquisition.

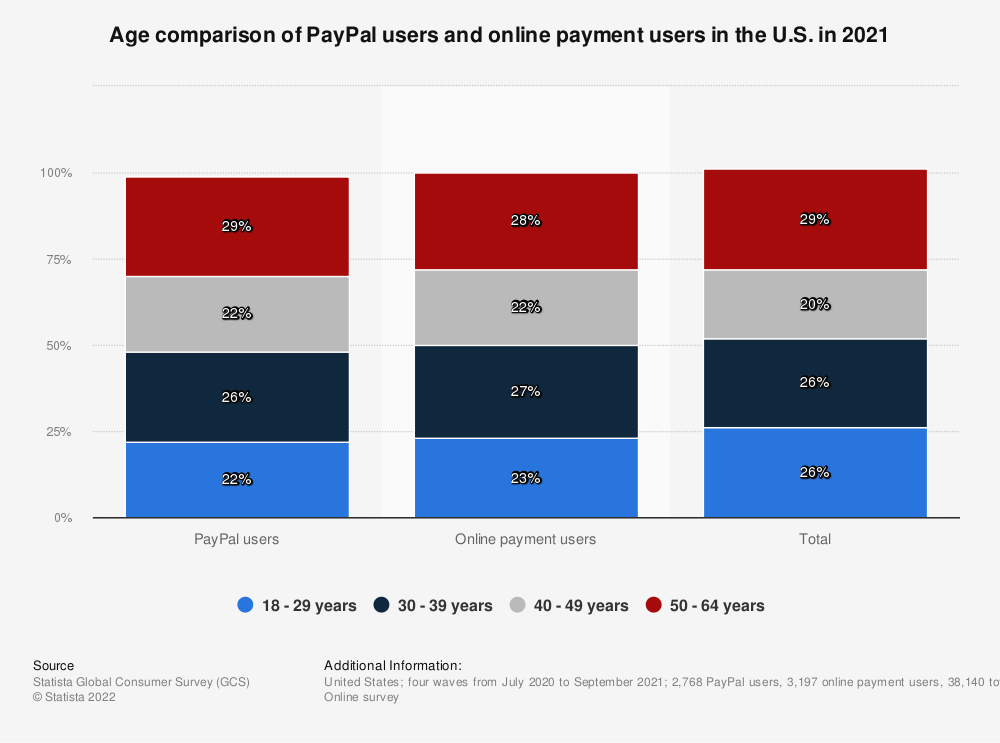

Venmo has experienced viral growth as the company focuses on the younger set. Today, their users tend to be younger, higher educated, and have higher earnings.

Venmo is on the same “super-app” trajectory as PayPal. It continues to innovate and branch into different products to enhance its value.

Venmo operates at lower margins but is quite effective at generating organic user growth. The app has over 85 million users as of today.

Venmo monetizes in many of the same ways the PayPal platform does, including instant transfers and a Venmo merchant option.

The balancing act is similar to PayPal, as Venmo gives away the main money transfer system for free, but charges for additional services and other perks.

Partner Fees

Working with stores and other e-commerce websites brings PayPal some revenue. With its $4 billion acquisition of the shopping and rewards app, Honey, in 2020, it made a significant push into this market.

Shoppers can use the web application, Honey, to find discounts and promotional deals. Honey works with more than 30,000 different online merchants. These businesses reward PayPal and other third parties for bringing customers to their websites.

This demonstrates the strength of the platform and network effects of PayPal. It can persuade Venmo users and consumers to try Honey to save money while generating affiliate referral revenue for PayPal. Additionally, the merchant, in this instance, covers the incentive; thus, there are no additional costs for the customer to bear when using this service.

These four platforms help generate a large part of PayPal’s revenues. But we didn’t even touch some of the smaller portions of the company, such as Xoom, which enables cross-border transactions, or iZettle, which generates QR codes, which were so popular during the pandemic.

The bottom line: PayPal has a lot of irons in the fire. But focusing on the main KPIs and transaction revenues along with Braintree will help.

PayPal’s Moat

Any payment processing is extremely scalable since adding more transactions has a low incremental cost once they build a payment platform.

With approximately $1.3 trillion in annual volume, PayPal has a sizable scale when considered from the perspective of the acquiring sector. Yet, it is still far below the amounts handled by bigger competitors like First Data.

Although there are niches in the acquiring market, PayPal is the undisputed leader in the e-commerce sector, which, in my opinion, helps give the company a narrow moat.

PayPal’s unique business model centers around the two-sided platform, giving PayPal good relations with merchants and consumers.

For example, PayPal has a significant advantage in preventing fraud because it has information on both sides of the transaction. Fraud was a major problem in the early days of the internet and remains high on the list today.

PayPal was in a position to establish itself as a trusted partner on both sides of a transaction thanks to its capacity to fight fraud.

Additionally, compared to the industry average conversion rate of around 50%, using PayPal in an online transaction is rather simple, considerably increasing conversion rates, which hover in the 90% range.

The ease of use demonstrates how simple and appealing online checkout is for both customers and businesses. These dynamics allowed PayPal to create a network effect, which helped the company grow.

Because PayPal operates as a smaller portion of the larger payments ecosystem, they don’t have quite the same power as Visa or Adyen.

But within the online e-commerce world, they continue to function as a preferred partner.

Investor Takeaway

PayPal has created a tremendous business with a global reach. While PayPal’s initial focus was on enabling e-commerce transactions, it has since expanded its product line to produce a more capable and comprehensive platform. It should continue to expand its company and discover new methods to create income as Venmo continues to be adopted more widely and PayPal adds additional services like Honey.

Understanding how PayPal operates gives us insight into the payments ecosystem, and once we understand that ecosystem, we can explore other businesses. Companies such as Adyen, Fiserv, Visa, Mastercard, and Block offer something for many investors to like.

My hope is once you understand PayPal, you will have a better insight into others in the payments ecosystem and, possibly, e-commerce.

If you want to dive deeper into PayPal, check out the below writeup:

We will continue to explore different business models to help you overcome the too-hard pile and expand your circle of competence.

And with that, we will wrap up our discussion concerning how PayPal makes money.

Thank you for reading, and I hope you find something of value. If I can be of further assistance, please don’t hesitate to reach out.

Until next time, take care and be safe out there,

Dave

Related posts:

- Understanding the 12 Most Common Types of Business Models Updated 4/4/2024 In a speech in Switzerland, Warren Buffett discussed what he means by buying businesses he understands. “We don’t look for specific sectors; we...

- The Practical Solution to Begin Investing With No Money Updated – 11/3/23 Although it’s not easy to start investing with no money, it certainly isn’t impossible. Keep reading for tips to start your investment...

- A Beginner’s Guide to Cloud Computing What is cloud computing? How does the cloud work? To invest in companies such as Microsoft, Shopify, Google, or Crowdstrike, we need to understand the...

- How To Research Stocks (for Beginners) “Never invest in a business you don’t understand.” So you decided to invest in stocks but don’t know where to start? Think of researching stocks...