Why are all of our most valuable assets insured, except for the ones that you love? This post will explain how term life insurance works and how it can be the most responsible decision you can make for the ones that you provide for.

Click to jump to a section:

- Why Have Term Life Insurance?

- How Does Term Life Insurance Work?

- Do You Always Need Life Insurance?

- The Cost of Term Life Insurance

Why Have Term Life Insurance?

Picture this. Can you imagine if you relied on someone to provide for you and they didn’t have life insurance and they passed away? You would be 100% sore out of luck. Not only is your loved one gone, but you are now left with the same amount of obligations with none of that income.

This may sound like a horrible way to think. However, life is unpredictable. We sadly have to plan for horrible, unpredictable events to be safe.

Those mortgage payments for your $300,000 house don’t immediately cut in half because your income did. Your kids’ future college payments don’t decrease now. Nothing changes – except your income.

Think about it – what are your most valuable assets? The house? That’s insured. The car or cars? Also insured. Your health? Yup, that’s insured. But what your LIFE? “Eh, who cares – I’m gone anyways, right?”

Life insurance isn’t for you.

It’s for your loved ones.

Not having life insurance is one of the most financially irresponsible things you can do for your family. How often do you hear a company say that their people are their most valuable asset? Always!

So, if you’re the most valuable asset to your company, you’re definitely the most valuable asset for your family. No life insurance? It’s not worth the risk!

Ok – sorry for the yelling. Life insurance is just important to me and should be to everyone else. I am not the only one who is at risk of something horrible happening.

How Does Term Life Insurance Work?

Life insurance really comes in two different forms – term and permanent life insurance.

In essence, term is for a short period of time (think 5-30 years) and permanent life insurance is for just that – your whole life.

Term life insurance offers a lot of flexibility if you’re young and healthy. Maybe you don’t yet have a family or even plan to, or you just prefer the shorter term with the fixed payments.

Within permanent life insurance, you have various options such as Whole Life, Universal Life, or Variable Life Insurance. There are more options than this, but these are the main three for permanent insurance.

In short, the differences are noted below:

- Whole life – Amount grows at a guaranteed rate; you pay the same for the whole policy

- Universal life – Amount grows based on the market, but you have a guaranteed minimum return; you pay between a max/min premium range

- Variable life – You invest the money how you want (usually between certain mutual options); cost can completely vary

There are other types of term life insurance as well, but the most common is where you will pay the same price throughout the term. These plans make planning financially for the future far simpler.

Do You Always Need Life Insurance?

When I first started working, I wasn’t considered a “provider” for anyone. Hell, I didn’t even have a girlfriend. Because of this, I didn’t think I needed life insurance. If you find yourself in this situation, this is the ONLY excuse that I will accept as to why you don’t have life insurance. But even then, my company did offer a 1-year match of my salary if anything happened, so it was still something.

If you have anyone that depends on you, you need to get it.

My personal opinion is that the healthier you are, the better off you are utilizing term life insurance. You will pay more for permanent life insurance as the insurance company knows they will cover you up until you inevitably pass away. There is a 100% chance that your insurance policy will be used.

The Cost of Term Life Insurance

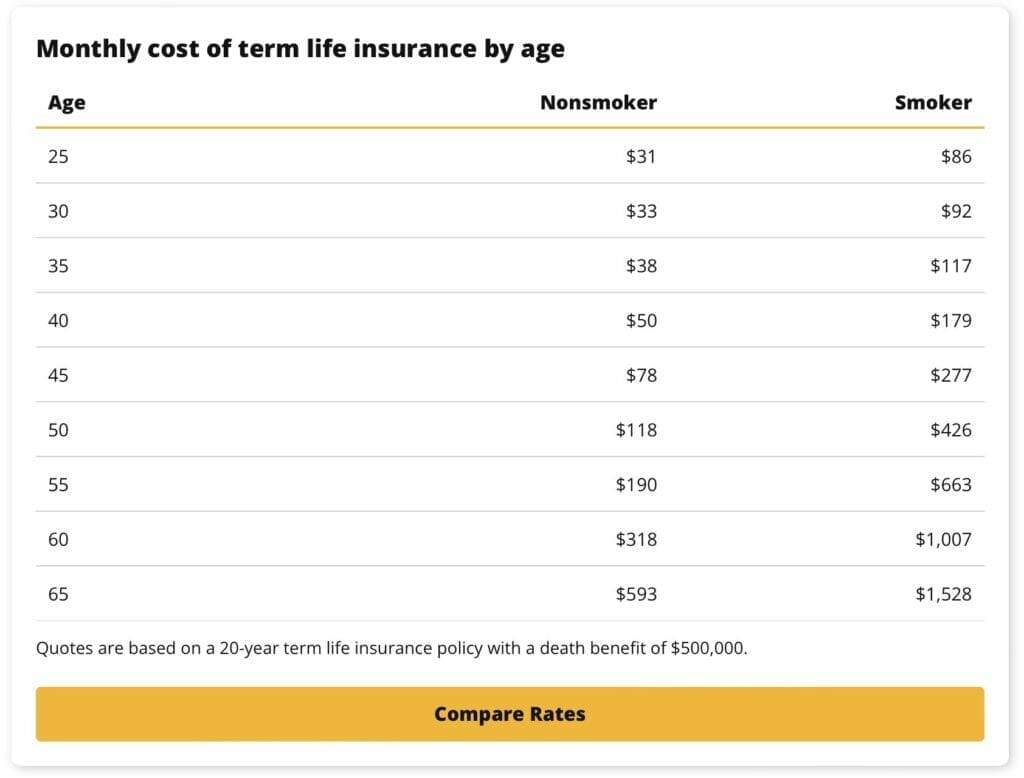

With term life insurance, that percentage chance is much less likely. So, in turn, the insurance company will offer you lower premiums. Below are some average premiums that I found from Value Penguin if you want to determine the cost of a 20-year term life insurance for $500,000 of coverage:

The two things that really stood out to me were:

- Premiums increase at a huge rate as you get older. This makes sense, but I was surprised at how much they went up.

- I am REALLY happy that I am not a smoker. Holy Crap. This brings me to my next point: Don’t smoke. You will pay over 3X as much as a smoker (among many other reasons not to smoke)

Not to mention – smoking also is really freaking expensive. If you were 30 when you got this 20-year term, you would pay almost $13,000 more than a non-smoker. That’s stupid. But, do you know how much you would spend during this 20-year life insurance term in cigarettes along? Enough to buy this:

Yes, you could literally buy a new BMW if you smoked a pack/day at $5/pack. Insane. You can have your cancer sticks. I’ll take the beamer. But again, I digress.

My point in all of this is really pretty simple – get life insurance. I have term life insurance, which has worked great for me. It has worked better for me because I haven’t had to use it, and every year that I don’t have to use my life insurance, I am better off paying the lower premium.

If you get term life insurance, you very well could get to the end of that term and feel like you just wasted that money. But the worst situation is not having life insurance when your family could’ve really used that protection.

I mean, come on – if you’re 50 and a non-smoker – you’ll pay a total of $21,550 to guarantee your family a $500K sense of security if anything ever happens to you. Do you think anything will happen to you? Nope, neither do I.

Sometimes it’s fun to take gambles in life. However, gambling on the future financial situation of your family, without yourself to help in any way, is not a gamble that I would want to take.

Related posts:

- Why Do Financial Gurus Love Short Term Life Insurance? First and foremost, I am very proud of you for taking the step to look at Life Insurance, but if you’re getting just started, you’re...

- Is Decreasing Term Life Insurance a Good Policy for You? DECREASING term life insurance? That sounds backwards, right? WRONG! Not too long ago I wrote a post about term life insurance that really explained some...

- How to Pick the Right Life Insurance Broker So…. life insurance. Nowadays you can easily get life insurance online if need be, but I think that a life insurance broker can help solve...

- Millennials: Is Pet Life Insurance a Good Investment? As you know, I am a huge advocate for life insurance for a human but should you get life insurance for your pets too? People...